Reviewing the Commodity Credit Corporation’s Borrowing Authority

TOPICS

USDAShelby Myers

Economist

photo credit: North Dakota Farm Bureau member Lindsay Faye

Shelby Myers

Economist

The Commodity Credit Corporation, with authorities granted by Congress, has been a funding mechanism for agriculture since 1933. It is available to stabilize and support farm income and prices through programs related to commodity and income support, conservation, export promotion, international food aid and disaster assistance, among others. Last modified in 1987, the CCC’s current borrowing authority is set at $30 billion.

The CCC’s responsibilities for funding are typically assigned through congressional action, like the farm bill. The recent Coronavirus Aid, Relief, and Economic Security Act provided the CCC with a $14 billion replenishment, which is expected to be available in July (What’s in the CARES Act for Food and Agriculture).

What is the CCC?

The CCC is the entity in charge of direct spending and credit guarantees created in the Agricultural Adjustment Act of 1933, the first farm bill, to fund agricultural programs established by Congress and to carry out activities under broad authorities granted in its founding charter, the CCC Charter Act. Some programs funded through the CCC include the Agriculture Risk Coverage and the Price Loss Coverage programs, as well as programs like the Dairy Margin Coverage, the Conservation Reserve Program, and most recently, the Market Facilitation Program.

The CCC is authorized to buy and sell farm commodities, lend, undertake activities for the purpose of increasing production, stabilizing prices, ensuring adequate supplies and facilitating the efficient distribution of agricultural commodities. It is owned by the government and was established to explicitly support U.S. agriculture under the supervision and direction of the secretary of Agriculture. In addition to its own funds, the CCC can borrow money up to the $30 billion limit set more than 30 years ago. The CCC cannot acquire property unless it is related to providing storage to assist in implementing certain programs, but it can rent or lease necessary space.

How Does the CCC Work?

The CCC borrows money from the U.S. Treasury as well as private lending agencies to finance agricultural programs and has indefinite authority to borrow within the limits set by Congress. As the amount of money needed to fund programs has increased, the limit for borrowing has also increased. All bonds, notes, debentures and obligations issued by the CCC are subject to approval by the secretary of the Treasury and all borrowing is subject to average interest rates.

CCC Funding

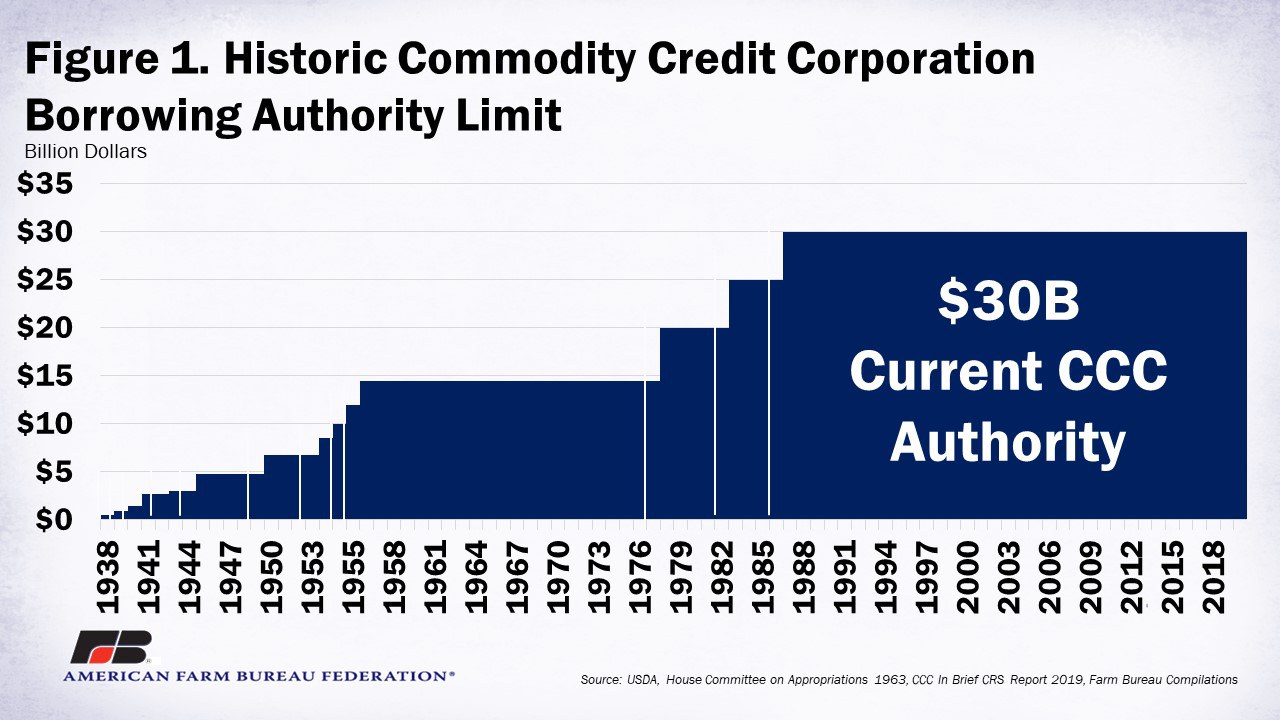

In 1933, Congress appropriated $3 million for the CCC. In 1936, enough stock was acquired to increase the capitalization of the CCC to $100 million. The CCC has maintained its authorized capital stock of $100 million held by the U.S. and has an outstanding borrowing authority of up to $30 billion at any one time. This limit was established by Congress in 1987 and has not changed since. Figure 1 displays the CCC’s historical borrowing authority limit.

Note: Before 1938, the CCC had no specific borrowing authority. In 1954, Congress passed two increases, one to $8.5 billion and a second to $10 billion.

The CCC is replenished for its “net realized losses,” which are the nonrecoverable expenditures the CCC makes to cover things like the cost of commodities sold or donated, uncollectible loans, storage and transportation costs, interest paid to the Treasury, farm program payments and operating expenses. This is done through the annual appropriation processes.

Adjusting CCC Funding for Inflation

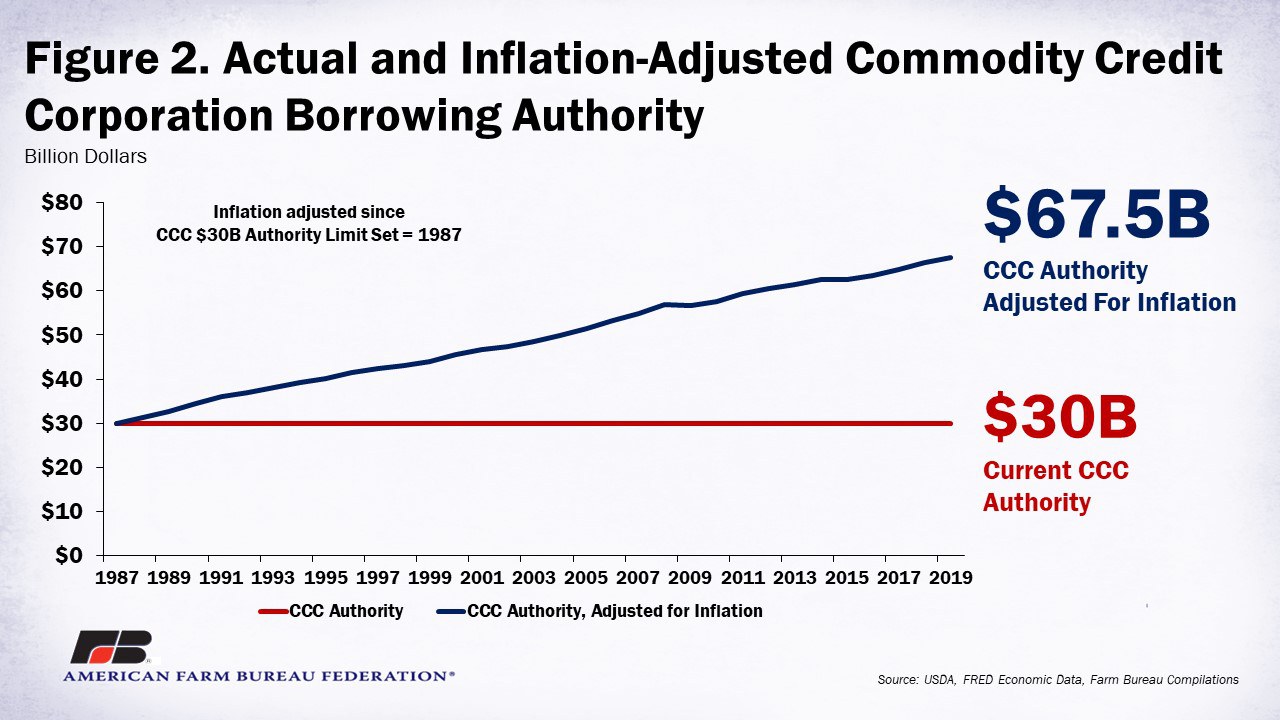

The CCC is only replenished for its nonrecoverable expenses and while those expenses are increasing, the CCC’s borrowing limit is not. The $30-billion limit has remained flat since it was set in 1987. However, if the borrowing limit were to be adjusted for inflation, the limit would be $67.5 billion. Figure 2 displays both the actual and inflation-adjusted CCC borrowing authority limits.

Summary

The CCC plays a significant role in providing support to U.S. agriculture, particularly in times of distress and uncertainty. The CCC’s $30-billion borrowing authority limit has been in effect since 1987. Since then, agriculture has faced many challenges, one of the most difficult being the economic impacts of COVID-19.

If adjusted for inflation, the borrowing limit for the CCC would be nearly $68 billion, providing the secretary of Agriculture with additional financial resources needed to stabilize and support farm income and commodity prices, assist in ensuring adequate supplies of agricultural products to consumers, and facilitate the distribution of commodities – all much-needed support programs given the unprecedented market volatility and supply chain disruptions resulting from COVID-19, which comes on the heels of trade-related demand uncertainty and consecutive years of natural disasters.

Trending Topics

VIEW ALL