Recovering Farm Income Jeopardized by Record Operating Expenses and Harvest Uncertainty

TOPICS

USDA

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Daniel Munch

Economist

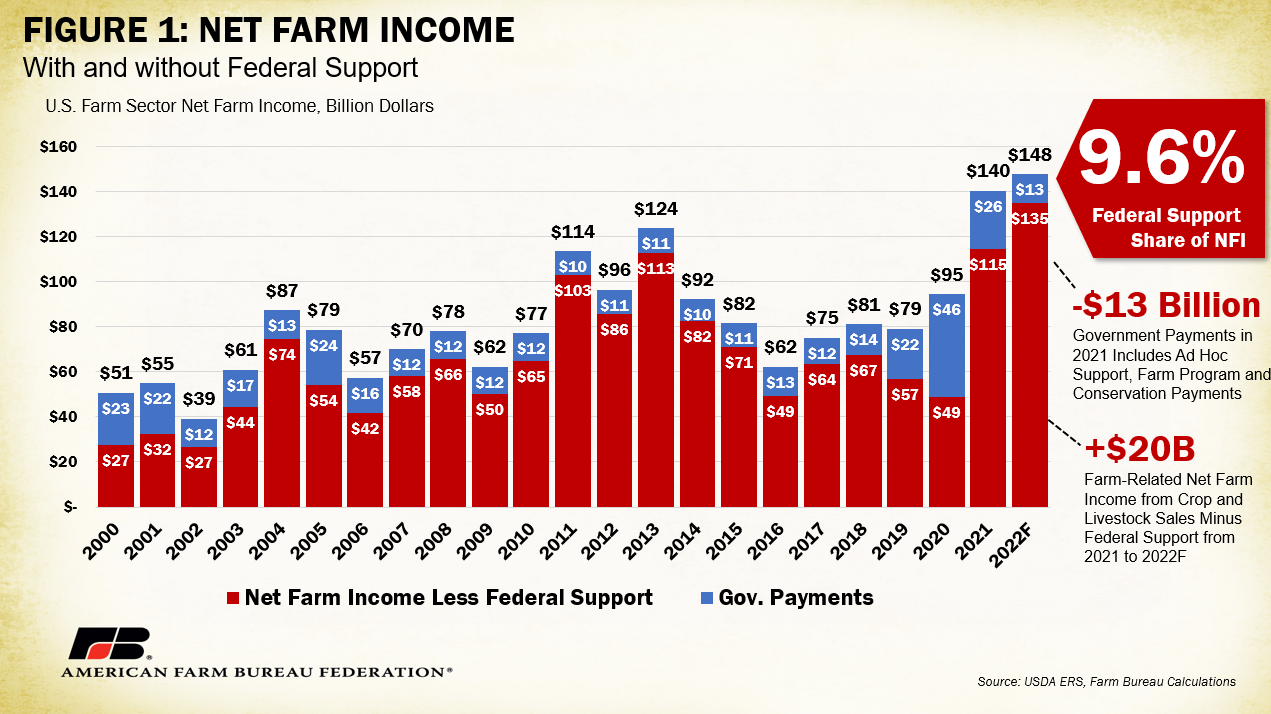

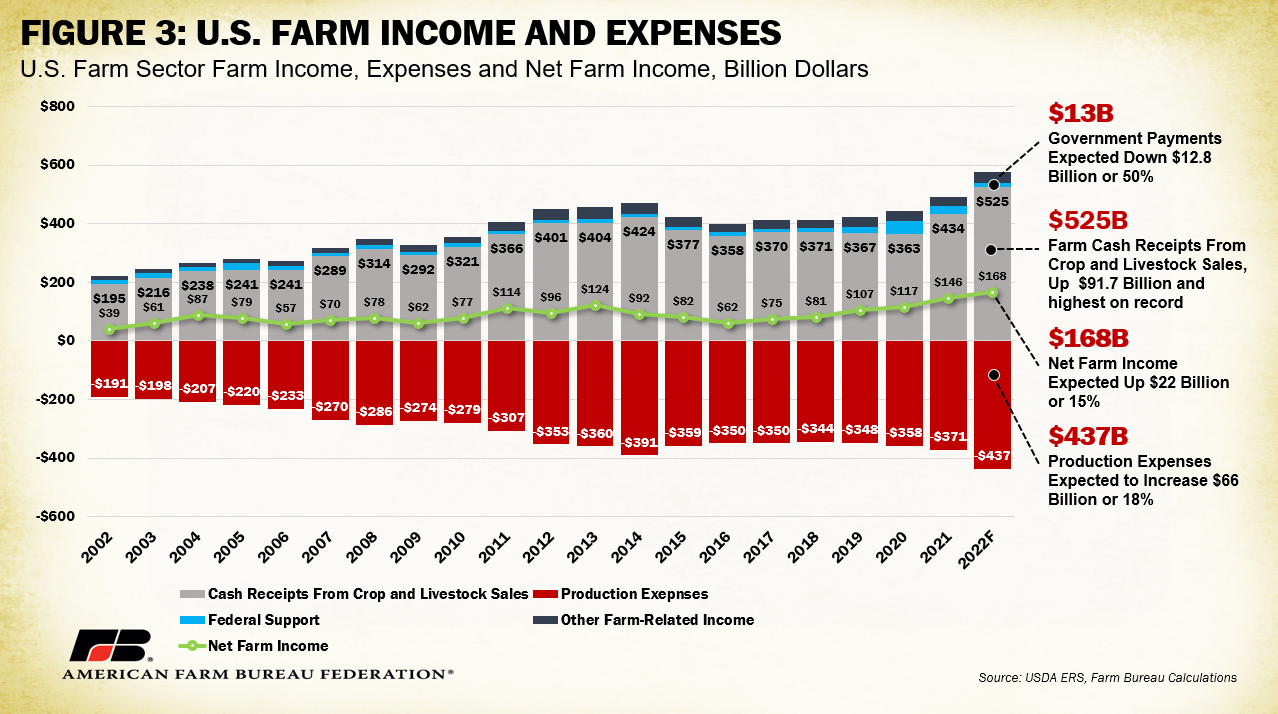

USDA’s most recent Farm Sector Income Forecast, released Sept. 1, anticipates an increase in net farm income for 2022. U.S. net farm income, a broad measure of farm profitability, is currently forecast at $147.7 billion, up 5.2%, or $7.3 billion, from 2021’s $140.4 billion. This increase contrasts with USDA’s original February estimates that forecasted a $5.4 billion (-4.5%) decline in net farm income and if realized, would represent the fourth consecutive year of improved net farm income. When adjusted for inflation, however, 2022 net farm income is expected to decline $0.9 billion (0.6%) from 2021 but remain 42% above the 20-year average of $104 billion in inflation-adjusted dollars. The report also finds the largest increase in production expenses on record in both numerical and percentage terms, up $66 billion across the farm economy (18%).

Net Farm Income Breakdown

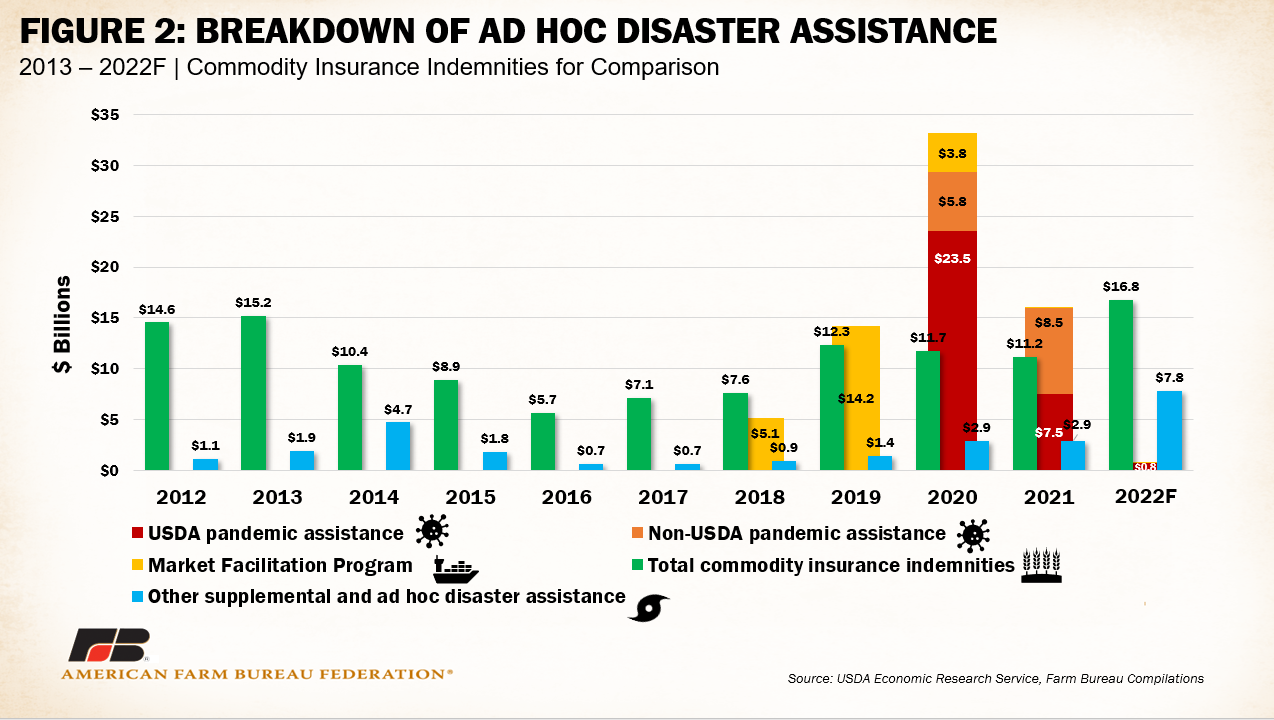

Direct government payments are forecast to decrease by $12.8 billion, or 49.7%, between 2021 and 2022. This drop is slightly lower than the $15.5 billion, or 57%, drop forecast in February. As displayed in Figure 2, the decrease corresponds to reductions in both USDA pandemic assistance, which included payments from the Coronavirus Food Assistance Programs and other pandemic assistance to producers, and non-USDA pandemic assistance programs, such as funds from the Small Business Administration’s Paycheck Protection Program.

From 2021 to 2022, federal payments through USDA’s pandemic assistance initiatives are expected to drop $6.7 billion, from $7.5 billion to $0.78 billion, or 89%, and non-USDA pandemic assistance is expected to disappear completely, a difference of $8.47 billion from 2021. In addition to the reduced pandemic-related payments, the Market Facilitation Program, which provided a series of direct payments to farmers and ranchers impacted by trade retaliation, ended in 2021 and will not be part of net farm income going forward. The “other supplemental and ad hoc disaster assistance” category includes payments from the Wildfire and Hurricane Indemnity Program (WHIP+), Quality Loss Adjustment Program, and other farm bill designated-disaster programs. Most recently, this includes the Emergency Relief Program (ERP) which replaced WHIP+ for 2020 and 2021 disaster-related crop losses. The arrival of this program pushed payments from the ad hoc assistance category from the original February projection of $2.9 billion to $7.8 billion – a 168% increase – the primary reason for a smaller drop in government-linked payments. In Figure 2, total commodity insurance indemnities, which are triggered in the event of revenue or yield loss for growers who have purchased crop insurance, are not direct government payments but are included for comparison. Commodity insurance indemnities are expected to increase in 2022 by 50%, or $5.6 billion, moving from $11.2 billion to $16.8 billion. This increase is the likely result of increased crop insurance enrollment by those who received a WHIP+ payment and who must purchase crop insurance or Noninsured Crop Disaster Assistance Program coverage (when crop insurance is not available) for the next two available crop years under program requirements – a requirement also of ERP.

A significant portion of the increase in net farm income is linked to a projected jump in cash receipts from crops and livestock production expected up 21% or $91.7 billion in 2022 in nominal dollars. Higher projected commodity prices across the board, project out to higher cash receipts. Receipts for corn are expected to increase 16.7% ($11.9 billion), soybeans are expected up 30.6% ($14.9 billion), and wheat is expected up 33.7% ($4 billion). These three crops account for the bulk of cash receipt increase projections. A whopping 80.4% of the increase in cash receipts is expected to be linked to higher prices versus only 9.3% linked to volume changes. Some of these commodity price increases may be attributed to the Ukraine-Russia conflict. Ukraine is the seventh-largest producer and fourth-largest exporter of corn in the 2020/21 crop year. Ukraine is also the eighth-largest producer and sixth-largest exporter of wheat. When Russia invaded Ukraine, it was a wake-up call regarding food security. Farmers have made feeding the world look easy for a long time and when the invasion occurred supply concerns immediately surfaced. More recent supply adjustments, however, have temporarily eased some of these worries and prices have come back down. Importantly, each USDA forecast is based on a point in time calculation based on certain commodity reference prices. The magnitude of the projected cash receipts increase is likely linked to a period of record reference prices and may not reflect the price received for crops at harvest. On the livestock side, total animal/animal product receipts are expected up $55.3 billion (28.3%) for a total of $251 billion based on strong prices across species. Some of this increase is temporary, due to more cattle marketed because of drought and increased input costs.

On the cost side, production expenses, including operator dwelling expenses, are forecasted to increase by $66.2 billion, or 17.8%, reaching $437.3 billion in 2022, a record high total and record high dollar and percentage increases in one year. This includes increases in costs like cumulative feed, which is expected to increase nearly $9.7 billion, or 15%, to $75.9 billion. Fertilizer, lime and soil conditioner costs are expected to increase $15.4 billion, or 52%, from $29.5 billion to $45 billion. Typically, fertilizers represent about 15% of a crop farmer’s costs and an increase of this magnitude can be crushing for some producers, even with the increases in revenue. Other increased production costs in the manufactured inputs category include pesticides, which are expected up $3.6 billion, or 20%, from $17.8 billion to $21.5 billion and fuels and oils, expected up 42%, or $5.86 billion, from $13.9 billion to $19.8 billion. Farmers and ranchers are facing the same challenges as other Americans when it comes to the cost of electricity, which is expected to increase $469 million (7.3%) for producers, from nearly $6.4 billion to nearly $6.9 billion. Other farm-related income, which includes things like income from custom work, machine hire, commodity insurance indemnities and rent received by operator landlords, is estimated to increase by $6.4 billion, or 19.7%, from $32.3 billion to $38.6 billion in 2022. When all these factors are accounted for, the resulting expectations for net farm income become apparent, as illustrated in Figure 3.

Other Considerations

USDA’s Farm Sector Income Forecast also provides expectations of farm financial indicators that can give insight into the overall financial health of the farm economy. During 2022, U.S. farm sector debt is projected to increase $21.9 billion, or nearly 4.6%, to a record $496 billion in nominal terms. When adjusted for inflation, the increase changes to a 1.2% decrease in farm sector debt. Nearly 69% of farm debt is in the form of real estate debt, for the land to grow crops and raise livestock. Real estate debt is projected to increase $17.66 billion to a record-high $341.9 billion, largely due to an increase in land values across the country. Non-real estate debt, or debt for purchases of things like equipment, machinery, feed and livestock, is projected to increase only slightly to $154.1 billion. The value of the farm assets that are purchased via farm debt, including farmland, animals, machinery and vehicles and crops in inventory, is projected to reach $3.7 trillion, $328 billion higher than 2021. Most of this increase, $292 billion, is also attributed to higher farmland values. A key point is that the value of assets being purchased with debt is rising, which means it will continue to be important for farmers and ranchers to pay down debt and cover interest to maintain a healthy balance sheet.

Inflation is another item to consider when evaluating the increase in net farm income. Inflation is more than just a general increase in prices, it’s a fall in the purchasing value of money. So, while farmers are facing growth in both operating expenses and net income, that income doesn’t go as far when paying for inputs like fertilizer and fuel.

Inflationary pressures and operating expenses are two of the largest factors reducing the impact of higher net farm income, but these two macro-trends fail to capture the additional regional uncertainties and ground-level hardships facing farmers and ranchers. For instance, drought, which continues to hammer western states, has resulted in major herd selloffs and crop removals. A recent AFBF survey of farmers and ranchers in drought-stricken regions found 66% of respondents were liquidating herds as feed was too costly to find and water often inaccessible. Animals sold at market in these areas are often below average market weight due to forage conditions – reducing revenue to ranchers in an already flooded, low price, placement market. Over a third of respondents reported destroying their orchard or other multi-year crops or tilling under crops due to drought. These operational changes inhibit revenue potential, often permanently or for years to come. With harvest incomplete across commodities, weather and other unexpected supply restricting forces can quickly dampen revenue expectations for impacted producers. Consideration must be given to individual farm operation challenges in order to measure the health of the broader farm economy.

Summary

USDA released the most recent estimates for 2022 net farm income, providing an early estimate of the farm financial picture. For 2022, USDA anticipates an increase in net farm income, moving from $140.4 billion in 2021 to $147.7 billion, an increase of 5.2%. Much of the 2022 net farm income is expected to be produced by crop and livestock cash receipts, a record increase in production costs and a decrease in ad hoc government support, resulting in an overall increase of forecasted net farm income. Farmers and ranchers face an uphill battle despite the increases in net farm income. One of the greatest concerns is the increase in operating costs, particularly in fertilizer and other inputs. Other concerns come from the effects of inflation and harvest uncertainty. These issues will challenge the ability of farmers and ranchers to reach above break-even levels in 2022.

Trending Topics

VIEW ALL