Farmers Can Expect Limited Disaster Support from the Latest ERP Reboot

photo credit: Alabama Farmers Federation, Used with Permission

Daniel Munch

Economist

On Oct. 27 USDA announced the allocation of more than $3 billion to support commodity and specialty crop producers impacted by natural disasters in 2022 through a modified continuation of the Emergency Relief Program (ERP). Though initially welcomed by farmers and ranchers recovering from exceptional drought conditions, severe hurricanes, derechos, flooding and other natural disasters, a change in how assistance is calculated will drastically reduce the support many impacted producers receive. In particular, the program’s new progressive factoring methodology limits sufficient support to a small percentage of operations, a puzzling approach when natural disasters devastate operations of all types. This report discusses how the ERP 2022 works.

Though permanent disaster assistance programs, crop insurance and the Noninsured Crop Disaster Assistance Program (NAP) provide a substantial safety net to livestock and crop producers, the losses that occur outside the scope of an existing policy or coverage level can destroy a farm business, especially those resulting from large-scale weather disasters. Congress has historically responded to disaster situations by authorizing additional disaster funds via ad hoc disaster programs like the Wildfire and Hurricane Indemnity Program Plus (WHIP+) and, most recently, the Emergency Livestock Relief Program (ELRP) and ERP. The first iteration of ERP, discussed in our From WHIP+ to ERP: A New Name for 2020-2021 Ad Hoc Disaster Assistance Market Intel report, was included in a September 2021 continuing resolution that appropriated $10 billion to the Office of the Secretary of Agriculture to support ad hoc assistance programs.

On Dec. 29, 2022, President Biden signed the Disaster Relief Supplemental Appropriations Act of 2022 into law, providing $3.74 billion in financial assistance for agricultural producers impacted by eligible natural disasters that occurred in calendar year 2022. Note, analyses have estimated 2022 uncovered losses of over $10 billion for crops alone, $7.26 billion higher than appropriated funds. Like the previous iteration of ERP, ERP 2022 covers losses to crops, trees, bushes and vines due to qualifying natural disaster events including wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze (including a polar vortex), smoke exposure, excessive moisture, qualifying drought and related conditions. Related conditions under ERP include “weather and adverse natural occurrences that occurred concurrently with and as a direct result of a specified disaster event.” Examples include excessive wind that occurred with a derecho or silt and debris that occurred as a result of flooding. Losses due to drought are eligible if they occurred in areas rated by the U.S. drought monitor as D2 (severe) for eight consecutive weeks or D3 (extreme drought) or higher at any time during the applicable calendar year.

Instead of two “phases,” ERP 2022 will have two “tracks.” These tracks largely parallel the phases from ERP 2020/21 in terms of how applications will be handled and processed. Track 1 focuses on streamlining payments to producers whose crop insurance and NAP data are already on file. Track 2 focuses on filling payment gaps to cover producers who did not participate or received payments through existing programs or with other special cases. Under Track 1, eligible crops include all crops for which federal crop insurance or NAP coverage was available and a crop insurance indemnity or NAP payment was received, except for crops intended for grazing. Track 2 will provide payments for eligible crop and tree losses through a revenue-based approach using data provided by eligible producers on application forms. Producers with losses that are eligible for Track 1 may apply for Track 1, Track 2 or both tracks; however, the Track 2 payment calculation will take into account any payments the producer receives under Track 1 to ensure a producer is not receiving duplicate benefits under both tracks. Both tracks cover the same eligible crops.

Applying

Like 2020/21 ERP, USDA and USDA-Risk Management Agency will automatically generate Track 1 applications, with certain items pre-filled with information already on file. These applications will be mailed to corresponding producers starting Nov. 8. It is important to note, just because a producer received a pre-filled application doesn’t mean they are eligible for assistance. The producer must certify their crop insurance or NAP indemnities were from a qualifying disaster event. USDA estimates that ERP Track 1 benefits will reach more than 206,000 producers who received indemnities for losses covered by federal crop insurance and more than 4,500 producers who obtained NAP coverage for the 2022 crop year.

The application period for Track 2 opened on Oct. 31. Producers applying for Track 2 must submit FSA–524, ERP 2022 Track 2 Application, certifying their benchmark year revenue and disaster year revenue. In addition, all producers applying for Track 2 must submit FSA–525, which is the producer’s commitment to obtain crop insurance and/or NAP coverage for the next two crop years, by the application deadline to have a complete application on file. The deadline had not yet been announced by FSA.

In addition, USDA is requiring the following forms, which should already be on file for those with prior Farm Service Agency program participation, for ERP eligibility:

- Form CCC-901, Member Information for Legal Entities (if applicable).

- Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs (if applicable).

- Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, if applicable, for the 2021 program year.

- A highly erodible land conservation (sometimes referred to as HELC) and wetland conservation certification (Form AD-1026 Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) Certification) for the ERP producer and applicable affiliates.

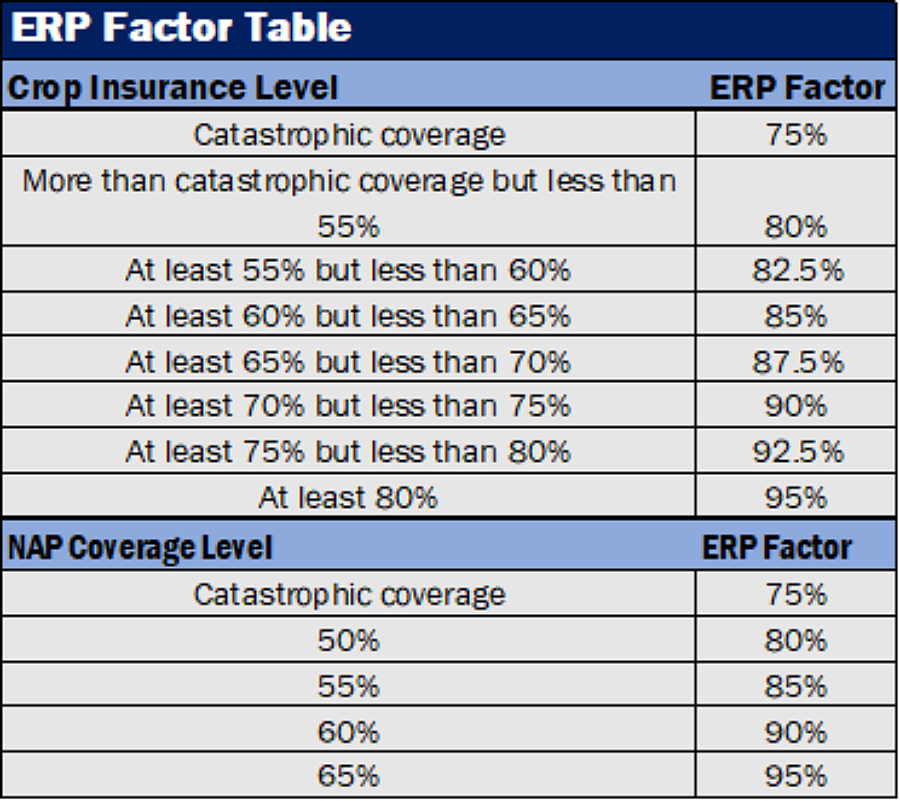

Track 1 Indemnity Calculations

There are several aspects of the ERP 2022 payment calculation that remain the same compared to its predecessor. First, for Track 1, ERP base calculations for a crop will be based on the existing coverage obtained by a producer. Calculations will parallel the formula of the existing coverage but use an ERP factor in place of the producer-selected coverage level. For example, a producer with at least 55% coverage on their 2022 crop insurance plan will have a corresponding ERP factor of 82.5%. ERP factor tables for crop insurance and NAP are provided below.

Like its predecessor, base ERP 2022 assistance will subtract the calculated indemnity at the higher ERP factor from the previously paid indemnities received for a producer’s existing crop insurance or NAP coverage. This is where the program similarities end. In ERP 2020/21, producers were indirectly reimbursed for premium and fee costs for 2020 and 2021 program years during this step. This does not occur in ERP 2022. The next step, instead, is a new “progressive factoring” approach in which income-tax-like downward adjustments are made to the base calculation for those who had crop insurance. The adjustments will follow the specifications below.

- Base calculation of up to $2,000 multiplied by 100% (no change)

- Base calculation between $2,001 and $4,000 multiplied by 80% (-20%)

- Base calculation between $4,001 and $6,000 multiplied by 60% (-40%)

- Base calculation between $6,001 and $8,000 multiplied by 40% (-60%)

- Base calculation between $8,001 and $10,000 multiplied by 20% (-80%)

- Base calculation over $10,000 multiplied by 10% (-90%)

This means, any base-calculated payment of over $10,000 will be reduced by 90%. In other words, the calculated loss a farmer faces is being massively devalued. Progressive factoring does not apply to those with NAP coverage. Once this progressive factoring is applied, if and only if you qualify as an underserved producer will FSA reimburse for premiums and fees paid in 2022. An underserved farmer is defined as a beginning farmer or rancher, limited resource farmer or rancher, socially disadvantaged farmer or rancher, or veteran farmer or rancher. Socially disadvantaged farmers include American Indians or Alaskan Natives, Asians or Asian-Americans, Blacks or African Americans, Hispanics or Hispanic Americans, Native Hawaiians or other Pacific Islanders and women. Limited resource is defined as a farmer or rancher who is both: 1) a person whose direct or indirect gross farm sales did not exceed $189,200 in each of 2019 and 2020 calendar years and 2) a person whose total household income was at or below the national poverty level for a family of four during the same years.

After the adjustment is made for underserved producers, all ERP payments, for all producers, are then prorated at 75% (reduced by another 25%). As a reminder, Track 1 NAP applicants are not subject to progressive factoring but are subject to the 75% prorate. Note that this final 75% proration of the payment is identified in the formal notice in the Federal Register, but not in the program factsheet as of this writing.

Track 1 Indemnity Examples

The following examples provide a general framework for how Track 1 ERP 2022 is expected to compensate qualifying producers.

To start, providing an example of how progressive factoring works is valuable. Consider a base ERP calculation (after losses are reduced by the ERP factor calculation and crop insurance indemnities have been subtracted) of $430,000 in disaster losses. FSA would multiply:

- the first $2,000 by a factor of 100% ($2,000 × 100% = $2,000),

- the second $2,000 by a factor of 80% ($2,000 × 80% = $1,600),

- the third $2,000 by a factor of 60% ($2,000 × 60% = $1,200),

- the fourth $2,000 by a factor of 40% ($2,000 × 40% = $800),

- the fifth $2,000 by a factor of 20% ($2,000 × 20% = $400),

- and the remaining $420,000 by a factor of 10% ($420,000 × 10% = $42,000).

The sum of those calculations is $48,000. For underserved producers, premiums and fees would be reimbursed after progressive factoring. Finally, the $48,000 would be multiplied by 75% for a final indemnity of $36,000. A disaster-induced crop loss of at least $430,000 would receive disaster assistance of $36,000, covering, at most, 8% of the producer’s total disaster related loss.

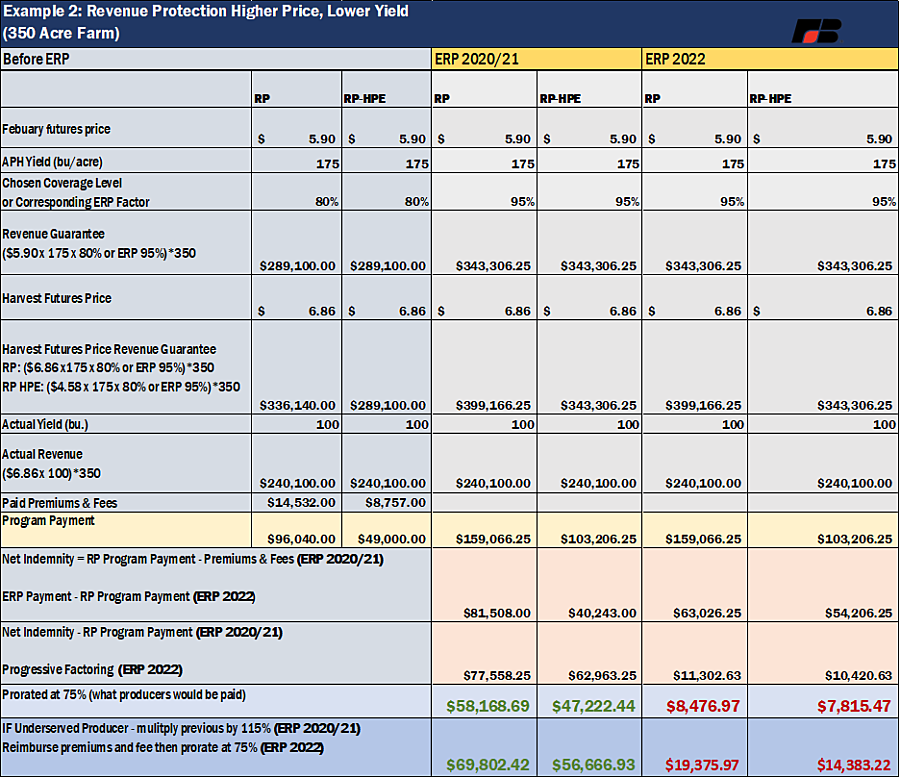

In a second more specific example, presented below, we use a 350-acre corn producer who had an active revenue protection (RP) or RP with the harvest price exclusion (HPE) policy during the corresponding ERP program year when the harvest price moved higher than the February reference price, but yields dropped due to a qualifying weather disaster. The left, “Before ERP,” columns display the variables and elections of the plan without ERP assistance. Note the comparison of ERP 2020/21 and ERP 2022 columns. The producer purchased an 80% coverage level, which resulted in a total farm indemnity of $96,040 under the RP example and $49,000 indemnity under the RP-HPE example (yellow, left). With ERP in place, the coverage level is swapped with the associated ERP factor (in this case, 80% is increased to 95%) and the total resulting base ERP support becomes $159,066 under the RP example and $103,206 under the RP-HPE example (yellow, right).

For ERP 2020/21, service fees and premiums are subtracted from the base RP/RP-HPE indemnity to equal $81,508 and $40,243, respectively. Those values are then subtracted from the base ERP payments (yellow, right) to become $77,558 for RP and $62,963 for RP-HPE. Prorating 75% then drops these down to $58,168 and $47,222, respectively, which is what a producer should expect to receive. Underserved producers, as defined by USDA, under ERP 2020/21 received an additional 15% on top of the base ERP 2020/21 payment, resulting in a payment of $69,802 under the RP example and $56,666 under RP-HPE.

For ERP 2022 Track 1 for crop insurance, no reimbursement of premiums and indemnities takes place before original indemnities are subtracted. Instead, once those indemnities are subtracted, resulting in $63,026 for RP and $54,206 for RP-HPE, they are adjusted using the progressive factoring sequence described earlier. This adjusts the ERP 2022 values to just $11,302 for RP and $10,420 RP-HPE. For all producers, this value is then prorated by another 75%, resulting in loss assistance of $8,476 (compared to $58,168 previously) and $7,815 (compared to $47,222 previously). For underserved producers, premiums and fees would be reimbursed before proration of 75%, leading to finals of $19,376 (compared to $69,802 previously) for RP and $14,383 (compared to $56,666 previously) for RP-HPE.

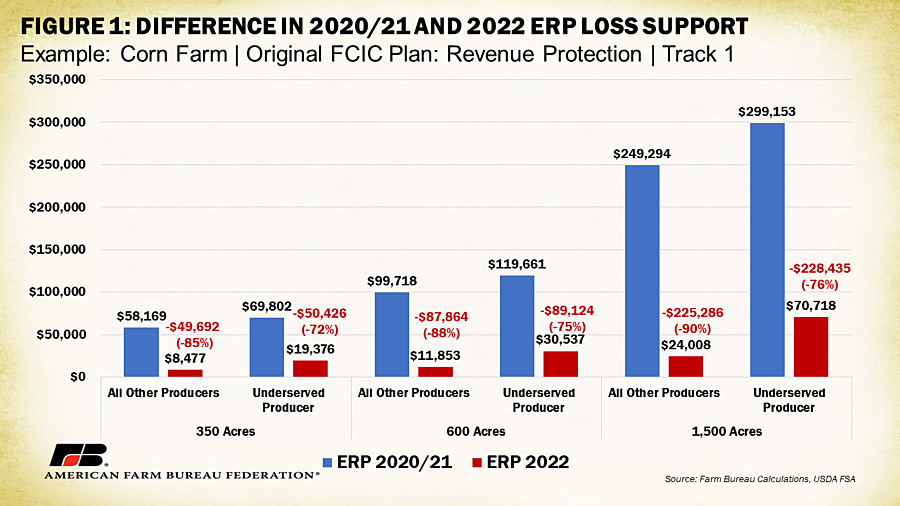

Non-underserved producers would experience a decrease in assistance of 85% under this new methodology and underserved producers a decrease of 72% from ERP 2020/21. Figure 1 displays the differences between ERP 2020/21 and ERP 2022 for underserved and all other producers for this example and two mostly identical examples except for increased acreage (600 acres and 1,500 acres). The larger the farm, the larger the decline in comparative support between ERP 2020/21 and ERP 2022. This seems to imply operations with more revenue (not to be confused with profit) are less susceptible to the impact of natural disasters, a confusing and misguided implication.

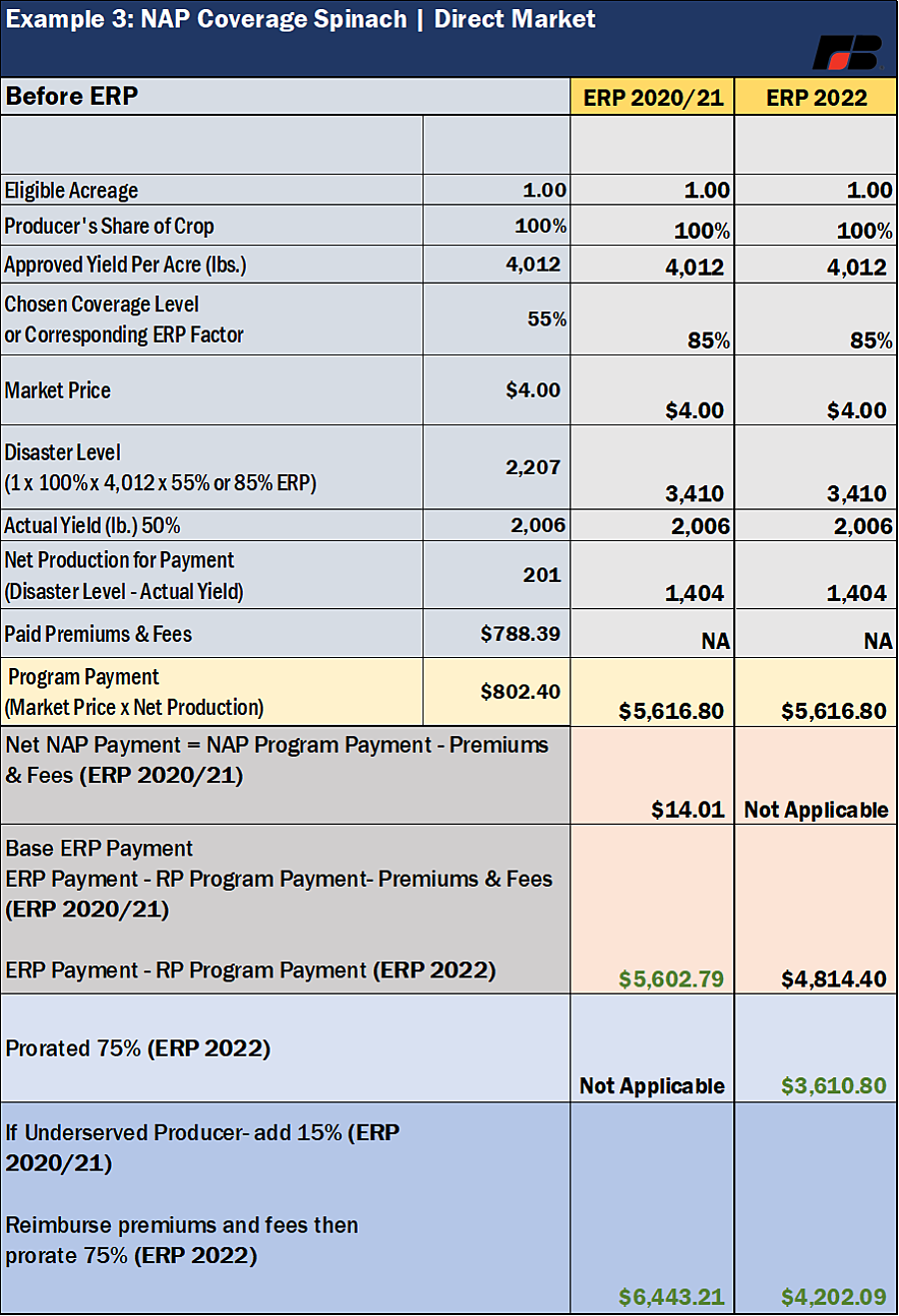

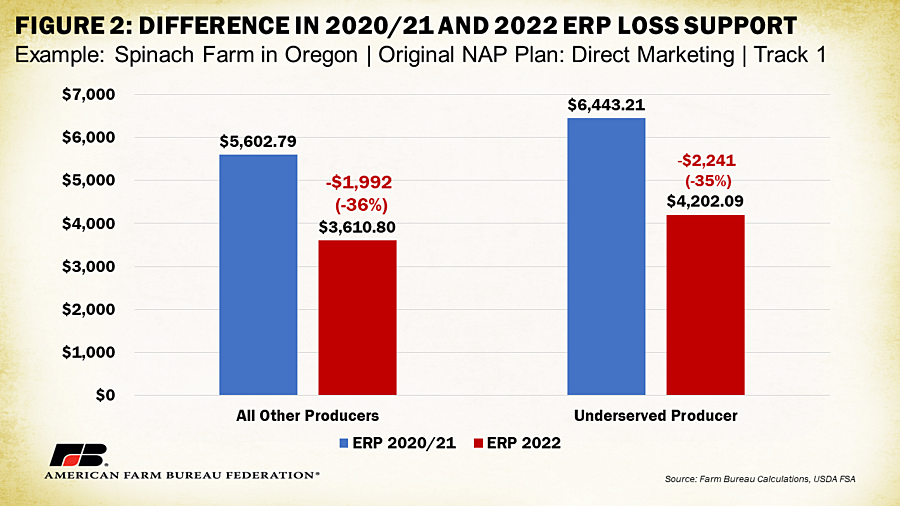

In the third example, we use a specialty crop producer in Oregon who had active NAP coverage during the corresponding ERP program year when a loss in their spinach crop (50% of their volume) took place because of a qualifying disaster. They had chosen the direct market option. Before ERP their chosen NAP coverage level was 55%, which resulted in a payment of $802.40 for their lost spinach crop under the market per-pound price. With ERP 2020/21, the 55% level is swapped for the ERP factor of 85% and the resulting base indemnity becomes $5,616.80. After service fees and premiums are subtracted from the base ERP 2020/21 NAP indemnity payment, that value is then subtracted from the base ERP payment to become $5,602.79. ERP 2020/21 payments for those with NAP coverage were not prorated at 75%. Underserved producers, as defined by USDA, receive an additional 15% on top of the base ERP 2020/21 payment, resulting in a payment of $6,443.21.

For ERP 2022, premiums and fees are not deducted before subtracting already-paid NAP indemnities, resulting in a base of $4,814 ($5,616 - $802). For all other producers, this ERP 2022 value is then prorated by 75% to equal $3,610 (compared to $5,602 previously). For underserved producers, the premiums and fees ($788) are reimbursed, and that value is prorated by 75% to equal $4,202 (compared to $6,433 previously).

Compared to ERP 2020/21, in this example, an underserved producer sees a decline of 35% and all others, 36% (Figure 2). The lack of progressive factoring for producers with NAP plans results in a less severe difference than those with traditional crop insurance, resulting in a fairer level of compensation across operations.

Track 2 Indemnity Calculations

Track 2 provides two options for determining a revenue benchmark and the disaster year revenue to which the revenue benchmark is compared. The first is a tax year option that allows producers to use tax records from 2018 or 2019 to apply. The second is an expected revenue option designed to better assist producers who have had a change in operation capacity during a disaster year as compared to the 2018 or 2019 tax year. A producer’s expected revenue includes all revenue from all eligible crops that could have been affected by a qualifying disaster event in 2022. Expected revenue must be based on “realistic projections that can be supported by acceptable documentation of expected inventory, acres, yield, and unit price” including documents such as sales contracts, purchase agreements, lease agreements, etc.

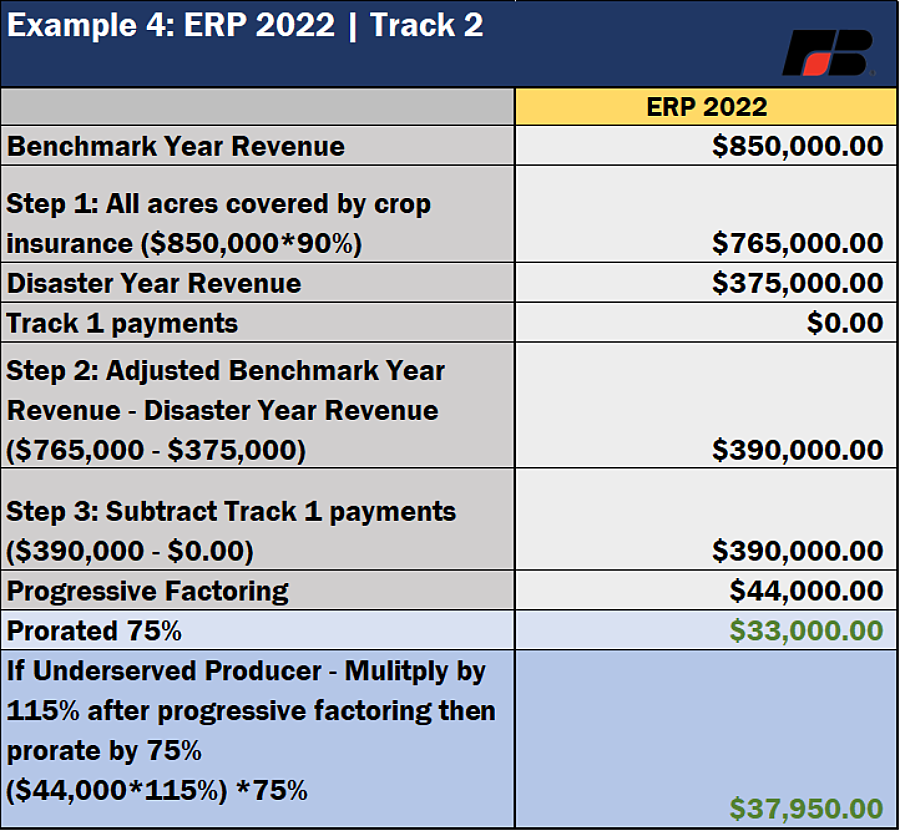

The Track 2 ERP calculation will start by multiplying the producer’s benchmark year revenue by an ERP factor of 90% (-10%) if all acres of all eligible crops were covered by crop insurance or NAP, or 70% (-30%) if not all acres of all eligible crops were covered. Next, both the producer’s disaster year revenue and any Track 1 payments will be subtracted from that adjusted value. After performing these steps, the same progressive factoring used in Track 1 will be applied (where values over $10,000 are reduced by 90%). For underserved producers, the sum of the results will be multiplied by 115% and the semifinal assistance value will be the lesser of the final value before progressive factoring or after the 115% adjustment after progressive factoring. A final payment factor of 75% will be applied to all calculated indemnities, including to underserved producers, further reducing assistance by 25%. FSA will also keep track of the percentage of revenue from specialty crops for certain payment limitations.

Track 2 Indemnity Example

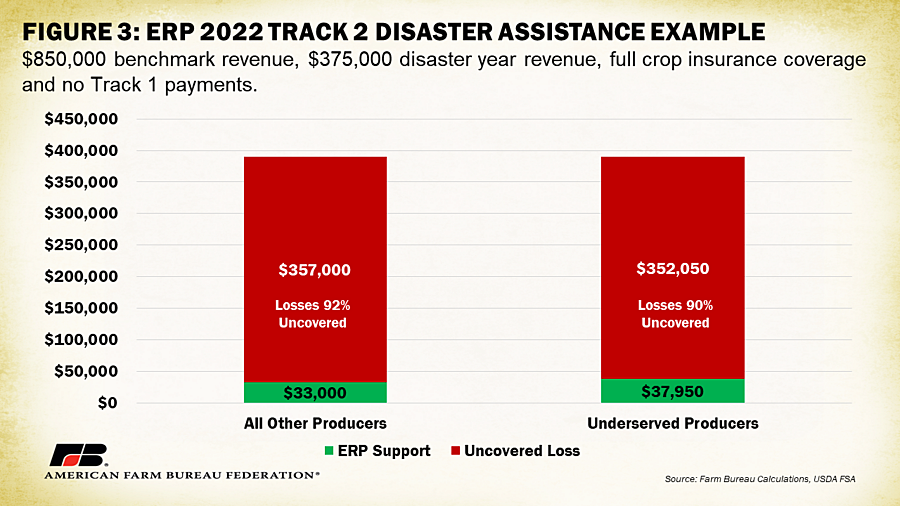

In the Track 2 example, a farm has established their benchmark revenue of $850,000 using tax records from 2019. All of this farm’s acreage was enrolled in crop insurance and they received no Track 1 payments. Their 2022 disaster year revenue was $375,000. Because all of their acreage was enrolled in crop insurance, the first step is to multiply their benchmark revenue by 90% (as opposed to 70%), equaling $765,000. Next, the disaster year revenue is subtracted ($375,000) and any Track 1 payments ($0), equaling $390,000. Progressive factoring as described in Track 1 is then applied, resulting in a base value of $44,000. For underserved producers, the base value is multiplied by 115% and then prorated by 75% to equal $37,950 in disaster assistance. For all other producers, that value is then prorated by 75%, further reducing the support to $33,000. In this example, the operation’s $390,000 disaster-related loss was supported with $37,950 for an underserved producer and $33,000 for all other producers meaning only 10% and 8% of losses were compensated for, respectively (Figure 3).

Payment Limitations

Payment limitations for ERP are dependent on farm-related adjusted gross income (AGI). Payment limitations are addressed by USDA as follows:

- A person or legal entity, other than a joint venture or general partnership, cannot receive, directly or indirectly, more than $125,000 in payments for specialty crops and $125,000 in payment for all other crops under ERP 2022 (for tracks 1 and 2 combined) for a program year if their average AGI farm income (see relevant tax years below) is less than 75% of their average AGI the three taxable years preceding the most immediately preceding complete tax year.

- If at least 75% of the person or legal entity’s average AGI is derived from farming, ranching or forestry-related activities and the participant provides the required certification and documentation, as discussed below, the person or legal entity, other than a joint venture or general partnership, is eligible to receive, directly or indirectly, up to:

- $900,000 for each program year for specialty crops; and

- $250,000 for each program year for all other crops.

- The relevant tax years for establishing a producer’s AGI and percentage derived from farming, ranching or forestry-related activities are 2018, 2019 and 2020.

- To receive more than $125,000 in ERP 2022 payments, producers must submit form FSA–510, including the certification from a certified public accountant or attorney that the person or legal entity has met the requirements to be eligible for the increased payment limitation.

Requirement to Purchase Federal Crop Insurance of NAP Coverage

Like ERP 2020/21, ERP 2022 requires future insurance coverage by participating producers. All producers who receive payments are required to purchase crop insurance or NAP coverage where crop insurance is not available for the next two available crop years. Insurable crops must be covered at greater than or equal to 60% or at the catastrophic level for NAP crops.

Conclusion

With 2024 around the corner, the ERP 2022 announcement presents an opportunity for producers to receive some assistance for crop losses from major weather disasters in 2022. The program, similar to ERP 2020/21, will provide an expected $3 billion in funds to producers with prior crop insurance or NAP coverage under Track 1 and address remaining producers under Track 2. Previous analyses have estimated farmers faced over $10 billion in crop losses in 2022 due to severe disasters, demonstrating the provided appropriation from congress is limited. Combining these funding constraints with drastic changes to how ERP assistance will be calculated, ERP 2022 is unlikely to provide producers with the buffer needed to absorb recovery costs and lost income. Severe drought does not select which farms in a region to dry out nor do hurricanes pick and choose which operations to aim for and flatten in their path. The progressive factoring approach used in ERP 2022 creates winners and losers in ad hoc disaster assistance when a wide diversity of operations and crop types have experienced devastation. Ensuring disaster assistance programs provide adequate support to all farm types is vital – not only for farm-level stability but for a safe and secure domestic food supply – and ERP 2022 falls short.

Top Issues

VIEW ALL