NAFTA Holds Mexico’s Door Open to U.S. Wheat; Could Open Cross-Border Trade with Canada

TOPICS

TradeSteve Mercer

Vice President of Communications

photo credit: AFBF Photo, Mike Tomko

Steve Mercer

Vice President of Communications

This article was guest written by Steve Mercer, Vice President of Communications, U.S. Wheat Associates, Inc.

Background

Wheat is the source of 20 percent of the world’s caloric intake and a dietary staple around the world. It is an excellent source of energy-providing complex carbohydrates, fiber, B vitamins and iron. The U.S. wheat store is always open because hard-working farm families produce enough wheat every year to fill American tables, while still supplying a leading share of world trade with six distinct wheat classes. Total U.S. wheat production is about 58 million metric tons, or about 2.13 billion bushels, per year. U.S. wheat is exported to more than 100 countries, average about 28 MMT, or just over 1 billion bushels, per year.

Farmers and commercial warehouses can maintain wheat in top condition until the market needs those supplies. USDA's Federal Grain Inspection Service independently certifies grade and quality specifications for buyers. And, by law, the U.S. government is banned from imposing grain embargos, except in the case of a national emergency. The U.S. wheat industry operates an open and transparent market. Both our domestic and export customers depend on the integrity of the supply chain, the quality of U.S. wheat and our unmatched reliability as a supplier.

U.S. Wheat Flows Freely to Mexico Under NAFTA

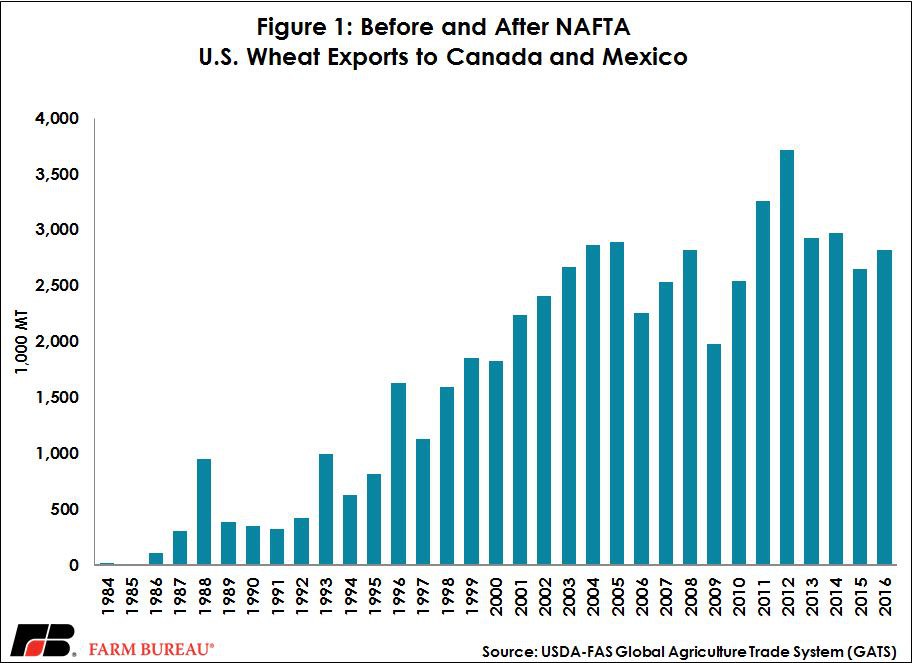

Before the North American Free Trade Agreement entered into force on Jan. 1, 1994, state intervention and import tariffs held U.S. wheat exports from the Mexican market. NAFTA ended both, and the newly opened market helped the Mexican flour milling and wheat foods industries to flourish, as did U.S. wheat imports (see Figure 1).

U.S. Wheat Associates (USW) represents the interests of U.S. wheat farmers in international markets. As it does with all U.S. wheat importing customers, USW focuses on helping Mexico’s sophisticated buyers, millers and food processors solve problems or increase their business opportunities utilizing specific U.S. wheat classes as ingredients in specific types of wheat foods. This effort, supported by wheat farmers and the partnership with the Market Access Program and Foreign Market Development program, has fostered a productive relationship that has endured for decades through many challenges.

Mexico Leads All U.S. Wheat Importers

Today, Mexico is one of the largest U.S. wheat buyers in the world, importing just under 3 MMT on average going back many years. Mexico’s U.S. wheat imports typically only fall just short of the volume Japan imports. In marketing year 2016/17 (June to May), however, Mexico’s flour millers imported more than 3.3 MMT of U.S. wheat, which is more than any other country. That volume is up 39 percent over marketing year 2015/16.

Breaking down their purchases by class, flour millers in Mexico generate strong demand for U.S. hard red winter wheat. The association representing Mexican flour millers says a rising number of industrial bakeries, along with traditional artisanal bakeries, account for about 70 percent of the country’s wheat consumption. That puts HRW producers in a good position to meet that demand. In 2015/16, Mexico was the leading HRW importer and buyers took advantage of favorable prices and the high quality of the 2016/17 HRW crop to import 2 MMT. That is 79 percent more HRW imports compared to 2015/16 and again Mexico led buyers of that class. Being closer to HRW production and having a highly functioning ability to import a large share of HRW directly via rail from the Plains states — duty free under NAFTA — is an advantage for Mexico’s buyers.

In addition, Mexico is home to Bimbo, the world’s largest baked goods company, and an increasing number of other cookie and cracker companies. The functional properties of U.S. soft red winter wheat is well-suited to the production of cookies, crackers and pastries, and serves as an excellent blending wheat. Millers supplying this growing market imported an average of 1.2 MMT of SRW between 2011/12 and 2015/16. With imports from the Gulf of more than 1.0 MMT of SRW in 2016/17, Mexico was again the year’s top buyer of SRW. USW and state wheat commissions from the Pacific Northwest are also helping demonstrate how millers and bakers can reduce input costs by using U.S. soft white as a blending wheat for specialty flour products.

U.S. wheat farmers and their customers in Mexico have successfully worked together in a mutually beneficial way under NAFTA and, for now, U.S. wheat continues to flow to our customers in Mexico. Total exports sales to Mexico returned more than $633 million to wheat farmers across the Plains and east of the Mississippi River in 2016/17.

The data for this map is based on Mexico’s market ranking for primary class of wheat grown in that state in the 2015/16 marketing year. Most wheat states’ farmers rely on Mexico as their number one market.

Source: Small Grains Summary and Export Sales, USDA

“I need foreign markets to stay in business and on my farm. There’s no market more important than Mexico,” said David Schemm, a wheat farmer from Sharon Springs, Kansas, and current president of the National Association of Wheat Growers. “We have the strength of NAFTA to thank for that.”

David Schemm, Sharon Springs, Kansas

Increasing Competition

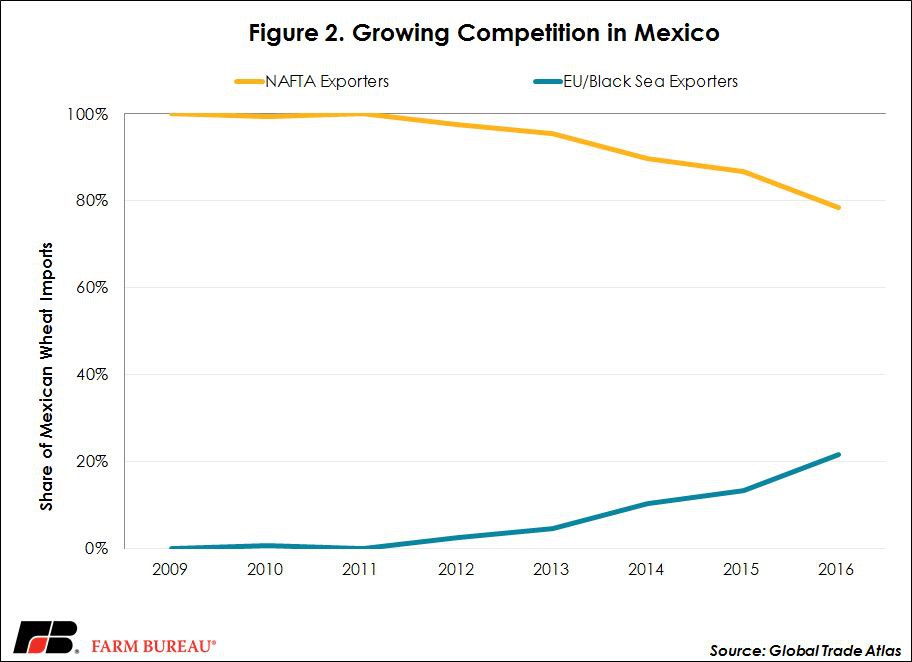

With U.S. wheat farmers facing financial hurdles, open access to the Mexican market is needed now more than ever. A prosperous Mexico is crucial for U.S. wheat farmers. But these savvy Mexican milling and baking sector customers have shown they can also adapt to other wheat supplies.

After a price shock in 2007/08, Mexico lifted its non-NAFTA wheat import tariff and wheat from other origins began to trickle in. From the first single boat carrying French wheat in 2010/11, non-NAFTA imports became a quarter of all Mexico’s wheat imports by 2015/16. The United States has a freight advantage over competitors, but if Mexico encourages purchasing from other origins because of political pressure or a new NAFTA agreement with impediments to U.S. wheat imports, it has plenty of supply alternatives that are ultimately harmful to U.S. wheat growers.

New Negotiations Can Build on NAFTA’s Success

Wheat trade with Mexico under NAFTA is already open and fair, but improvements to the agreement are possible. The three NAFTA parties agreed to some improvements as part of the Trans-Pacific Partnership agreement that could be incorporated into a NAFTA update. TPP would have updated rules on sanitary and phytosanitary measures, which have created major trade problems in some markets. U.S.-initiated trade restrictions often backfire on U.S. agricultural exports, so the wheat industry supports maintaining open markets for all parties.

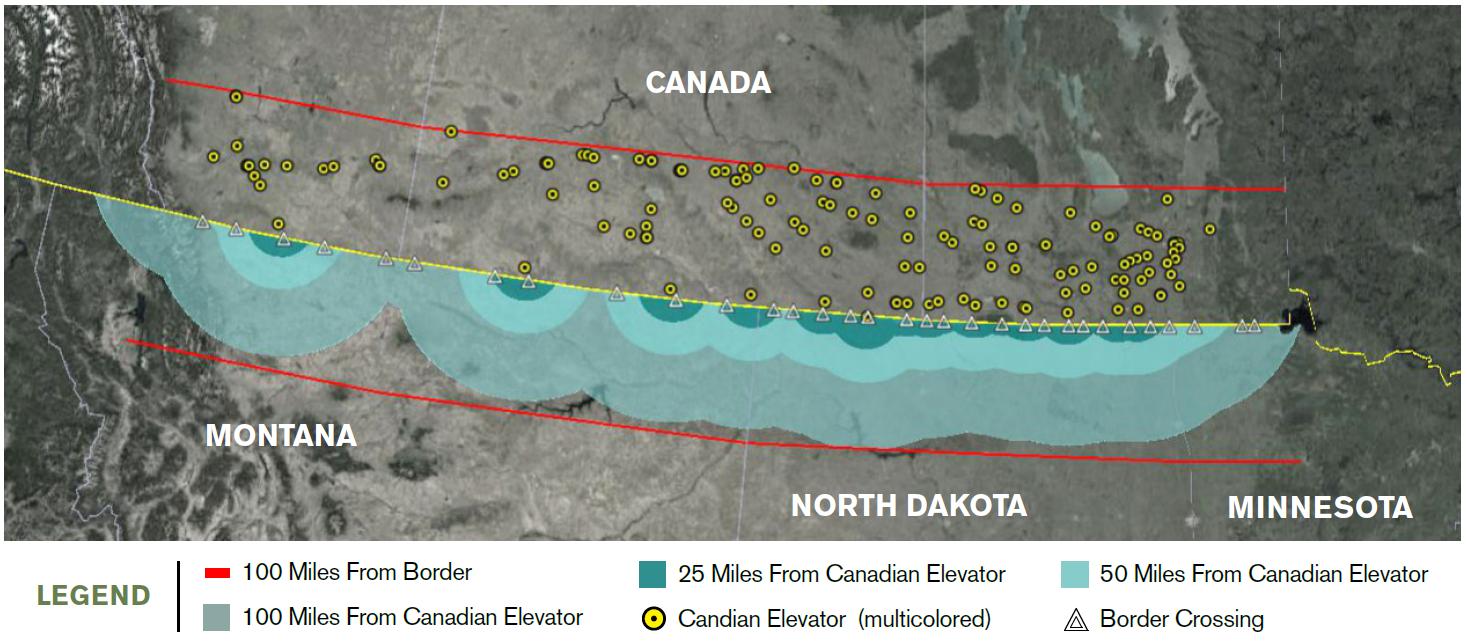

Renegotiations could also enable full reciprocity for cross-border wheat trade with Canada. Canada allows tariff-free access to wheat from the United States and certain other foreign sources. However, a Canadian law requires that imported wheat, even wheat of the highest quality, must be segregated from most Canadian wheat. It is automatically given the lowest grade established by regulation and therefore receives the lowest possible price.

By contrast, Canadian producers are free to market their wheat in the United States through normal marketing channels. When graded at a U.S. elevator, Canadian wheat is treated the same as U.S.-origin wheat and is assigned a grade based on objective quality criteria, meaning that unlike U.S. wheat going north, it retains its value when it crosses the border.

"U.S. farmers should be able to deliver their wheat to a Canadian elevator and not automatically receive the lowest grade because it was grown on our side of the border,” said Ben Conner, USW director of policy. “This concept is needed for U.S. wheat farmers who live near the Canadian border, is supported by the Western Canadian Wheat Growers Association, and is already Canada’s legal obligation under existing trade agreements."

The map above illustrates U.S. land that would be most affected by an open border with Canada for wheat via truck. The blue rings represent land south of the border that is within 25, 50 and 100 miles of a Canadian elevator.

Withdrawal is a Terrible Option

Put simply, a withdrawal from NAFTA or a different agreement with new trade barriers could be disastrous for the U.S. wheat industry. If the new agreement results in tariffs or non-tariff measures on U.S. wheat again, transaction costs would go up and U.S. competitiveness would go down. The fallout of losing a significant share of the Mexican market would be felt by thousands of American farmers while prices are at extreme lows. These farmers would be forced to sell into less valuable markets or produce less wheat if trade barriers are restored after major changes to NAFTA.

The U.S. wheat industry welcomes the opportunity for improving the framework for cross border wheat trade between the United States, Canada and Mexico, but would strongly oppose changes that might limit NAFTA’s current benefits for wheat farmers and their customers, particularly in the Mexican food processing industries.

Since NAFTA entered into force on Jan. 1, 1994, trade has boomed between the United States, Canada and Mexico. Specifically, NAFTA delivered a winning combination of free trade on a level playing field and a growing Mexican middle class with the income to demand better products, including food using imported wheat. Following years of market development work and duty free access, Mexico dramatically increased its U.S. wheat imports after NAFTA and imports in the current marketing year are up 40 percent, making Mexico our largest buyer.

“I cannot emphasize enough how important our Mexican customers are to U.S. wheat farmers,” said Jason Scott, a wheat farmer from Easton, Maryland, and USW Chairman. “There is nothing wrong with modernizing a 23-year-old agreement, but it must be done in a way that benefits the food and agriculture sectors in both countries.”

Trending Topics

VIEW ALL