Weekly Update on Export Inspections

Megan Nelson

Economic Analyst

photo credit: AFBF Photo, Mike Tomko

Megan Nelson

Economic Analyst

USDA’s March 25 Federal Grain Inspection Service report revealed soybean export inspections passed the 1 billion bushels mark to reach 1.1 billion bushels, down 31 percent from this time last year. While soybean export inspections remain down from prior year levels, corn export inspections total 1.1 billion bushels and are up 205 million bushels, or 22 percent, from prior-year levels.

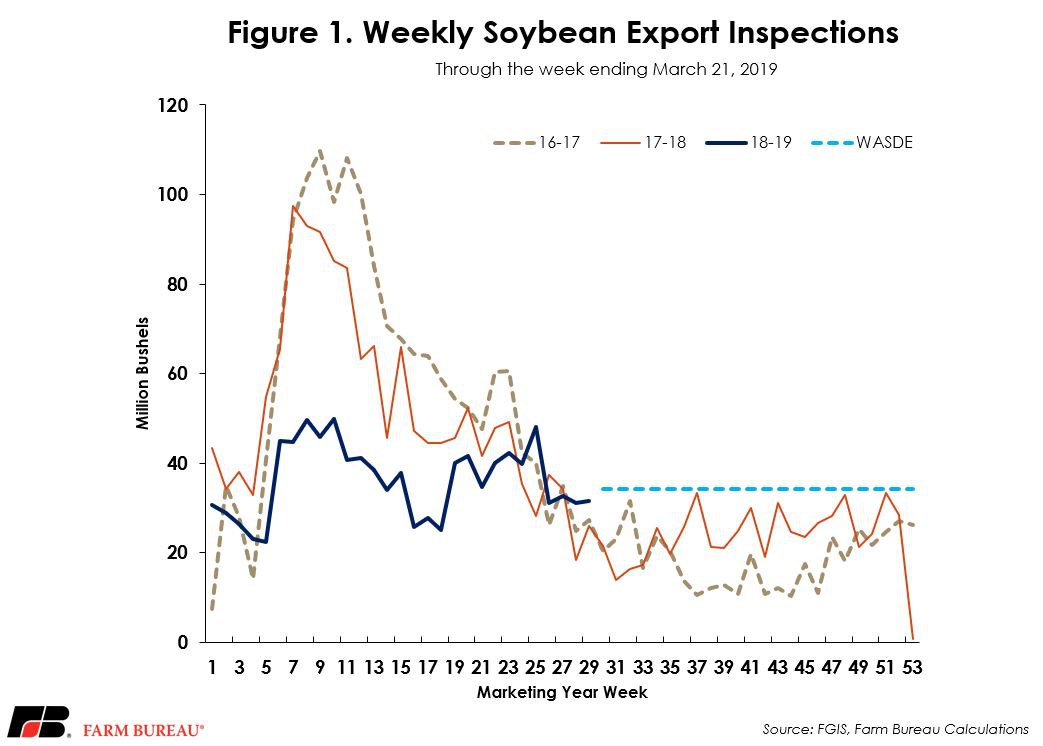

Pace of Soybean Exports

Through the week ending March 21, soybean export inspections, at 1.1 billion bushels, are down 463 million bushels, or 31 percent, from prior-year levels. Weekly soybean exports have remained steady over the past four weeks, adding around 31 million bushels to the export totals for marketing year 2018/19. Historically, at this point in the marketing year, weekly soybean export inspections are beginning to decline, with 26 million to 27 million bushels exported for the 29th week of the marketing year in 2016/17 and 2017/18. However, with 24 more weeks left in the 2018/19 marketing year, soybean exporters will need to continue shipping higher volumes each week to get close to historical levels as well as USDA’s projections for 1.875 billion bushels.

Remaining one of the largest drivers of the year-over-year decrease in soybean exports is the 82 percent decline in soybean export inspections to China. With 175 million bushels exported so far, soybean exports to China are down 779 million bushelfrom last year.

Overall soybean exports remain down 824 million bushels from USDA’s projection of 1.875 billion bushels exported this marketing year. With 24 weeks left in the marketing year, weekly soybean exports will need to reach an average of 34 million bushels per week to reach USDA’s projection. Figure 1 illustrates the weekly soybean export inspections through the week ending March 21.

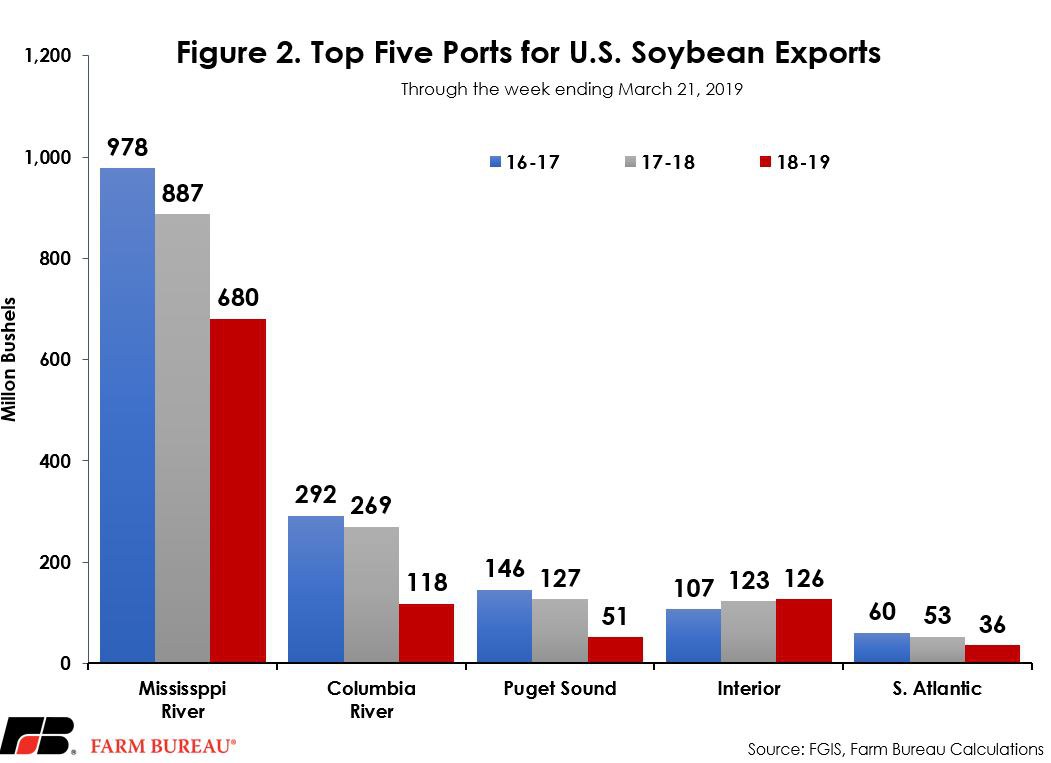

Most soybeans comedown from the Midwest, making the Mississippi River port the largest export hub for U.S. soybeans, with 680 million bushels shipped out so far in marketing year 2018/19. The current export pace from the Mississippi River represents a 23 percent decline from last year’s 887 millon bushels exported for the first 29 weeks of the marketing year. Soybean export inspections from the Columbia River port and Puget Sound represent the largest decline from last year, with a 56 percent and 60 percent decline, respectively. The only major U.S. soybean exporting port with a small increase from last year at this point in the marketing year is the Interior port, which had a 3 percent increase. Figure 2 outlines the cumulative soybean exports inspections from the top five export ports for the first 29 weeks of the marketing year.

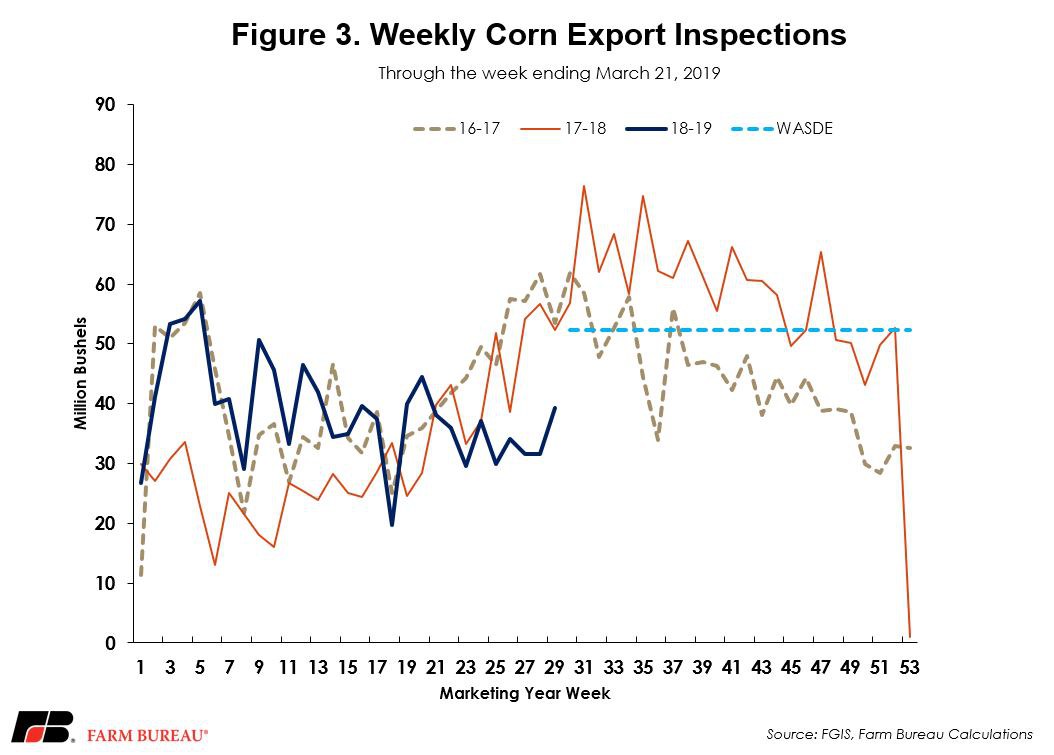

Pace of Corn Exports

USDA’s most recent FGIS report revealed corn export inspections at 1.1 billion bushels through the week ending March 21, representing a 22 percent increase from this time last year. As opposed to a historically slower export pace for soybeans at this point in the marketing year, corn export inspections tend to be at their highest levels. However, they have remained relatively steady, holding at an average pace of 34 million bushels per week for the last four weeks.Total corn export inspections through the first 29 weeks of the marketing year are trailing by 1.3 billion bushels from USDA’s projection of 2.375 billion bushels for marketing year 2018/19. In order for corn exports to reach USDA’s projection, weekly corn export inspections will need to average 52 million bushels per week. Figure 3 outlines cumulative weekly corn export inspections through the week ending March 21.

Trending Topics

VIEW ALL