Negative PPDs to Offset Milk Price Rally

photo credit: Big Foot Media, Used with Permission

John Newton, Ph.D.

Former AFBF Economist

Approximately 80% of the milk in the U.S. is marketed and pooled on Federal Milk Marketing Orders. FMMOs ensure the orderly marketing of milk through end-product pricing formulas, minimum price enforcement and market-wide revenue sharing pools, e.g., How Milk Is Priced in Federal Milk Marketing Orders: A Primer.

Recent price volatility related to COVID-19, though not a new phenomenon, and a modification to milk pricing rules in the 2018 farm bill are now likely to result in negative or very low returns from FMMO revenue sharing pools, i.e., negative producer price differentials. These negative PPDs are expected to offset recent price increases in some dairy farmers' milk checks to the effect of $5 to $7 per hundredweight. Subsequently, these negative PPDs are likely to lead to large volumes of manufacturing milk being de-pooled from FMMO revenue sharing pools. Today’s article reviews negative PPDs and the current economic conditions that have resulted in low or negative producer price differentials and the de-pooling of milk.

What Causes Negative PPDs

A key component of FMMOs are the revenue sharing pools, which, at a high level are designed to redistribute the higher prices extracted from the beverage milk market to the manufacturing markets. This form of cross-subsidization is achieved by establishing a Class I milk value that is (generally) higher than the value of milk used to manufacture milk products such as cheese, butter, dry milk powders or dairy ingredients. In multiple component pricing orders, proceeds from the pool are based on the difference between the classified value of the milk and the component value of the milk – which is effectively the Class III price. When the component value of the milk exceeds the classified value of the milk, the proceeds from the pool are negative and result in a negative producer price differential.

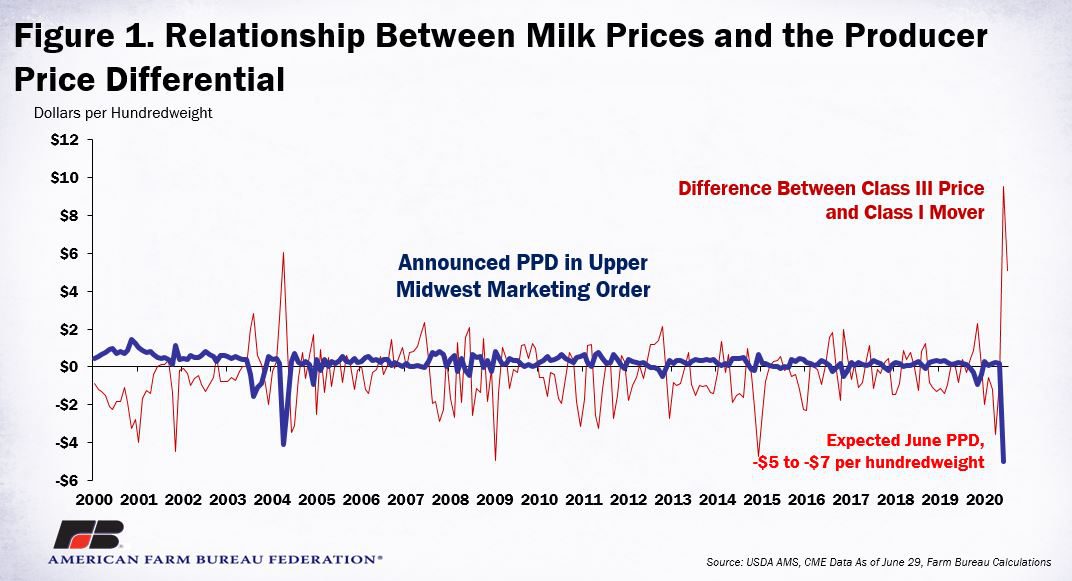

Historically, and prior to farm bill price changes and COVID-19, the difference between the Class III milk price and the Class I mover ranged from a low of -$4.96 per hundredweight to a high of $6.02 per hundredweight and averaged -47 cents. In general, the greater the difference (on the positive side) between the Class I mover and the Class III price, the greater the PPD.

As evidenced in Figure 1, the PPD and the difference between the Class I mover and Class III prices are highly and negatively correlated, with a correlation coefficient of -70%. The takeaway is that negative PPDs generally occur when the Class III price exceeds the Class I mover. Importantly, based on current futures prices for Class III milk, the difference between the Class III milk price and the Class I mover is likely to be record large in June and the third highest in July at $9.51 and $5.08 per hundredweight, respectively. Some dairy industry analysts indicate the June PPD could be in the range of -$5 and -$7 per hundredweight in some portions of the country. The July PPD is also expected to be negative due to the wide difference between the Class III and the Class I milk price. August Class I milk prices have yet to be announced, but some also anticipate a negative PPD in August too. As a result of these negative PPDs, milk prices paid to dairy farmers are likely to be well below the $20-per-hundredweight headlines.

What Caused Recent Negative PPDs?

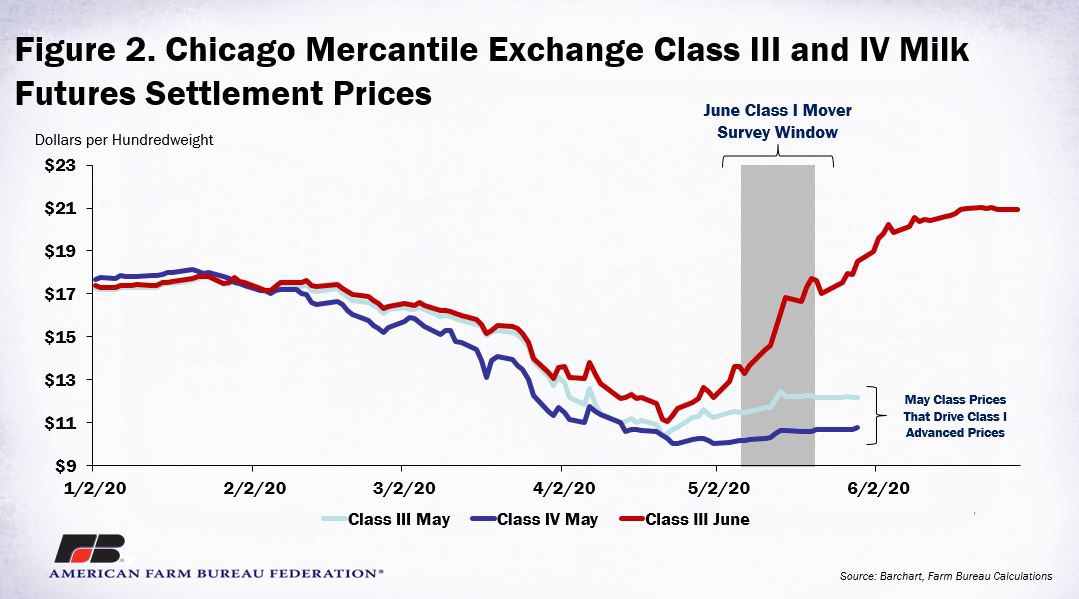

There are two predominant factors that led to the current negative PPD situation. First, COVID-19-related price volatility resulted in a sharp decline in milk prices beginning in March, followed by a rapid increase in spot cheese prices in early May. Given the two-week lag from the Chicago Mercantile Exchange spot market prices to USDA’s National Dairy Products Sales Report prices and the nature of advanced pricing (Class I prices are announced one month in advance), the June Class I milk price was established using late-April and early-May spot market prices for cheese, butter, dry whey and nonfat dry milk. This means that the market lows experienced in late April – six weeks ago – are now being used to price fluid milk in June. (For more information on the relationship between the CME and USDA’s NDPSR see How Milk Is Really Priced in the U.S.)

Consider that between mid-March, when social distancing and stay-at-home orders first went into place, and May 20, when the June Class I mover was announced, the Class III milk price declined by 21%, or $3.30 per hundredweight. Similarly, the Class IV milk price declined by 26%, or $3.80 per hundredweight. This contributed to a Class I price decline of 34%, or more than $6 per hundredweight, from March to June. The June Class I mover was announced at $11.42 per hundredweight – the lowest since the Great Recession.

While the June Class I milk price suffered a steep price decline, by mid-April, the June Class III milk price began to rally on the back of anticipated demand spurred by restaurant reopenings and the USDA food purchase and distribution program. Cheese prices more than doubled during this time, and as a result, between mid-April and June 29, the June Class III milk price increased by 89%, or nearly $9 per hundredweight. In fact, the June and July Class III milk prices are higher now than pre-COVID-19 levels.

The second reason PPDs are expected to be negative in June and July is the modification to the Class I milk price formula in the 2018 farm bill. The 2018 farm bill changed the Class I milk price from the higher of the Class III or Class IV advanced price to the average of the Class III and IV advanced skim milk price plus 74 cents per hundredweight, i.e., Proposed Changes to Fluid Milk Pricing. While the June milk price under this newly implemented pricing formula is above the higher-of pricing formula, the July Class I milk price, announced in June at $16.56 per hundredweight, is $2.57 per hundredweight below what would have been the higher-of July Class I price of $19.13 per hundredweight.

Currently, the July Class III milk price is $5.08 per hundredweight above the July Class I price. Had the higher-of formula still been in place, the Class III price would have been only $2.51 per hundredweight higher. Not only would this have reduced the magnitude of the negative PPD expected in July, but the Class I mover price would have been nearly $20 per hundredweight, and as much as $25.13 per hundredweight in portions of Florida.

De-Pooling Likely

For the most part, the only milk that is required to participate in the FMMO pool is milk delivered to a regulated Class I milk processor. All other milk, i.e., milk in manufacturing classes, has the option to participate in the pool. Given the current price relationships, there is an economic incentive to keep Class III milk out of the pool, i.e., de-pool the milk. By de-pooling the milk, handlers do not have to “share” the higher Class III proceeds with other producers in the pool and de-pooled milk is not subject to FMMO minimum price enforcement. As a direct result, for June and July – and potentially August -- the FMMO minimum prices and the mailbox milk price paid to farmers may not fully reflect the high Class III values currently in the market.

If the Class III handler is a dairy cooperative, the higher proceeds from the Class III market would belong to their producer-owners. Dairy cooperatives are not required to pay FMMO minimum prices so the additional Class III revenue could be used to offset anticipated or previously incurred operating, marketing or balancing costs, COVID-19-related revenue declines, used as retained equity or used to pay higher milk prices to their members.

Although de-pooling is highly likely, FMMOs do have provisions to discourage de-pooling. This is done by limiting the amount of milk that can be re-pooled in subsequent months, e.g., 125% of the previous month’s pooled volume. However, there is a provision that suggests that these re-pooling limitations can be waived administratively by the FMMO market administrator for “an existing handler with significantly changed milk supply conditions due to unusual circumstances” – meaning the disincentive to de-pool milk could be reduced administratively by relaxing these re-pooling rules. This would allow any milk that was de-pooled due to the current price relationships to quickly regain access to the pool when the price relationship is more favorable to the pooling handler, i.e., a positive PPD. Further clarification on this provision is being sought by AFBF staff from USDA.

Summary

COVID-19-related milk price volatility combined with recent modifications to the Class I milk price formula are contributing to a record-large spread between the Class III milk price and the Class I base price. The expectation is for large negative producer price differentials in both June and July alongside wide de-pooling of milk from FMMO revenue sharing pools. The combination of large negative PPDs, de-pooling of milk and the lack of minimum price enforcement on de-pooled milk could prevent many dairy farmers from realizing the price increases experienced in recent months.

Moreover, the price risk associated with the PPD can only be managed through the terms of a forward contract. Commercial exchanges cannot entirely cover PPD-related price risk. In addition, Dairy Revenue Protection and Livestock Gross Margin federal crop insurance policies are based on the announced USDA prices and do not include the PPD as it is not a publicly-traded instrument. It’s unclear at this point what the impact of large negative PPDs will be on the U.S. all-milk price and the Dairy Margin Coverage payments that will be based on that price. As a result, the large negative PPDs are unlikely to be fully offset by federal risk management programs. However, payments from the Coronavirus Food Assistance Program to dairy producers will help to offset a portion of this negative PPD – but it is based on first quarter 2020 production only.

Currently, there is no mechanism to prevent negative PPDs. FMMO price reform 20 years ago established end-product pricing formulas, and with multiple component pricing comes the possibility of negative PPDs. Historically, negative PPDs occur less than 15% of the time. Methods to prevent or mitigate negative PPDs -- such as eliminating the advanced pricing component, reconsidering the higher-of pricing formula (but with forward contracting of Class I milk), requiring mandatory pooling of milk in all Classes or consideration of decoupling the Class I milk from the price of manufactured milk products – could be explored. These considerations would require FMMO reform, which traditionally occurs through a formal hearing process, but as evidenced in the 2018 farm bill, it could also be done through congressional action.

Trending Topics

VIEW ALL