Proposed Changes to Fluid Milk Pricing

TOPICS

Milk

photo credit: Getty

John Newton, Ph.D.

Former AFBF Economist

The beverage milk industry is a risky business. One of the more complicated provisions of the complicated Federal Milk Marketing Order system is in fluid or beverage milk pricing. Buying and selling milk going into fluid milk beverages is confusing because of Federal Milk Marketing Order end-product pricing formulas, along with an inability for processors to directly forward contract milk intended for fluid use and a lack of a commercially traded futures contract for beverage milk.

These roadblocks prevent those that deal in the beverage market from being able to effectively manage their risks on either the supply-side or the demand-side of the equation. This puts those working in the beverage market at a significant disadvantage over those working in the product – cheese, butter and powder – markets. And if as dairy farmers, the idea is to try to get the highest value for their milk, it’s probably a good idea to make it that much easier – and less risky – for milk handlers to be in the fluid milk business.

A new proposal to change the way USDA regulates fluid milk markets could potentially alleviate many of these risk management concerns. Farmer cooperatives and processor trade organizations are currently considering a farm bill request to change the beverage milk price to the simple average of the advanced Class III and IV skim milk prices plus 74 cents per hundredweight plus the Class I butterfat value and the existing Class I differential (Note: This is not a Farm Bureau proposal). While this proposal would facilitate the use of commercially traded milk futures contracts to more directly manage beverage milk price risk, it may represent an opportunity to reverse the long-term decline observed in per capita fluid milk consumption.

Beverage Milk Price Risk

Most milk marketed by dairy farmers across the nation is priced through FMMOs. These orders are designed to facilitate orderly marketing of milk by guaranteeing a minimum cash price received by dairy farmers for milk using revenue pooling, classified pricing and end-product price formulas.

Through these price formulas, milk intended for fluid use generally has the highest price and milk intended to produce storable dairy products like nonfat dry milk powder or cheese generally have the lowest price. During the monthly pooling process, FMMOs determine the weighted average minimum monthly value of milk based on how milk is used in a marketing area. Only Class I beverage milk processors are required to pay these FMMO minimum prices since forward contracting is allowed for all other classes of milk including yogurt, cheeses, milk powders, butter and other non-beverage dairy products.

Class I Milk Pricing and Basis Risk

Currently, on or before the 23rd of each month USDA announces the beverage milk price for the upcoming month. For example, the January beverage milk price is announced on or before Dec. 23. The beverage milk price is the higher of the advanced Class III or Class IV milk price plus a differential. Class III is milk that is used to produce cheese products and Class IV is milk that is used to produce nonfat dry milk and butter products.

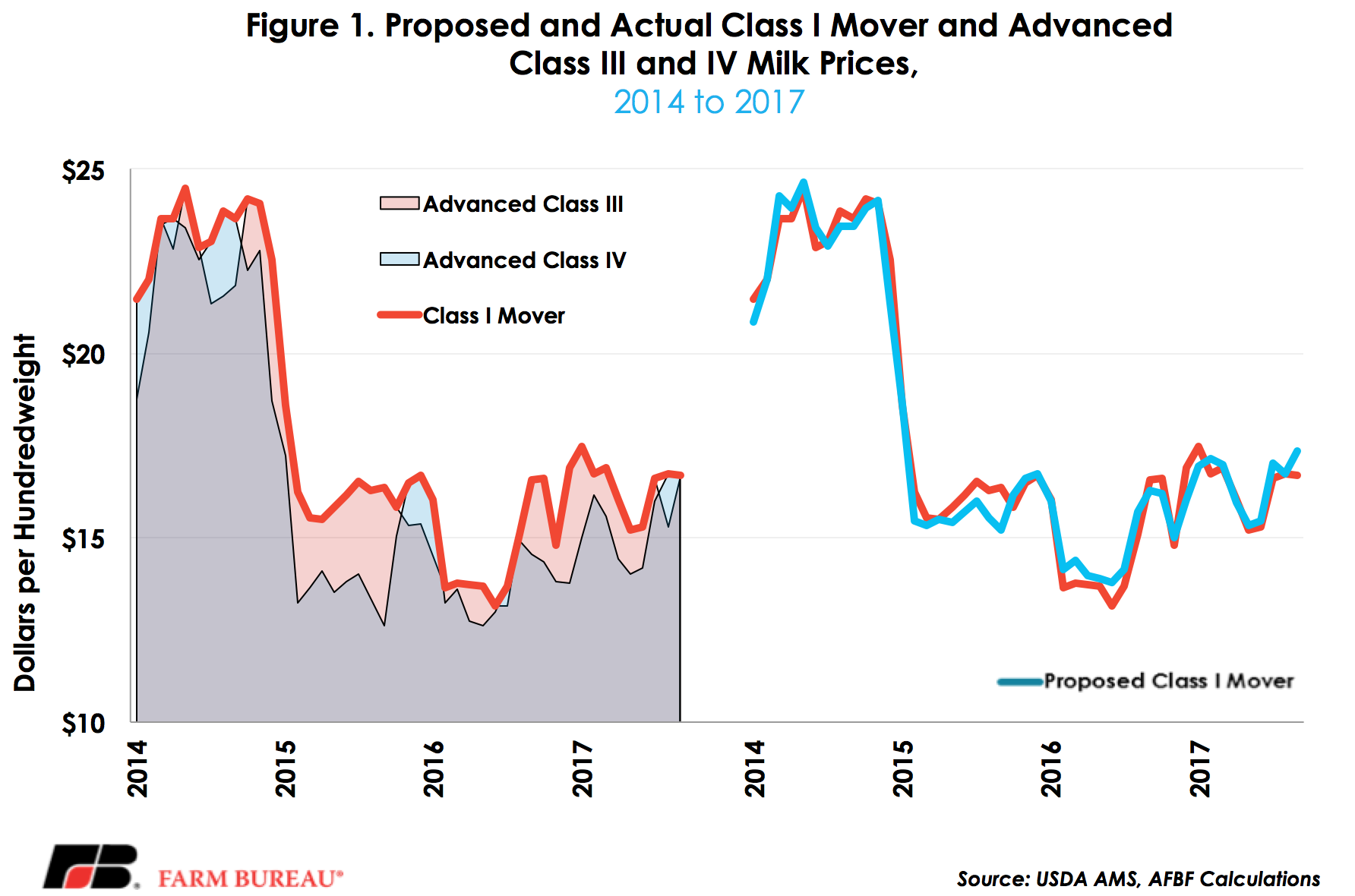

Due to the “higher-of” mechanism, the beverage milk price often switches between the two milk classes depending on supply and demand conditions in butter, cheese and powder markets. From 2001 to September 2017, the advanced Class III milk price was the Class I mover 62 percent of the time. During this time, the average contribution of the “higher-of” provision to the Class I value was 43 cents per hundredweight. Figure 1 highlights the advanced Class III and IV milk prices and the higher-of mechanism of Class I milk pricing. Notice that the Class I price is always the maximum of the two advanced prices.

The “higher-of” and advanced pricing features of the Class I milk price make it difficult to directly cross-hedge beverage milk price risk due to the basis risk (basis = cash price minus futures price). First, because the price is announced on or before the 23rd of the prior month and the Class III and IV milk prices are not final until the 5th of the month, there is a 1- to 2-week lag between the announcement of the advanced Class I price and the expiration of the underlying futures contracts. During this two-week period prior to the contract expiration, the market is absorbing new information on cheese, butter, dry whey and nonfat dry milk entering the market. Due to this uncertainty, the underlying futures prices two weeks from expiration have no implicit reason to align with the advanced prices announced for Class III and IV.

Second, because the Class I value can alternate between the advanced Class III and IV milk price, currently there is no single futures contract that fully captures the price risk. For example, if a milk buyer used Class III to cross-hedge fluid milk, but an event in butter or powder markets caused Class IV to become the higher milk price in a given month, the risk exposure faced by the milk buyer is not fully captured. In this case, a price change in the Class I milk price is not offset by a similar movement in the Class III milk futures contract.

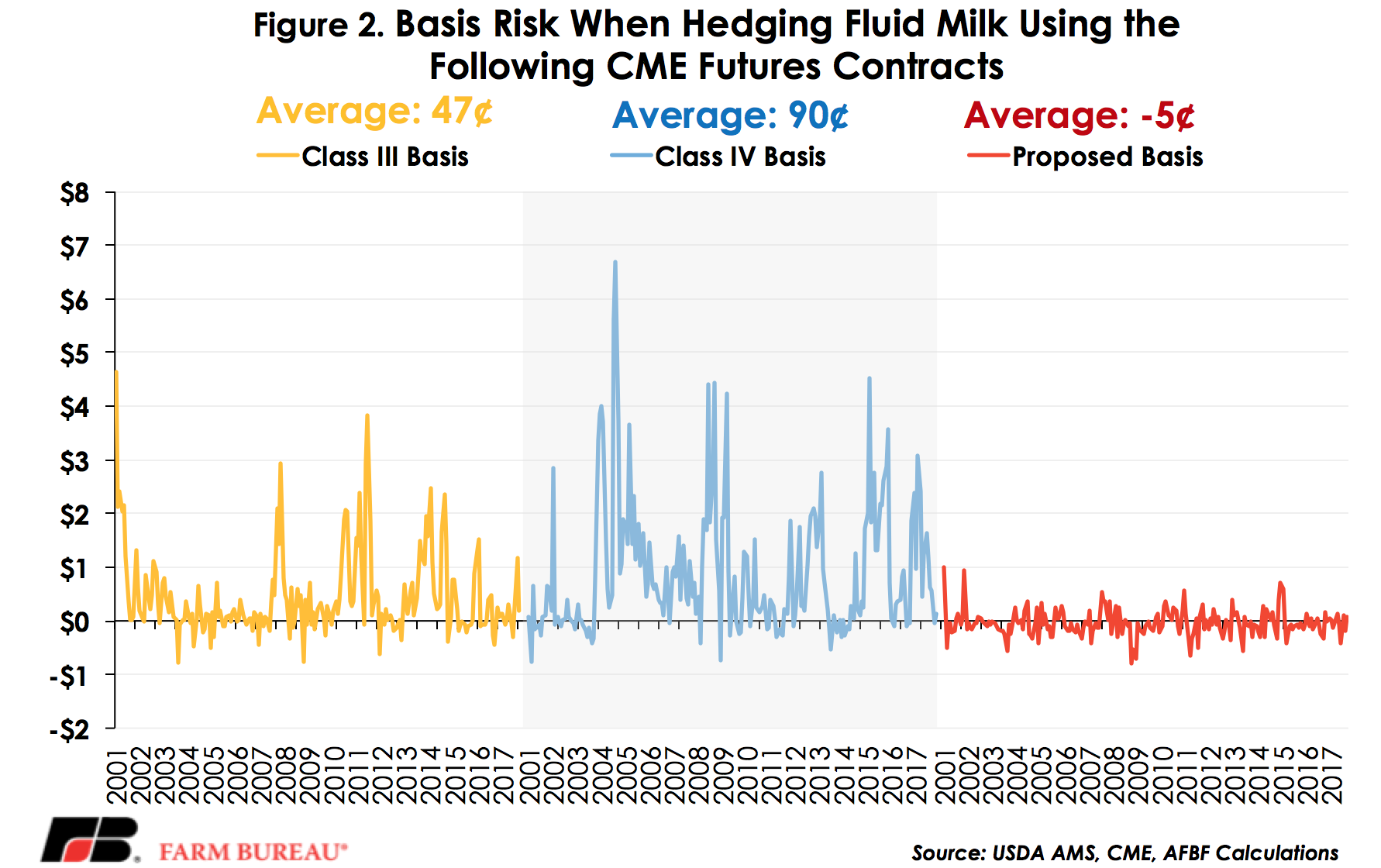

These two sources of basis risk reduce the effectiveness of cross-hedging beverage milk. Historically, from 2001 to 2017 the basis risk when using the Class III milk futures contract to cross-hedge Class I milk averaged 47 cents per hundredweight and ranged from a low of -78 cents to $4.64 per hundredweight. During this same time, the basis risk when using the Class IV milk futures contract averaged 90 cents per hundredweight and ranged from a low of -77 cents to a high of $6.68 per hundredweight, Figure 2.

Depending on the volume of milk hedged, this unanticipated price risk could result in a milk buyer paying thousands to millions of dollars each month in milk procurement costs above or below what was hedged using the futures contract. This either increases the effective cash price of milk or results in additional cash on hand; both cases disrupt supply chain finance.

Benefits of Risk Management

The proposed milk pricing regulation would set the monthly beverage milk price equal to the simple average of the advanced Class III and IV skim milk prices plus 74 cents per hundredweight plus the Class I butterfat value and the existing Class I differential . The 74-cent addition to the simple average is in lieu of the higher-of mechanism. Importantly, using the simple average of Class III and IV milk prices would make it possible to more fully hedge fluid milk using the CME futures market.

Those seeking to directly manage fluid milk price risk would benefit from this change. Since Class I forward contracting is not permitted, the only way to directly manage Class I milk price risk is using CME milk futures or through over-the-counter derivative markets. Under the proposal, the contribution to the basis due to the higher-of would be eliminated for participants using both Class III and IV milk futures contracts to hedge fluid milk.

While much of the basis risk would be eliminated, basis risk would remain due to the advanced pricing component. Under the current pricing rules, basis risk when using Class III or IV milk futures averages 47 cents and 90 cents per hundredweight, respectively. Under the proposed pricing rules, and as evidenced in Figure 2, the average basis would drop to -5 cents per hundredweight, and from 2001 to 2017 would have ranged from -79 cents to $1.00 per hundredweight. This leaves some risk in the market, but is a substantial improvement over the existing cross-hedging approach.

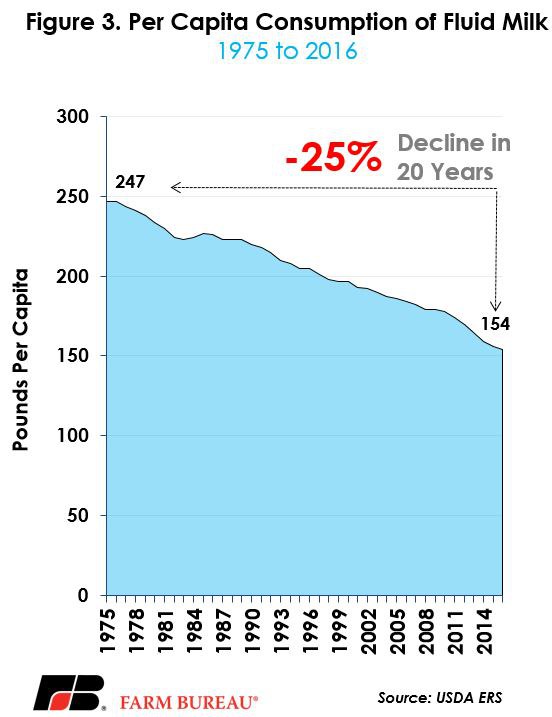

Improved risk management opportunities can have other benefits along the supply chain. For example, the risk associated with developing a new beverage milk product can be better managed if the input costs are known. Additionally, beverage milk processors could negotiate long-term pricing contracts with schools using known prices from the CME. This would reduce the risk of servicing the school milk contracts currently held by the milk processors. Multi-national food companies like Starbucks® or McDonalds® could hedge the input costs of all their dairy ingredients and provide more price stability for consumers. Finally, retailers could plan and design promotions around beverage milk products without absorbing unexpected changes in the fluid milk price, e.g. seasonal eggnog promotions. All of these benefits could ultimately help to reverse the much longer trend plaguing the dairy industry: declining per capita consumption of beverage milk products, Figure 3.

Implications

The proposed Class I milk pricing formula would improve the ability of fluid market participants, including farmers, to manage price risk. While these types of FMMO modifications typically go through a formal rulemaking process and producer referendum, Congress could use its authority to improve the ability for dairy industry participants to manage Class I price risk.

The benefits of this proposal have merit in the risk management arena, and are long overdue given the emphasis on risk management in modern farm policy. Improved risk management tools would provide pricing certainty along the supply chain.

Pricing certainty along the supply chain could ultimately help to reverse the most noticeable trend facing the dairy industry. Over the last 20 years, per capita consumption of beverage milk products has fallen by 25 percent, or 51 pounds per person. For 2016, USDA ERS projected per capita consumption of beverage milk at an all-time low of 154 pounds per person. Improved marketing and innovation in the beverage milk space, facilitated by the proposed pricing change and associated risk management benefits, is a first step in reversing this trend.

Modified: November 2017

Trending Topics

VIEW ALL