U.S. Economy Growth Slows in Second Quarter, But Consumer Spending an Important Bright Spot

Bob Young

President

photo credit: AFBF Photo, Terri Moore

Bob Young

President

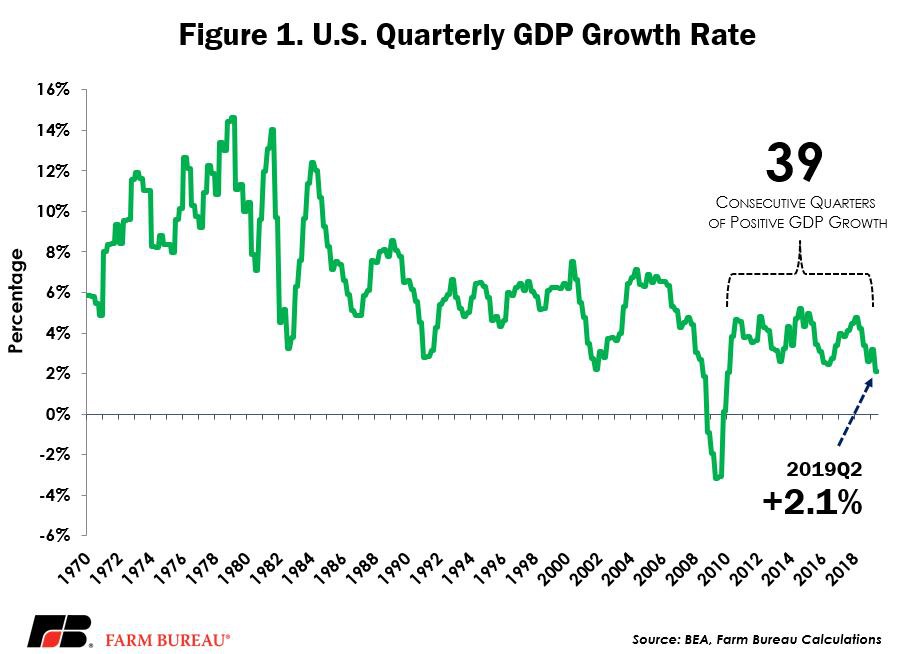

Figures recently released by the Bureau of Economic Analysis put the growth of the economy for the second quarter of 2019 at 2.1%, a slow down from the fairly robust 3.1% posted in the first quarter of the year.

To determine gross domestic product growth, analysts usually look at the contribution various components of the economy make to the overall growth rate. For example, if one looked at personal consumption expenditures alone for the second quarter, it would have driven a rise in GDP of 2.85% on its own. Compared to the first quarter of 2019, during which personal consumption expenditures showed only a 0.78% contribution to GDP growth, this was a major bump. Between the last quarter of 2018 and the first quarter of 2019, personal consumption, real expenditures grew by $37 billion (2012 dollars). Personal consumption expenditures came in at $13.241 Trillion (2012 dollars), an increase of $138 billion from the first quarter of 2019. Durable goods expenditures – part of this overall personal consumption expenditure category – increased by only $1 billion in the first quarter of 2019, while it rose by $52 billion this quarter. Out of the durable goods category, motor vehicles and parts declined in the first quarter of 2019 by $14 billion, only to grow by $20 billion in the second quarter, a significant swing. Food purchased for consumption off-premises -- grocery store sales, in other words -- had also declined by $4 billion in the first quarter, as did expenditures on clothing and footwear. Food for off-premises purchases grew by $12 billion, with the clothing and footwear category rising by $13 billion. These may not be large numbers in the overall $13.2 trillion economy, but they represent a major shift in the spending patterns in those smaller groupings.

With personal consumption growing by more than the overall rise in GDP, something had to be a “Debbie Downer.” Frankly, all of the rest of the economy was turning the other way.

Gross private investment added just over a full percentage point to GDP growth in the first quarter, only to pull the growth rate down by that same full percentage point in the second quarter. The biggest contributor to this shift was a change in inventories. While inventories grew in the first quarter at a rate that bumped GDP growth by 0.5%, inventories shrank at a 0.9% rate in the second quarter. As has been discussed before, declining inventories can be a good thing for future growth as product that moves off the shelves today will have to be replenished tomorrow, but as it happens, it does draw things down.

One of the bigger stories out of the report comes from the export picture. While exports contributed to a 0.5% rise in GDP growth last quarter, exports pulled down the GDP by 0.6% in the second quarter. Imports were unchanged from the first quarter.

Federal government spending overall added 0.5% to GDP growth, with non-defense consumption expenditures making up the majority of that growth. State and local government spending have stabilized at a pace adding roughly one-third of a percent to GDP growth.

So, how should we take this report overall? The growth in personal consumption is a significant positive. The consumer, after drawing back somewhat in the first quarter, has come roaring back. When consumer spending alone drives an almost 3% GDP growth, one has to feel pretty good. The private investment data is only marginally concerning, given that almost all of the drawdown came out of inventory shifts.

The challenge area has to be the trade data. The import side of the equation was interesting. With the significant growth in overall consumer spending, there was no simultaneous rise in imports. The major fall in exports, however, while not surprising, is a concern. Eventually, those numbers could well drive through to reduced business activity and eventually employment.

Overall a strong report with much to be happy about, but storm clouds are gathering.

Trending Topics

VIEW ALL