Treading Water – The January Jobs Report

TOPICS

Jobs ReportBob Young

President

Bob Young

President

After some of the sweeping numbers this past year, the January Jobs Report’s headline figure of a 49,000-job rise in nonfarm employment is undoubtedly better than last month's adjusted fall of 227,000 slots, but once you get further down in the weeds, especially recognizing the data revisions, it gets clearer this report is just marking time.

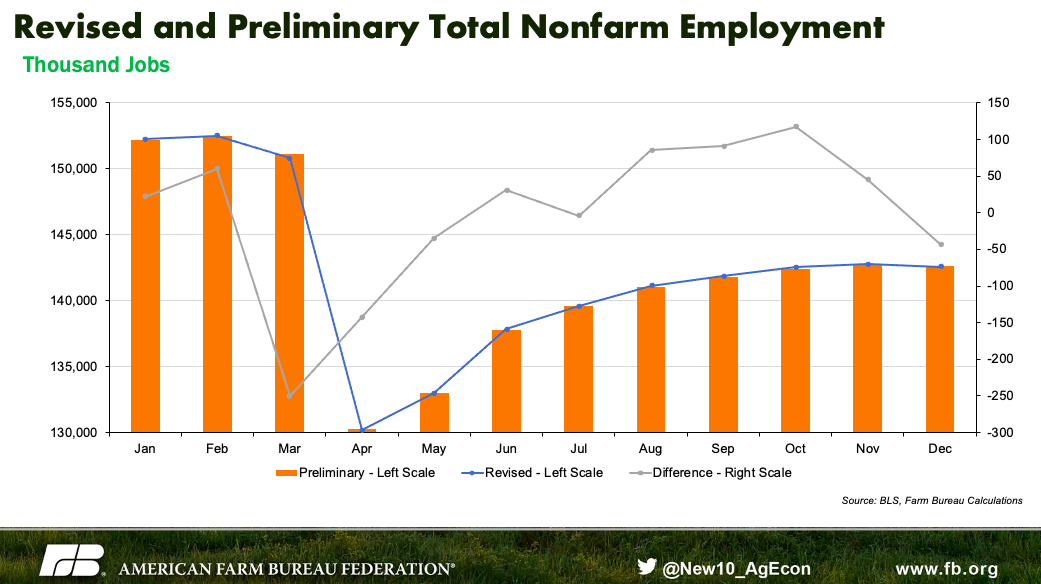

Notably, this report contains data revisions accounting for quarterly census data and other sources. Both revised and preliminary data are on the graph, but it isn't easy to separate the two series due to the scale. The actual difference uses the right-hand scale. It depicts the sharper drop in the spring indicated by the revised data, which also showed a somewhat more robust recovery in the fall. By the end of the year, however, the two series are within 50,000 positions of each other, out of 142,600,000 jobs. While the difference between the two series is small, it does have a common-sense appeal. The collapse started a little earlier than thought, and the fall recovery was modestly stronger than viewed at the time.

While the top-level numbers were revised lightly, a dig into the details reveals more noticeable differences. One of the largest employment categories – health care workers – was revised downward from the preliminary numbers every month since March. The December 2020 employment numbers are now 10,000 positions lower than initial reports. Manufacturing’s revised December data drops that sector’s jobs down 30,000 from the earlier reports. Wholesale trade, too, is now 27,000 positions lower for December than the preliminary report showed. Leisure and hospitality, on the other hand, came in about 80,000 positions higher.

With those data-revision-driven changes in mind, let us turn to the establishment figures and the monthly employment changes.

As mentioned earlier, overall nonfarm employment rose by 49,000 jobs, but digging just a little below the surface suggests things are not even that positive. Total private-sector jobs rose by a scant 6,000 slots. It was a rise of 67,000 state and local jobs driving the overall boost.

Within the private sector, construction and manufacturing dropped 3,000 and 10,000 positions, respectively. Nondurable goods manufacturing grew by 7,000 -- not enough to offset the 17,000-job loss in durable goods manufacturing.

Overall, the service sector added 10,000 jobs, but the details tell some widely divergent stories. Professional and administrative services added over 40,000 jobs, with computer systems design, management and consulting, and scientific research and development each contributing over 10,000 positions. Temporary help services also pitched in nearly 81,000 slots. Retail trade, as well as wholesaling, however, slipped 38,000 and 28,000 posts, respectively.

After months of significant job gains, health care slipped nearly 30,000 positions. with losses in in-home health care and nursing home care driving most of the decline.

Overall, government employment grew by 43,000 positions, despite a 24,000 decline in federal employment. State government jobs rose by 31,000 posts, all in education-related employment. Local government rose by 36,000 again, with all of the gains coming in education-related positions.

The headline numbers also reported the unemployment rate dipped from 6.7% to 6.3%. Unlike some of the spring reports, this was not particularly good news. The 49,000 net new jobs were nowhere near sufficient to drive that decline. Instead, it was the withdrawal of more than 400,000 people from the workforce. In January 2020 the labor force participation rate was 63.4%, with 164,455,000 people working or actively looking for work. In January 2021 there were only 160,161,000 in the labor force and a participation rate of 61.4%. More than 4 million people have been out of work for more than 27 weeks today, versus only 1.1 million people in the same category in January 2020.

We are merely marking time in the labor market, waiting for the leisure and hospitality sectors to come back – to the extent they can once vaccinations are in place. Will we go out to eat – probably – but will the dining establishments be there for us? Will we go to a movie again – maybe not. Many of us have gotten used to being entertained at home with four or five separate streaming services.

The potential demand is there. The national personal savings rate was 13.7% in December, compared to a historical savings rates in the 7-8% range. The second stimulus check will likely give that another bump when the new data comes in. People have money, they just need something to spend it on.

Trending Topics

VIEW ALL