The House and Senate Tax Plans, Side-by-Side

TOPICS

Taxes

photo credit: AFBF Photo, Philip Gerlach

Veronica Nigh

Former AFBF Economist

Over the weekend, the Senate passed its version of the Tax Cuts and Jobs Act (H.R.1). This action followed the passage of H.R.1 in the House on Nov. 16. The business elements of the bills have many similarities, though differences in a handful of areas are quite substantial. In an effort to compare the bills and inform our decision-making, we have prepared a matrix that compares the House and Senate bills to one another, as well as the current tax code. For some elements, the only way to determine the impact on farm and ranch businesses is to compare the tax treatment of the same farm under both plans. We have done that below for differences in the individual income tax rates and the taxation of pass-through businesses.

Business Tax Provisions That Are Substantially the Same

Corporate Tax Rate

Deduction for Property Taxes

Sect 199 Domestic Production Activities Deduction

Capital Gains Taxes

Sect. 1031 Like-Kind Exchanges

Self-employment taxes

Business Tax Provisions That Are Similar

Individual Income Tax Rates

Sect. 179 Small Business Expensing

Immediate Expensing (Bonus Depreciation)

Deduction for Business Interest Expenses

Estate Taxes

Net Operating Loss

Business Tax Provisions with Differences

Taxation of Pass-Through Businesses (Sole-proprietors, partnerships and S-corporations.)

Alternate Minimum Tax (AMT)

Depreciation of Farm Machinery

Deduction for Replanting Citrus

Taxation of Craft Beverages

Our Calculations

During the recent tax debate a lot of attention has been paid to pass-through businesses, which are businesses in which the individual owners of the business pay taxes on income derived from that business on their personal income tax returns. This is different from C-corporations, where the company itself pays corporate taxes on profits produced by the business. Pass-through taxation applies to sole proprietorships, partnerships and S-corporations. More than 93 percent of farms are considered pass-through businesses and as such the individual income tax rates and pass-through provisions are of significant importance to farming and ranching businesses.

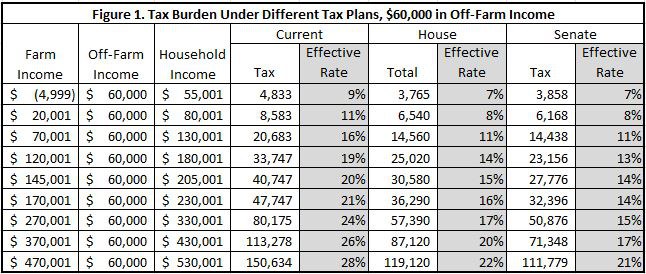

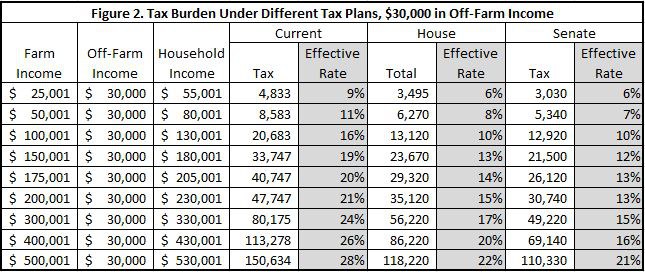

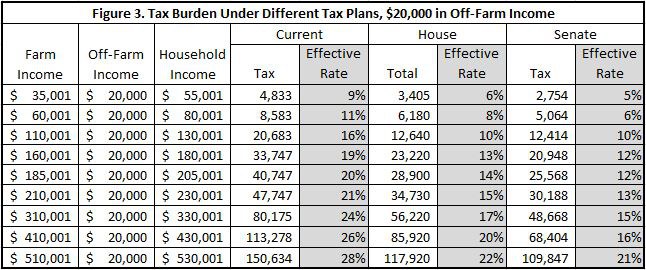

In our calculations, we have also included the important element of off-farm income, since according to the last Census of Agriculture (2012), more than 94 percent of farms had off-farm income. For more than 70 percent of farms less than 25 percent of total household income was derived from farming. In fact, only 21 percent of farm households derived a majority (more than 51 percent) of their household income from farming.

The level of importance of that off-farm income varies considerably by farm size. According to the latest ARMS data (2015), median earned off-farm income was $22,500, $31,789 and $62,500 for commercial, intermediate and residence farms, respectively. Commercial farms are defined as those with annual gross sales of $350,000 or more, intermediate farms are those with less than $350,000 in sales whose principal operators considered farming their primary occupation and residence farms are those with less than $350,000 in sales but whose principal operators’ primary occupation is not farming. As we regularly remind others, farms come in all shapes and sizes, the population of farm households is economically diverse; we examine tax reform with all of those farms in mind.

Our estimates of the impact of the House, Senate and current tax plan are based on a few select elements that are included in all three plans and critical for a basic understanding of the differences between the plans. Our examples are based on taxable income for a married couple filing jointly, calculated based on individual tax rates, standard deduction, two personal exemptions (current only, exemptions are eliminated in both version of H.R. 1) and pass-through business tax rates. The calculations do not include self-employment taxes, which will have an impact on the taxes owed under the House plan since the 30 percent of income from active business activity (i.e. farming and ranching) will be considered a return on investment and not subject to self-employment taxes. Though important, we have omitted this element, since we wanted to focus on the tax liability associated with the pass-through and individual tax rates.

Figures 1 through 5 compare the tax treatment of a married couple with the same household incomes, across different combinations of farm and off-farm incomes. Figure 1 is the result for a farm household with $20,000 in off-farm income. Figure 2 represents a farm household with $30,000 in off-farm income and figure 3 represents a farm with $60,000 in off-farm income. These thresholds are approximately equal to the earned off-farm income of the commercial, intermediate and residence farms surveyed in the 2015 ARMS survey.

Both the House and Senate plans offer significant reductions in tax liability and the effective rate that farmers pay, based on the elements of H.R. 1 that we evaluated. Of course, there are a number of elements that we did not include, some of which may be very important in determining the amount each individual farm pays. We encourage you to compare all of the differences and refigure your last tax bill to see what it would have been under both plans. And at the end don’t forget to calculate your total effect tax rate, because as we noted a few weeks ago, we’re all about that effective rate.

Trending Topics

VIEW ALL