Reviewing Dairy Margin Coverage

TOPICS

Risk Management

photo credit: AFBF

John Newton, Ph.D.

Former AFBF Economist

The 2014 farm bill provided the most comprehensive reform to the U.S. federal safety net in decades by replacing countercyclical income and commodity price support programs with a margin-based insurance-style safety net. Following the 2014 farm bill, the Bipartisan Budget Act of 2018 revamped the Margin Protection Program to make it more affordable while providing timelier and additional financial support to dairy farmers in times of low income-over-feed-cost margins (For Some, New MPP Makes Plenty of Cents).

The 2018 farm bill builds on the improvements made in the Bipartisan Budget Act to significantly enhance the commodity support from USDA’s Farm Service Agency. Reflecting these changes, the Margin Protection Program was renamed Dairy Margin Coverage. In addition to Title I improvements, the farm bill also allows dairy farmers to fully utilize the risk management tools available through private crop insurance products such as Dairy Revenue Protection or Livestock Gross Margin for Dairy Cattle.

Along with boosting support for dairy farmers, Congress also modified milk pricing provisions to facilitate improved risk management for the beverage milk industry (Proposed Changes to Fluid Milk Pricing). Then, to address seasonal oversupplies and periodic dumping of milk, a milk donation program was authorized.

Today’s article highlighting the new Dairy Margin Coverage program is the first of two to review the major changes made in the dairy subtitle of the 2018 farm bill. The second article in the series will review the pricing changes to Federal Milk Marketing Orders and the new milk donation program.

Dairy Margin Coverage

Like MPP, DMC is a voluntary program that makes payments when the national average income-over-feed-cost margin falls below a farmer-selected coverage level. Coverage is now available from $4 per hundredweight to as high as $9.50 per hundredweight. Dairy producers pay premiums for coverage and may annually re-select their coverage options. Farmers making a one-time election receive a discount on DMC premiums. Program payments may be triggered monthly and are made if the DMC margin falls below the farmer’s elected coverage level. Program payments are based on the amount of milk covered in the program and may range from 5 percent to 95 percent of a farm’s milk production history in 5 percent increments.

Among the major changes in DMC:

- Three new Tier 1 coverage levels of $8.50, $9.00 and $9.50 per hundredweight;

- Premiums are made more affordable for certain coverage levels;

- Premium discount for a one-time election;

- Farms may now cover between 5 percent and 95 percent of their historical milk production history;

- Farms may make different coverage elections for Tier 1 and Tier 2 coverage;

- MPP premiums paid from 2014 to 2017 are eligible for a refund;

- Retroactive coverage for MPP in 2018 for farms with LGM-D coverage; and

- Farmers can use DMC and crop insurance programs on the same milk.

These changes are reviewed below.

Higher Tier 1 Coverage

From 2015 to 2018 many dairy farmers elected to enroll in MPP Tier 1 coverage, i.e., the first 4 million or 5 million pounds covered, at either $6.50 per hundredweight or $8 per hundredweight. During this time, the MPP margin fell below $6.50 per hundredweight in 4 percent of the months and under $8 per hundredweight in 41 percent of the months.

To increase the frequency of Dairy Margin Coverage support, the Tier 1 coverage thresholds were raised to $9.50 per hundredweight. From 2015 to 2018, the MPP margin was below $9.50 in 80 percent of the months, below $9 in 63 percent of the months and below $8.50 in 52 percent of the months.

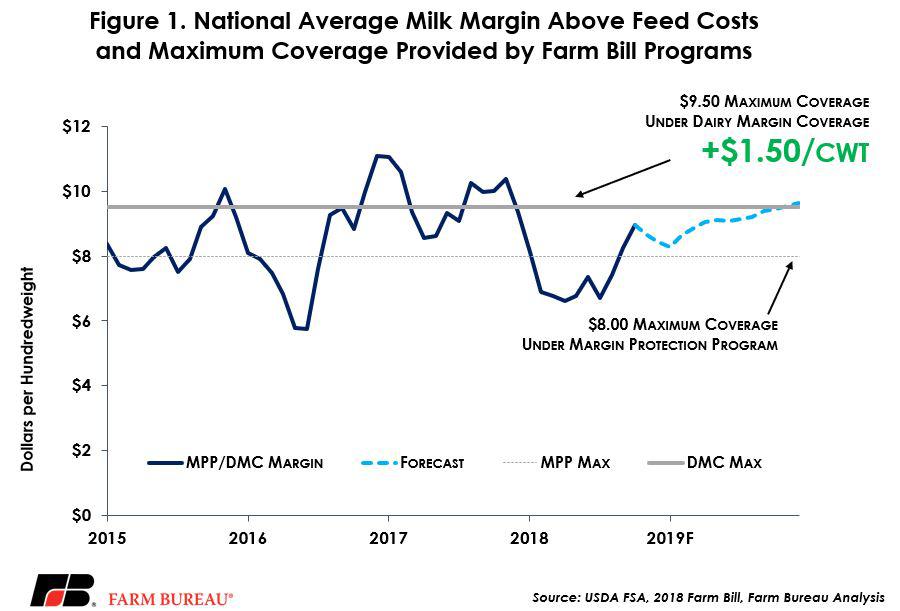

While not a predictor of future program success, over the last decade the average MPP/DMC margin was $8.11 per hundredweight, making the maximum support under DMC equal to 117 percent of the 10-year historical average, i.e., 1.17 = $9.50¸$8.11. However, the five-year average margin, which includes the record-high margins of 2014, is equal to $9.51 and is in line with coverage provided by DMC. Figure 1 highlights the historical MPP/DMC margin and the maximum coverage levels available under MPP and DMC.

Importantly, the higher Tier 1 coverage is only available to the first 5 million pounds of milk covered. The maximum amount of milk eligible for a Tier 1 program payment in a month is 416,666 pounds, i.e., 5,000,000¸12. Coverage for Tier 2 remains capped at $8 per hundredweight.

Adjustments to Tier 1 and Tier 2 Premiums

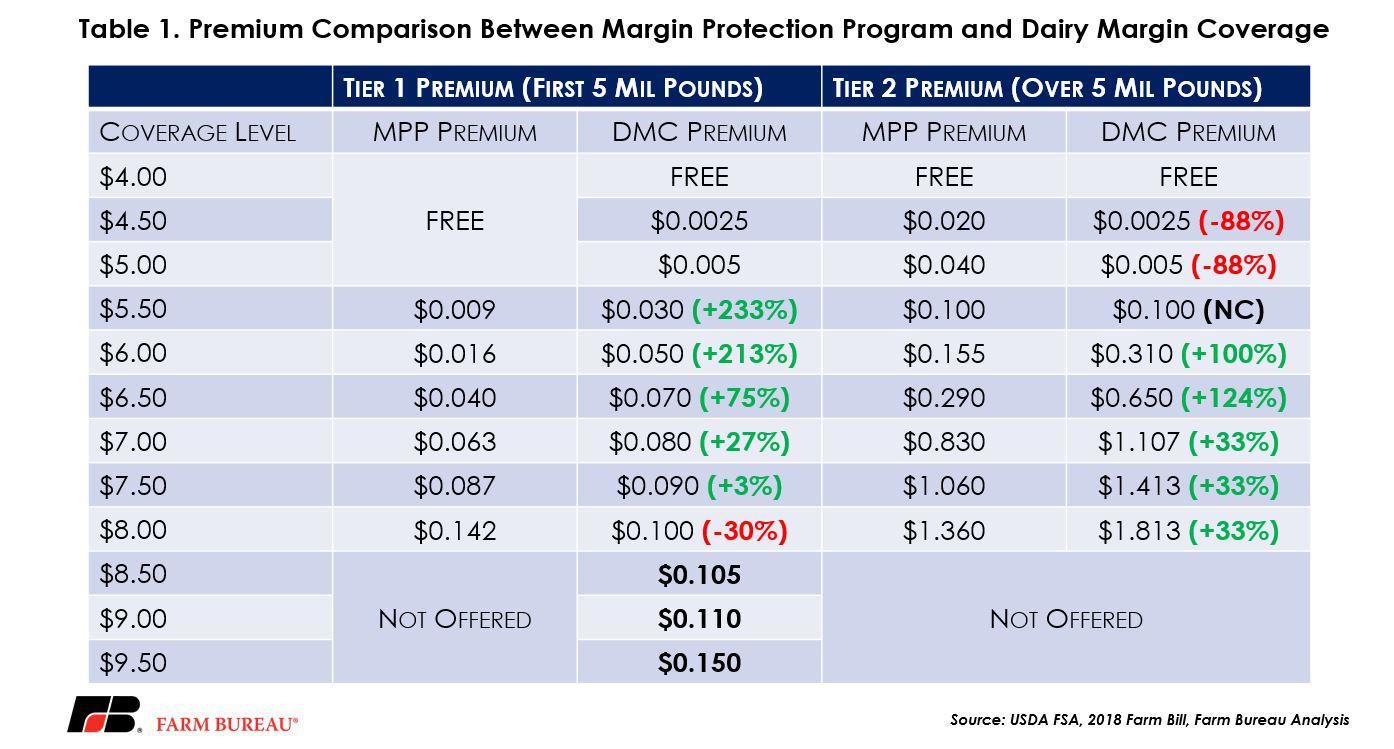

Premium rates for both Tier 1 and Tier 2 were also modified to make certain coverage options more affordable to all participating dairy farmers. Under DMC, dairy farmers can be covered up to $9.50 per hundredweight for only 15 cents per hundredweight. The price of Tier 1 $8 coverage was reduced by 30 percent to 10 cents per hundredweight.

Tier 2 premiums are structured to encourage participation at the $5 and $4.50 coverage levels for farmers covering more than 5 million pounds of milk. The premiums for both levels of coverage were reduced by 88 percent to one-half of 1 cent and one-quarter of 1 cent, respectively. A comparison of premium rates under DMC and MPP – as amended by the Bipartisan Budget Act -- is provided in Table 1.

Premium Discount for One-Time Election

Dairy farmers participating in DMC may receive a 25 percent premium discount if they make a one-time election for both the coverage level and the amount of milk enrolled in the program. For example, a farmer electing the Tier 1 $9.50 coverage option would receive a 25 percent discount on premiums for all five coverage years – reducing the premium from 15 cents to 11.25 cents per hundredweight – if a one-time election is made. New entrants in dairy farming may receive this discount in subsequent enrollment years if they also make a one-time coverage election effective for the remaining years of the farm bill.

Margin Coverage for Medium and Larger Farms

The enhanced margin safety net is bifurcated and offers more protection to the first 5 million pounds of milk covered (about 215 milking cows). Milk covered in excess of 5 million pounds is subject to higher premium rates for shallow-loss coverage but can be covered at catastrophic coverage levels such as $4.50 and $5 per hundredweight at low-cost premium rates.

For medium-to-large dairy operations, the benefits of Tier 1 coverage were extended through two functions. First, the coverage percentage was changed to range from 5 percent to 95 percent in 5-percentage-point increments. Under the 2014 farm bill, the coverage percentage ranged from 25 percent to 90 percent. This modification allows larger farms to cover lower volumes of milk, and smaller farms to cover higher volumes of milk. For example, under the 2014 farm bill, a farm with 100 million pounds of production history had to cover at least 25 million pounds of milk when participating in MPP. This required both Tier 1 and Tier 2 coverage and substantially increased the cost of participation. Now, this same operation can cover only 5 million pounds of milk – all at the lower priced Tier 1 coverage.

Second, the 2018 farm bill includes a second coverage election for Tier 2. Under this provision, the first 5 million pounds of milk can have one Tier 1 coverage election, i.e., $9.50 per hundredweight, while any milk covered in excess of 5 million pounds can have a second coverage election such as $5 per hundredweight. This flexibility allows medium and large dairy operations to receive affordable Tier 1 and Tier 2 protection.

Margin Protection Program Refund

During the three-year period prior to the 2018 Bipartisan Budget Act more than 20 thousand dairy farmers annually participated in MPP – covering as much as 80 percent of the U.S. milk supply. For this coverage, dairy farmers paid more than $100 million in administrative fees and premiums to USDA’s Farm Service Agency. Due to the low frequency of program payments, total program payments made to dairy farmers during this time are estimated at less than $12 million – resulting in an aggregate loss ratio of less than one-sixth of 1 percent.

The 2018 farm bill will refund up to 75 percent of the premiums paid by dairy farmers, not including administrative fees, for Margin Protection Program coverage during the 2014 to 2017 coverage years. Based on estimates of premiums paid into the program and program payments, up to $60 million dollars are likely eligible for premium refunds. Premiums paid for 2018 coverage – post-Bipartisan Budget Act improvements – are nonrefundable.

The premium repayments will be distributed in one of two ways: a farmer can receive 50 percent of the repayment as a direct cash repayment, or a farmer can receive 75 percent of the repayment as a credit toward Dairy Margin Coverage for the 2019 to 2023 coverage years. Farmers making this election must consider the total amount of the potential refund compared to the cost of DMC coverage over the five-year life of the farm bill.

Title I and Crop Insurance

The 2014 farm bill prohibited dairy farmers from using both the Margin Protection Program and the margin-based crop insurance product Livestock Gross Margin for Dairy Cattle. The 2018 farm bill removes this restriction and provides dairy farmers the opportunity and flexibility to use both DMC and crop insurance tools such as LGM-D and the Farm Bureau-developed Dairy Revenue Protection on the same milk.

Importantly, farmers who were prevented from participating in MPP following the Bipartisan Budget Act due to an existing LGM-D policy will be allowed to retroactively receive MPP benefits for 2018.

Dairy Margin Coverage is Worth a Look

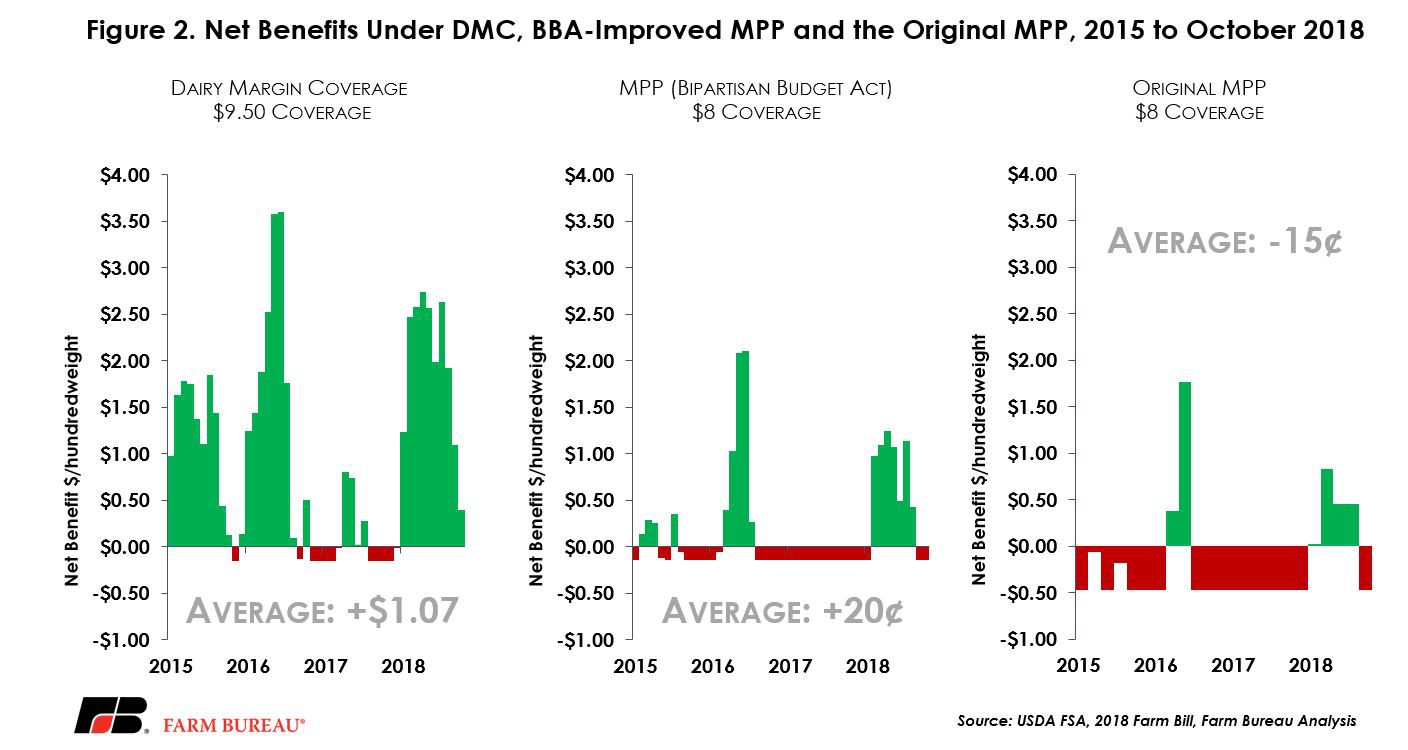

The question many dairy farmers are likely asking is how would DMC have performed in recent years? To answer that question, Figure 2 compares net benefits, i.e., program payments minus premiums, from DMC $9.50 coverage to $8 coverage for both the Bipartisan Budget Act-improved MPP and the original MPP from 2015 to October 2018.

As evidenced in Figure 2, the improvements made in DMC would have provided much-needed financial support to dairy farmers during the recent downturn in the dairy economy. Monthly net benefits would have averaged more than $1 per hundredweight for Tier 1 $9.50 coverage, compared to 20 cents per hundredweight for the Bipartisan Budget Act-improved MPP and -15 cents per hundredweight for the original MPP, both at $8 coverage.

Going forward, dairy farmers will have access to a variety of affordable risk management tools to protect against downturns in the income-over-feed-cost margin or downturns in the revenue from milk sales. With respect to DMC, current projections are for margins to remain below $9.50 per hundredweight through November 2019, making DMC an attractive risk management tool. Then, like their field crop brethren, dairy farmers will also now have the flexibility to use both Title I and crop insurance tools simultaneously. Combined, these tools will allow farmers to have more skin in the game and proactively and consistently manage risks at the farm level.

Trending Topics

VIEW ALL