Latest USDA Forecast: Smaller – but Still Significant – Farm Income Drop

photo credit: North Carolina Farm Bureau, Used with Permission

Daniel Munch

Economist

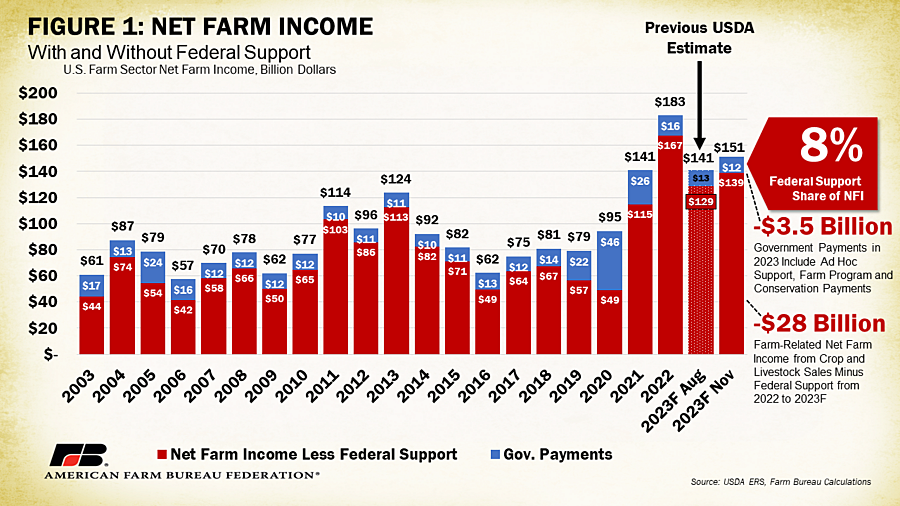

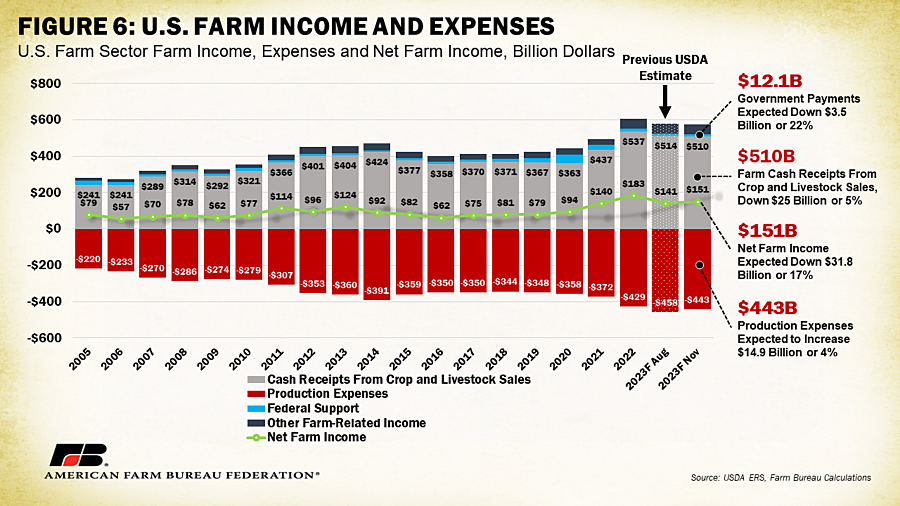

USDA’s most recent Farm Sector Income Forecast, released Nov. 30, projected a smaller – but still significant - drop in 2023 net farm income compared to August estimates. The $41.7 billion (23%) decline forecast in August was adjusted to a $31.8 billion (17%) drop for a total net farm income of $151 billion expected for 2023 (compared to $141 billion estimated in August). When adjusted for inflation, net farm income, a broad measure of farm profitability, is expected to decrease 20%, or $37.9 billion, from 2022. If realized, 2023 net farm income would be above the 2003-2022 average in inflation-adjusted dollars. The most significant factor influencing the revision is production expenses, estimated to increase 4%, or $14.9 billion, over 2022 compared to the 7%, or $29.5 billion, increase forecast in August’s report for a total of $443 billion across the farm economy. Even with this adjustment, production expenses remain forecast at their highest levels to date. Net farm income reflects income after expenses from production in the current year and is calculated by subtracting farm expenses from gross farm income.

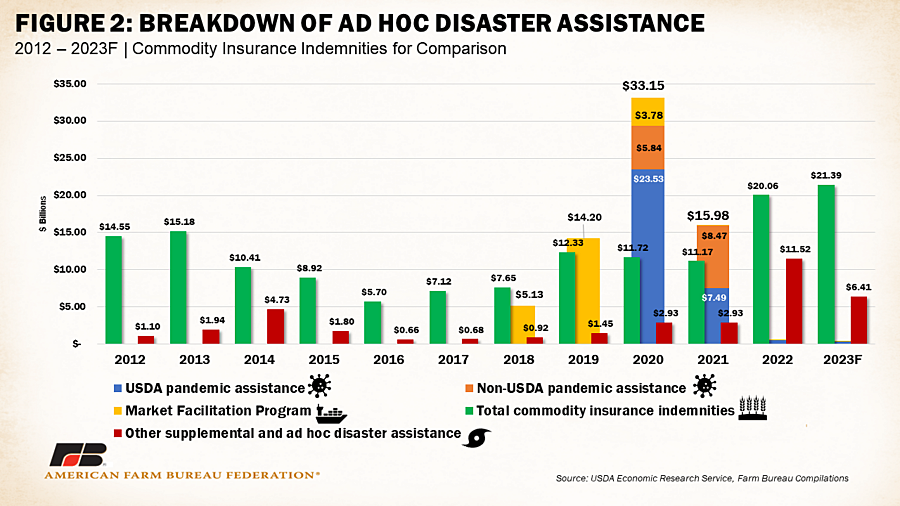

Direct government payments are estimated to decrease by $3.5 billion, or 22%, between 2022 and 2023 to $12.1 billion. This marks the third consecutive annual decrease in government payments for producers since the peak of the COVID-19 pandemic in 2020 and is lower than the $12.6 billion in payments forecast in February. Ad hoc and supplemental program payments, which include payments from the Emergency Relief Program (ERP), Quality Loss Adjustment Program and other farm bill designated-disaster programs, are expected to decrease from $11.5 billion to $6.41 billion, a 44% decline and less than the $7.4 billion in payments originally forecast in August under the category. Given the announcement of some limited additional funds to extend ERP to cover 2022 disaster losses, future estimations in this category will likely be revised upward.

Since the August release, commodity insurance indemnities were adjusted down slightly for 2023 for an expected $21.39 billion. This is a 7%, or $1.34 billion, increase over 2022’s $20.06 billion, marking the highest payout of indemnities since the data series began in 2005. This increase is likely the result of increased crop insurance enrollment by those who received a Wildfire and Hurricane Indemnity Program-Plus or ERP payment and are required to purchase crop insurance or Noninsured Crop Disaster Assistance Program coverage (when crop insurance is not available) for the next two available crop years. This requirement was continued under the latest ERP announcement.

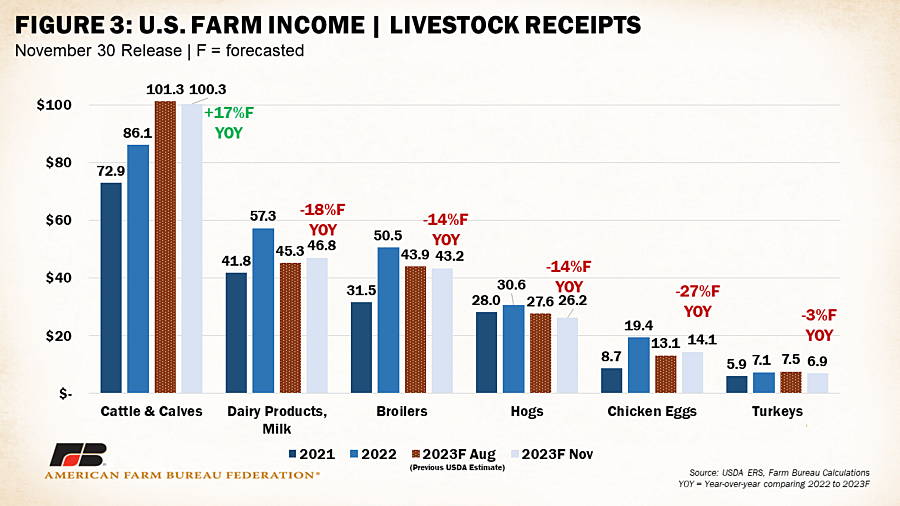

Livestock

Lower livestock receipts remain the primary culprit behind lower forecast 2023 farm receipts. In the August release, the value of livestock production (in nominal dollars) decreased $11.9 billion to $246 billion total. In the November release, livestock receipts dropped slightly more to $245 billion, a $13 billion, or 5%, drop from 2022. All top livestock categories are expected to see declines in cash receipts besides cattle and calves. Cattle and calves are expected up $14.27 billion (17%) over 2022 to $100 billion, a $1.02 billion downward revision from the August forecast. Hog receipts had the largest downward revision, moving from $27.6 billion forecast in the August release to $26.23 billion forecast in the November release, a 14% decrease from 2022. Expected receipts for broilers ($43.23 billion) and turkeys ($6.87 billion) were also down from August estimates. Dairy products and chicken egg receipts were adjusted upward. Dairy products are now forecast to decline 18% from 2022 to $46.79 billion; USDA previously estimated a 21% drop. Chicken egg receipts are forecast to decline 27% from 2022 to $14.12 billion, compared to the 32% drop previously estimated.

Earlier Market Intel reports have discussed the primary market drivers behind recent cattle, poultry and dairy prices. It is important to note that hog farmers have experienced considerable losses in 2023. Losses for farrow-to-finish farms in Iowa were estimated to be $18.52 per head in October, with negative profitability estimates in eight out of the last 10 months. While prices have remained relatively high, high input costs and production issues have been the main causes for negative returns. Overall, most livestock producers are facing reduced revenues going into 2024.

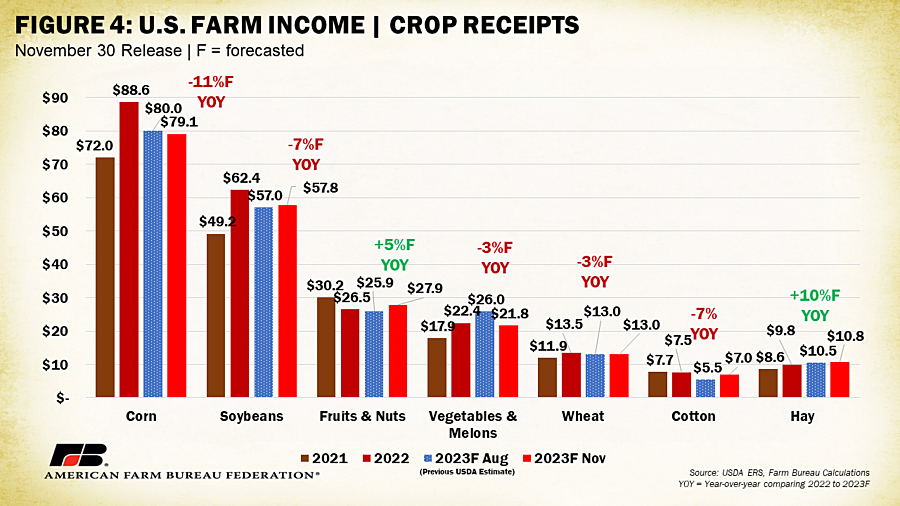

Crops

Crop receipts remain forecast down from 2022. In the August release, total crop receipts were expected to decline $9.9 billion for a total of $266 billion. In the November release, this figure was adjusted to a drop of $12.1 billion, or 4.3%, from 2022 to $264 billion. Estimates for wheat receipts remain unchanged for 2023 at $13 billion, a 3% decline from 2022. November release estimates were lower for corn, down an additional $970 million to $79 billion from the August release, and vegetables and melons, which are down $4.22 billion to $21.8 million from the August release. On the other hand, receipts for soybeans, fruits and nuts, cotton and hay were adjusted upward compared to the August release, though only fruits and nuts and hay will have receipt increases as compared to 2022. Soybean receipts are forecast down 7% to $57.8 billion from 2022, $750 million higher than the August release. Fruits and nuts are forecast up 5% to $27.9 billion from 2022, $1.92 billion higher than the August release. Cotton receipts are forecast down 7% to $7 billion from 2022, $1.5 billion higher than the August release. Hay receipts are forecast up 10% to $10.8 billion from 2022, $260 million higher than the August release. Factors impacting crop pricing dynamics have been discussed in recent Market Intels including Grain Storage Capacity Can Buffer Impact of Transportation Disruptions, September WASDE: Ringing in 50 Years with Reduced Corn, Soybean Yields and Lower Livestock Production Expectations, and Severe Weather and Low Mississippi River Levels Bring Uncertainty to Harvest. Like livestock producers, crop growers are generally working with lower sales than in 2022.

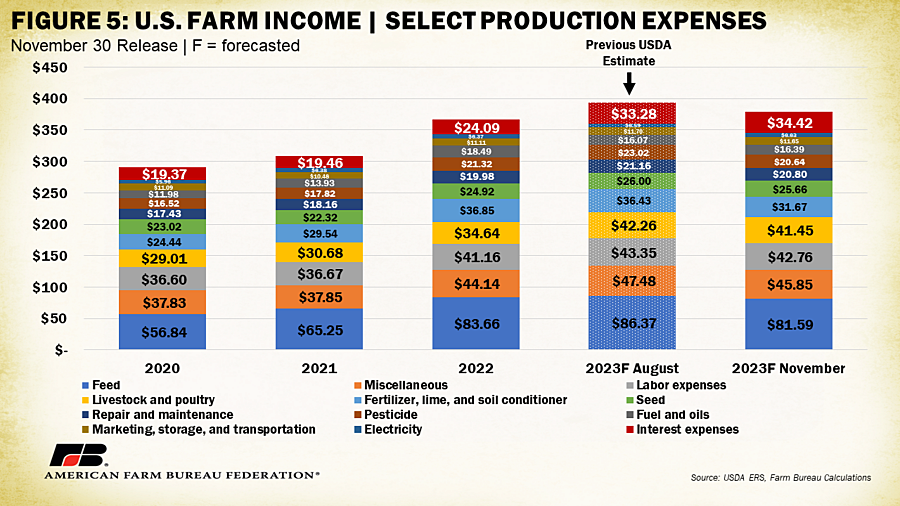

Production Expenses

The most significant forecast revision is attributable to lower production expenses, estimated to increase 4%, or $14.9 billion, over 2022 compared to the 7%, or $29.5 billion, increase forecast in August’s report for a total of $443 billion across the farm economy. Production expenses are still expected to reach their highest levels on record and their sixth consecutive year of growth in 2023. Compared to the August release, all production expense categories were adjusted downward (meaning farmers are paying less than originally forecast for them) except for fuels and oil, electricity and interest expenses. Compared to 2022, however, only fertilizers, fuels and oils, pesticides and feed are forecast to decline. Fertilizers are expected to experience the largest percent decline — 14% or $5.18 billion — to $31.67 billion across the farm economy. Fuels and oils are expected to drop 11%, or $2.1 billion, to $16.39 billion in 2023, $320 million higher than the August release estimated. Pesticides are expected to drop 3%, or $750 million, to $25.66 billion. Feed is expected to decrease 2%, or $2.06 billion, to $81.59 billion, still the largest cost category.

Interest expenses and livestock/poultry purchases are expected to see the largest increases in 2023, far outpacing the declines in other categories. The cost of livestock and poultry purchases are expected to increase $6.8 billion to $41.5 billion, up 20%. Interest expenses are expected to increase a whopping $10.3 billion to $34.42 billion, a 43% jump. Other categories such as labor, marketing and transportation, and electricity are forecast up 4% in 2023.

Other farm income, which includes things like income from custom work, machine hire, commodity insurance indemnities and rent received by operator landlords, is estimated to increase by $1.4 billion, or 2.6%, from $52.3 billion in 2022 to $53.6 billion in 2023 (a $200 million downward revision from the August release). When all factors influencing income are accounted for, the resulting expectations for a net farm income decline become apparent, as illustrated in Figure 6, albeit at a less drastic decline than estimated in August.

Summary

USDA’s most recent estimates for 2023 net farm income provide an updated estimate of the farm financial picture. For 2023, USDA anticipates a 17% decrease in net farm income, moving from $183 billion in 2022 to $151 billion in 2023. Much of the forecast decline in 2023 net farm income is tied to lower crop and livestock cash receipts, continued increases in production costs and a decrease in ad hoc government support. It is important to highlight the projected nature of this forecast. Net farm income numbers for 2022 were not finalized until August 2023 and have been adjusted upward over $20 billion in the eight months since the year ended. During this time USDA is digesting new information and data as it becomes available, shifting calculations from estimates to actual values. This means there is still much variability in final 2023 net farm income.

At the very least, these estimates show the relationship between, on average, falling commodity prices and rising production costs and the ultimate impact on farmers’ bottom lines. Combined with weather uncertainty and a high cost of capital to operate their businesses, farmers and ranchers will be forced to adapt as they always have. Part of being able to adapt means having clarity on rules that impact their businesses’ ability to operate, having access to comprehensive risk management options and being given a respected voice during formulation of vital legislation such as the farm bill, which can either complicate or streamline farmers’ and ranchers’ ability to sustainably contribute to a reliable and resilient U.S. food supply.

Trending Topics

VIEW ALL