USDA Aligns Definition of “Ag Products” to Global Trade Standard

TOPICS

WTO

photo credit: Getty Images

Veronica Nigh

Former AFBF Economist

On Friday, March 5, USDA will release January 2021 trade data. This release will be special because in addition to new data, trade enthusiasts will get a new definition. USDA, in coordination with the U.S. Census Bureau, will adopt the World Trade Organization's internationally recognized definition of "agricultural products" as its standard definition for the purposes of reporting U.S. agricultural trade data. What will that mean?

What’s in a Definition?

The length of the king’s arm. The weight of an average corgi dog. The time it takes a woman to circle the block. These are all definitions, but they aren’t very useful or transferrable -- unless you’re with the king, holding the dog or walking next to the woman. Obviously, differences can arise from each individual’s interpretation of “common” measurements, which has led to the adoption of widely agreed upon standards.

One of the basic goals when the WTO was created was to establish standard definitions for trade so that countries could more easily discuss issues. One of the more than 60 agreements that came out of the 1986–94 Uruguay Round negotiations, signed at the Marrakesh ministerial meeting in April 1994, was the Agreement on Agriculture. An important part of the AoA is the list of products, by HS code, that fall into the agriculture category. Generally speaking, agriculture is defined as HS Chapters 1 to 24 less fish and fish products and parts of HS Chapters 29, 33, 35, 38, 41, 43, 50-53. An exact list can be found here. Fish and fish products are defined as HS Chapter 3, HS 0509, HS 0511.91, HS 1504.10, HS 1504.20, HS 1603-1605 and HS 2301.20. (Definition based on 2008 Draft Modalities for the Liberalization of Tariffs on Fish and Fish Products.)

Until this recently announced change, USDA was utilizing a definition of agriculture that is similar to the WTO definition, but not quite the same. According to USDA’s Foreign Agricultural Service, agricultural products are currently defined as: “All of the products found in Chapters 1-24 of the U.S. Harmonized Tariff Schedule (except for fishery products in Chapters 3 and 16, manufactured tobacco products like cigarettes and cigars in Chapter 24, and spirits in Chapter 22) are considered agricultural products. Certain other products outside of Chapters 1-24 are also considered agricultural products. The most significant are essential oils (Chapter 33), raw rubber (Chapter 40), raw animal hides and skins (Chapter 41), and wool and cotton (Chapters 51-52).”

The differences between the U.S. definition and the WTO definition can cause confusion and makes talking about trade unnecessarily more difficult. USDA and the U.S. Census Bureau have decided to eliminate the differences between the two entities’ definitions, which should make conversing about trade easier, both inside the U.S. and out.

What’s the Difference?

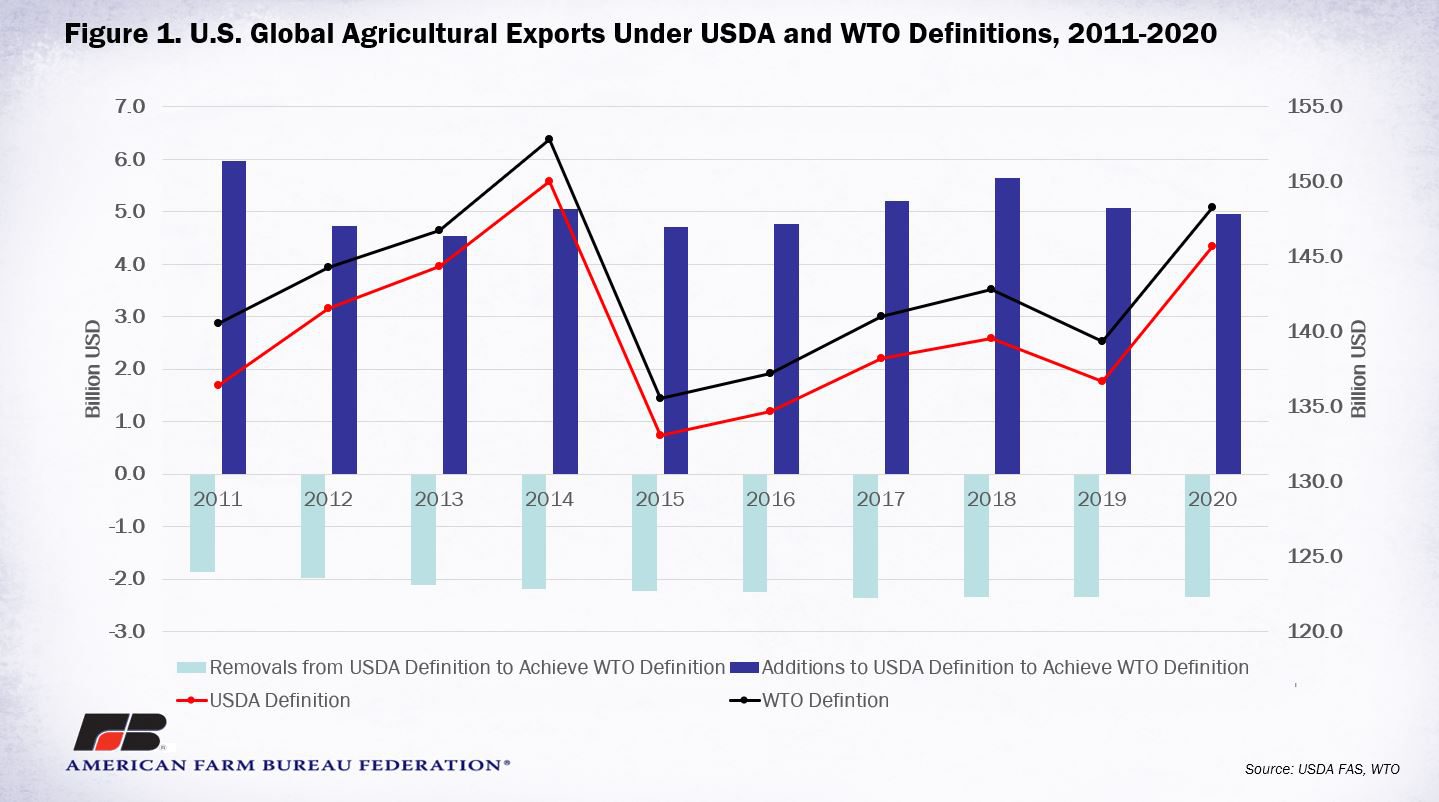

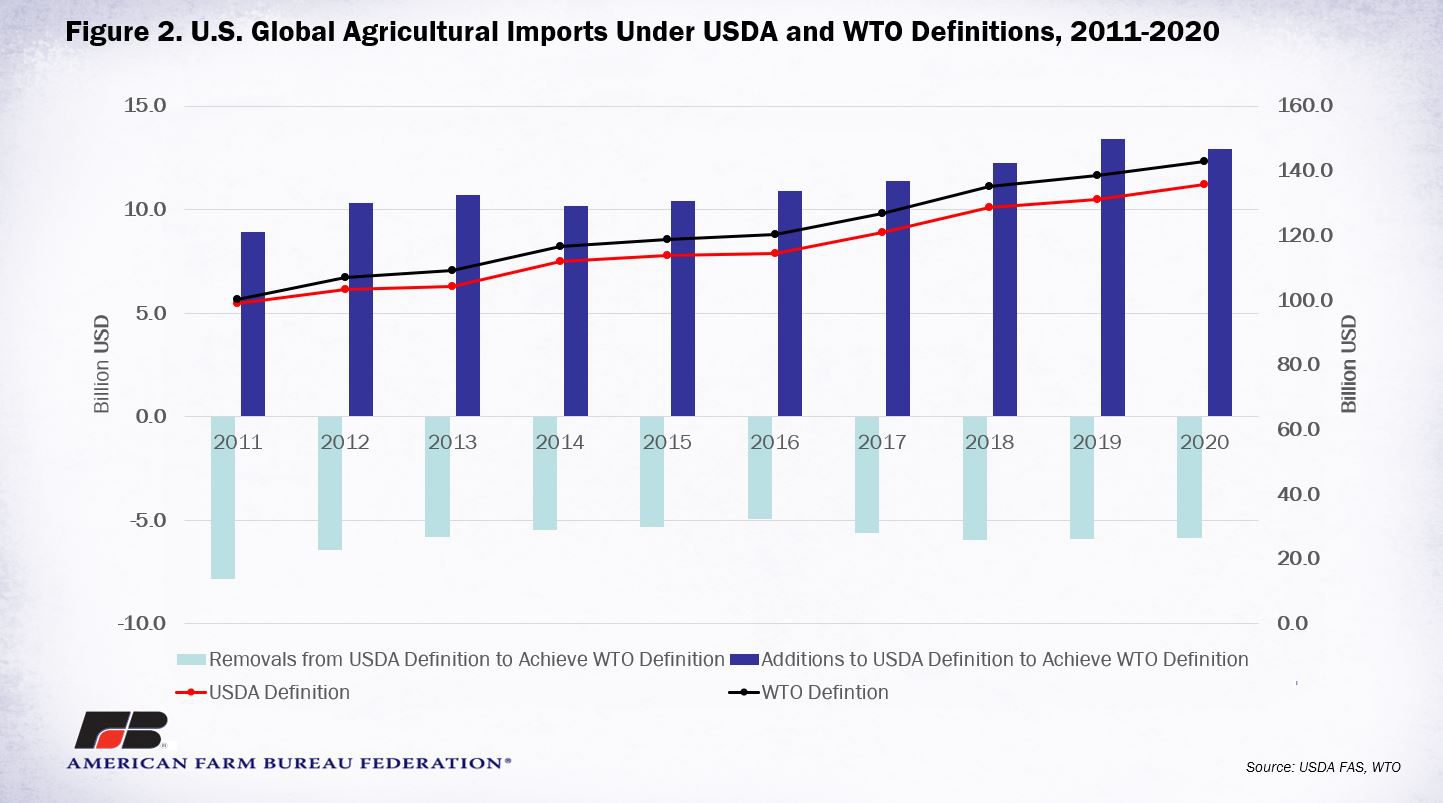

More than 90% of the tariff lines that define agriculture will be the same, but in order to utilize the WTO definition, a few tariff lines are subtracted from the previous U.S. definition and a few others are added. Based on an extensive comparison of each definition at the HS10-digit level, the differences are addressed below.

USDA’s current definition of “agricultural products” includes a limited number of tariffs lines across several HS chapters that are not in the WTO definition of agriculture. These tariff lines come from the following chapters: 16 (Preparations of fish), 29 (some organic acids), 33 (an essential oil mixture), 35 (rennet and Penicillin G Amidase), 38 (stearic and oleic acid), 40 (natural rubber), 53 (jute) and 98 (comingled donated food). Over the last 10 years, total U.S. exports of these tariff lines averaged $2.2 billion, while total U.S. imports of these tariff lines averaged $5.9 billion.

The WTO definition of agriculture includes many more tariffs lines that are not in USDA’s current definition of “agricultural products.” These tariff lines come from the following chapters: 1 (live animals, predominantly exotics), 5 (products of animal origin), 12 (seaweed), 13 (gum arabic), 14 (bamboo), 15 (glycerol and degras), 21 (certain soup and alcohol preparations), 22 (mineral water, denatured and undenatured ethyl alcohol, spirits), 24 (manufactured tobacco products), 29 (mannitol and D-glucitol), 35 (protein substance), 38 (finishing agent and dye), 50 (silk waste), 51 (wool waste) and 52 (cotton waste and carded cotton). The bulk of the added lines are in chapters 22 and 24. Over the last 10 years, total U.S. exports of these tariff lines averaged $5.1 billion, while total imports of these tariff lines averaged $11.1 billion.

On Balance

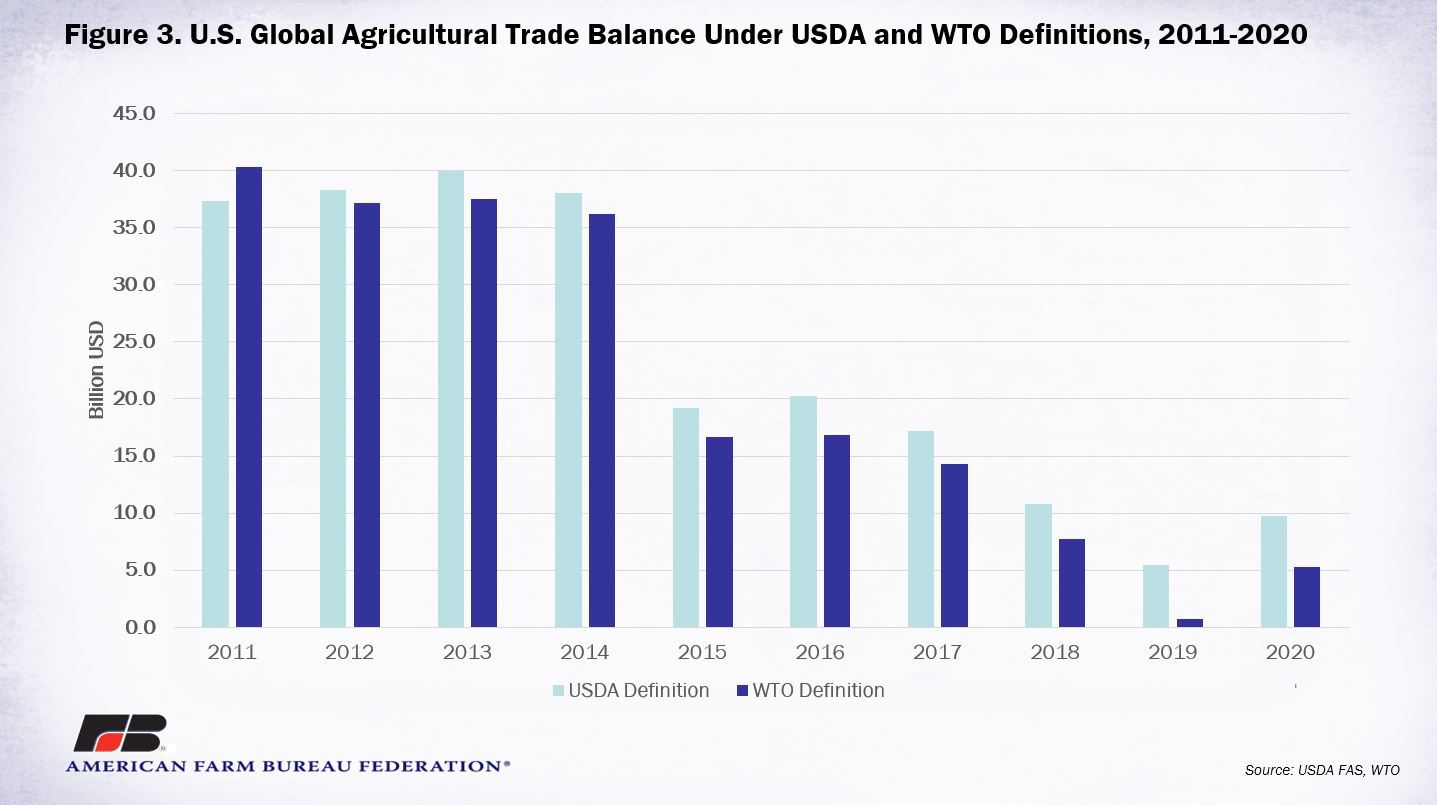

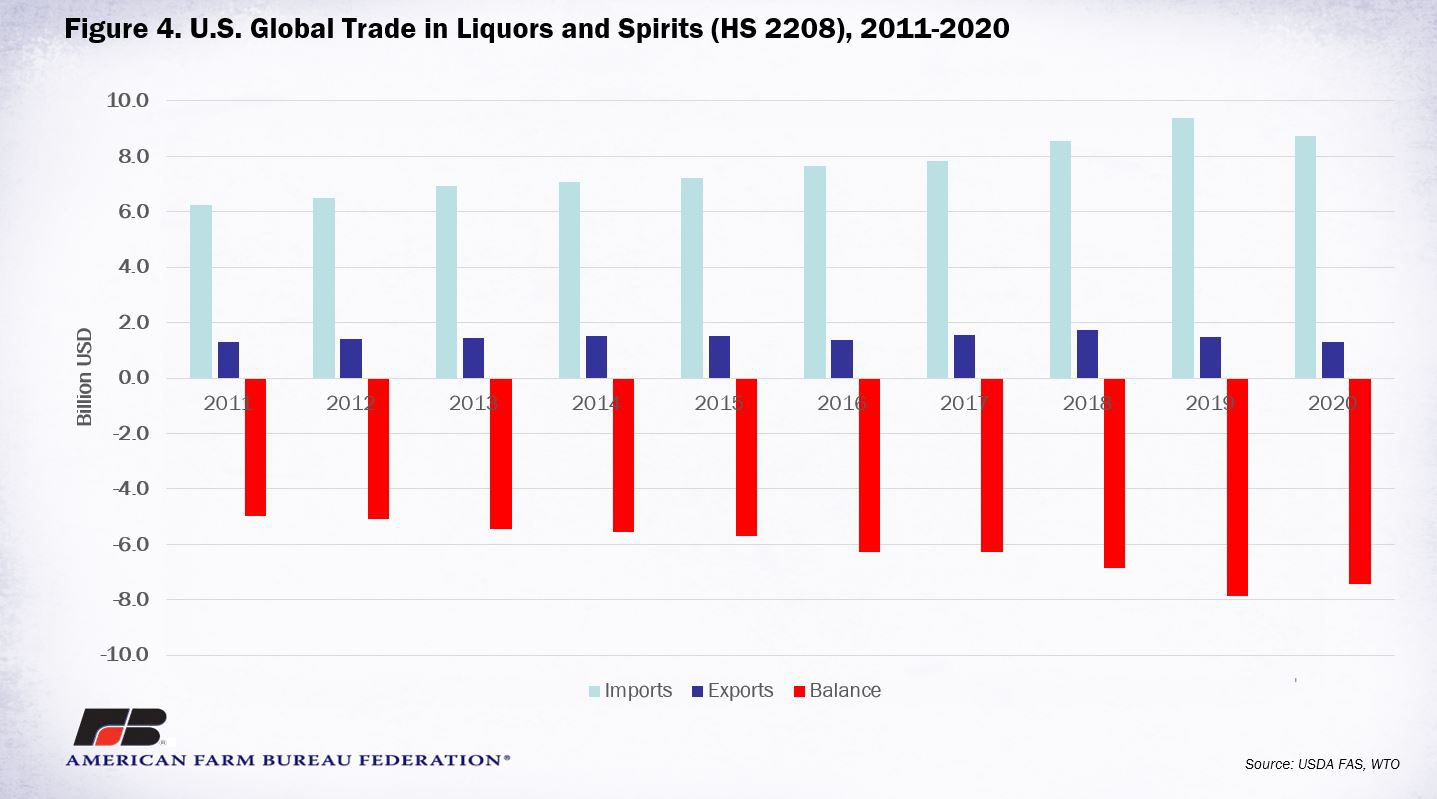

The change from USDA’s previous definition of “agricultural products” to the WTO’s definition will impact both import and export trade figures. When the last 10 years are averaged using the WTO definition, ag exports would have been $2.8 billion higher. On the other hand, over the same time period, the WTO definition would have resulted in ag imports that were $5.2 billion higher. This, of course, means that the U.S. ag trade balance would have averaged $2.3 billion less if the WTO definition had been utilized. The largest driver of this trade balance change is the inclusion of distilled spirits in the definition of agriculture. This is particularly true on the import side of the ledger. In Figure 4 we can observe the significant trade imbalance that the U.S. has in liquors and distilled spirits. Overall, the change to the WTO definition of agriculture does not produce trade statistics that are all that much different from the statistics that came out of USDA’s previous definition. However, the concordance of this definition will make talking about and negotiating trade significantly easier, and that is a very good thing.

Trending Topics

VIEW ALL