Semiannual Cattle Inventory and Cattle Contract Library Set the Tone for the 2023 Marketing Year

photo credit: Sheri Glazier, Used with Permission

Bernt Nelson

Economist

Jan. 31 proved to be an important day for cattle producers as the cattle contract library pilot website went live on the same day USDA released its semiannual cattle inventory report. Each of these provides important market information that can help cattle producers in 2023 and sets the tone for the cattle market in 2023 and beyond. This Market Intel will provide background and analysis of the inventory report and the new pilot program.

USDA Semiannual Inventory Report

USDA’s January and July cattle inventory reports, released toward the end of each respective month, provide the total inventory of beef cows, milk cows, bulls, replacement heifers, other steers and heifers and calf crop for the current year.

The story of the current cattle inventory has been building throughout the last year. Cattle producers were facing headwinds from high input costs, inflation and three consecutive years of drought in some of the most cattle-dense regions of the United States. Many opted to liquidate cattle, primarily replacement heifers, that would normally be kept and used to build herd numbers. As a result, marketings of fed cattle and, most importantly, heifers were high throughout the year, with several months of records for beef production. There has been much speculation regarding how many cattle, particularly heifers, were marketed and what that might mean for the overall cattle market outlook for 2023.

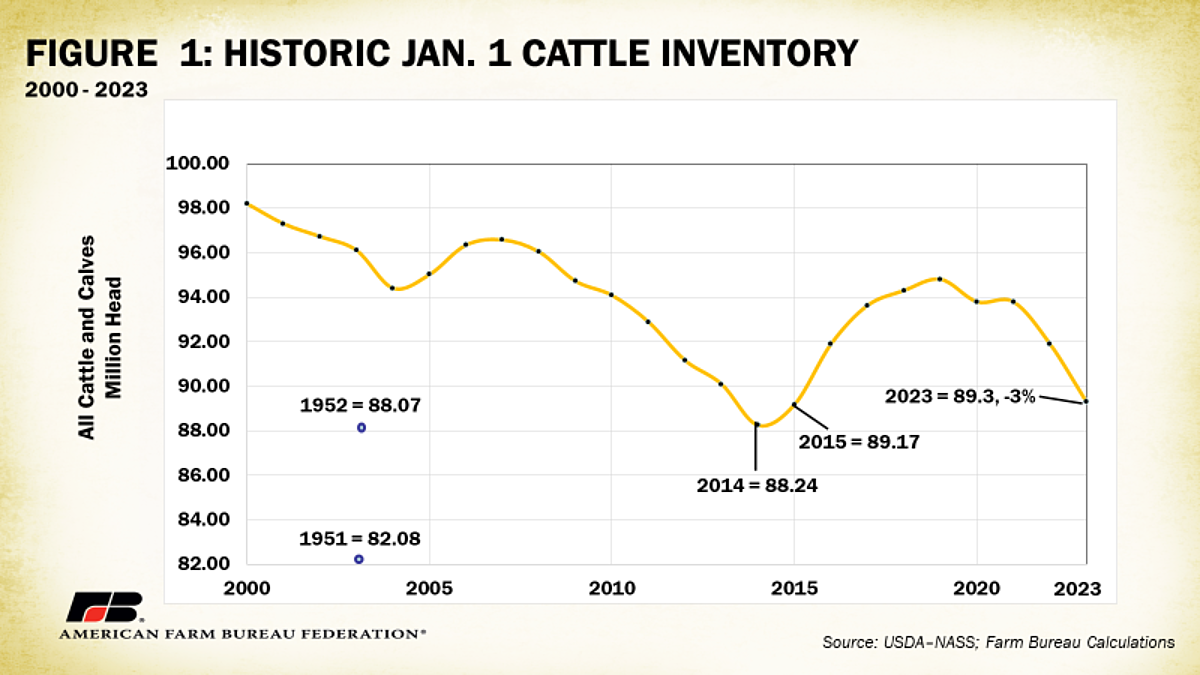

All cattle and calves in the United States on Jan. 1, 2023, were 89.3 million head, 3% lower than this time in 2022. This is the lowest Jan. 1 inventory since USDA’s 89.17 million estimate in 2015 (Figure 1). The calf crop is estimated at 34.5 million, down 2% from last year.

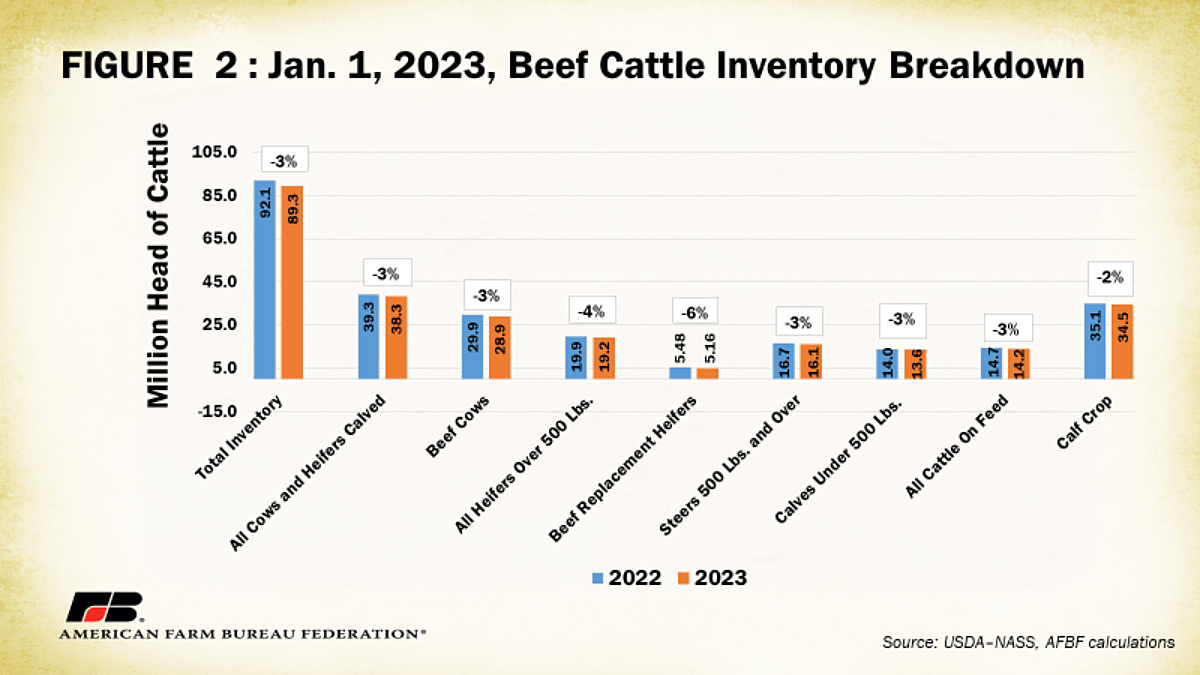

At first glance the overall numbers do not seem like big market movers. To really understand the implications of this report we need to break down beef cattle (Figure 2). The inventory of all U.S. beef cows on Jan. 1, 2023, was 28.9 million, down 4% or 1.16 million head from Jan. 1, 2022. This is the largest annual decline in beef cow inventory since 1986. Heifers kept as beef cow replacements were estimated at 5.16 million, down 6% for 2022. This is a very strong indicator that the industry is still in the contraction phase of the cattle cycle.

Cattle Contract Library

Jan. 31 also marked the unveiling of the new website for USDA’s cattle contract library. The Cattle Contracts Library Pilot Program, established by USDA’s Agricultural Marketing Service (AMS) under the Consolidated Appropriations Act of 2022, went into effect on Jan. 6, 2023. This program is designed to increase market transparency for cattle producers by establishing a cattle contract library similar to USDA’s Swine Contract Library maintained pursuant to sec. 222 of the Packers and Stockyards Act (7 U.S.C 198a).

As of Jan. 6, packers who slaughter 5% or more of the total fed cattle slaughtered in the previous five years, must submit contract information for each active contract, oral or written, and every new active contract. This information, submitted by the packers, includes premium schedules, discount schedules, delivery and transportation, terms and payments, financing, risk sharing and other financial arrangements. AMS will also report on the number of head of cattle purchased under the terms of the contract. This information must be made available to producers along with any changes to contract terms within one business day of the contract being made available.

AMS will be conducting a series of stakeholder webinars to assist stakeholders in using this new tool. The webinars are scheduled to begin this month. The dashboard will go live on Feb. 6, 2023.

What does it all mean?

This report is bullish. The cattle inventory is down in every category of beef cattle, with the greatest declines coming from beef replacement heifers that are responsible for next year’s calf crop. The latest Cattle on Feed report estimated that heifers on feed represent 40% of all cattle on feed -- the highest percentage of heifers on feed since 2002. The declining inventory of beef heifers is a clear indicator that beef production will decline in 2023, 2024, and maybe even farther.

Drought is still a big challenge facing farmers. Farmers will have to see profitability improve before cattle numbers will begin to grow again. A change in the drought situation would help pasture and rangeland recover and present an opportunity for a larger corn and hay crop. Any improvement in the drought situation would provide more profitability in the cattle business. When this happens, producers will have to retain more heifers to increase herd size. This will tighten beef cattle supplies even more and provide another level of price support until the cattle inventory begins to rise again.

Trending Topics

VIEW ALL