USDA Grain Stocks and WASDE Shock Markets

TOPICS

WASDEShelby Myers

Economist

photo credit: AFBF Photo, Philip Gerlach

Shelby Myers

Economist

Following USDA’s release of the September 30 Quarterly Grain Stocks Report that lowered old-crop corn and soybean inventory levels well below pre-report expectations, and subsequently shocked the market leading to a sharp price rally. Today, adjustments were made in the October World Agriculture Supply and Demand Estimates to old-crop and new-crop supply and demand expectations.

Updated Corn Supply and Demand Expectations

For the 2019/20 marketing year, corn ending stocks were lowered 258 million bushels from 2.25 billion bushels to just under 2 billion bushels. The changes to corn supply and demand reported in the WASDE resulted from a decrease in ethanol use by 3 million bushels, estimated now at 4.8 billion bushels of corn to be used for ethanol, which is down 9.7% from 2018. Corn use going to food, seed and industrial uses increased 17 million bushels, and feed and residual use increased 200 million bushels to 5.8 billion bushels from 5.6 billion bushels in September. All in all, 2019/20 corn domestic use increased from 11.8 billion bushels to 12.1 billion bushels. The 13-million-bushel increase in exports for the 2019/20 corn crop amplifies the increases to corn demand for the 2019/20 crop year. The average corn price for 2019 lowered slightly from $3.60 to $3.54 per bushel.

The 1.9 billion bushels of corn ending stocks published in September 20’s Grain Stocks report updates the 2020/21 marketing year supply picture. Moreover, USDA made changes corn planting and harvested area, with planted areas dropping 1 million acres from previous estimates. USDA now pegs the 2020 corn area planted at 91 million acres, lower from the September estimate of 92 million acres, which was already a significant adjustment from the 97 million acres previously estimated earlier this year. USDA’s corn production number is 14.7 billion bushels for 2020 as a result of the 1.5 million-acre change in estimated area harvested and a slightly lower yield number, moving from 178.5 to 178.4. The overall 2020/21 corn supply moves to 16.7 billion bushels, up 5% from 2019, but below the 16.9-billion-bushel peak of 2016 and lower than last month’s WASDE estimate.

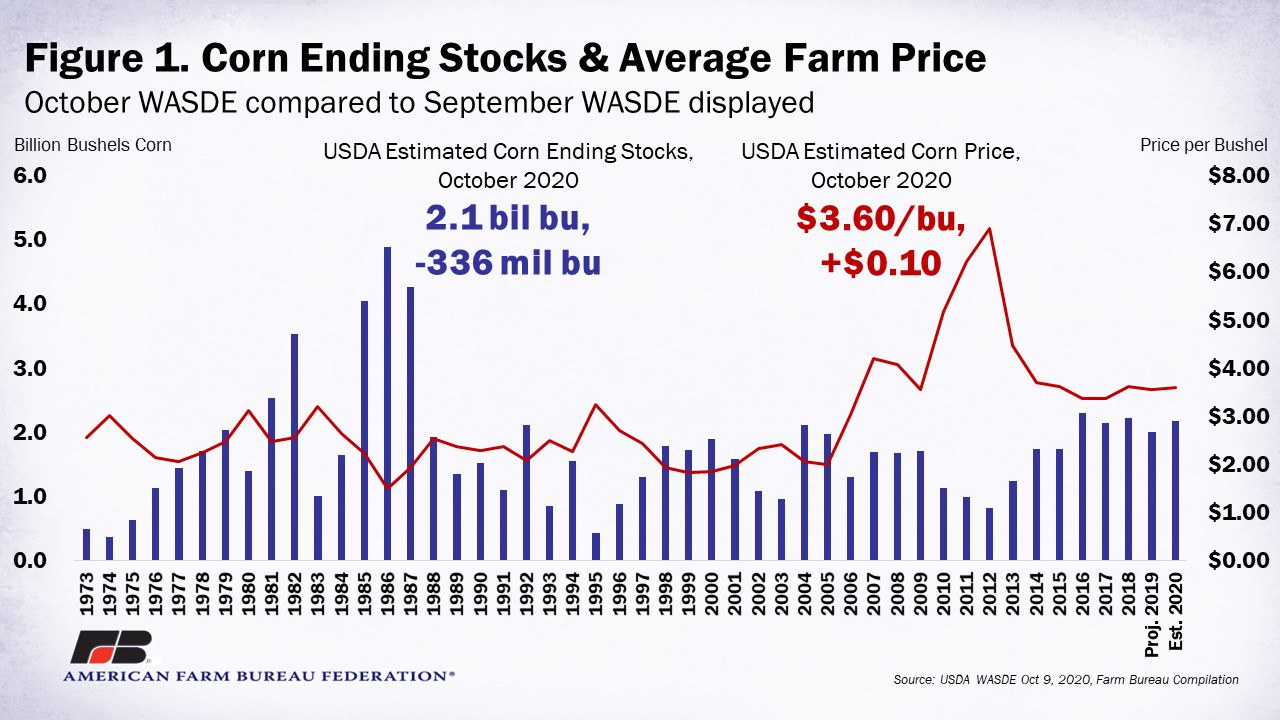

For 2020/21 demand, USDA cut ethanol corn use for the second month in a row by 50 million bushels to 5.05 billion bushels and also cut feed and residual use by 50 million to 5.7 billion bushels. However, exports were left unchanged at 2.3 billion bushels, which is just behind the 2.4-billion-bushel corn export peak in 2017. The resulting ending stocks after lowered supply and changes to demand result in 2.1 billion bushels estimated for the end of the 2020/21 marketing year, a significant downshift from where estimates sat earlier in April when 97 million acres were being estimated and ending stocks were quickly rising above 3 billion bushels (e.g. Corn Acres Should Be Reconsidered in 2020). However, hopes of a larger price rally will fall upon the need for corn demand to pick up further. USDA increased the average farm price from $3.50 per bushel in September to $3.60 per bushel. Figure 1 displays historic corn ending stocks with historic average farm price for corn and the changes from the September WASDE to October’s report.

Updated Soybean Supply and Demand Expectations

Soybean ending stocks for the 2019/20 marketing year were lowered from 575 million bushels to 523 million bushels from the September WASDE to October’s report. Soybean demand was adjusted with 5 million bushels in increased crushing but a 4 million-bushel decrease in exports. The largest adjustment occurred in soybean residual that led to the total soybean demand increase of 50 million bushels from September to October to account for the changes to ending stocks.

Rolling into the 2020/21 marketing year for soybean supply with 523 million bushels on-hand, USDA cut soybean area planted by 700,000 acres from 83.8 million acres to 83.1 million acres and lowered the amount to be harvested from 83 million acres to 82.3 million acres. With yield unchanged, the soybean supply for 2020/21 was lowered to 4.8 billion bushels.

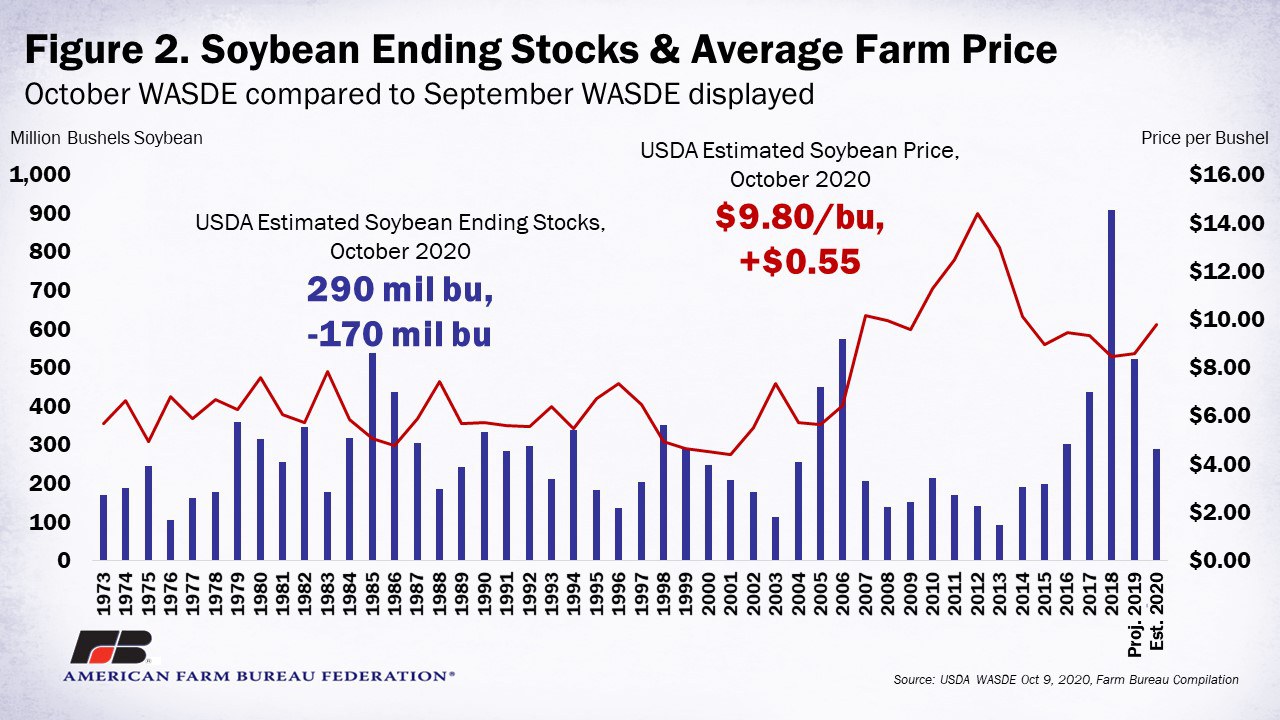

Good news is expected for the 2020/21 soybean demand with rising export estimates from 2.1 billion bushels in September to 2.2 billion bushels, which would be the largest on record if achieved. The smaller supply and increased demand from exports pushes ending stocks for 2020/21 even lower to 290 million bushels, a cut of 170 million bushels from September and the lowest levels since the 2013/14 marketing year. The 2020/21 average farm price estimate for soybeans jumps 55 cents, from $9.25 per bushel to $9.80 per bushel. Figure 2 shows historic soybean ending stocks with the soybean historic average farm price and the changes of the September WASDE compared to the October WASDE.

Summary

USDA’s Quarterly Grain Stocks Report brought adjustments forward to the October WASDE, which made adjustments to demand, and the markets reacted in a big way. Corn futures were already trading higher prior to the reports release and made gains after the report. Soybean futures were climbing before USDA released the report and futures kept climbing into contract highs. The impacts of the adjustments made in these reports will continue to ripple through farm country. Unfortunately, the reactionary price bumps came later than what would have been ideal for many farmers – especially those marketing the old-crop in what ultimately ended up being a tighter-than-expected supply environment -- but the price rally is welcome news for those with bushels still to sell.

With harvest underway, farmers and analysts will keep their eyes on any potential yield changes that would impact supply, while renewed hope for demand increases in exports and ethanol corn use materialize.

Trending Topics

VIEW ALL