Quarterly Grain Stocks & Prospective Plantings Set Tone For 2023 Growing Season

photo credit: Arkansas Farm Bureau, used with permission.

Bernt Nelson

Economist

USDA released two big reports on Friday, March 31, 2023. Quarterly Grain Stocks addresses grain leftover from 2022. Prospective Plantings is an annual report that sets the tone for the new year by estimating harvest data and planted acres of principal crops and tobacco at the state level. These two survey-based reports set the tone for the marketing year and can be used for a wide variety of purposes by farmers, market analysts and others. This Market Intel will provide an overview of the content of these reports and implications for farmers getting ready to get into the field for spring planting 2023.

The Reports – what’s left over & what’s to come

The Quarterly Grain Stocks report is a survey-based document published four times per year. The survey addresses old crop stocks in two ways: location (state) and position (on-farm or off-farm storage). This particular report provided information on old crop U.S. grain stocks as of March 1, 2023. Grain stocks reports are subject to revisions which typically occur in the following quarterly report. USDA’s annual Prospective Plantings report is also a survey-based report but is published only once per year. This publication presents last year’s harvest data and anticipated planted acres for the marketing year for principal crops and tobacco.

Corn

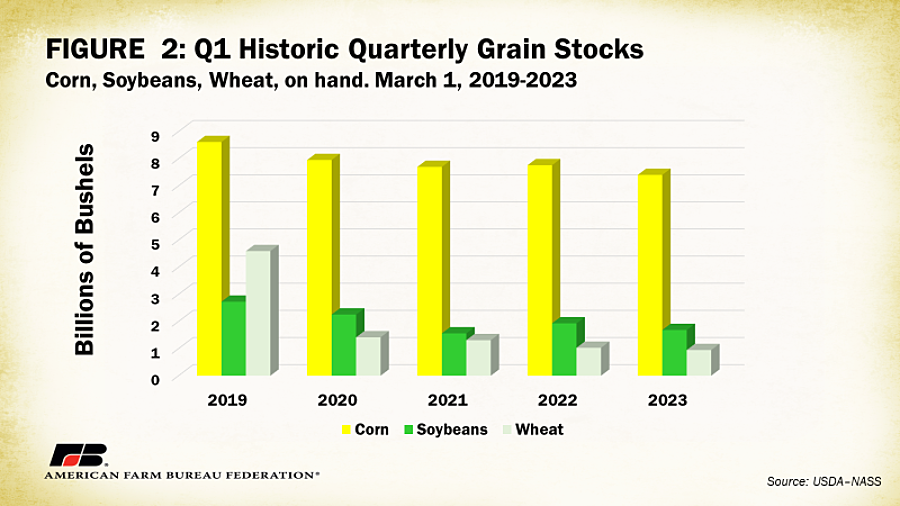

Corn stocks on March 1, 2023, were estimated at 7.4 billion bushels, down 5% or 180 million bushels from March 1, 2022. This is about 69 million bushels below trade analysts’ average estimate.

USDA estimates farmers intend to plant 4% or 3.42 million more acres of corn than last year. This estimate comes out to about 92 million acres compared to trade analysts’ average estimate of 90.88 million acres.

Soybeans

Soybean stocks on March 1, 2023, were estimated at 1.69 billion bushels, down 13% or 240 million bushels from March 1, 2022. This number is about 57 million bushels below average analysts’ estimates of 1.74 billion bushels.

USDA estimates farmers intend to plant 87.5 million acres of soybeans. This is only slightly more than 2022 and unchanged in 15 of 29 states.

Wheat

USDA estimates all old crop wheat stocks are 946 million bushels, down 8% from March 1, 2022. This was 12 million bushels above average analyst estimates of 934 million bushels.

USDA estimates farmers intend to plant 49.9 million acres of wheat in 2023. That’s 9% or 4.1 million acres more than 2022. Further, this number comes in higher than USDA’s February Grains and Oilseeds Outlook estimate of 49.5 million acres.

To further break down wheat estimates, USDA expects all wheat acres to include 10.6 million acres of spring wheat (down 2% from 2022), 37.5 million acres of winter wheat (up 13% from 2022) and 1.78 million acres of durum wheat (up 9% from 2022).

Cotton

USDA estimates that farmers will plant 11.3 million acres of cotton in 2023. This is down 18% from 13.76 million acres planted in 2022. However, this number comes as a bit of a surprise as it is 350,000 acres more than their February Cotton Outlook estimate. Cotton is a staple crop in the Southern United States where it often competes for acres with corn and soybeans. Upland cotton is forecasted to make up 11.1 million acres of the total which is 18% below 2022. American Pima is estimated to make up the remaining 154,000 acres, down 16% from the 183,000 acres planted in 2022.

Analysis & Conclusions

This is a complicated time of year to evaluate crop markets. Traders, analysts and producers will spend time evaluating USDA WASDE numbers against Quarterly Grain Stocks, Prospective Plantings and global export situations to try to develop marketing plans and prepare for what lies ahead.

USDA’s Ag Outlook Forum estimated larger corn production for 2023 with a crop estimate of 15.085 billion bushels. If we use last year’s harvest percentage of 91.32% and multiply this by expected acres and a trendline yield of 181.5 bushels per acre, we have an estimated crop size of 15.25 billion bushels. If we add in grain stocks and imports from USDA’s Grains and Oilseeds Outlook, the crop size comes in at 16.54 billion bushels. Bottom line – this is a bearish number for corn.

Since USDA’s soybean acreage is largely unchanged, weather and demand factors will play a bigger role in directing soybean prices until spring planting wraps up. Soybean stocks on the other hand, came in much lower than expected. The 1.69-billion-bushel stocks number is 247 million bushels below March 1, 2022.

Wheat acreage was a surprise with planted acres forecasted 400,000 higher than USDA’s February estimate. This is substantially higher than analyst expectations that were much closer to last year’s 45.74 million acres.

On the acreage side of things, there are some new weather concerns that may affect planting as we head toward spring. Much of the Dakotas remain covered in snow and more is in the forecast for the upper Midwest this week. This may lead to planting delays due to cool soil temperatures and wet conditions. These uncertainties could potentially trigger farmers to adjust cropping plans or eventually lead to prevented plant acres in the days ahead.

Trending Topics

VIEW ALL