March Cattle on Feed Report Shows Inventory Up, Decline in Placements and Marketings

TOPICS

USDAMichael Nepveux

Economist

photo credit: AFBFA

Michael Nepveux

Economist

USDA’s latest Cattle on Feed report, released March 19, shows the number of animals on feed as of March 1 is 1.6% above year-ago levels. The report provides monthly estimates of the number of cattle being fed for slaughter. For the report, USDA surveys feedlots of 1,000 head or more, as this represents 85% of all fed cattle. Cattle feeders provide data on inventory, placements, marketings and other disappearance.

March Cattle on Feed Report

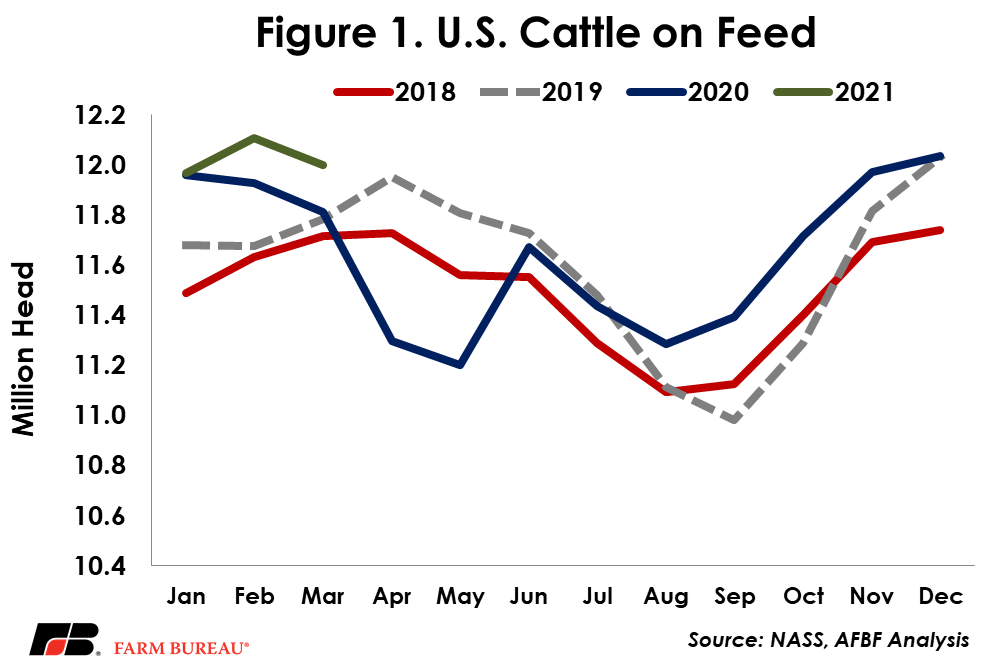

This report showed a total inventory of 12 million head in the United States on March 1, up from the same time in 2020 but down from last month. This 1.6% increase is in line with analysts’ expectations of feedlot inventories increasing 1.5% from last year. After strong impacts from the pandemic last spring, the number of cattle on feed has largely followed seasonal patterns, but since August has mostly been running above recent years’ levels, with this Cattle on Feed report continuing that pattern, even with a month-over-month decline. This report marks the second highest March inventory since the series began in 1996.

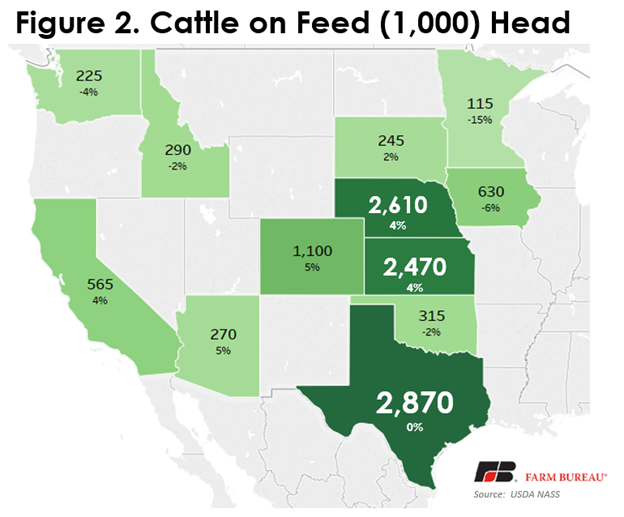

As usual, Texas, Kansas and Nebraska led the way in total fed cattle numbers, accounting for over 8 million head, or approximately 67% of the total on-feed inventory in the country. Texas mostly held steady relative to 2020. Kansas and Nebraska posted moderate gains, adding 4% each.

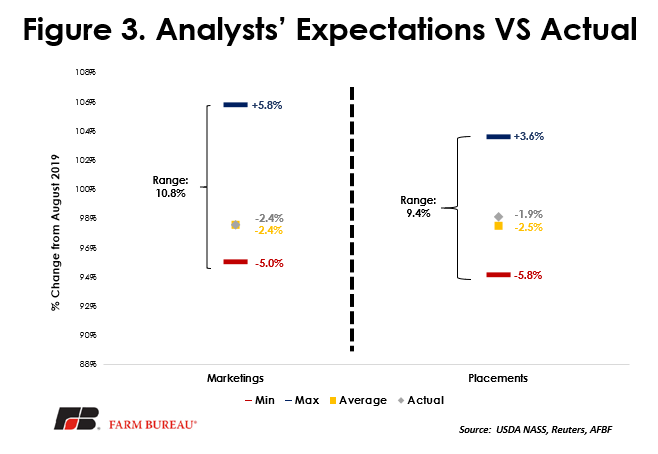

While total inventories are an important component of the report, other key factors include placements (new animals being placed on feed) and marketings (animals being taken off feed and sold for slaughter). Coming in at 1.9% under 2020, placements in February came in above the average analyst expectation of a 2.5% decrease. The relatively wide range of forecasts for placements – over 9% -- highlights the uncertainty that can exist in forecasting this specific variable. Specifically, the February winter storm that stretched down throughout the country’s cattle feeding region and crippled much of Texas, a key feeding and cow/calf state, made predicting this month’s numbers particularly difficult. The weather hampered producers’ ability to move animals, and we saw feeder and stocker sales decline. Slower sales would negatively impact both placement and marketing numbers. Cattle imports were down in February as well, which also could impact placements, adding to the uncertainty. In February, placements clocked in at 1.684 million head, 333,000 head below a year ago and below January’s increase in placements. Lower placements may continue as long as the cost of feeding remains elevated, and feeders try to keep animals off feed to an extent. In addition to the impacts corn and soybean prices are having on cost of feed, elevated wheat prices could lead to impacts on decisions to graze on wheat pastures.

The winter storm that impacted the movement of cattle impacted slaughter levels, which was reflected in lower weekday slaughter levels during the storm. These slaughter impacts showed up in lower cattle marketings throughout February. Marketings came in at 1.732 million head, or 2.4% below last year. This is right in line with the average analyst expectation of a 2.4% decline from year-ago levels. Like placements, marketings also had a wide range of expectations in this report, with analysts’ predictions ranging from a decline of 5% to an increase of 6%.

Summary

This March Cattle on Feed report is considered relatively neutral to bullish. While the decline in placements is bullish for future supplies of fed cattle, the industry mostly anticipated this decline, though they predicted a larger decline than occurred. The overall supply of cattle on feed is up moderately over last year, and the number of animals marketed throughout February is below a year ago, but right in line with expectations.

Looking forward, the questions of COVID-19 cases and vaccine distribution remain key. Most of the U.S. is looking at warmer weather moving forward, which means giving many restaurants a lifeline with the revitalization of outdoor dining. Depending on when the warmer weather hits, many consumers will be looking to fire up their grills and we can expect a seasonal bump in demand at the retail level as well.

Trending Topics

VIEW ALL