Just Ahead of Thanksgiving, Record Turkey and Egg Prices Indicate Strain on Poultry Sector

TOPICS

Turkey

photo credit: Getty Images

Bernt Nelson

Economist

Fall has arrived and Thanksgiving is just around the corner. As many begin planning for the holiday meal, one of the questions being asked is, “Will there be enough turkeys to go around for Thanksgiving?” There are many factors fueling this question. High prices, highly pathogenic avian influenza (HPAI) and inflation have garnered attention from consumers and media nationwide. This Market Intel will address the current issues influencing the turkey industry and what consumers can expect as we edge closer to Thanksgiving and beyond.

HPAI

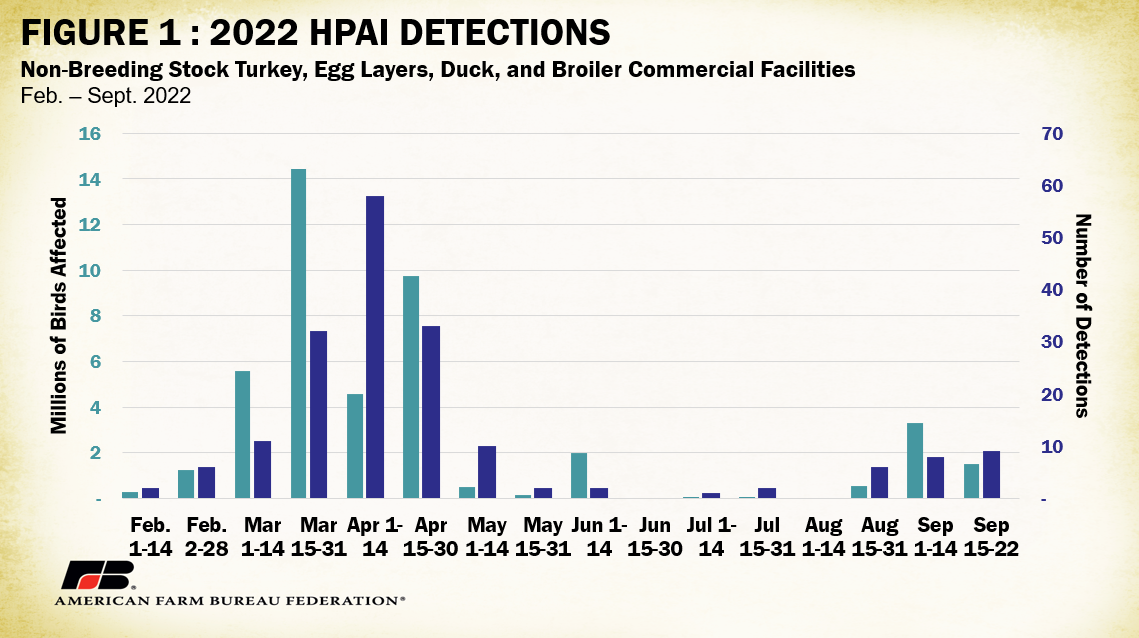

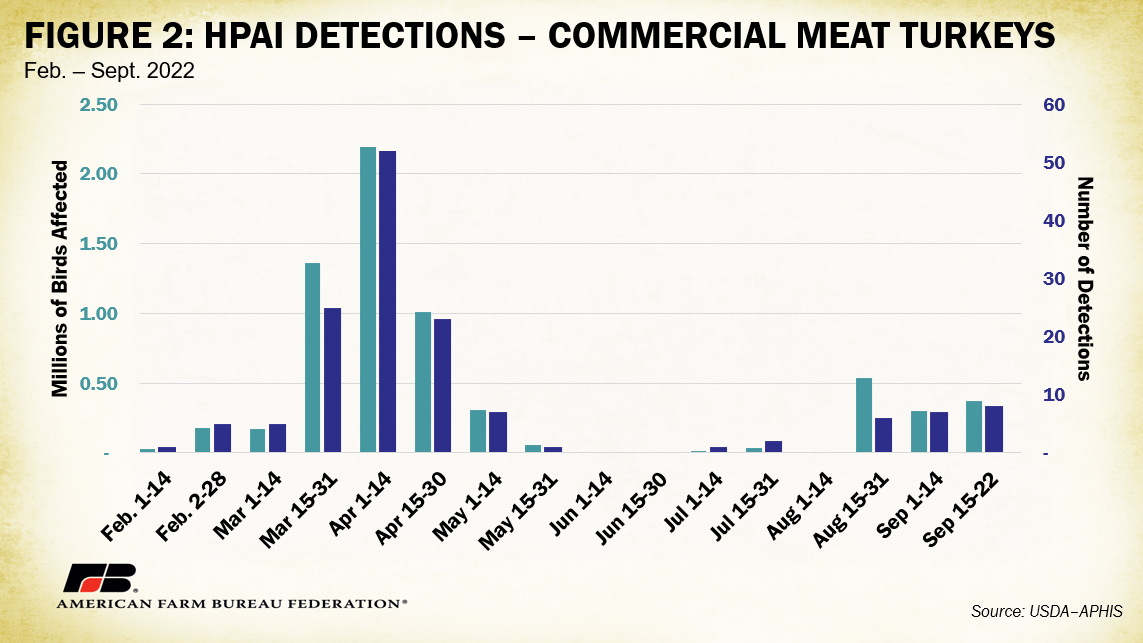

The first U.S. case of HPAI in a commercial or backyard flock since the 2014/2015 outbreak occurred on Feb. 8, 2022, in a commercial turkey meat bird operation in Indiana. Since then, there have been 468 detections of HPAI in 2022. As wild birds made their pilgrimage north in the spring, they spread HPAI to 33 states. Among commercial production, most of the HPAI cases occurred before mid-summer. Until recently, the most recent cases of HPAI in broiler production, ducks, table egg layers and turkey were April 22, June 2, June 7 and July 26. However, the fall migration of wild birds south has reignited the spread of HPAI. Thankfully thus far, the fall spread of HPAI has been significantly less than what occurred in the spring. The first fall detection in a commercial flock occurred on Aug. 26. Since that date there have been 23 cases of HPAI with active control areas across commercial broiler production, ducks, table egg layers and turkey operations. For context, between Feb. 8 and July 26 there were 159 cases. Similar to the spring wave, this fall, commercial turkey operations have been the most significantly impacted, with 21 of the 23 cases. The remaining two cases have been in commercial table egg laying facilities. While troubling, the number of facilities and birds impacted this fall is still well below the spring outbreak numbers.

SUPPLY

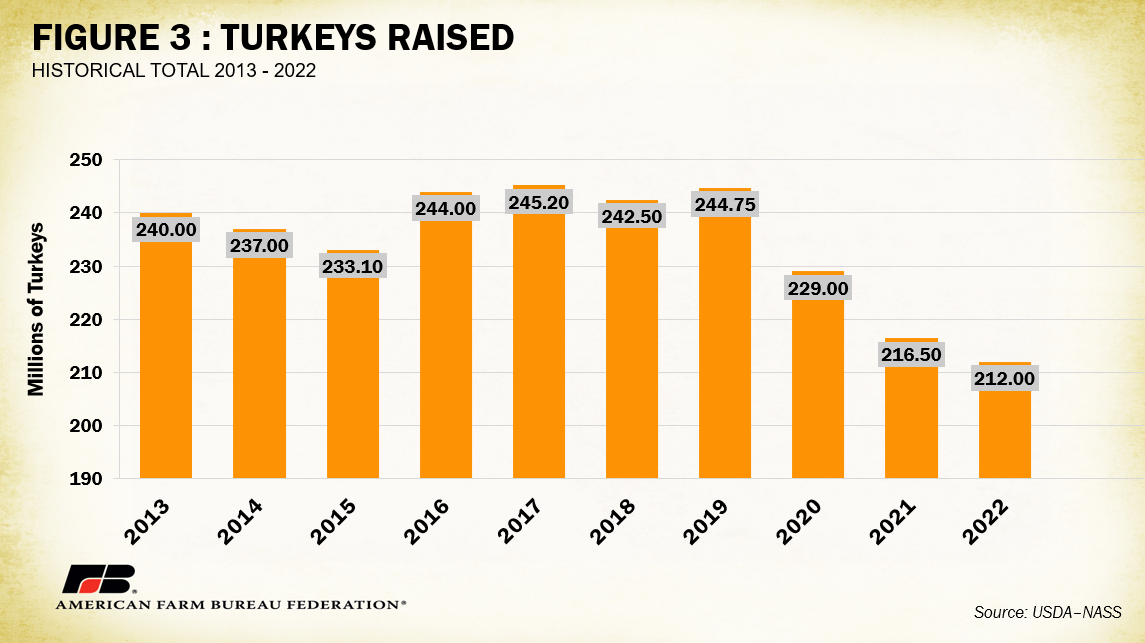

HPAI has had a significant impact on turkey production in 2022. According to USDA’s September 2022 Livestock, Dairy, and Poultry Outlook, August 2022 turkey production came in at 450.6 million pounds, 16% below July, and 9.4% below the same time in 2021. Turkeys raised in the United States are forecast at 212 million in 2022, down 2% from 2021. Recently, processing weights have been below historic levels.

The risk of HPAI outbreaks has incentivized growers to market younger birds, resulting in lower market weights. The average weight of a mature turkey for the first two weeks of September was just under 29 pounds, 4.5% below August, and 7% below the average weight in September 2021. July marked the only month where average processing weights have increased since the HPAI outbreak began.

The typical amount of time it takes for a hen turkey to reach market weight is 14 weeks in contrast to 18 weeks for a tom turkey. This means turkey poults (young birds) need to be placed on feed in July to be ready for Thanksgiving. Placements have been increasing since April with July placements estimated at 22 million birds, slightly lower than the same time in 2021. The combination of lower placements and processing weights may add strain to supplies, which would likely push prices higher.

Turkey in cold storage has remained somewhat steady during August. USDA’s September Cold Storage report estimated total pounds of turkey in freezers was 431.67 million pounds on August 31, growing by 1% in the month of August and 1% above this time last year. Total whole turkeys in freezers were estimated to be 254.79 million pounds, growing by 2% in August but down 3% from this time in 2021.

DEMAND

Inflation has contributed to the rise in turkey and egg prices. USDA released changes to the Food Price Outlook, 2022 and 2023 on Sept. 23. The Consumer Price Index for all food (not seasonally adjusted) increased 0.8% between July and August 2022 and all food prices were 11.4% higher than August 2021. The index for grocery store food purchases increased 1.4% during July and was 13.1% higher than July 2021.

Despite record high prices for turkey, demand has remained strong and is even forecast to increase. The September USDA World Agricultural Supply and Demand Estimates (WASDE) report estimated demand for turkey in 2023 down slightly from August at 5.25 million pounds or 15.7 pounds per capita. If realized, this would mean 2023 demand for turkey is 7.7% greater than the 2022 demand value of 4.87 million pounds or 14.9 pounds per capita.

PRICES – Turkeys and Eggs

Turkey prices are currently at record levels, resulting from the combination of tighter supplies caused by HPAI, higher demand, inflation, and increased demands on U.S. food systems. The national average price for a frozen, Grade A, whole young hen, 8-16 pounds, posted a record price of $1.72 per pound on Sept. 3, 2022. That’s 20% higher than the same time last year when the price was $1.44 per pound. Fresh boneless, skinless tom turkey breasts reached a record high of $6.70 per pound on Sept. 17, 112% higher than the same time in 2021 when prices were $3.16 per pound. The previous record high price was $5.88 per pound on Nov. 21, 2015, during the 2015 HPAI outbreak.

Egg production has also been affected by inflation and HPAI. Table egg prices have come back down after posting record highs of $3.34 on July 30, 2022. The combined regional average price for a dozen grade A large eggs delivered to warehouse was $2.34 on Sept. 17, 2022, 27% higher than the same time in 2021 and 44% above the five-year average of $1.29.

USDA’s Chickens and Eggs report estimates that egg production for August was 9.1 billion eggs, 2% below the same time in 2021. Total egg layers in the United States were 372 million, down 3% from 2021. Accounting for 82% of the total egg layers, there are 305 million table or market egg layers. Sixty-three million layers, or 17% of the total, produce broiler-type hatching eggs while 3.55 million layers are responsible for egg-type hatching eggs, accounting for less than 1% of total egg layers. Egg-type chicks hatched were 56 million, up 13% in the month of August, with 49.2 million eggs in incubators on Sept. 1.

August pullet placements reflect a decline in the inventory of egg-layers that was caused by the spring HPAI outbreaks. Egg-type eggs hatched in April 2022 were 50.8 million, down 15% from 2021. This resulted in a smaller number of egg-type pullets available for placement. August placement of egg-type pullet chicks for future hatchery supplies was 249,000, down 25% from the same time in 2021. August placement of broiler-type chicks was down 12% from last year, with 7.58 million broiler-type pullets placed for future hatchery supplies.

CONCLUSIONS

HPAI has had a significant impact on the supply of turkey available in the United States in 2022. Turkey production is below this time last year and is forecast to be lower yet in 2023. Fewer turkeys raised combined with strong demand, inflation and growing demands on food systems have led to record high prices for turkey and other poultry products such as table eggs. The good news is fall HPAI detections are well below spring numbers. While there should be enough turkeys to go around for Thanksgiving, pressure will keep prices high with supplies forecasted lower and demand forecasted higher for 2023.

Trending Topics

VIEW ALL