Majority of Crop Acres Covered by Crop Insurance

TOPICS

Wheat

photo credit: Mark Stebnicki, North Carolina Farm Bureau

John Newton, Ph.D.

Former AFBF Economist

Designed to protect against a drop in crop revenue or yields due to price declines or crop losses, crop insurance policies are one of the most important risk management tools available to farmers. While these federal crop insurance programs are considered voluntary, for many farmers and ranchers seeking farm operating loans or lines of credit, crop insurance is likely required by most creditors as a condition of the financial risk associated with these lines of credit.

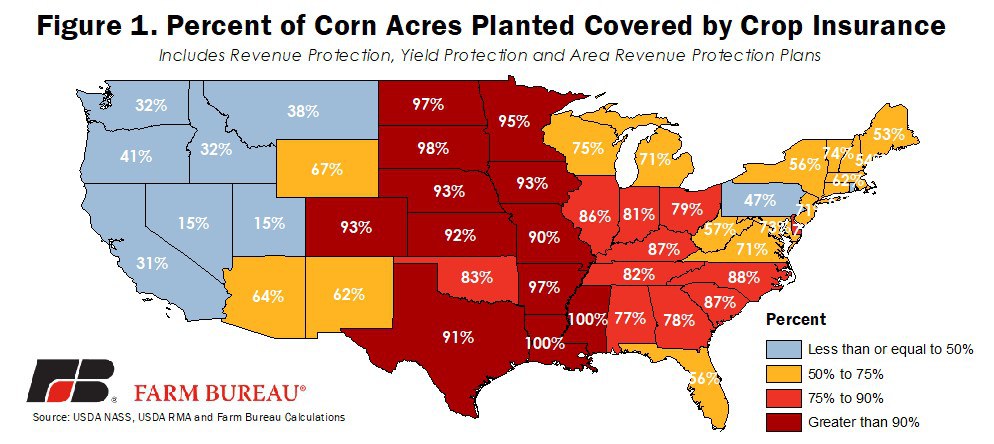

Corn Crop Insurance in 2018

During 2018, crop insurance was purchased on 77.9 million acres of corn across the U.S., representing 87% of all corn acreage based on USDA’s 2018 Acreage survey. This included 70.6 million acres covered under traditional revenue protection policies, 5.7 million acres covered by yield protection and 1.5 million acres covered under an area-based plan or a plan with the harvest price exclusion.

Crop insurance coverage for corn was the highest in Iowa at 12.2 million acres, followed by Illinois at 9.5 million acres. In the top 10 corn-producing states (in terms of the planted area), crop insurance was purchased on 61.4 million of the 65.2 million acres planted, representing crop insurance coverage for 94% of corn acreage. Many states had more than 90% of their corn acreage covered by crop insurance, and 39 out of 48 corn-producing states had more than 50% of their acreage covered by crop insurance, Figure 1. Areas with lower levels of corn covered under crop insurance reflect corn planted for silage purposes. For example, a majority of the corn grown in California in 2018 was grown for silage as opposed to grain and thus had a lower percentage of crop insurance coverage.

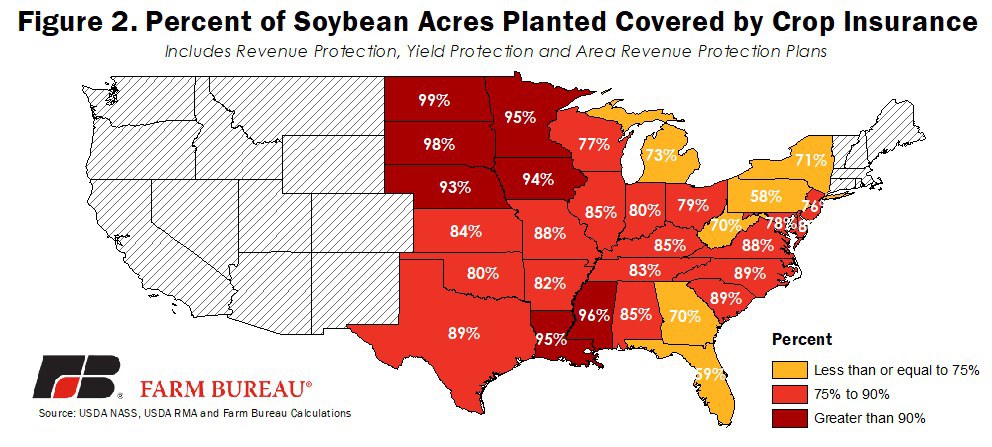

Soybean Crop Insurance in 2018

Crop insurance for soybeans was purchased on 78.7 million acres across the U.S. during 2018, representing 88% of all soybean acres planted. Coverage was the highest in Iowa at 9.3 million acres, followed by Illinois at 9.2 million acres. In the top 10 soybean-producing states (in terms of the planted area) crop insurance was purchased on 61.4 million of the 68.4 million acres planted, representing crop insurance coverage for 90% of soybean acreage. Coverage was the highest in the Dakotas, where more than 98% of the soybean acreage was covered by crop insurance, and more than half of the soybean-producing states had crop insurance coverage greater than or equal to 80% of the planted area, Figure 2.

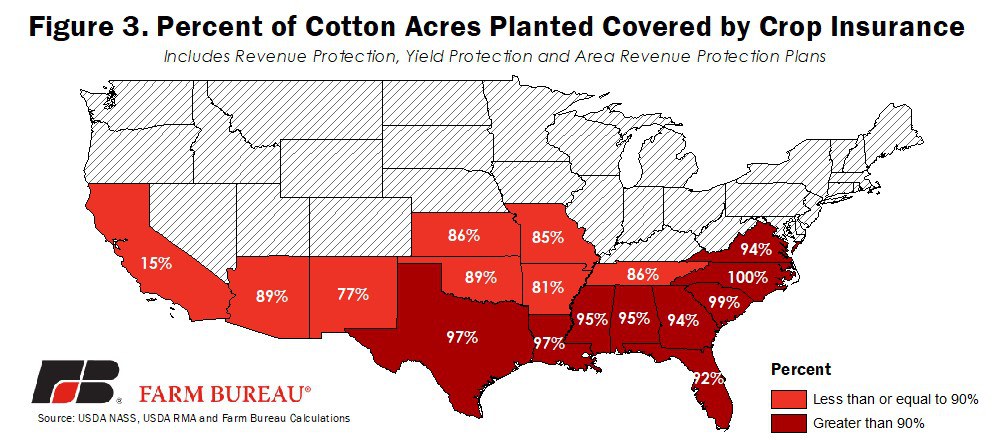

Cotton Crop Insurance in 2018

During 2018, U.S. growers planted 14.1 million acres of cotton across the southern U.S. Coverage under crop insurance totaled a combined 13.1 million acres across the revenue protection, yield protection and area-based policies, representing 93% of all cotton acreage. Crop insurance coverage for cotton was the highest in Texas at 7.5 million acres, followed by Georgia at 1.3 million acres. In all but two cotton-producing states more than 80% of the planted area was covered by crop insurance, Figure 3.

Wheat Crop Insurance in 2018

In 2018 U.S. growers planted 32.7 million acres of winter wheat and 13.2 million acres of spring wheat. Total wheat acreage in 2018 was 47.8 million acres and was the second lowest wheat acreage on record in the U.S. Wheat-based crop insurance policies were purchased on 38.7 million acres in 2018, representing 81% of all wheat planted area. Crop insurance coverage was the highest in North Dakota at 7.5 million acres followed by Kansas at 6.8 million acres. In the top 10 wheat-producing states (in terms of the planted area) crop insurance was purchased on 33.1 million of the 38.9 million acres planted, representing crop insurance coverage for 85% of wheat acreage. The percent of the planted area covered by crop insurance was the highest in North Dakota, followed by South Dakota, Minnesota and Washington, Figure 4.

Summary

USDA’s Economic Research Service estimates that the total cost of producing corn in 2017 was $664 dollar per acre with operating costs of $329 per acre. USDA’s most recent Census of Agriculture revealed the average size of a corn operation in 2017 at 278 harvested acres per farm. Combined, the average farm size and average operating costs point toward an average operating cost above $90,000. For a 2,000-acre operation, the operating costs exceed $658,000. With so much financial and credit risk associated with crop production, it is likely that many lenders require growers to purchase federal crop insurance.

For the four major crops in 2018 (corn, soybeans, wheat and cotton), growers planted 240 million acres. Crop insurance coverage for these same four crops in 2018 totaled 208 million acres, indicating that 87% of planted acres had crop insurance coverage. While there may be limited double-counting due to prevented planting, the high level of enrollment is a testament to the importance of crop insurance as a risk management tool to U.S. farmers, their creditors and the rural economies that depend on agriculture.

Trending Topics

VIEW ALL