U.S. Citrus Production – An Uphill Battle to Survive

photo credit: AFBF Photo, Big Foot Media

Daniel Munch

Economist

While many people enjoy a hot cup of coffee or an iced latte in the morning, others, including myself, prefer a cold, crisp glass of orange juice to start the day. Known for the hefty dose of vitamin C they provide in their original form, as well as their use as fragrances and as flavors for sweets and teas, fruit classified under the genus “citrus” are often identifiable by a thick and usually firm rind and pulpy interior flesh. Oranges, grapefruit, tangerines, limes and lemons are just a few of the many citrus crops adored by consumers around the world. Once leaders in citrus crop production, citrus farmers in the United States, particularly in Florida, have faced numerous challenges that have led to an unfortunate decline in domestic supply. In this Market Intel we provide an update on domestic citrus production and the factors driving U.S. market share across borders and overseas.

Florida Citrus Growers Face Unique Challenges

Citrus fruits account for 14% of total fresh fruit volume available to Americans, with oranges ranking fourth behind bananas, apples and melons in terms of per capita availability. Four states, Florida, California, Arizona and Texas, have been overwhelmingly responsible for citrus production in the United States since oranges were first grown domestically when Pedro Menèndez de Avilès founded St. Augustine in 1565. Citrus fruits have geographic roots in what is now northeastern India, southwestern China, Burma and the Malay Archipelago. The climate requirements of these crops contribute to their unique geographic distribution, as well as exposure to a number of climate- and biological-related challenges. Destructive weather events like tropical storms and hurricanes are common in many citrus-growing regions and often result in significant loss of crop as well as injured or uprooted groves. Many citrus trees take as many as 15 years from seed or three to five years from grafting to begin bearing fruit. Any conditions that interrupt this process risk long-term production and revenue for farmers. For instance, on Sept. 10, 2017, Hurricane Irma’s high winds and damaging rains battered key citrus-producing regions in Florida, resulting in the smallest Florida crop yield in over 70 years. More recently, on Sept. 23, 2022, Hurricane Ian hammered southwest Florida, destroying between $416 million and $675 million of citrus crop and perennial infrastructure.

Heightened weather-associated production risk in Florida has been overshadowed by the ongoing presence of citrus greening disease – a currently incurable disease carried by the Asian citrus psyllid, a small sap-sucking insect invasive to the Western Hemisphere. Citrus greening was first detected in Florida in 2005, thought to have been brought through the Port of Miami. According to the American Society of Horticultural Sciences, as trees are affected by the disease they suffer premature fruit drop, the fruit harvested is smaller and misshapen and the juice quality is compromised, all resulting in lower yields. Since 2005, orange production in Florida has dropped 90%, from 150 million boxes to a mere 16 million boxes expected in 2023. Between 2002 and 2017, the number of citrus growers in Florida decreased from 7,389 to 2,775 (a 62% decline) and the number of juice processing facilities decreased from 41 in 2003 to 14 in 2017 (a 66% decline). This is particularly biting in a state where citrus supports over 32,000 indirect and direct jobs, $1.61 billion in labor income and nearly $7 billion in output to the economy as of the 2020-2021 marketing year.

General Production Trends

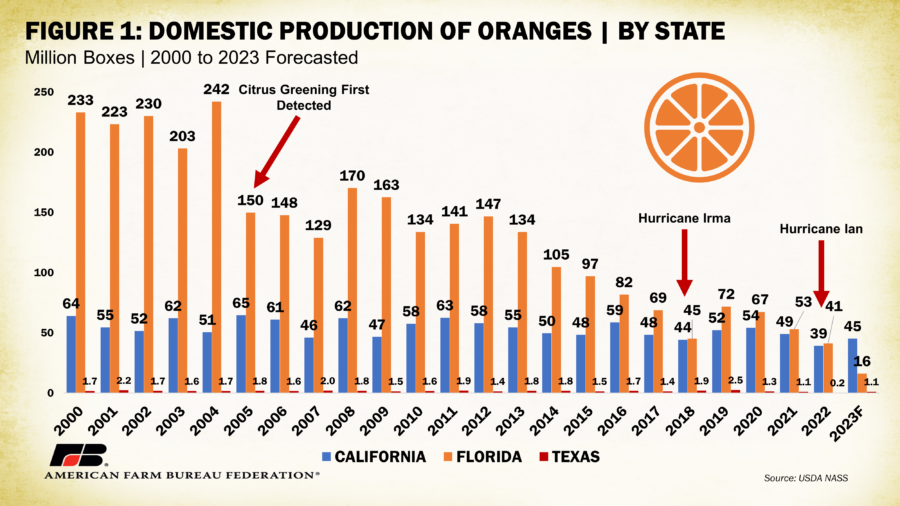

Figure 1 displays the national production of oranges since 2000 by state. In the citrus industry fruit is often bought and sold by box rather than pounds or tons. The standard box of oranges weighs 90 pounds and the standard box of grapefruit weighs 85 pounds. There is no standard for lemons or limes. USDA no longer reports on Arizona orange production due to its small output. This year is expected to be the first in which California produces more oranges than Florida, with California expected to produce 45 million boxes or 72% of all domestic oranges. Before 2014, Florida consistently produced over 70% of the nation’s oranges. California’s commercial citrus crop is geographically immune to the impact of Southeastern hurricanes and has been spared from citrus greening thus far though detections in residential groves have sparked much concern. Drought conditions, and more recently high-precipitation events, have pressured orange yields in California, though production has held steady between 40 million and 65 million boxes since 2000.

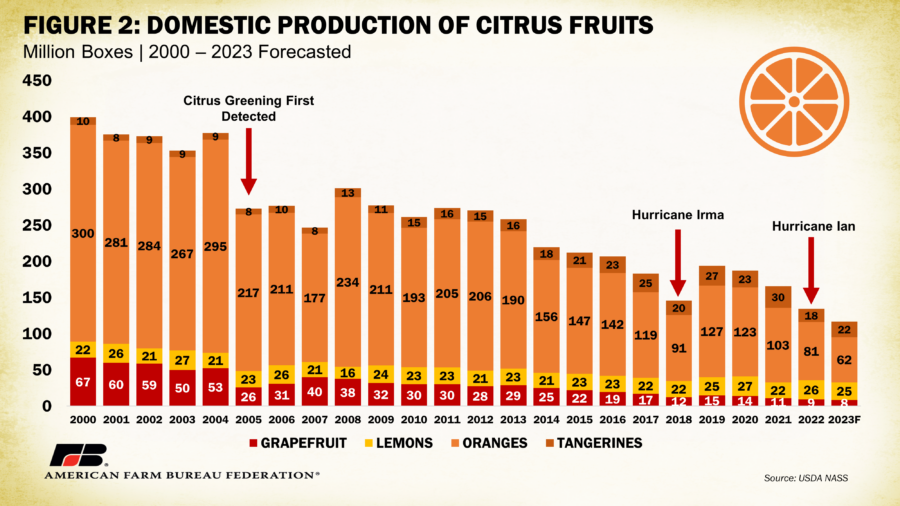

Figure 2 displays total domestic production of citrus fruits (lime production is not reported by USDA’s National Agricultural Statistics Service). Until 2015, oranges consistently made up over 70% of citrus production in the United States by volume. Since 2000, total domestic production of oranges has dropped 80%, from 300 million boxes to a projected 62 million in 2023. The bulk of oranges (84%) available for domestic consumption are used in juice, with most of the remainder being consumed fresh. Though orange juice consumption in the United States has declined since the 1970s, the onset of COVID-19 spurred sales to their highest levels in five years. The increase was likely linked to consumers trying to increase their intake of vitamin C, commonly known to build up a healthy immune system.

Like oranges, grapefruit have seen a continuous drop in domestic production heavily linked to the weather and disease factors affecting Florida. Since 2000, domestic grapefruit production has dropped from 67 million boxes to 8 million boxes, an 88% decline. In 2000, 80% of domestically grown grapefruit was from Florida, followed by California (11%), Texas (8%) and Arizona (1%). In 2023, 51% of the much smaller projected crop is expected from California, followed by Texas (29%) and Florida (20%).

Citrus fruits not as commonly grown in Florida have not faced the same domestic output declines. Lemon production, exclusive to California and Arizona, has hovered between 20 million and 30 million boxes since the 1980s. Only because of the decline of orange and grapefruit production have lemons made up a larger share of citrus produced. The only citrus fruit category to show a clear increase in production is the tangerine category, which includes tangelos, mandarins, clementines and traditional tangerines. Successful marketing campaigns showcasing easy-peel seedless options in small handheld sizes have boosted the share of fresh consumption of tangerines to over 40% of the fresh orange/tangerine market (compared to under 20% in 2000). By volume, tangerine production has increased from 10 million boxes to over 21 million boxes since 2000, a 107% increase. California is projected to produce over 97% of the tangerines in 2023 with the remainder in Florida. In 2016, California surpassed Florida in terms of total citrus fruit production, again, a function of lower Florida output rather than higher California production.

Other Factors at Play

Notably, weather and plant diseases are not the only factors driving down citrus production in parts of the United States. In 1970, Florida’s population sat at under 7 million people. Today, Florida is the third most populous state in the nation, with an estimated 21.78 million people. In 2022 alone, over 310,000 people migrated into Florida, pressuring land-use dynamics and intensifying urban development. Demand for new housing, associated businesses and infrastructure has reduced the percentage of land dedicated to agriculture, rangeland and forestry. The index for all-transaction house prices in Florida shows an average post-2008 recession increase of 8% annually. Between the first quarter of 2020 and end of 2022, the index reveals a 58% increase – showing real estate prices have intensified in the past few years. For citrus growers in particular, the prospect of record land sales values can be a much safer option than risking another year to the whims of weather or disease. High values are also a barrier to entry for new or beginning farmers. Removing acreage from production reduces domestic output further.

Additionally, like with most specialty crops, citrus harvesting is manual and labor intensive. Any reduction in the availability of labor and increase in cost of that labor further handicaps citrus producers in their ability to increase production. According to the USDA, the number of U.S. farmworkers has continuously declined since 2003, leading many operations to turn to the H-2A guestworker program to secure needed labor. Though the program offers solutions, compliance and documentation can be cumbersome and enforced wage rates can be unrealistic. Currently, the U.S. Department of Labor requires operations to pay guestworkers an Adverse Effect Wage Rate (AEWR) depending on the type of position and location. In 2023, every state has an AEWR in excess of $13 per hour, with 16 states having an AEWR in excess of $17 per hour (Illinois, Indiana, Ohio, Hawaii, Kansas, Nebraska, North Dakota, South Dakota, Michigan, Minnesota, Wisconsin, Iowa, Missouri, Oregon, Washington and California). Florida and Texas have an AEWR between $14 and $14.99 per hour. Changes to methodologies used to calculate the AEWR put many farms in further jeopardy of being unable to cover costs. With labor costs accounting for up to 38.5% of total production expenses in the fruit and tree nuts sector (Castillo et al., 2021), this segment is no small part of the budget. Not to mention, beyond labor, farmers are already facing record production costs, which increased $70 billion in 2022 and are expected to increase another $18 billion in 2023. These factors, combined with complex environmental and tax-related regulatory conditions make growing citrus crops in the United States a very daunting and often uneconomical task.

Market Share Moving Over Borders and Overseas

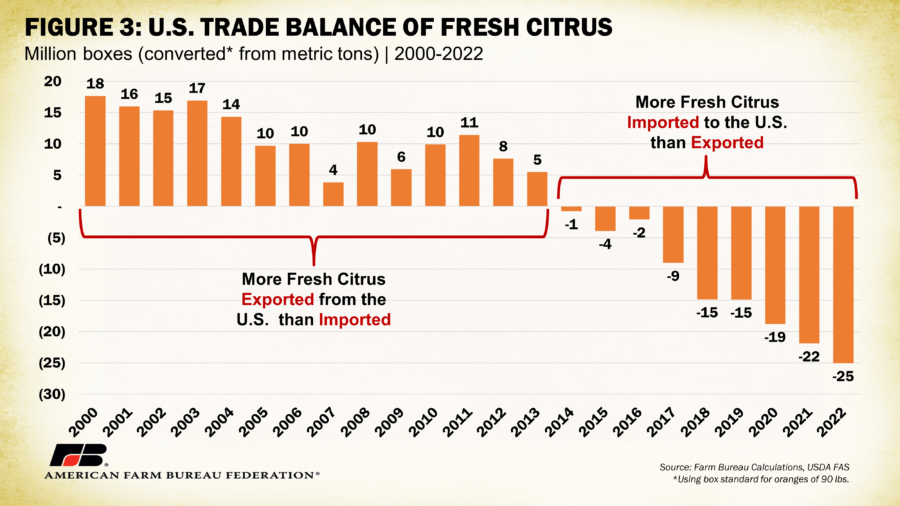

While the domestic supply of citrus fruits has declined tremendously, our imports have increased substantially, a telltale sign that consumer demand for citrus in the United States is now greater than domestic production capacity. In other words, we’ve become partially reliant on other nations for citrus products. In 2000, the U.S. imported just under 9 million boxes of fresh citrus fruits; in 2022 that number jumped over 320% to over 37 million boxes. Nearly half of those 37 million boxes were imported from Mexico, followed by Chile (15%) and Peru (10%). In terms of exports, we’ve seen the expected opposite. In 2000, the U.S. exported over 26 million boxes of fresh citrus fruits; in 2022 that number dropped to just over 12 million boxes – a 53% decline. Until 2014, the volumetric trade balance of U.S. citrus imports and exports was positive, meaning the U.S. exported more fresh citrus to other countries than it imported. Since then, however, the trade balance has switched to negative, moving from a difference of 770,000 boxes in 2014 to a deficit of over 25 million boxes in 2022 (Figure 3).

The decline in citrus production in the United States has diminished the country’s longtime role as a leader in global market share. In 1970, for instance, the U.S. produced nearly 50% of the world’s oranges (Figure 4). This number dropped to 25% by 2000 and sits at an expected 5% for 2023. Much of that share reduction has been taken by Brazil (35%), China (16%) and the European Union (12%). Similarly, this has occurred with grapefruit (Figure 5). In 1970 the U.S. produced 75% of the world’s grapefruit, which dipped to 43% in 2002 and now is projected to sit at a mere 4% in 2023. China now claims almost 80% of global grapefruit production, followed by Mexico and South Africa at 6% each. You may notice production has increased in foreign countries even with the presence of citrus greening disease. Though citrus greening disease is very much present in other leading production nations, like Brazil and China, and has resulted in production losses, these countries have more land available in climate zones favorable to citrus crops. This means they can more effectively hedge against disease spread by growing in different areas, an option farmers in Florida cannot take advantage of. Not to mention, the lower cost of labor and lower presence of environmental regulatory hurdles likely contribute to ease of growing crops and battling disease in these competitor nations.

Conclusions

Citrus production in the United States has dropped to levels so low that U.S. citrus producers can no longer support domestic demand nor lead the world in market share. The primary factor contributing to this continues to be the spread of citrus greening disease throughout the primary production state of Florida, though other forces are at play. California and Texas, which have been able to maintain and even increase production of most citrus crops, could take on some of this production decline but face their own intrastate challenges including potential citrus greening outbreaks in their own groves. Persistent hurricanes, ever encroaching urban development, high labor costs and regulatory uncertainty have cornered Florida citrus producers into what, at times, seems like a battle lost. While the geographic limitations of growing citrus crops limits U.S. farmers in their ability to be resilient under intensifying conditions, this situation may likely grow to agricultural markets outside of citrus. Economic and production conditions that make growing food within the United States too challenging and too expensive, especially when compared to overseas competitors, jeopardizes U.S. farms and domestically sourced food. Lack of novel innovations and support for research to help growers manage and control the spread of citrus pests and diseases worsens the long-term outlook for these domestic markets. Thankfully, land grant university research has revealed modest advancements in breeding and treatment options to counter citrus greening. Recurring authorizations of programs including the Emergency Citrus Disease Research and Development Trust Fund are essential to finding effective, financially sustainable solutions for farmers combatting these diseases. Additionally, ensuring risk protection programs, such as crop insurance, provide affordable and adequate protection of high-value specialty crops such as citrus is critical to maintaining operations in the face of natural disasters.

It is vital that farming, regardless of crop type, remains an economical option in the United States. Land-use dynamics, high costs and regulatory networks that discourage farmers from producing domestically puts national food security at risk and sends production overseas.

Top Issues

VIEW ALL