Reviewing Participation in Dairy Risk Management Programs

TOPICS

Risk Management

photo credit: New York Farm Bureau member Laura Audrey Hanehan

Daniel Munch

Economist

In dairy risk management, one size does not fit all. Throughout recent history, a number of dairy-related risk management programs, some available through private crop insurance providers and others available through the Farm Service Agency (FSA), have been designed to fill gaps in protection against market risk and uncertainty. With extreme ups and downs defining dairy markets over the past several years and an unclear future for milk prices, the effectiveness of these programs remains vital. Reviewing dairy farmer participation trends and general program performance statistics may help reveal areas of strength or where improvement is needed as 2023 farm bill discussions ramp up.

Dairy Revenue Protection (DRP)

Available since 2018, DRP is an area-based federal crop insurance product that provides quarterly revenue coverage for dairy farmers. The quarters available for coverage correspond to the quarters of the calendar year, i.e., January to March, October to December. Under DRP, an indemnity is paid to a dairy farmer if an operation’s actual milk revenue falls below the final revenue guarantee. The final revenue guarantee is the product of the farmer’s chosen coverage level, from 70% to 95% in 5% increments, based on futures values. The final milk revenue is the product of the final class- or component-based value of the producer’s milk and the amount of covered milk production elected by the dairy farmer.

Under DRP, farmers can determine how their milk is priced by selecting the class- or component-based pricing option. The class-pricing option uses a weighted average of a three-month average of Chicago Mercantile Exchange Class III and Class IV milk futures prices based on the insured’s declared class price weighting factor and corresponding to the months of the quarter. The component-pricing option uses three-month averages of Chicago Mercantile Exchange butter, cheese and dry whey futures to derive implied values for butterfat, protein and other milk solids. The farmer then selects a component value of milk by declaring an amount of butterfat and protein in the milk.

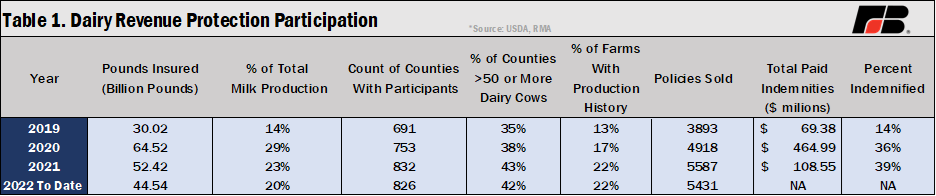

Table 1 displays participation statistics in DRP from 2019 to the latest data available in 2022. You will notice, over the three-year period of 2019-2021 the number of policies sold rose (+43%), number of counties with participants rose (+20%) and the percent of farms with established production history participating rose (+66%) – assuming one policy per farm. 2022 participation, so far, has nearly exceeded these metrics from 2021, with more than half the year remaining. Between 2019 and 2020, likely spurred by the uncertainty from the onset of the COVID-19 pandemic, insured production jumped from 30 billion pounds to 64 billion pounds, a 114% increase. Insured production has since declined, which is not unexpected with the improvement of milk prices toward the end of 2021 and strong prices continuing into 2022. The percent of policies indemnified hovered under 40% during 2020 and 2021, with paid indemnities reaching $464 million and $108 million, respectively.

The average loss ratio, which represents the ratio of paid indemnities to premiums earned by the program, reached a massive 150% in 2020, revealing the severity of price volatility. For example, if an insurer pays $80 in indemnities for every $160 in collected premiums, the loss ratio would be 50%. In 2020, premiums before subsidy incentives covered about 137% of the indemnities paid out while in 2021 premiums covered 63% of indemnities. This alternation over time between net losses and benefits for insurers underscores the actuarial soundness of the program.

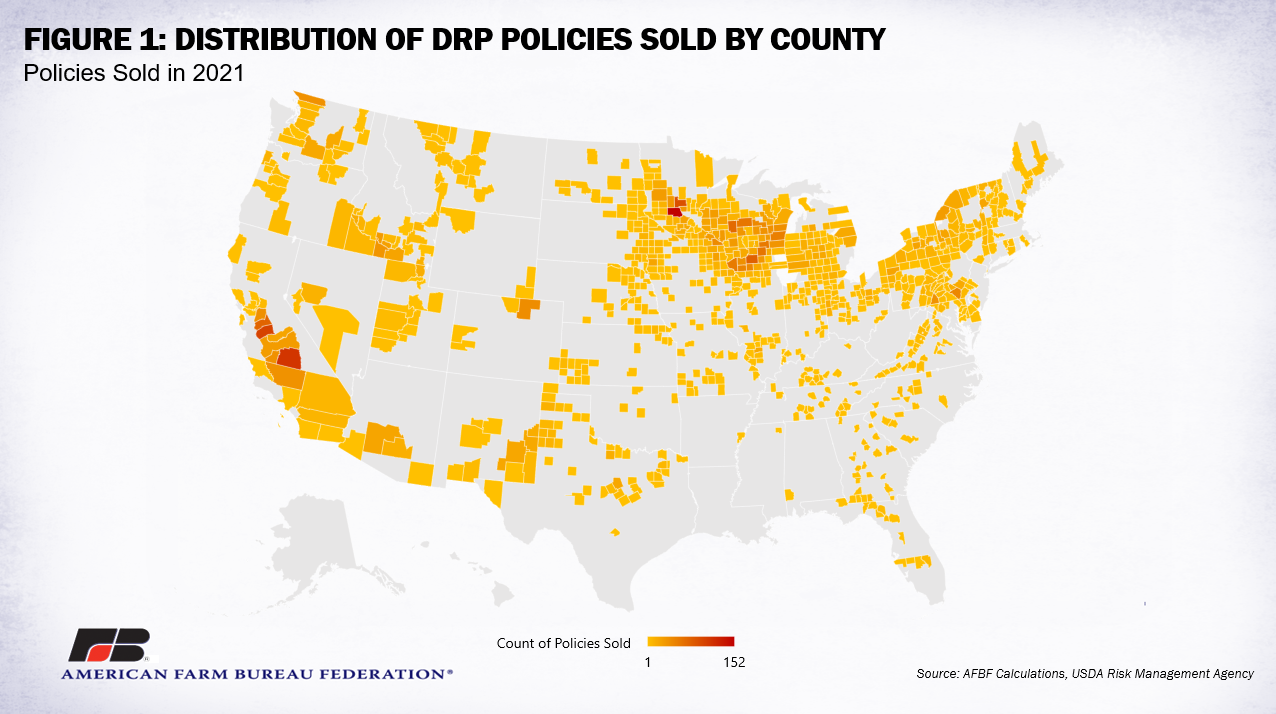

Figure 1 displays the county-by-county geographic distribution of DRP policies in 2021. You will note significant concentrations in heavy milk-production counties across the upper Midwest and California. Other high milk producing states like New York, Pennsylvania, Idaho, Washington and New Mexico also hold significant participation. By state, Wisconsin had the most 2021 DRP policies with 1,466, followed by Minnesota (757), California (488) and New York (377). Participation in 2022, so far, is currently only 156 policies behind last year, with the largest net gains in California (+56 policies), Iowa (+25 policies) and Texas (+11). Year-over-year declines, which could change by the end of the year, were largest in Minnesota (-143) and Wisconsin (-45). A portion of these declines may be linked to a temporary shutdown of the component pricing option in some regions linked to underlying Risk Management Agency regulatory rules. Regardless, DRP remains a highly utilized and highly effective risk management program across the country.

Livestock Gross Margin – Dairy (LGM-Dairy)

LGM-Dairy is another option that can be used to protect against risk. An older product, LGM-Dairy was first available in 2008 and provides protection against a loss in gross margin as opposed to total revenue protection in DRP. Using CME futures prices for feed commodities like corn and soybean meal and the value of Class III milk to calculate a guaranteed gross margin, farmers can hedge against unanticipated declines in average income-over-feed-cost margins. This risk management style is considered bundled hedging, in which both the output price (milk) and input price (feed) are hedged at the same time. Farmers can purchase a single month or combination of months (12 periods each year) during a rolling 11-month insurance period with multiple contracts as long as no more than 100% of milk marketed is insured. Flexibility and customizable options are available for farmers who rely on their own feed production, purchase feed from outside sources or who may only want to protect against milk revenue volatility rather than feed cost risk. An indemnity is paid out under the program if the difference between the total guaranteed gross margin and the actual gross margin (over the insured period) is positive after accounting for any deductibles. Actual margins are based on simple averages of CME group futures contract daily settlement prices and are not based on individual farm-level prices farmers receive in the market.

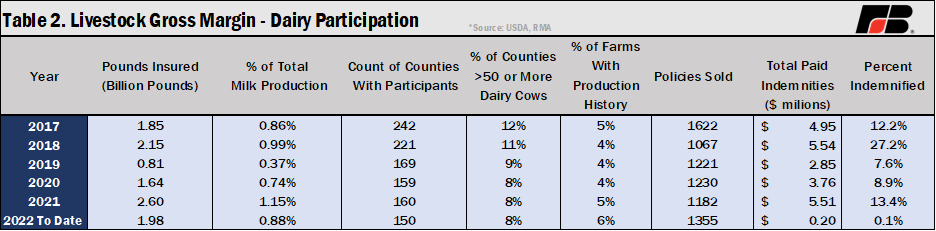

Table 2 displays LGM-Dairy participation and utilization statistics over the past five years (2017- 2022 to date). Over this period, there are few discernable trends defining participation or performance. The number of counties with active LGM-Dairy policyholders has declined by about 40% since 2017 though the percent of total U.S. milk production insured has hovered between 0.74% and 1.15% during the same timeframe. The 1.98 billion pounds insured this year is only about 0.05% of volume insured under DRP, with the average volume insured also much smaller at 1.59 million pounds versus 8.6 million under DRP. This contrast in average volume size could be linked to the shorter timeframe options insurable under LGM-Dairy (as low as a month versus a quarter), reducing the average amount of covered production per contract. That said, even though month-to-month options are available, indemnities are not paid until after the closure of the 11-month insurance period. This means DRP plans could pay out more frequently (within 30 to 90 days of the end of each relevant quarter), enticing farmers to cover more milk under DRP. While dairy farmers are permitted to have both LGM-Dairy and DRP in effect for the same crop year, they cannot cover the same milk within an insurance period. This may lead farmers to choose DRP for more of their milk over LGM-Dairy. Additionally, signing up for LGM-Dairy must occur during a 27-hour window (the end of the last business Friday of each month and ends at 9:00 p.m. EST on Saturday). This may act as a limiting factor on signup more generally.

Any decline in the percent of participating farms with established production history, assuming one policy per farm, is buffered by actual declines in the number of operating dairy farms. Policies sold ranged between a low of 1,067 in 2018 and high of 1,622 in 2017, with 2022, so far, at 1,355. This represents a fourth of the DRP policies sold this year. Total indemnities paid out ranged from $3.76 million in 2020 to $5.54 million in 2018 and the percent of policies indemnified ranged from 7.6% in 2019 to 27.2% in 2018. Loss ratios ranged from 21% last year to 77% in 2018, with premiums covering 287% of indemnities paid out in 2021 and a low of 75% in 2019.

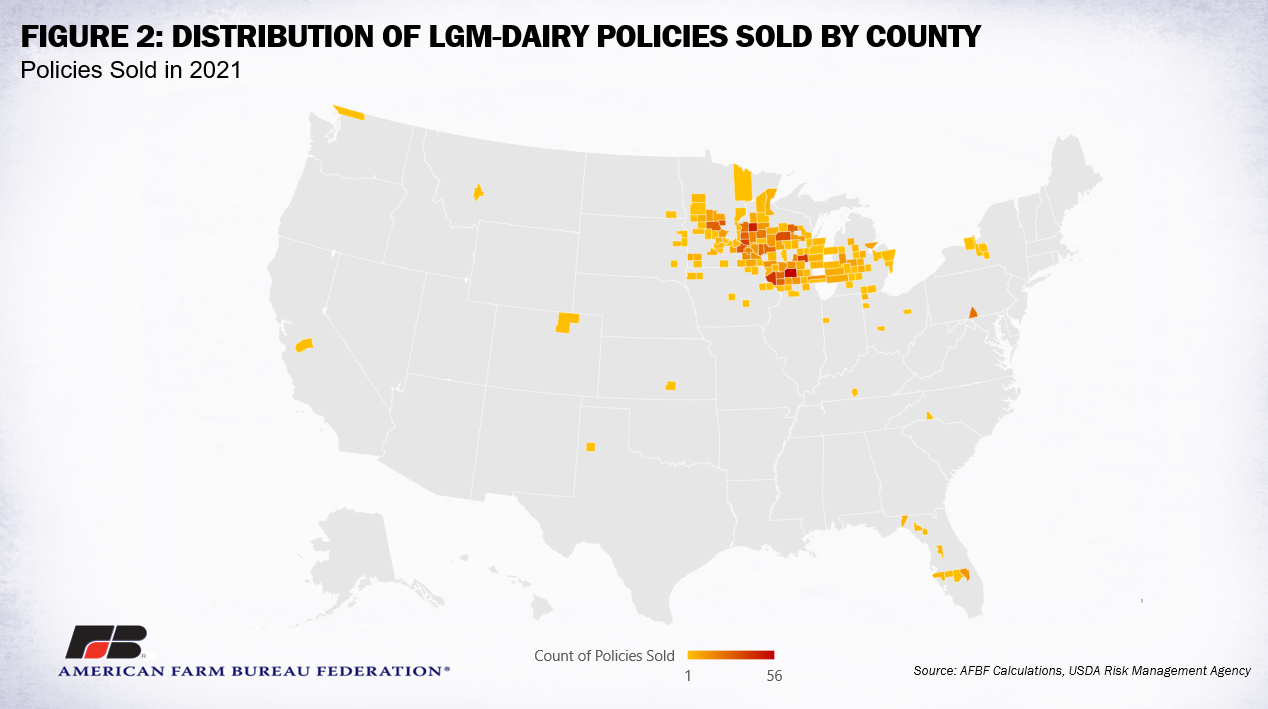

Figure 2 displays the county-by-county geographic distribution of sold LGM-Dairy policies in 2021. You will note a stark contrast in regional diversity from the DRP distribution in Figure 1 with LGM-Dairy sales almost exclusively in upper Midwest states. By state, Wisconsin had the most policies sold with 872, or 64% of all LGM-Dairy policies sold last year, followed by Minnesota (268) and Michigan (118). Concentration of LGM-Dairy sales in the upper Midwest reveals the attraction of the program in high Class III (cheese) utilization states likely linked to the practice of using Class III futures prices in the guaranteed gross margin and actual milk price calculations, making it easier for Class III heavy producers to effectively utilize the program. Between 2021 and 2022 the largest increase in policies sold occurred in Wisconsin (+144) and Michigan (+22), while the largest drops occurred in Florida (-26) and Ohio (-5). Overall, participation in LGM-Dairy over the past five years shows a fairly stable base of users who have found benefits in using the programs unique bundle hedging approach under short- or longer-term, highly customizable contracts. Though the LGM-Dairy is much less utilized than DRP and the percentage of total insured volume remains a small segment of U.S. milk production, these statistics prove a segment of dairy farmers enjoys this alternative risk management option.

Dairy Margin Coverage (DMC)

DMC exists to provide risk protection to dairy producers when milk prices are low and/or feed costs, on average, are high. Unlike DRP or LGM-Dairy, this program is administered directly through USDA’s FSA instead of private crop insurance providers. It is completely voluntary and provides payments when the calculated national margin falls below a producer’s selected coverage trigger. The margin is the difference between the average price of feedstuffs (the price of high-quality alfalfa hay, corn, and soybean meal) and the national all-milk price.

Producers are required to select a margin trigger rate and a percentage of production history to be covered. Coverage is available for margins between $4 and $9.50 under a Tier I CAT (catastrophic) level for production history up to 5 million pounds or between $4 and $8 for a Tier II level in 50 cent increments for production history over 5 million pounds. Producers who select coverage triggers at or above the $4.50 level must pay per hundredweight premiums ranging from $0.0025 to $1.813 per hundred pounds of milk enrolled, depending on the tier and trigger rate selected. All enrolled producers must also pay a $100 administration fee. Producers who only select the $4 coverage trigger do not pay premiums. Production history selection ranges from 5% to 95% (in 5% increments) of a producer’s established production history.

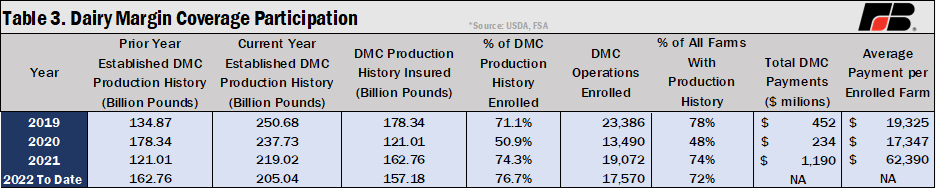

Table 3 displays DMC participation and utilization statistics for 2019-2022 to date. Note: because DMC is administered by FSA and not through private crop insurance providers, an equivalent summary of business data to compare to DRP and LGM-Dairy is not available. Instead, summary statistics are reported in FSA’s weekly DMC reports, which do not provide county-level information, with enrolled production based on historical production history. Between 2019 and 2022 an average of 68.3% of established DMC production history has been insured. This number is skewed by a lower percent coverage year (2020) during which many farmers did not sign up by the deadline because of a more positive market outlook right before the onset of COVID-19. Since then, however, we’ve seen a swift recovery in participation as dairy farmers recognized the role the program can play in hedging against margin risk. The drop in 2020 participation was also reflected in the number of participating dairy farms, which dropped to 48% from over 70% all other program years. In 2021, over $1.1 billion in DMC payments were paid out. There was a period of 12 consecutive months (December 2020 to December 2021) during which at least one DMC payment level was triggered because of lower all milk prices and elevated feed costs. More recently, however, milk prices have not triggered DMC payments, which could reduce 2023 participation if margins hold into the end of the year. Producers can enroll in DMC and DRP simultaneously. LGM-Dairy can also be enrolled at the same time as DMC and/or DRP so long as DRP and LGM-Dairy do not cover the same milk production.

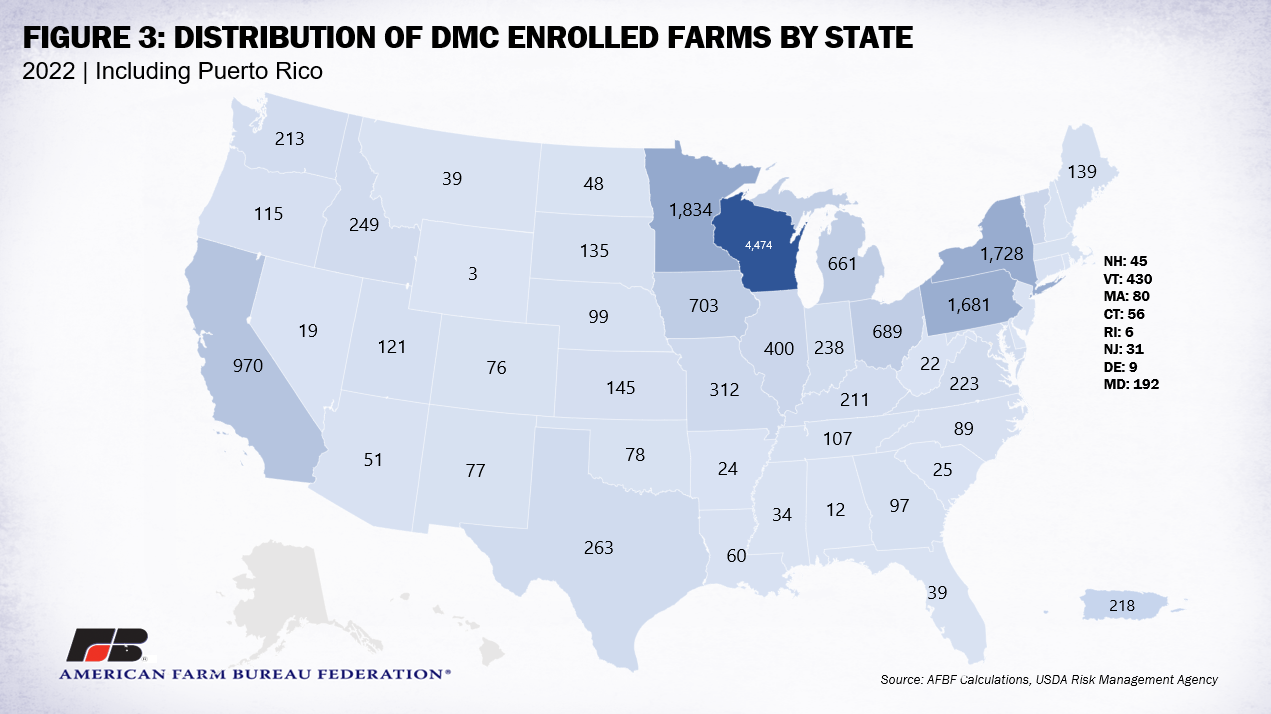

Figure 3 displays the state-by-state and Puerto Rico geographic distribution of participating DMC operations in 2021. Like DRP and as expected, DMC participation parallels states with high milk production, though the Midwest outscores states like California and Idaho by a wide margin. Wisconsin has the highest concentration of enrolled farms in 2022 with 4,474, followed by Minnesota (1,834), New York (1,728) and Pennsylvania (1,681). Between 2021 and 2022 there was a decline of 1,502 enrolled farms, primarily in Wisconsin (-344), New York (-293) and Minnesota (-133). North Dakota had an increase in five producers between 2021 and 2022 and Puerto Rico, three. DMC remains a widely relied upon risk management option.

Conclusion

Existing dairy risk management programs play an important role in offering a level of security for thousands of dairy producers across the United States. DRP, LGM-Dairy and DMC all have a stable if not increasing user base that has benefited from the continued existence of the programs. Endeavors to improve and help make programs more reflective of regional production differences and everchanging market conditions are an important piece in helping these options remain relevant and effective. Dairy farmers interested in selecting a risk management option should work with their local crop insurance provider or FSA office to choose a plan that best fits their operation’s balance sheet fundamentals and risk exposure characteristics. A crucial step, obtaining this assistance and information on program use requirements is often challenging for farmers who face a montage of differently formatted USDA websites and often confusing or conflicting information from FSA offices and insurance providers.

Top Issues

VIEW ALL