Renewable Fuel Standard Final Rule – 2023, 2024, 2025: Increases Short of Expectations

photo credit: Arkansas Farm Bureau, used with permission.

Bernt Nelson

Economist

In December, the Environmental Protection Agency (EPA) issued a proposed multiyear rule on renewable fuel requirements for the liquid fuel industry. On June 21, they issued a final version of thatrule rule that establishes RVO targets and percentage standards for 2023 to 2025 and modifies the RFS program. This Market Intel provides an analysis of the changes to the RFS standards and their potential impacts on farmers.

Background

The RFS program was established in 2005 and expanded under the Energy Independence and Security Act of 2007, which specified mandatory volumes of renewable liquid fuel use only through 2022 and required EPA to set levels after that. In this rule EPA is establishing final Renewable Volume Obligations (RVO) for 2023-2025 – volumes of fuels of various categories that the liquid fuel industry is required to incorporate into their supply to replace petroleum-based fuel for all categories under its authority. When determining RVOs for years after 2022, EPA must consider a variety of factors specified in the statute, including costs, air quality, climate change, implementation of the program to date, energy security, infrastructure issues, commodity prices, water quality and supply.

EPA was required by statute to release its 2023 RVO levels by November 2021. Pushed by legal action by Growth Energy, a national biofuels association, and a under a consent decree agreement reached in federal court between EPA and Growth Energy, the final rule was finally published on June 21.

What’s in the Final Rule?

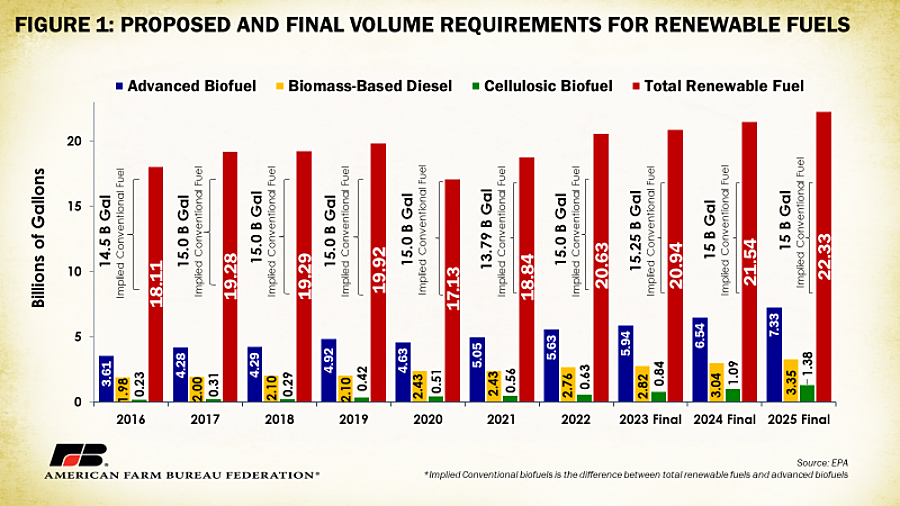

The final rule increases total renewable fuel volumes to 22.33 billion gallons by 2025, up 1.7 billion gallons, or 8%, from 2022. This includes an increase of 120 million gallons in 2023, another 600-million-gallon increase in 2024, and a final increase of 790 million gallons in 2025. Figure 1 illustrates the final volume requirements from 2016 to 2025 for all four categories of renewable fuels. We provided more detail on the renewable fuel categories and the content of the December 1 proposed rule in a previous Market Intel.

Biomass-based diesel: The final rule increases biomass-based diesel RVOs (which includes biodiesel, renewable diesel, heating oil and jet fuel) by 60 million gallons to 2.82 billion gallons in 2023, by 220 million gallons to 3.04 billion gallons in 2024, and by 310 million gallons to 3.35 billion gallons in 2025. The RVO is calculated by subtracting total advanced biofuel from total renewable fuel. According to a report by USDA’s Economic Research Service, the United States had the capacity to produce over 4 billion gallons of biodiesel and renewable diesel from 83 plants on Jan. 1, 2022.

Advanced biofuel: The final rule increases the RVO for advanced biofuel (made from qualifying biomass other than cornstarch) by 310 million gallons in 2023, 600 million gallons in 2024, and 790 million gallons in 2025. The majority of growth in total renewable fuel comes from increases in the RVO for advanced biofuel.

Renewable (or implied conventional) fuel refers to biofuel, including ethanol, derived from starch feedstocks. The implied conventional biofuel requirement finalized by EPA is 15.25 billion gallons for 2023, and 15 billion gallons for 2024 and 2025. This was reduced from the proposed rule’s 250-million-gallon implied conventional fuel supplement through 2025.

Renewable Identification Numbers under the Renewable Fuel Standard Program

Renewable Identification Numbers (RINs) are attached to each gallon of renewable fuel produced. This is a measure of energy contained in each gallon of renewable fuel produced relative to the energy contained in 1 gallon of ethanol. One gallon of biomass-based diesel contains about 150% of the energy contained in 1 gallon of ethanol, so each gallon produced yields 1.5 RINs. For the final rule, EPA adjusted the conversion factor for biomass-based diesel to 1.6.

e-RINs Removed From Final Rule

The rule proposed by EPA in December 2022 included the addition of a RIN-generating pathway for electricity made from renewable biomass and used as transportation fuel. The system was intended to provide greater beneficial use of landfills and digesters as a source for renewable energy. EPA decided not to move forward with e-RINS in the final rule, citing varied comments from stakeholders as the reason for this decision. EPA further attributes reductions in the cellulosic biofuel RVO to this decision.

Impacts on Corn, Soybean Oil and Soybeans

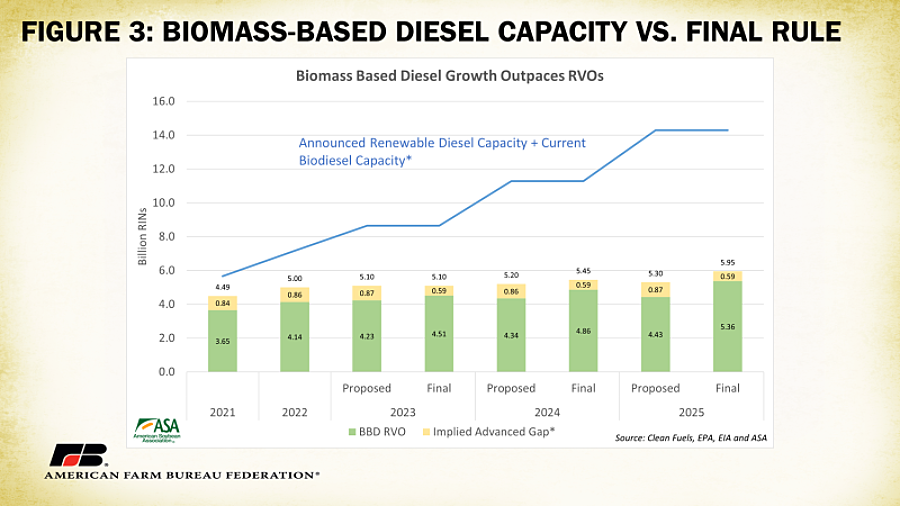

On the soybean side, U.S biomass-based diesel supplies (including imports) were about 3.1 billion gallons in 2021 and about 3.2 billion gallons in 2022. USDA now projects 12.5 billion pounds of soybean oil will be used to produce biodiesel during the 2023/24 marketing year, up nearly 8% over 2022. The use of soybean oil for biodiesel production as a percent of total consumption surpassed the use of corn for ethanol production in 2020 and has continued to climb (Figure 2). EPA’s proposed rule sets RVOs for biomass-based diesel at 2.82 billion gallons for 2023, 3.04 billion gallons in 2024, and 3.35 billion gallons in 2025. According to the final rule, the 3.35-billion-gallon RVO for 2025 would be about 7.7% above 2022 supply levels and 3.7% above projected supplies for 2023/24. Figure 3 provides a comparison in RINs of the announced and current renewable diesel capacity compared to the RVO for biomass-based diesel, and the implied advanced gap (advanced gap = total advanced biofuels – cellulosic – biomass-based diesel). The 5.95-billion-RIN RVO falls far short of the U.S. capacity of 14.3 billion RINs. The RVO is increased significantly compared to the proposed rule, but it promises to lag behind renewable fuel production capacity, so it will limit the RFS’ short- and medium-term positive price impact on RINs and biofuels and curb the biomass-based industry’s policy-based incentive to grow. In the proposed rule, EPA included a 250-million-gallon supplemental increase over the 15-billion-gallon RVO for implied conventional fuel for 2024 and 2025. EPA did not include these additional gallons in the final rule, putting implied conventional fuel at 15 billion gallons for 2023, 2024 and 2025.

Key Takeaways

Renewable fuels have provided a significant and steady market for American growers. In the 2023/24 marketing year, 5.3 billion bushels of corn, nearly 37% of total U.S. consumption, are projected to be used by ethanol producers. At the same time, 12.5 billion pounds of soybean oil, the oil from over 1 billion bushels of soybeans, is projected to be used in biodiesel production (Figure 2).

The final volume increases raise the floor for demand in the biomass-based diesel and advanced biofuel sector; but as long as they lag behind capacity, they will not incentivize continued growth in a sector that has made a substantial contribution to corn and soy demand for American farmers, and to the overall sustainability of American energy supplies. The rule further reduces this floor through the removal of the 250-million-gallon supplemental conventional fuel requirement for 2023, 2024 and 2025, leading to lower corn demand and the implications that come with that.

Trending Topics

VIEW ALL