Legislative Changes Could Bring Flexibility to PPP

photo credit: Kansas Farm Bureau, used with permission.

Veronica Nigh

Former AFBF Economist

The U.S. House of Representatives overwhelmingly passed the Paycheck Protection Program Flexibility Act of 2020 (H.R. 7010), which amended several provisions in the Paycheck Protection Program. Many of the changes in the House bill provide flexibility in length of time for repayment and rehiring as well as how the loan proceeds must be spent. The Senate is considering its own version of the legislation along with the House version this week.

While farmers and ranchers seeking loans during the COVID-19 emergency welcome the flexibility the House and Senate bills would provide, outstanding questions remain related to rental income, H-2A workers and the availability of additional funds for those shut out of the program.

Proposed Changes

The Payroll Threshold

Under the current regulation, a PPP loan recipient is required to spend at least 75% of the loan proceeds on payroll costs to qualify for full loan forgiveness. The remainder of the loan proceeds can be used on certain employee benefits relating to health care, interest on mortgage obligations, rent, utilities and interest on any other existing debt obligations. If a recipient spends less than 75% of the loan proceeds on payroll, the difference between the amount actually spent on payroll and the 75% threshold is not forgiven.

For example, assume a farmer receives a $200,000 PPP loan and spends $150,000 on payroll costs and the remainder on other eligible costs. In this case, because 75% of the loan was used on payroll costs, after applying for forgiveness, the farmer’s loan would be reduced to $0. The proposed changes to the PPP would not impact this farmer.

Now let’s assume the farmer spends $100,000, or 50% of the loan, on payroll costs. Under the current regulation, which is unchanged in the Senate bill, the farmer’s loan would be reduced by $150,000 with a remaining loan balance of $50,000 ($200,000 x 75% - $100,000). Under the House bill, the farmer’s loan would be reduced by $180,000, and the farmer would be left with a loan balance of $20,000 ($200,000 x 60% - $100,000). For this farmer, the difference between a 75% and 60% payroll cost threshold is $30,000.

Time Period for Loan Forgiveness

Both the Senate and House bills would increase the minimum loan term from the current two years to five years, while maintaining the 1% interest rate. Additionally, both bills would permit businesses seeking loan forgiveness to defer payroll taxes without penalty for two years.

Another proposed change in both bills is an extension of the time period for businesses to spend the loan proceeds from the current eight-week period to 24 weeks in the House bill and 16 weeks in the Senate version. Current regulation stipulates that to get forgiveness for a PPP loan, the funds must be spent within eight weeks of receipt on qualifying expenses.

Employee Rehire

To address the uncertainty that continues to impact small businesses as the country gradually reopens, both the Senate and House bills would extend the rehiring window from June 30, 2020, to Dec. 31, 2020. This would give businesses an additional six months to rehire employees or restore payroll levels without incurring any reduction in the forgiven amount.

In addition, both measures provide an exemption in eligibility for loan forgiveness for employers unable to rehire an employee or a replacement if the business is unable to return to the same level due to compliance with social distancing guidelines or an inability to hire similarly qualified employees.

Outstanding Questions

While the House and Senate bills improve the PPP, the measures are missing provisions that would make the program more helpful to farmers and ranchers.

At the end of April, the IRS ruled that expenses incurred by businesses that are paid with PPP loan proceeds are non-deductible and thus subject to taxation. While many believed the intent of Congress was that loan forgiveness would be non-taxable, the legislation did not explicitly state this. Without a legislative change, the loan amount and interest on the loan assistance will be taxed as income.

Since PPP details were first made available, many farmers have asked for a fuller definition of “rent.” While rent is understood as it relates to a storefront, farmers rent a wide variety of business-related items including equipment, land and buildings. Clarification that rent encompasses all these business-related items would be helpful.

As detailed in the Market Intel, Farmers’ Losses a Barrier to PPP Participation, a large share of self-employed farmers report a loss on their tax return. In fact, according to the most recently available data, in 2017, 37% of farmers reported net losses from farming on their Schedule F. This is important because farm participation in the PPP is based solely on net farm profits (or losses), line 34, form Schedule F, from 2019. Reliance on Schedule F alone has made many farmers ineligible for PPP benefits. If in addition to profits shown on Schedule F, if income from farm equipment trades, breeding livestock, all rental income and in-kind wages such as commodity wages were included in the calculation of income, more farmers would be eligible for PPP loans.

Finally, certainty that all H-2A workers in the United States qualify as an employee upon satisfaction of a “principal place of residence” test that includes living in the U.S. for more than half a year would be exceedingly helpful. Wages paid to H-2A workers are a considerable expense for non-mechanized commodities and excluding them is counter to helping businesses with high payroll expenses.

Summary

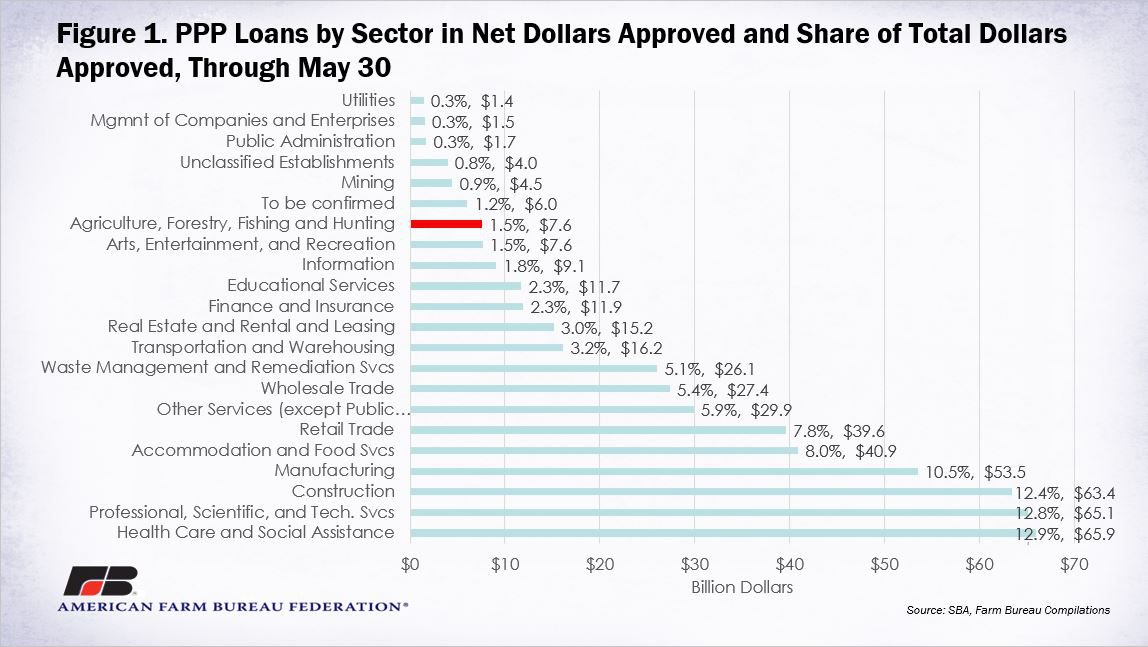

Through May 30, 2020, $510.2 billion in PPP loans have been approved. This loan value has been spread across 4,475,599 loans. Unfortunately, only $7.6 billion of those funds, or 1.5%, have been given to agriculture, forestry, fishing and hunting operations. Changes proposed in the House and Senate bills could make the program more attractive to farmers and ranchers.

Trending Topics

VIEW ALL