New-Crop Sales to China: How Do they Actually Measure Up?

TOPICS

Trade

photo credit: AFBF Photo/Terri Moore

Veronica Nigh

Former AFBF Economist

New-crop sales of soybeans, corn, sorghum and cotton to China have been getting a lot of attention. These purchases are being closely watched and interpreted as potential signs as to whether China will be fulfilling their Phase 1 commitments, which were finalized in January 2020. Data from USDA’s Foreign Agricultural Service’s U.S. Export Sales Report, released on August 13 and covering sales through August 6, back up the rumors of large sales. However, how do new-crop sales compare to previous years? To find out, we compare new-crop sales (2020/21 marketing year) to the similar week from the last five years.

Soybeans

According to FAS’ latest report, new-crop soybean sales to the world stand at 660.5 million bushels. New-crop sales to China are at 377.4 million bushels, plus 192.1 million bushels to locations unknown, which are often directed to China. The remaining 14% of 2020/21 orders, 91.1 million bushels, are destined for all other countries.

These numbers have garnered a lot of attention because at this point in 2019, only 164.2 million bushels of 2019/20 new-crop sales had been recorded. Of those 164.2 million bushels, 7.1 million bushels were sold to China and 80.3 million bushels were to destinations unknown. Even more importantly, at this point in 2017, the last “normal” trade year, 258.4 million bushels of 2017/18 new-crop sales had been recorded. Of those 258.4 million bushels, 113.7 million bushels were sold to China and 69.5 million bushels were sold to destinations unknown.

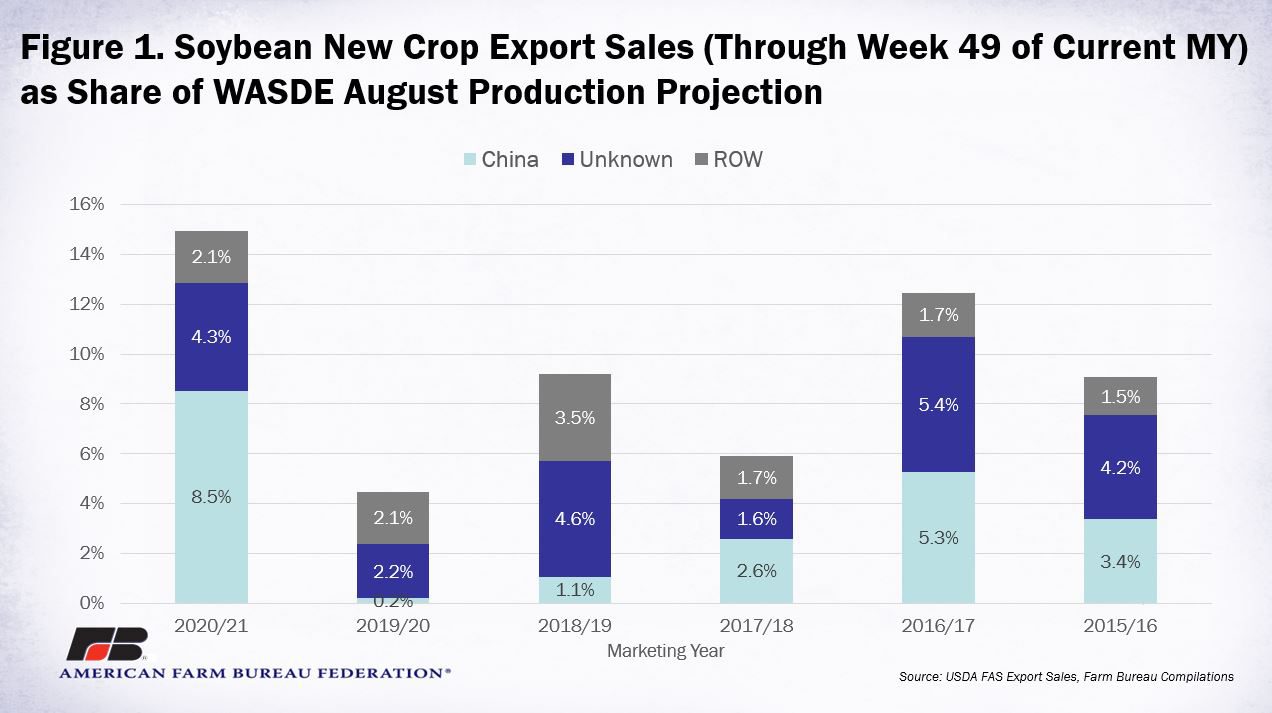

New-crop soybean sales are larger-than-average on a bushel-by-bushel basis, but how these sales relate to expected crop production also matters. With a monster crop of soybeans expected this fall, should the market still be excited? Using USDA’s August estimate of 2020/21 production, the sales of new-crop soybeans to China represent 8.5% of total production. The sales to destinations unknown and the rest of the world account for another 4.3% and 2.1% of estimated 2020/21 production, respectively. Combined, 14.9% of estimated 2020/21 production has been purchased for export, as of August 6. As seen in Figure 1, this is significantly higher than the 4.5% of the new-crop 2019/20 production that had been purchased through the same week in 2019. It’s also well above the 5.9% of the new-crop 2017/18 production that had been purchased through the same week in 2017.

Corn

As of August 6, new-crop corn sales to the world stand at 452 million bushels. New-crop sales to China are at 225.2 million bushels, plus 36.5 million bushels to locations unknown, which are often directed to China. The remaining 42% of 2020/21 orders, 190.2 million bushels, are destined for all other countries.

As with soybeans, these numbers have garnered a lot of attention because at this point in 2019, only 172.5 million bushels of 2019/20 new-crop sales had been recorded. Of those 172.5 million bushels, only 2.4 million bushels were sold to China and 25.9 million bushels were to destinations unknown. Even more importantly, at this point during the last “normal” trade year of 2017/18, 199.5 million bushels of 2017/18 new-crop sales had been recorded. Of those 199.5 million bushels, 0 bushels were sold to China, 36.9 million bushels were sold to destinations unknown and 162.6 million bushels were sold to the rest of the world.

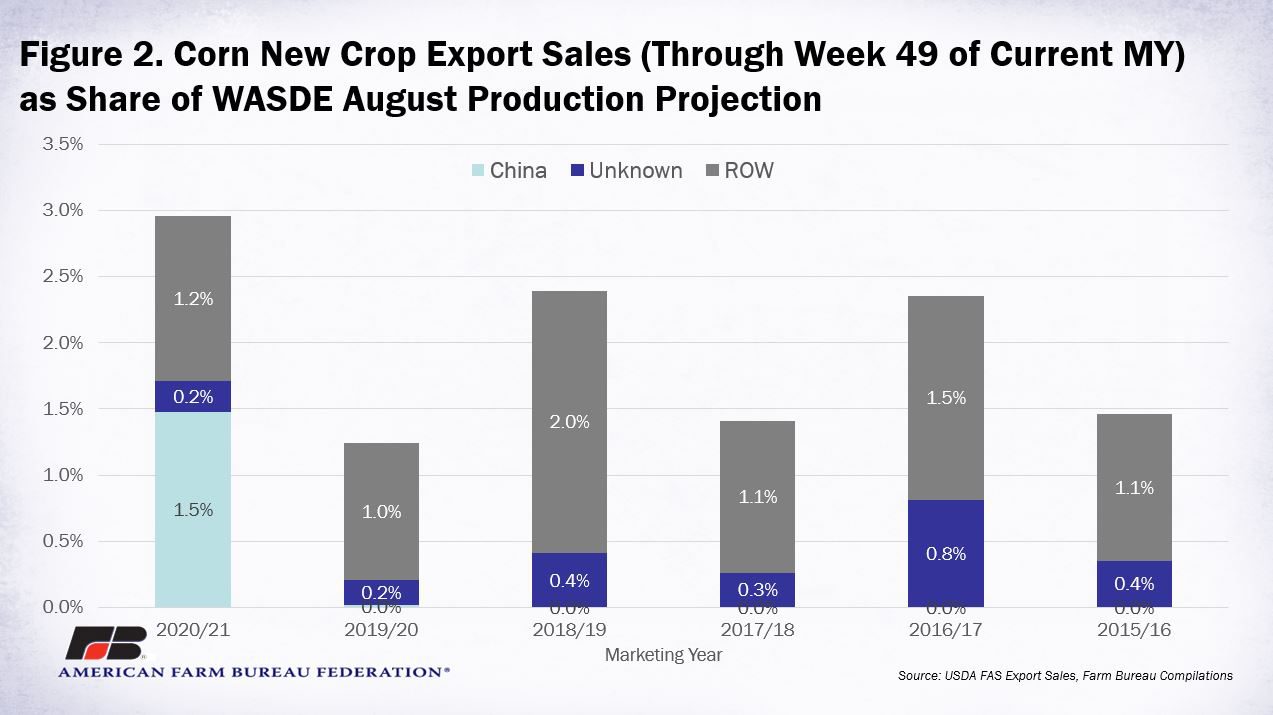

New-crop sales for 2020/21 are the highest recorded in the last six years. But relative to the huge corn crop expected this fall, new-crop sales are, frankly, rather small. Given USDA’s August estimate of 2020/21 production, sales of new-crop corn to China represent 1.5% of total production. The sales to destinations unknown and the rest of the world account for another 0.2% and 1.2% of estimated 2020/21 production, respectively. Combined, only 3% of estimated 2020/21 production has been purchased for export, as of August 6. However, as seen in Figure 2, sales of next marketing year corn have not been nearly as prevalent as they have been in soybeans. Over the previous five years, the average share of the new-crop corn export sales as a percent of the August WASDE crop production forecast was only 1.8%.

Sorghum

As of August 6, new-crop grain sorghum sales to the world stand at 67.8 million bushels. New-crop sales to China are at 38.1 million bushels, plus 28.2 million bushels to locations unknown, which are often directed to China. The remaining 2% of 2020/21 orders, 1.5million bushels, are destined for all other countries.

As with corn and soybeans, these numbers have garnered a lot of attention because at this point in 2019, zero bushels of 2019/20 new-crop sales had been recorded, to any destination. Even more importantly, new-crop sales for 2020/21 are closer to 2015/16, the second-highest export volume year in recent history. At this point in 2015, 110.2 million bushels of 2015/16 new-crop sales had been recorded. Of those 110.2 million bushels, 58 million bushels were sold to China and 52.2 million bushels were sold to destinations unknown.

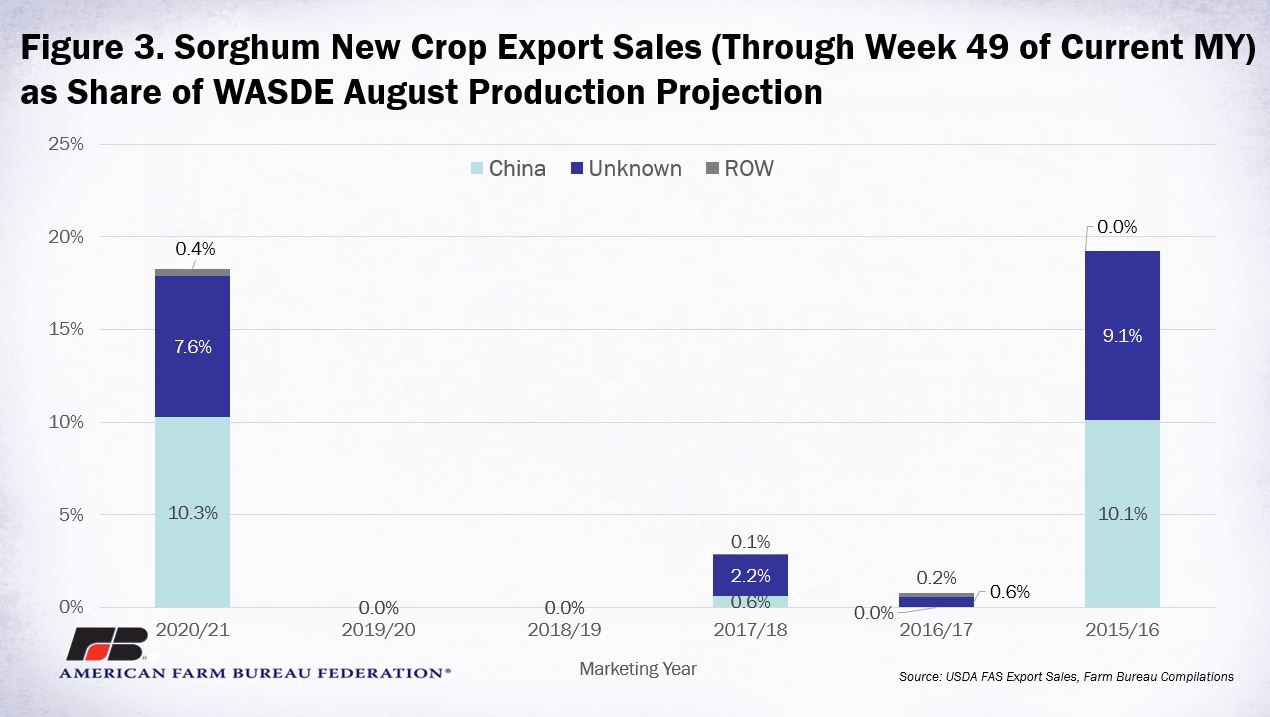

New-crop sorghum sales are larger-than-average on a bushel-by-bushel basis, but once again, how these sales relate to expected crop production matters greatly. Given USDA’s August estimate of 2020/21 production, the sales of new-crop sorghum to China represent 10.3% of total projected production. The sales to destinations unknown and the rest of the world account for another 7.6% and 0.4% of estimated 2020/21 production, respectively. Combined, 18.3% of estimated 2020/21 production has been purchased for export, as of sales through August 6. As shown in Figure 3, this is a marked increase from the last several years and very similar to the 19.2% level of 2015/16 “pre-sales.”

Cotton

As of August 6, new-crop cotton sales to the world stand at 6.3 million running bales. New-crop sales to China are 2.2 million running bales, plus there are 4.1 million running bales destined for all other countries.

New-crop sales of cotton to China are the largest outlier of the commodities discussed here because at this point in 2019 and 2020, zero new-crop sales had been made, to any country. Over the previous five years, 2017/18 was the largest year for new-crop sales of cotton -- to China and the rest of the world alike. At this point in 2017, 5.8 million running bales of 2017/18 new-crop sales had been recorded. Of those 5.8 million running bales, 1.3 million running bales were sold to China and 4.5 million running bales were sold to all other countries.

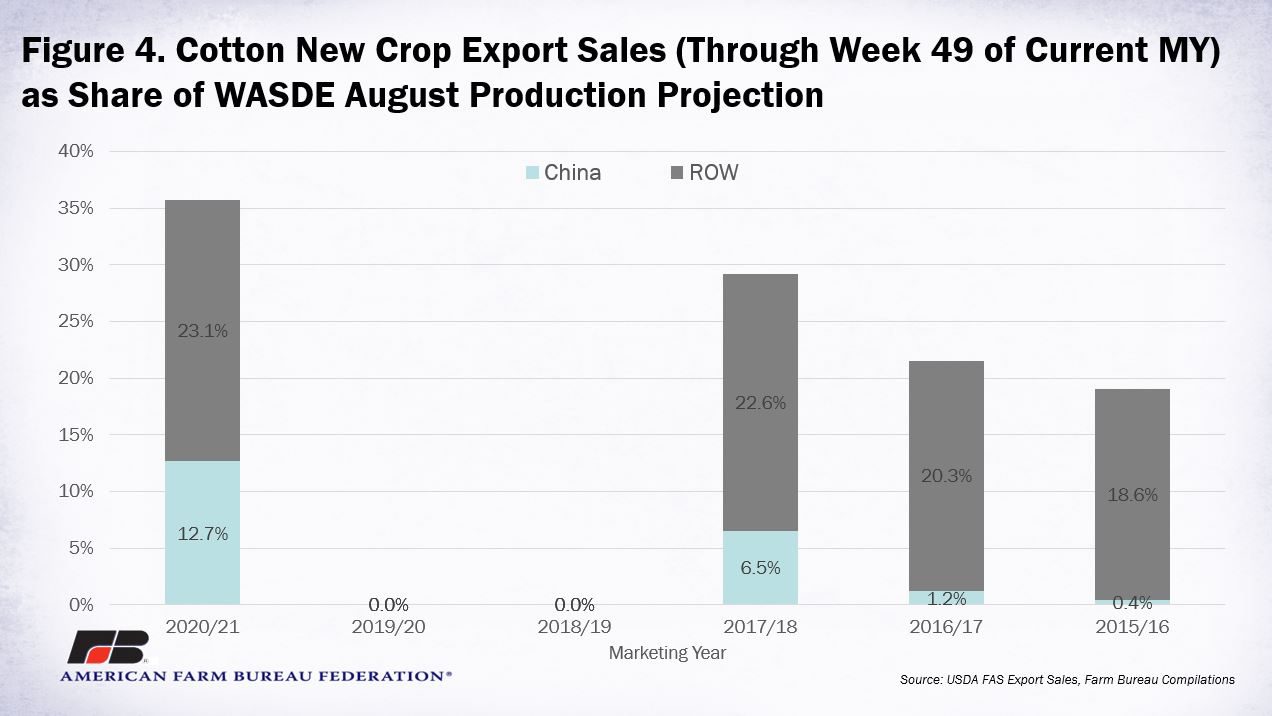

New-crop cotton sales are larger-than-average on a bale-by-bale basis, but once again, how these sales relate to expected crop production matters greatly. Sales of new-crop cotton to China represent 12.7% of USDA’s August estimate of 2020/21 production. The sales to the rest of the world account for another 23.1% of estimated 2020/21 production (running bales converted to 480-pound production bales). Combined, 35.8% of estimated 2020/21 production has been purchased for export, as of August 6. As shown in Figure 4, this is well above the 29.2% level of 2017/18 “pre-sales.”

Conclusion

As FAS points out in the August 2020 Grain Circular, “strong early season sales do not necessarily lead to greater total exports as numerous variables influence trade dynamics throughout the year. However, large early season sales do give a kickstart to exports in the coming year.” New-crop sales of soybeans, sorghum and cotton are significant and exceed the share of recent years’ projected production. New-crop sales of corn continue to be exciting, though they don’t represent a significant share of the large crop expected this fall. Time will tell if large new-crop sales commitments turn into actual exports that help China successfully fulfill its 2020 Phase 1 commitments.

Trending Topics

VIEW ALL