Monster Crops Expected in 2020

TOPICS

USDAShelby Myers

Economist

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Shelby Myers

Economist

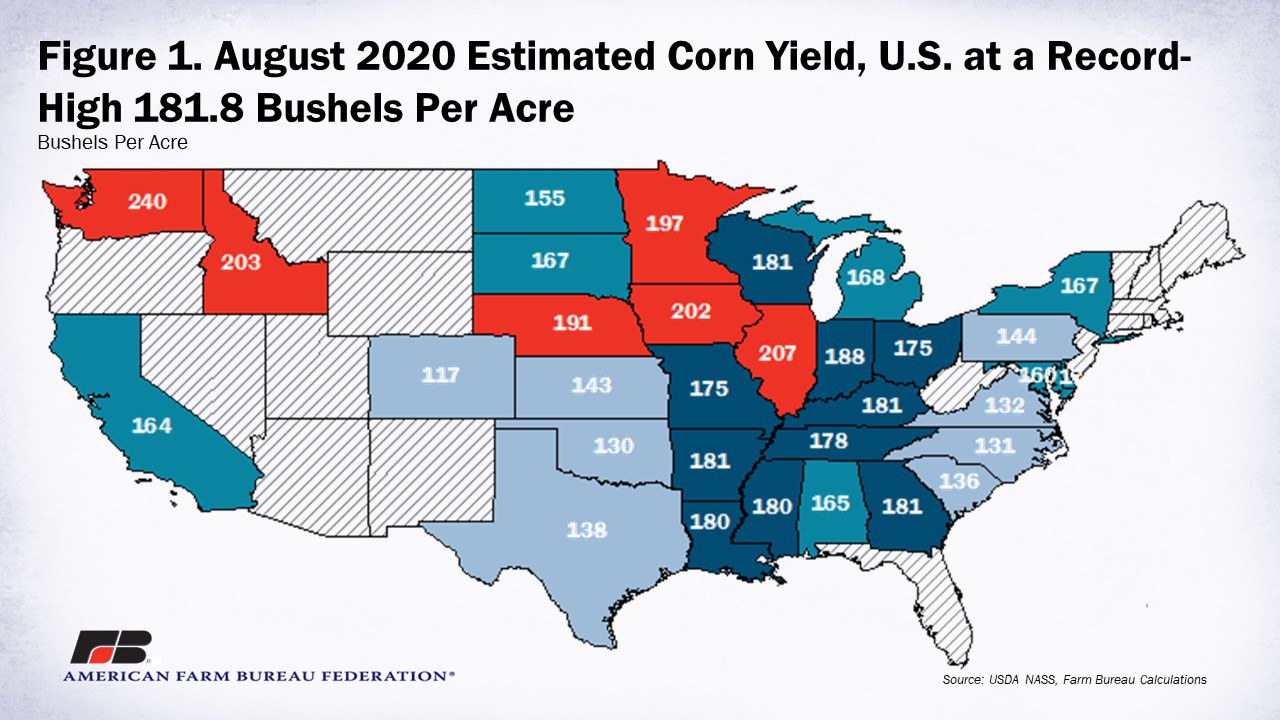

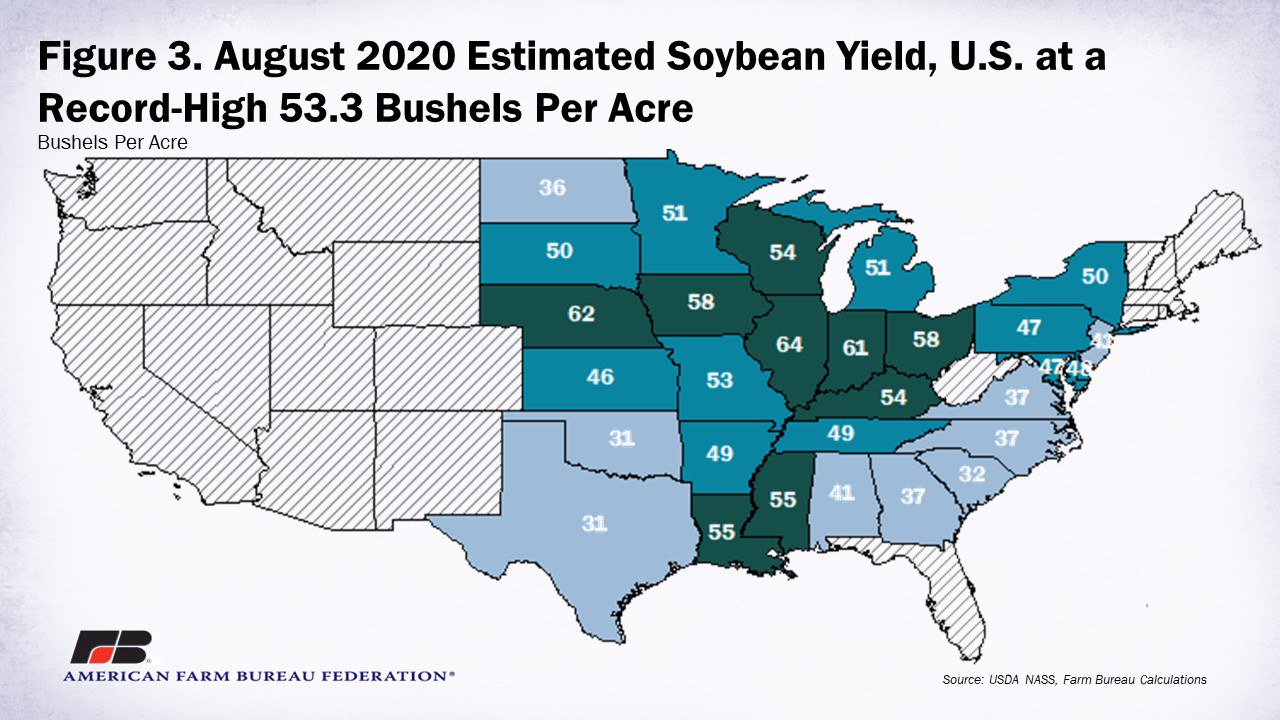

Corn, cotton and soybean yields are likely to hit record levels in 2020, according to USDA’s Crop Production Report, released on August 12. For the 2020 crop year, USDA estimates U.S. corn yield to be 181.8 bushels per acre, surpassing the previous record-setting estimate of 178.5 bushels per acre earlier this year. USDA has 2020 soybean yield estimates rising to 53.3 bushels per acre, up from 49.8 bushels per acre estimated earlier this year and surpassing the record yield of 52 bushels per acre set in 2016. USDA estimates 2020 cotton yields to reach 938 pounds per acre, up from 823 pounds per acre in 2019, surpassing the historic record of 904.7 pounds per acre. Prior to the report’s release, analysts pegged the average corn yield at 180.4 bushels per acre and the average soybean yield at 51.3 bushels per acre. Ahead of the report, cotton analysts estimated cotton production would decline to 17.19 million 480-pound bales.

With the record 181.8 bushels per acre, USDA estimates corn production to rise to a record 15.2 billion bushels, 12% higher than 2019. The August World Agricultural Supply and Demand Estimates (WASDE) report revealed a 20-million-bushel uptick in 2019/20 corn exports, which decreases 2020 beginning stocks accordingly. With corn imports remaining at 25 million bushels, the newest yield update moves 2020 corn supply estimates above 17.5 billion bushels, the largest supply of corn on record. With the adjustments made to supply and demand, USDA lowered the estimated average farm price to $3.10 per bushel, from $3.35 per bushel in July.

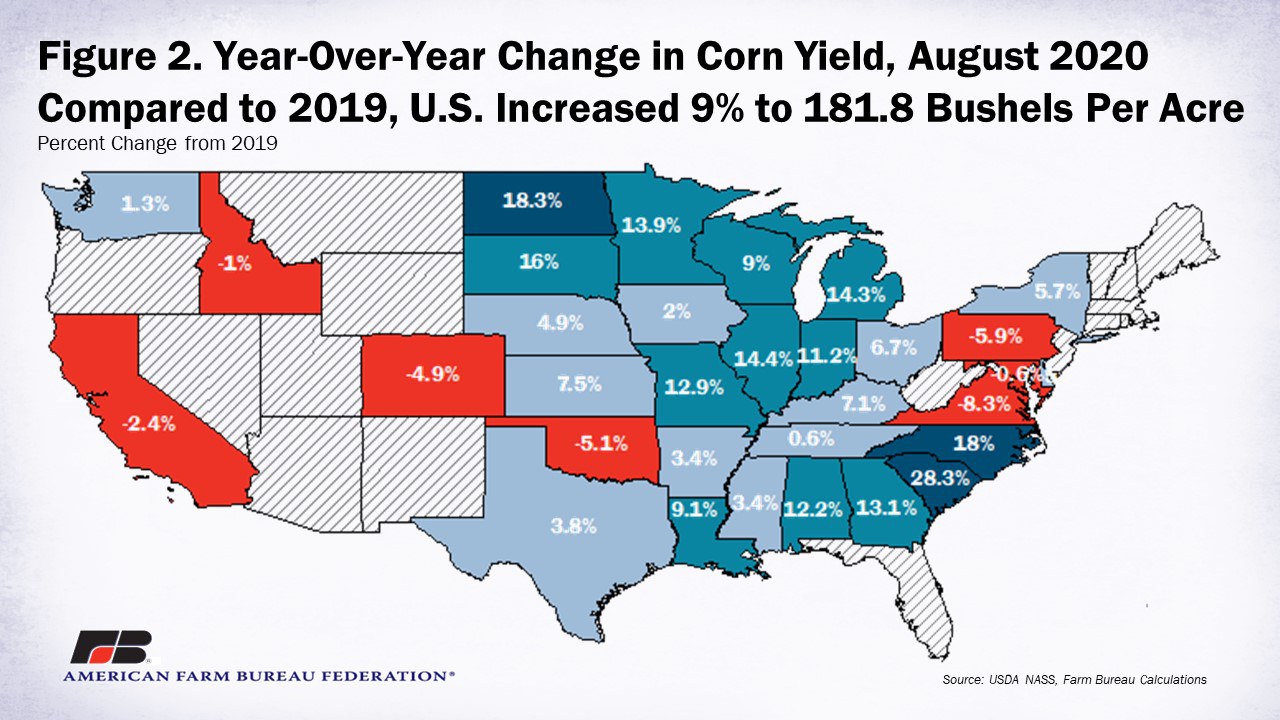

For non-irrigated corn, Illinois is estimated to produce yields of 207 bushels per acre, an increase of 14% compared to 2019. Iowa follows with an estimated 203 bushels per acre, up 2% from 2019. Minnesota is estimated to have the third-highest non-irrigated corn yield with 197 bushels per acre, up 14% from 2019. Washington leads irrigated corn yields with an estimated 240 bushels per acre, an increase of 1% compared to 2019. Idaho is just behind with an estimated 203 bushels per acre of corn, down 1% from 2019.

South Carolina is expected to have the largest year-over-year increase in corn yields from 2019 to 2020 at 136 bushels per acre, an increase of 28%. North Dakota and North Carolina follow, both with an 18% increase in corn yields for 2020 compared to 2019, at 155 bushels per acre 131 bushels per acre, respectively.

Figure 1 maps USDA’s August corn yield estimates and Figure 2 displays the year-over-year change from 2019.

The estimated record soybean yield of 53.3 bushels per acre pushes 2020 soybean production above 4.4 billion bushels, 24% above 2019 levels. The August WASDE increased soy crush use by 5 million bushels, reducing 2019 ending stocks accordingly. With the slight dip in 2020 beginning stocks and soybean imports holding constant at 15 million bushels, the 2020 soybean supply is on track for an estimated 5 billion bushels, which would be the largest soybean supply on record. These changes to soybean supply and demand resulted in USDA lowering the estimated average farm price from $8.50 in July to $8.35 in August.

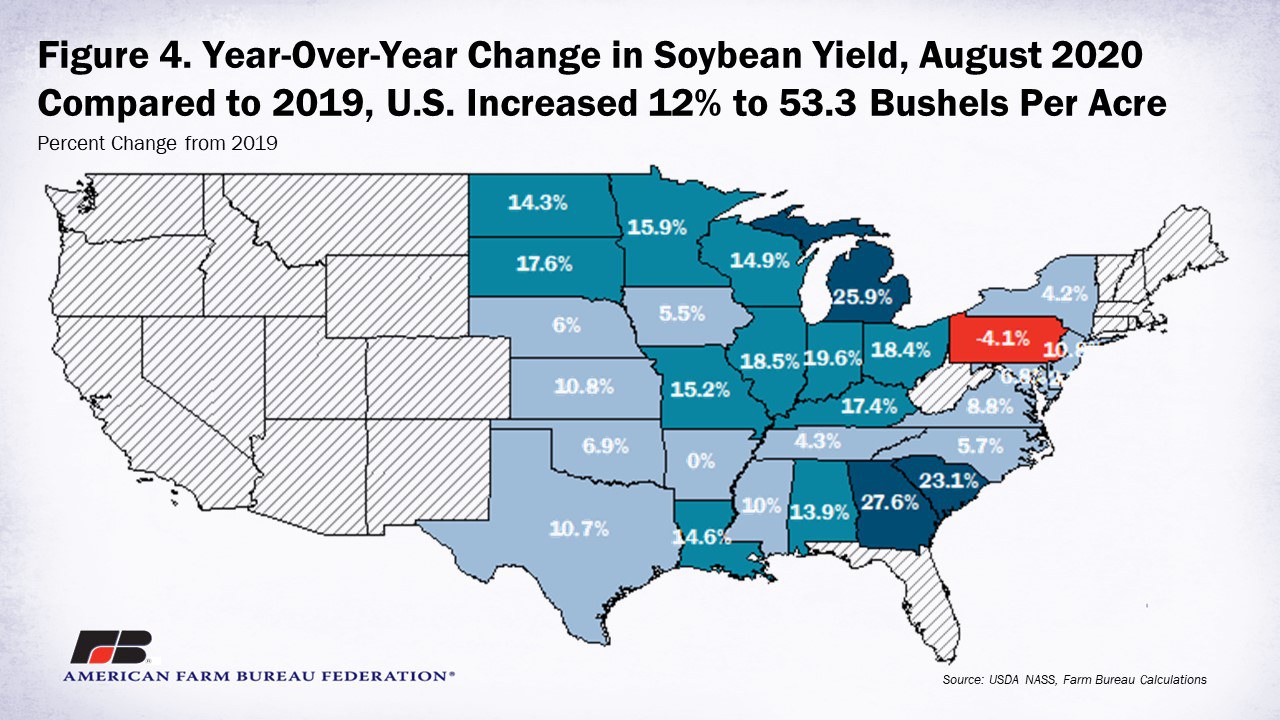

Illinois leads the country in estimated soybean yield with 64 bushels per acre, an increase of 19% compared to 2019. Nebraska is just behind with an estimated soybean yield of 62 bushels per acre, up 6% from 2019. Indiana has an estimated 61 bushels per acre of soybeans, which is up 20% from 2019. At 28%, Georgia has the largest year-over-year increase in estimated soybean yields, with soybean yields estimated to be 37 bushels per acre. Michigan follows with an increase of 26% from 2019 at 51 bushels per acre of soybeans. With an estimated 32 bushels per acre, South Carolina has a 23% increase in soybean yields from 2019.

Figure 3 maps USDA’s August soybean yield estimates and Figure 4 displays the year-over-year change from 2019.

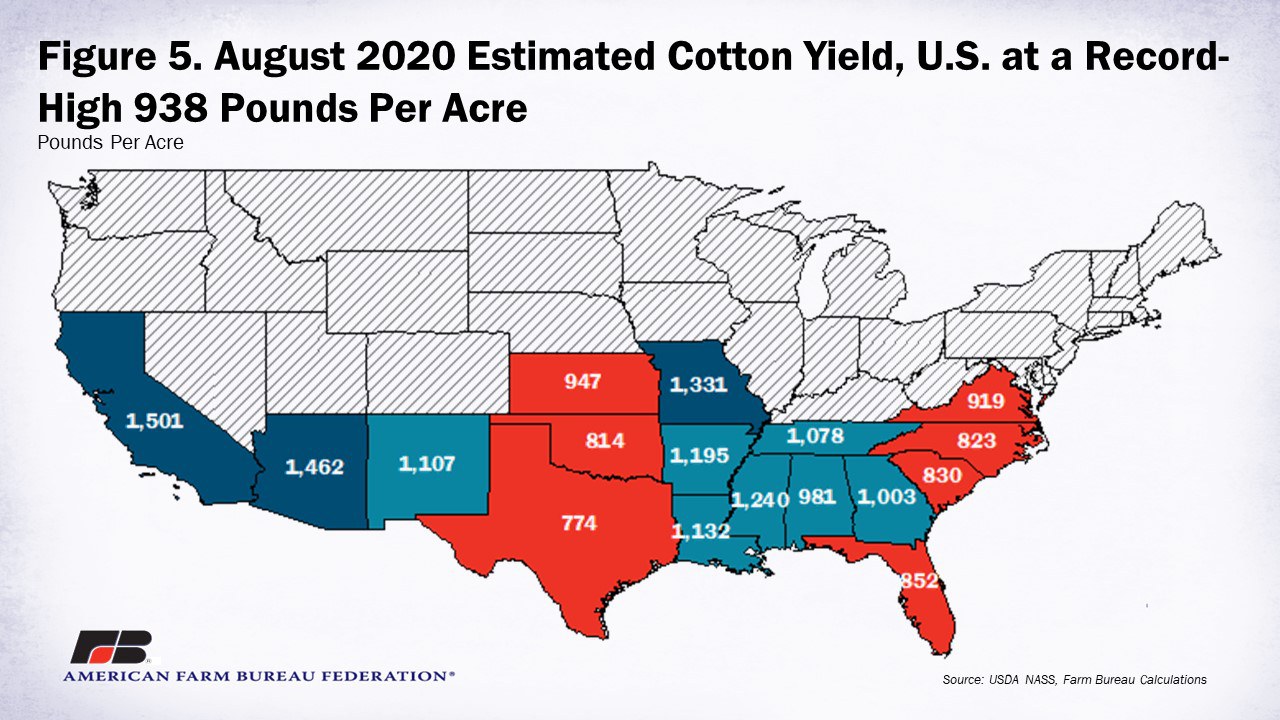

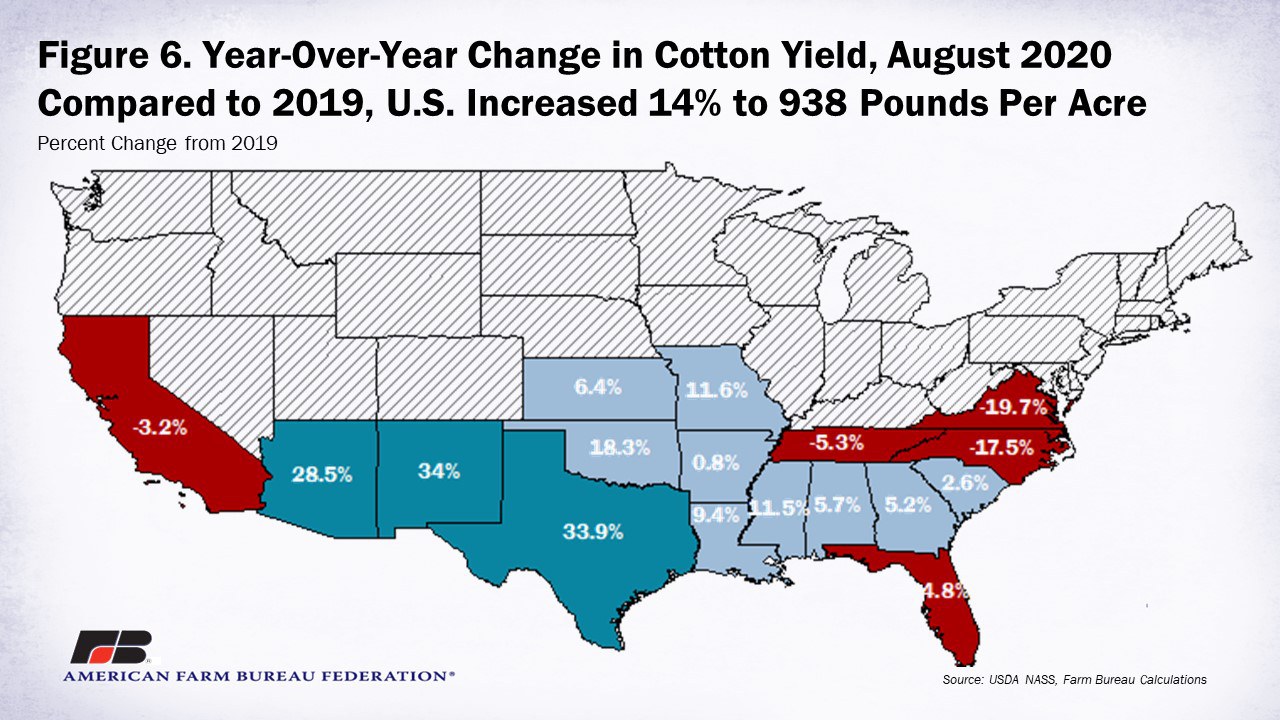

A record cotton yield estimate of 938 pounds per acre will push 2020 cotton production above 18 million 480-pound bales, just under production levels seen in 2018, but down 9% from 2019. The August WASDE lowered domestic use of cotton by 300,000 480-pound bales to a record low of 2.7 million 480-pound bales, pushing 2019 ending stocks up to 7.2 million 480-pound bales, despite the uptick in exports of 200,000 480-pound bales. Carrying the stocks into 2020 with rising yields, the cotton supply is estimated to be 25.28 million 480-pound bales, the largest cotton supply since 2007. With demand holding steady, USDA kept the average farm price of cotton from July to August at 59 cents per pound.

California is estimated to have the largest cotton yield at 1,501 pounds per acre, which is down 3% from 2019. Arizona is next with 1,462 pounds per acre of cotton estimated, up 28% in 2020 compared to 2019. Missouri rounds out the top three states with 1,331 pounds per acre estimated in cotton yield, up 12% from 2019 to 2020. At 34%, New Mexico and Texas have the largest increase in year-over-year yields at 1,107 pounds per acre and 774 pounds per acre, respectively. Arizona’s increase of 28% is the next largest, followed by Oklahoma, where cotton yields are estimated at 814 pounds per acre, an increase of 18% from 2019 to 2020.

Figure 5 maps USDA’s August cotton yield estimates and Figure 6 displays the year-over-year change from 2019.

Summary

In its survey-based August Crop Production Report, USDA estimates corn yield to be 181.8 bushels per acre, up 9% from prior-year levels, and soybean yield to be 53.3 bushels per acre, up 12% from 2019. For cotton, USDA estimates yields to be 938 pounds per acre, an increase of 14% from last year. Yield estimates will be updated in the September report using the objective yield plots for production estimates for the first time this year. Yield updates are most likely coming, especially after the wicked windstorm that swept through much of the Midwestern Corn Belt. Crop damage is still being assessed as cleanup is underway. Regardless, record production levels with uncertainty in demand and export markets are likely to move all three commodity prices even lower.

Trending Topics

VIEW ALL