USDA Announces Details Behind the New Trade Aid Package

TOPICS

USDAMichael Nepveux

Economist

photo credit: Getty

Michael Nepveux

Economist

Trade aid round two, or MFP2, is finally here. Regardless of what you call it, much-needed relief is on its way to farmers. On Thursday, USDA released the latest details on its actions to offer farmers reprieve from ongoing trade disputes. First announced in May, this new program will be structured similarly to last year’s program and will include:

- The Market Facilitation Program, a system authorized under the Commodity Credit Corporation and administered by the Farm Service Agency. This program is a series of direct payments to farmers who have been impacted by trade retaliation. The payments will total $14.5 billion.

- The Food Purchase and Distribution Program, a program administered by the Agricultural Marketing Service will purchase surplus commodities that have accrued due to lower export demand. It will be funded with $1.4 billion.

- The Agricultural Trade Promotion Program, a program administered by the Foreign Agricultural Service to assist in developing new export markets on behalf of producers. This program will be funded with $100 million.

How the MFP Program Will Work

Sign up for the program begins July 29 and will run through Dec. 6, so farmers should have enough time to participate. A wide range of commodities are covered, ranging from alfalfa hay and corn to dairy and hogs. USDA categorizes the commodities in three groups with different payment structures: non-specialty crops (i.e., corn, soybeans, etc.), specialty crops (tree nuts and fruits) and animal products (dairy and hogs only for MFP). USDA said applications will be released on July 29.Producers should be able to locate the proper application on the MFP website at that time.

The structure of the payment process is similar to last year, but this year USDA will split the payments into up to three tranches, as opposed to the two tranches last year. The first payment will consist of the higher of either 50% of a producer’s calculated payment or $15 per acre. The first payment is expected to go out in mid-to-late August. At this time, the second and third payments are not guaranteed, but instead will be evaluated as market conditions and trade opportunities develop over time. If USDA considers them to be warranted, the second payment is expected in November and the third payment is expected in January.

MFP payments are limited to $250,000 per person or legal entity for non-specialty crops. As with any farm program, there are eligibility restrictions. Producers must have an average adjusted gross income for the 2014, 2015 and 2016 tax years of less than $900,000. If they have an AGI above that level, they must derive at least 75% of their AGI from farming or ranching. Producers must also already have a farm number with FSA, as well as comply with the conservation compliance provisions of the “Highly Erodible Land and Wetland Conservation” regulations.

The Big Difference

This is the second year of MFP and trade assistance offered by USDA and the department has so far spent upwards of $8.5 billion in payments to producers who applied for MFP last year. While both are direct payment programs, this year’s program is slightly different than last year’s in terms of the way the payments are calculated.

As previously mentioned, the three different commodity groups will have three different payment structures. Non-specialty crops will receive a single-county payment rate multiplied by the farm’s total plantings of MFP-eligible crops in aggregate in 2019. USDA has placed a cap on a producer’s total payment-eligible plantings and they cannot exceed total 2018 plantings for that producer. This is in contrast to last year’s decision to make the payment rates based on unit of production for individual commodities, e.g., $1.65 per bushel of soybeans or 6 cents per pound of cotton (Trade Aid Round One: A State Perspective). Part of the reason USDA made the second round of MFP payments at the county, rather than the commodity level was an attempt to avoid influencing planting decisions in the middle of planting.

Mapping County-Level Payment Rates

This single payment rate means that regardless of what crops a farmer in a certain county planted, they will receive the same county payment that their in-county neighbors do.

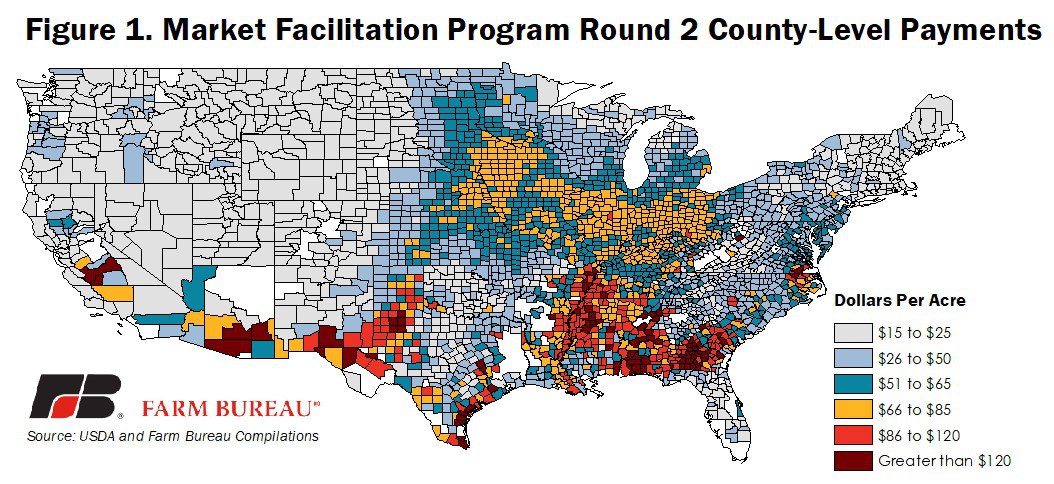

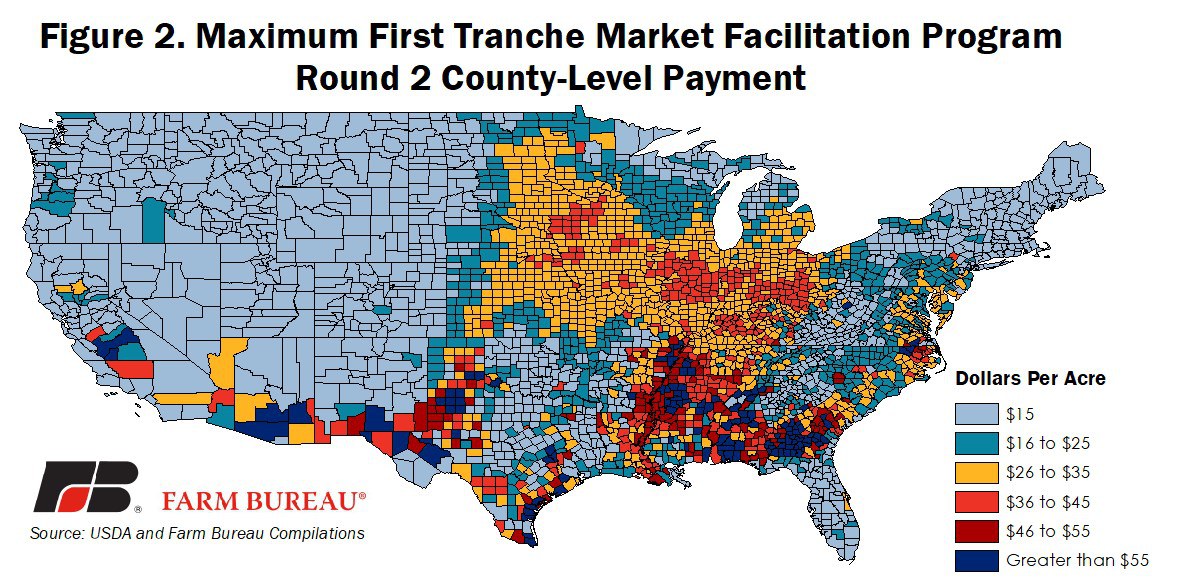

County payments across the country range from a minimum of $15 per acre to a maximum of $150 per acre. USDA has published a list of county payment rates, as well as a web tool that can be used to locate an individual county’s payment rate. There is a fairly wide regional distribution of payment rates across counties, as shown in Figure 1. The maximum county-level payment rate – ranging from $15 per acre to $75 per acre -- for the first tranche of payments last year is highlighted in Figure 2.

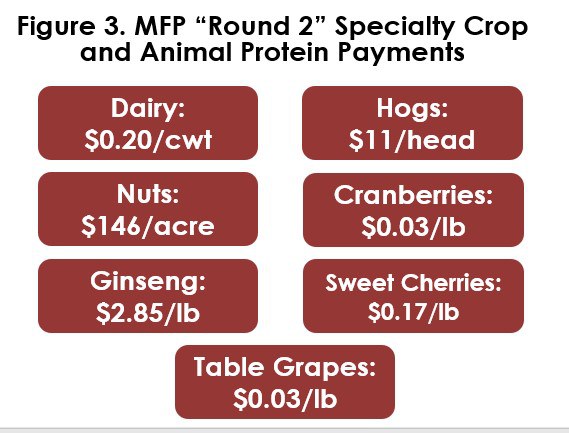

Payments for specialty crops, dairy and hogs will not be based on a single county payment, but segments of the specialty crops will also be on a per acre basis. Figure 3 shows the payment rates for the products.

Dairy producers who were in business as of June 1 will be able to receive a per-hundredweight payment based on production history. Hog producers will receive a payment based on the number of live hogs that were owned on a specific day, to be selected by the producer, between April 1and May 15. Specialty crop payments will be based on 2019 acres of fruit- or nut-bearing plants.

USDA hinted at potential benefits for producers who had opted to take the prevented plant option in their crop insurance policies and subsequently planted an eligible cover crop. These cover crops are likely going to fill a much-needed gap in forage needs for much of the country, and this announcement confirmed that these crops qualify for a $15 per-acre payment. However, these cover crops MUST be planted prior to August 1, so interested farmers may face challenges getting their hands on their desired eligible seed so quickly.

Summary

This announcement is still fresh, and there will be much more analysis to come on the subject, but in summary, USDA is providing much-needed short-term financial relief for farmers who are being hammered by the loss of markets, severe weather events, low commodity prices, mounting debt and a lack of available labor.

Trending Topics

VIEW ALL