Tariff Revenues Up Sharply

TOPICS

Trade

photo credit: Getty

John Newton, Ph.D.

Former AFBF Economist

Customs duties are tariffs, or taxes, placed on goods in international commerce. Tariffs may be levied on imports or exports and are designed to protect the local economy by limiting imports or deterring the export of certain domestically produced items. According to the U.S. Trade Representative, the U.S. has a trade-weighted average tariff rate of 2% for non-agricultural goods, one-half of which enters the U.S. duty-free, i.e., without a tariff. On average, the U.S. imports approximately $2.2 trillion in goods each year, generating approximately $31 billion in customs duties. The U.S. Department of the Treasury’s Monthly Treasury Statements provide information on customs duties.

U.S. Tariff Revenues

The Trump administration took the first step in its efforts to rebalance U.S. and global trade in January 2018 by raising customs duties on solar panels and washing machines. In March 2018, the U.S. introduced 232 national security tariffs on steel and aluminum. Beginning in July and August, the U.S. imposed tariffs on $50 billion of goods imported from China, followed in September by tariffs on an additional $200 billion worth of Chinese goods. Most recently, tariffs on $200 billion in goods imported from China were increased from 10% to 25% and more tariffs could be forthcoming as the administration is considering targeting an additional $300 billion worth of Chinese products. (For more details on the administration’s overall approach to the tariffs, see a previous Market Intel, Tariff Motivation 101, Reviewing the U.S. Trade Deficit.)

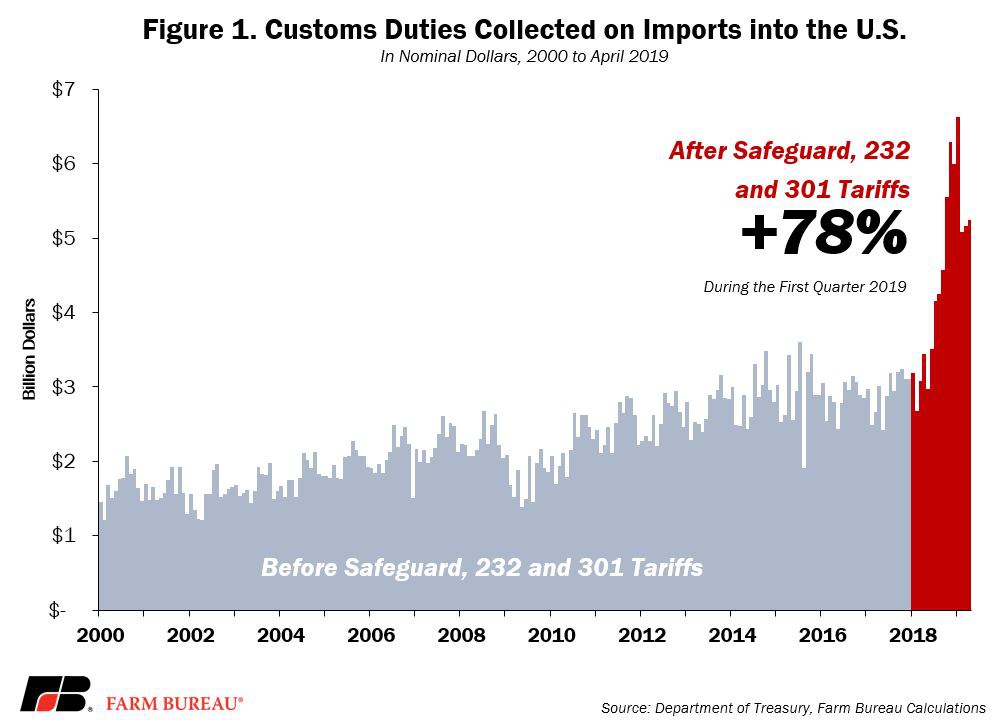

As a direct result of these actions, U.S. tariff revenues have nearly doubled. In 2018 the U.S. collected a record-high $50 billion in customs duties. During the first four months of 2019, Treasury Department data reveals customs duties totaled $22 billion, up 78% from prior-year levels, and reaching a high of $6.6 billion in January 2019. Assuming the current pace of tariff revenue collections continues, the U.S. will collect nearly $72 billion in customs duties in 2019 – topping the previous record by $22 billion. Figure 1 highlights U.S. tariff revenue collections.

Additional Tariffs Collected and Impact on U.S. Imports

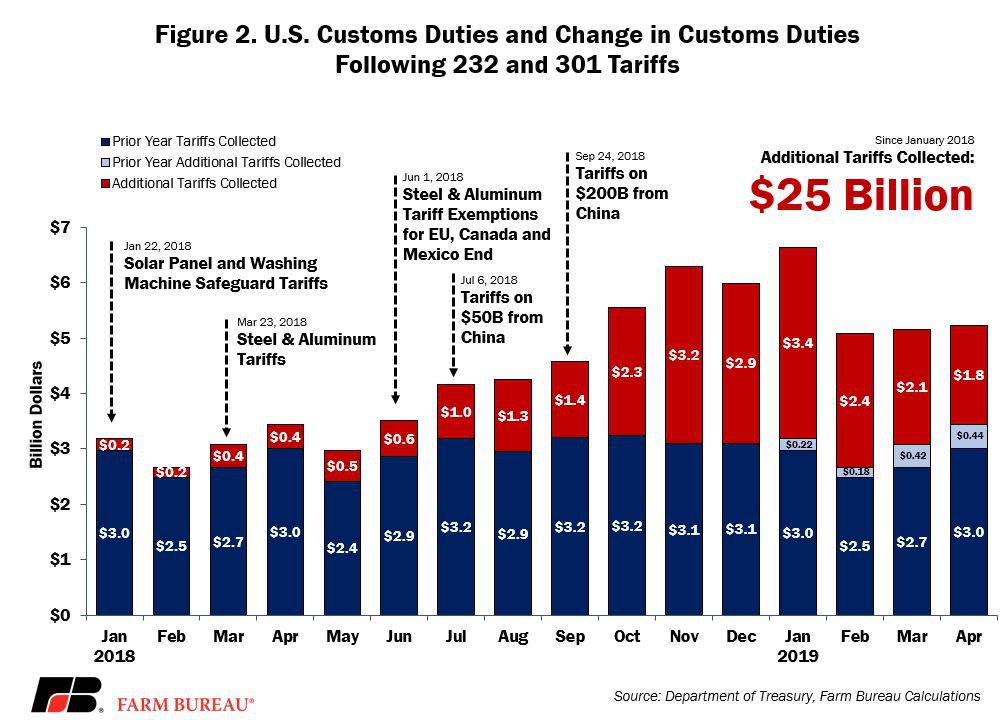

Given that the customs duties collected on U.S. imports historically have averaged $2.6 billion per month prior to the administration's use of 232 and 301 tariffs, it is possible to use the change in collected tariffs to estimate how much in additional customs duties has been collected since January 2018.

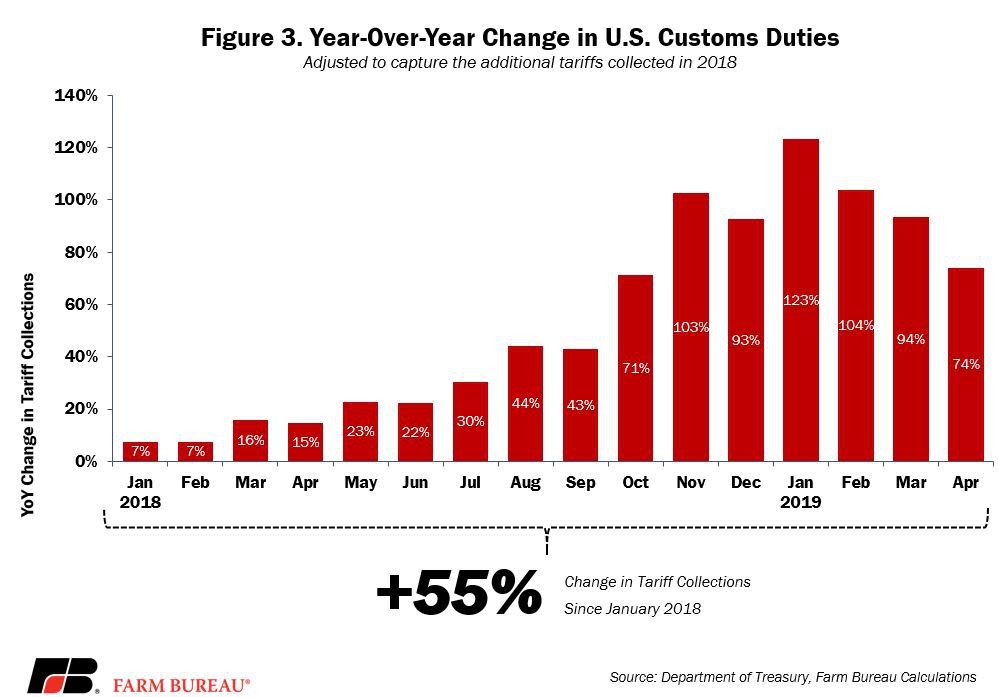

A comparison of customs duties collected in 2018 -- and year-to-date in 2019 -- to the duties collected in the prior years reveals that over the 16 months that 232 and 301 tariffs have been in effect, customs duties have increased by approximately $25 billion, or 55%. The increase in customs duties was the highest in January 2019 when an additional $3.7 billion was collected, leading to total customs duties of $6.6 billion. The increase in customs duties represented an increase of 123% compared to a pre-safeguard and pre-retaliatory tariff environment. Figures 2 and 3 highlight the year-over-year changes in tariff revenues collected on a dollar basis and a percentage basis (an adjustment was made to capture the additional tariffs collected in 2018 but reflected in the 2019 year-over-year calculations).

Since January 2019, and as evidenced in Figures 2 and 3, additional tariff revenues have started to decline, falling to $2.6 billion in February, $2.5 billion in March and $2.2 billion in April – the most recent month available from the Treasury Department.

Tariff Impact on U.S. Imports

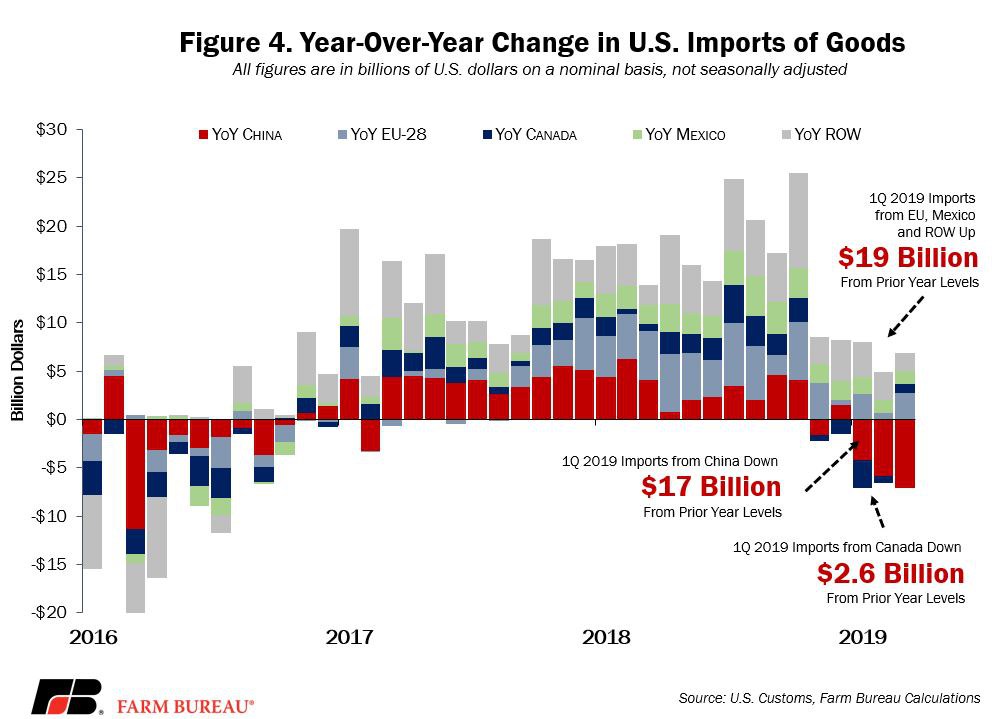

While tariff revenues have declined, U.S. imports have not. During the first quarter of 2019, the U.S. imported $598 billion in goods from around the world -- down only slightly from first quarter 2018 imports of $599 billion. Compared to 2017, however, and despite the higher customs duties, U.S. goods imports in 2018 and 2019 were nearly $50 billion, or 9%, higher than imports in the first quarter of 2017 and prior to the 232 and 301 customs duties. The lack of growth in 2019 imports demonstrates the impact of these additional tariffs on U.S. import volume.

Given that imports in aggregate have not substantially declined, the decrease in additional tariff revenue is likely due to a decline in U.S. imports of goods subject to higher duties, i.e., lower imports from China and other countries subject to higher customs duties. Further examination of U.S. Trade in Goods by Country data from the U.S. Census reveals U.S. imports from China in the first quarter of 2019 at $106 billion, down $17 billion, or 14%, from prior-year levels. U.S. imports from Canada, also subject to additional customs duties, totaled $74 billion and fell by $2.6 billion, or 3%, from prior-year levels. The decline in imports from these countries likely contributed to the decline in additional tariff revenues collected.

While imports from China and Canada fell, imports from other trading partners increased. Imports from the rest of the world during the first quarter of 2019 totaled $418 billion and were up $19 billion, or 5%, compared to the first quarter of 2018. Imports from the European Union totaled $122 billion and were up $6 billion, or 5%, from prior-year levels. Imports from Mexico in the first quarter totaled $87 billion and were also up 5%, or $4 billion, from prior-year levels. Figure 4 highlights the year-over-year change in U.S. goods imports in U.S. dollars on a nominal basis and not seasonally adjusted.

Summary

Additional tariff duties are increasing the magnitude of customs duties and slowing the growth in U.S. imports of goods from selected countries. As a direct result of the tariffs, U.S. imports from China during the first quarter of 2019 fell by $17 billion, or 14%, from prior-year levels. Year-over-year trade growth on imports of goods from China fell by 19% in March 2019 and was the second lowest level in nearly 20 years. Additional tariffs on China are likely to not only further reduce imports but may also increase customs duties collected given that tariffs have increased from 10% to 25% (More Tariffs on the Chinese Horizon) and the U.S. is considering tariffs on an additional $300 billion in Chinese goods.

The tariffs on steel and aluminum, as well as on products imported from China, have increased tariff revenues by an estimated $25 billion since January 2018 and are on pace to reach or exceed $72 billion in customs revenue in 2019. Importantly, these customs duties are paid by the person(s) or entities importing the products – and these duties could ultimately be passed onto the U.S. consumer given that they increase the transaction costs along the business supply chain.

Note: For more information on the timeline of tariff implementation see the following Market Intel articles: Administration Revises Steel and Aluminum Tariffs, But Worrisome Impact to U.S. Ag Exports Remains, Chinese Tariff Ping Pong and More Tariffs on the Chinese Horizon.

Trending Topics

VIEW ALL