What Do the Tax Cuts Mean for Farmers and Ranchers?

TOPICS

Taxes

photo credit: Getty Images

Veronica Nigh

Former AFBF Economist

Benjamin Franklin is credited with the astute observation that “nothing is certain except for death and taxes.” On Dec. 20, Congress voted to pass a sweeping tax reform bill that won’t change Franklin’s sage guarantee, but does seem certain to lower federal taxes paid by most farmers and ranchers.

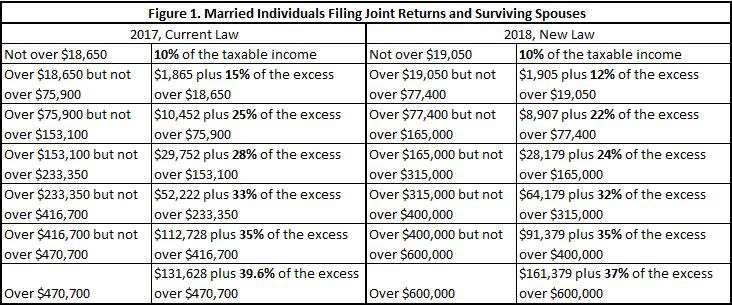

The Tax Cuts and Jobs Act (H.R. 1) will deliver modest tax reductions for W-2 earners in the form of modified individual tax brackets, which are included below. The bill attempts to simplify tax preparation for taxpayers by eliminating deductions that impacted a fairly small number of filers and replacing them with a higher standard deduction. In 2017, the standard deduction for a joint return was $12,700. In 2018, the figure will climb to $24,000. In addition, individual rates have been adjusted downward and the brackets expanded so that a larger amount of income is subject to lower rates. Figure 1 compares the 2017 and 2018 individual tables.

Given that 93 percent of U.S. farms file their taxes through the individual code, these changes are important. However, the business provisions that impact farms, ranches and other pass-through businesses offer the greatest chance of improvement for agriculture. The table at the end of the story compares the business provisions of current tax code and the Tax Cuts and Jobs Act.

Our Calculations

A few weeks ago we presented estimates of the impact of the House, Senate and current tax plans based on a few select elements critical for a basic understanding of the differences between the plans. We have updated our calculator to reflect the final bill, included below. Our examples are based on taxable income for a married couple filing jointly, calculated based on individual tax rates, standard deduction, two personal exemptions (current only, personal exemptions are eliminated in H.R. 1) and pass-through business tax rates. The final conference bill looks more like the Senate version, with a few modifications that fairly marginally impact the tax liability farmers and ranchers will face.

Pass-Through Business Provisions

The conference bill provides that individuals operating pass-through businesses will be able to take a deduction for 20 percent of their business income through Dec. 31, 2025. This is a small reduction from the Senate bill which would have allowed for a 23 percent deduction. As in the Senate version, the deduction is unlimited below a joint household income, though the threshold of $315,000 in the final bill is significantly lower than the $500,000 threshold in the Senate version.

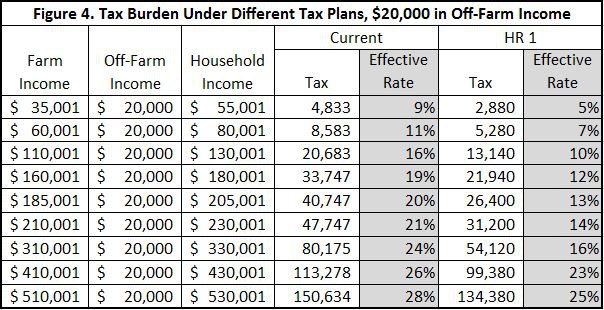

For farms and ranches with joint income beyond $315,000, the deduction is limited by one of two calculations, chosen by the business owner. Those calculations are 1) 50 percent of W-2 wages paid to employees or 2) the sum of 25 percent of W-2 wages paid plus 2.5 percent of depreciable business property. Farms and ranches with high labor costs, like dairies and specialty crop growers, will likely maximize their deduction using the first calculation, while farms and ranches with an extensive collection of expensive equipment and single-use agricultural buildings will maximize the deduction with the second calculation. We have not included any pass-through deduction for households with a combined taxable income above $315,000, since there is so much variability around which deduction limitation calculation would maximize the deduction available. Even without this deduction, the effective rate these farms and ranches will pay is reduced, but we should expect to see that effective rate fall considerably once the individualized deduction is included.

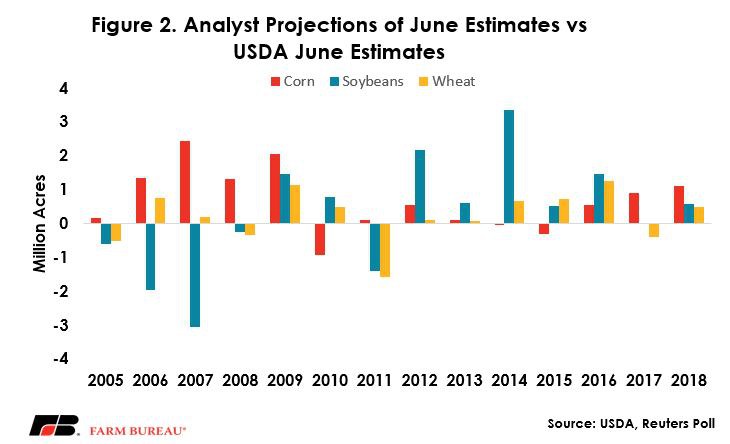

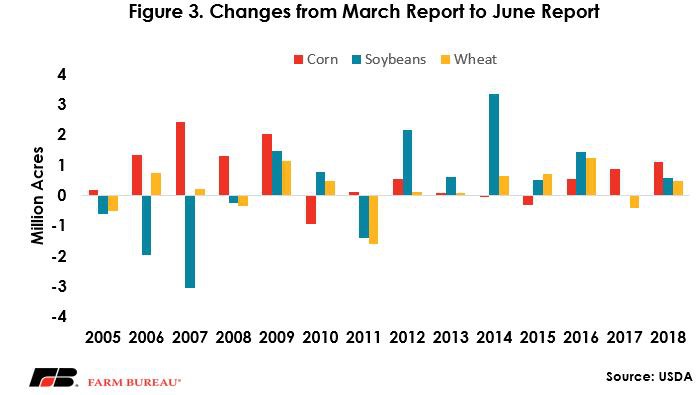

Figures 2 through 4 compare the tax treatment of a married couple with the same household incomes, across different combinations of farm and off-farm incomes. Figure 2 is the result for a farm household with $20,000 in off-farm income. Figure 3 represents a farm household with $30,000 in off-farm income and figure 4 represents a farm with $60,000 in off-farm income. These thresholds are approximately equal to the earned off-farm income of commercial, intermediate and residence farms surveyed in the 2015 ARMS survey.

H.R.1 offers a significant reduction in tax liability and the effective rate that farmers pay, based on the elements of H.R. 1 that we evaluated. Of course, there are a number of elements that we did not include, some of which may be very important in determining the amount each individual farm pays. We encourage you to compare all of the differences and refigure your last tax bill to see what it would have been under the rules of the new tax bill.

Follow Market Intel on Twitter: @FBMarketIntel

Trending Topics

VIEW ALL