Sustainability Markets, Part 1: Agricultural Ecosystem Credit Markets – The Primer

TOPICS

SustainabilityShelby Myers

Economist

photo credit: AFBF Photo, Morgan Walker

Shelby Myers

Economist

This Market Intel article is the first in a five-part series highlighting agricultural ecosystem credit markets and the opportunities and challenges they present farmers, as well as the policy levers and many other factors involved.

This article provides a primer on agriculture ecosystem credit markets. With so many emerging ideas and platforms, it’s important to explore how these markets are developing and operating, as well as who is behind them and why.

It seems like almost every month companies of various sizes across many industries are announcing new sustainability commitments, along with sustainability programs and markets that farmers and ranchers can participate in. Advancements in technology and increased capital have provided farmers more opportunities to generate additional revenue from participation in these markets. But with so many options and so many potential partners, it may be difficult for farmers to get all the information they need before signing a contract.

It's important to note that these credit markets are constantly evolving, and many are still under development or being refined in pilot stages. Information provided here should be used as background information only; there is much more to explore, company-by-company and asset-by-asset, before making any decisions.

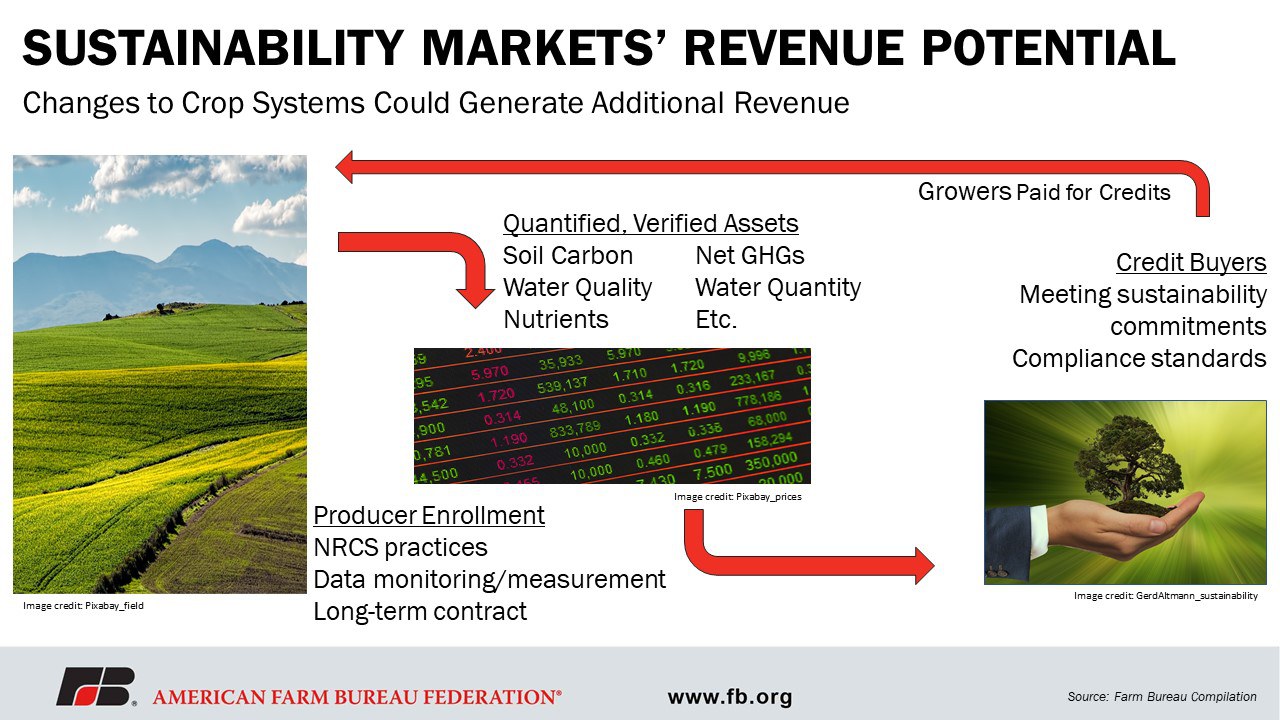

Regardless of the stage of development, there are a few common themes throughout all ecosystem credit markets; chief among them is they are all voluntary, incentive-based markets that connect buyers and sellers of ecosystem services credits. Typically, farmers are the sellers. They get paid for using animal and land management techniques proven to meet certain ecosystem benefit criteria. The most common target for these practices is carbon sequestration. Some common practices include cover crops, livestock grazing, crop rotation, no-till/ strip-till, anaerobic digesters, nutrient management, buffer strips, tree establishment, etc. As outlined in a contract, participating farmers opt into some version of data monitoring and measurement procedures. Once enrolled, farmers and ranchers will typically be paid based on measured outcomes, either on a per-acre basis or by asset generated.

Once an ecosystem asset is quantified and verified, it can be made available for purchase via the market. Credit buyers, like corporations looking to meet sustainability goals and compliance standards, can purchase those credits.

The American Farm Bureau has been very vocal about the markets remaining voluntary and economically viable for farmers and ranchers. Also a priority is that they go sensibly hand-in-hand with climate-smart practices in place on the farm.

The figure below shows how agricultural ecosystem credit markets could potentially operate.

Ecosystem credit markets are market platforms being developed to help farmers and ranchers generate agricultural ecosystem assets. The most common asset is carbon, but there are also efforts to quantify net greenhouse gas credits, water quality credits, water quantity credits, other soil nutrient credits and more. These credits are attracting corporate buyers like General Mills, Nestle and McDonald's, as well as agribusinesses like Cargill, Syngenta and Corteva and even government entities. Farmers and ranchers are being compensated for a generated asset in different ways, including cash payments or input credit discounts.

From public to nonprofit to private, there are already several markets in various stages of development that allow farmers and ranchers to generate agriculture ecosystem credits and sell them to a variety of buyers.

Public markets include those called for by the Food and Agriculture Climate Alliance to establish a USDA-led Commodity Credit Corporation carbon bank. There is also the Growing Climate Solutions Act; Introduced in the 116th Congress by Indiana Sen. Mike Braun and Michigan Sen. Debbie Stabenow, the bill called for a certification program at USDA to help farmer and forest landowners participate in carbon credit markets. There is likely to be another version of that public legislation introduced during the 117th Congress.

On track to be the largest credit exchange platform in the U.S. when it launches in 2022, the Ecosystem Services Market Consortium is an example of a nonprofit platform. Private markets have been launched by companies including Indigo Ag Carbon, Nori and Farmers Business Network. Private agribusinesses that have developed carbon market programs include Bayer and Nutrien.

Markets are at different stages of operation and development, with some already enrolling farmers and ranchers into programs with committed acres and others operating pilot projects on specific crop and grazing systems to research scientific methods of quantifying assets.

Many market developers still in the early stages are looking for farmer and rancher partners. Some companies are developing protocols for working agricultural lands that will go on to be reviewed and certified by third-party verifiers. This could be particularly important in establishing widely accepted standards for agricultural ecosystem asset credits. A significant amount of research is being done to quantify and verify the assets to ensure they hold value for buyers. Much of that research testing and refinement is being done through pilot projects in cropping systems across the U.S.

There are many reasons companies and organizations are jumping into the development of these markets. As previously mentioned, the number one theme is the voluntary, incentive-based structure that comes with launching independent markets. While the markets vary in shape and size, as well as stages of development, a common driver for their development is to foster healthy soils and ecosystems and reduce emissions. Many of the corporations involved are focusing on the public goodwill they’ll earn as consumers see them as playing a part in improving conservation and biodiversity, as well as pollinator/wildlife habitats.

The markets also provide diversified revenue potential for farmers and ranchers who want to participate in them. However, before any contracts are signed, farmers and ranchers should consult their trusted advisors to determine if enrolling in a market is truly the best thing for their farm.

The second article in this Market Intel series will discuss some of the common conservation practices used in agricultural ecosystem credit market contracts and their adoption rates across the U.S.

Trending Topics

VIEW ALL