Reviewing Trends and Capacity of Cold Storage

TOPICS

Market IntelMichael Nepveux

Economist

photo credit: Getty

Michael Nepveux

Economist

The monthly Cold Storage Report, released by USDA’s National Agricultural Statistics Service, shows the end-of-month volume of commodities in freezer storage throughout the U.S. As an important market-moving report, it covers most commodities that require cold transport, ranging from nuts, to fruits and vegetables, to dairy and meat. This report offers insight into how commodity stocks are piling up in storage, and adds another piece of information to help us glean how much of these products are moving through the supply chain versus ending up in freezers.

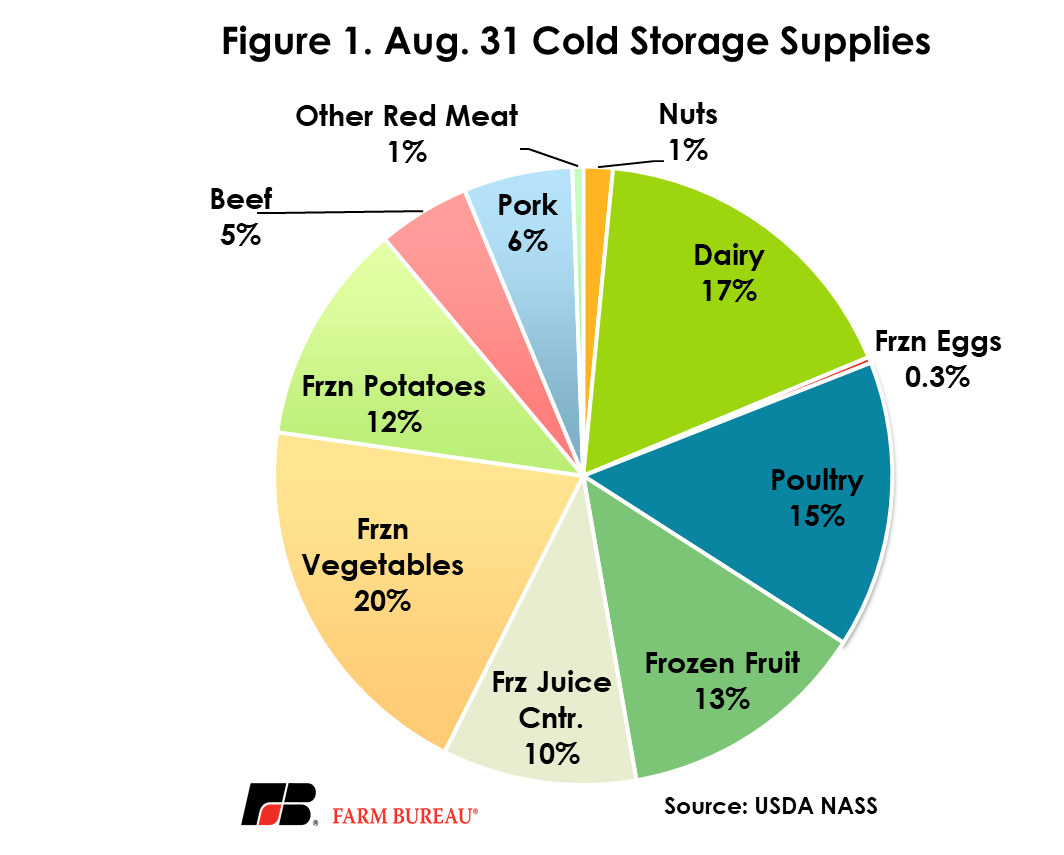

Frozen vegetables make up the largest share of the most recent cold storage report, followed by dairy (cheese and butter), poultry and fruit. Total commodities kept in cold storage increased 1 percent from a year ago, and 4 percent over last month’s report.

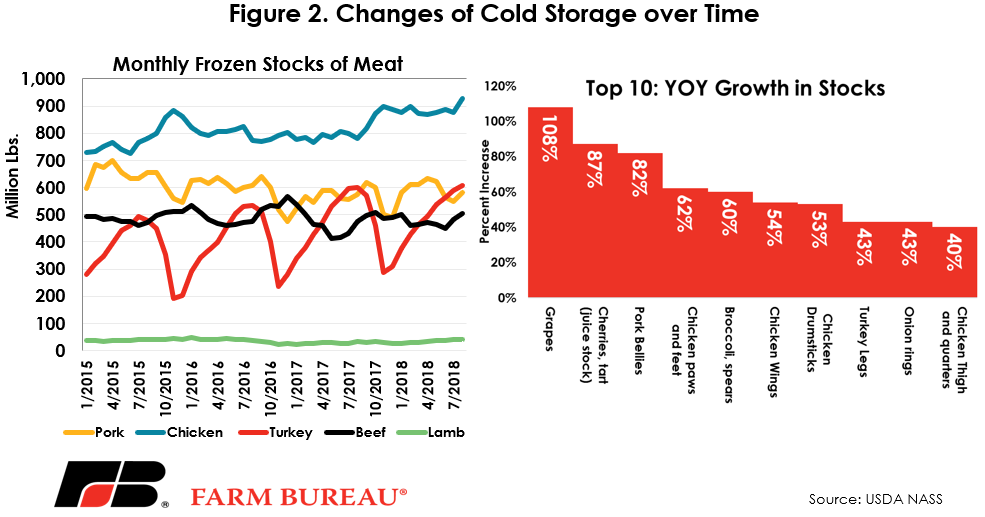

Since the cold storage report is a monthly report, one can see the change in stocks over time, and compare to previous periods (Figure 2). For instance, turkey supplies tend to exhibit the most seasonality of the meat and poultry products, due in large part to holiday preferences of consumers. Chicken supplies in storage have been trending upwards more than the other meat and poultry products, with the most recent report revealing sharp increases year-over-year for many chicken products kept in storage. One may look at the growing chicken supplies and surmise that demand has been somewhat weak, but one of the stories not quite being captured in this data is growth in both production and consumption of these meat and poultry products. For instance, even with significant growth in beef supplies, the relatively modest growth in beef in cold storage would suggest that beef demand is largely keeping up with large beef supplies. Chicken supplies in storage may be growing, but this country continues to consume massive amounts of chicken.

Of the top 10 products in terms of year-over-year percentage growth, poultry products account for half of them, with chicken making up the bulk of that. It should be noted that export markets can play a critical role in what is reflected in these supplies. Due to consumer preferences, people in the U.S. tend to be selective in which parts of the chicken they consume. Americans love their white meat when it comes to chicken, and so we tend to consume cuts like chicken breast and export larger shares of the remainder of the bird. Our poultry exports tend to be dominated by dark meat cuts, such as drumsticks, thighs and quarters, as well as specialty cuts such as chicken paws and feet. The same goes for other animals, we tend to export cuts such as variety meats and offal as American consumers do not particularly desire these cuts.

The largest year-over-year increase in stocks is in frozen grapes, with over 100 percent growth from 2017. While frozen grapes are not currently part of the tit-for-tat in trade disputes (that distinction goes to fresh grapes which do face import tariffs from China), a decrease in the market for fresh grapes could potentially push more grapes to be frozen and pushed into cold storage and thus may be contributing to the increase.

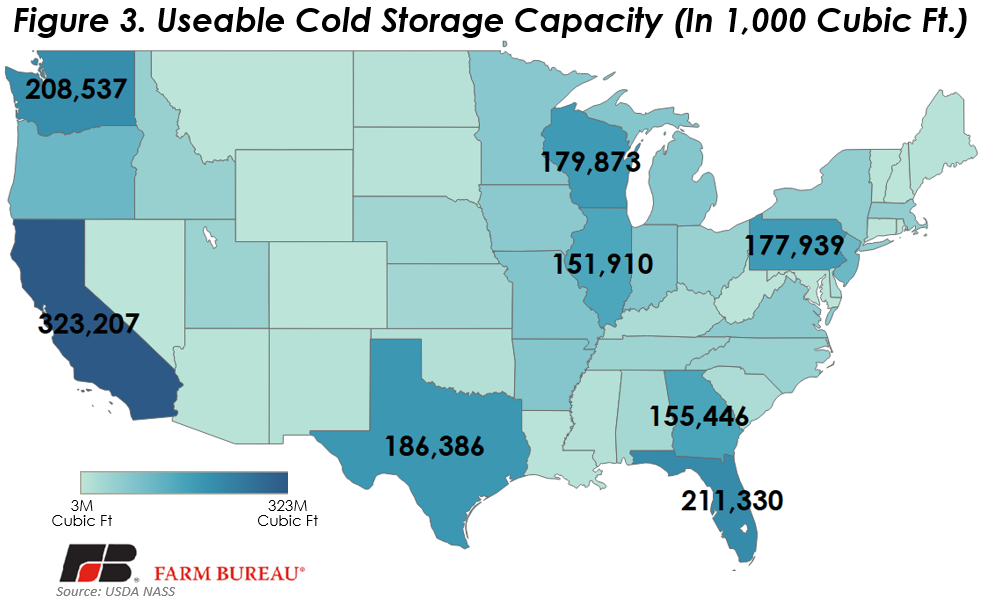

Cold storage in the U.S. also tends to be regionally focused (Figure 3), with the top 10 states accounting for approximately 65 percent of the nation’s useable cold storage capacity. As one would imagine, the states with the largest shares of cold storage (states with over 150 million cubic feet have labels) tend to be located where the products that are frozen are produced and where they are exported.

Trending Topics

VIEW ALL