Inflation and Money

TOPICS

Market Intel

photo credit: Getty Images

Roger Cryan

Chief Economist

A nickel ain't worth a dime anymore. – Yogi Berra

Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man. – Ronald Reagan

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. – Milton Friedman

The four most expensive words in the English language are, “This time it’s different.” – John Templeton

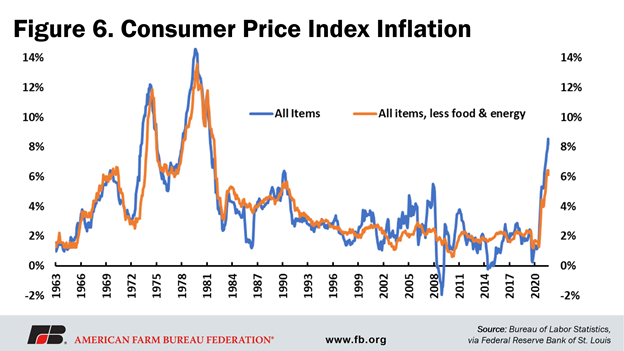

Overall consumer prices in April were 8.3% higher than a year ago, the federal government announced yesterday. This is a slight tick down from March’s peak, so far, of 8.5%, but still part of a dramatic rise in consumer prices that began a year ago. The March inflation figure is the highest rate since the painful conquest of inflation in 1981-82. So-called “core inflation”, (which doesn’t count the more volatile energy and food prices), was 6.2%, also a slight tick down from March; until recently this figure had not gone above 3% in 25 years. This doesn’t mean that a quick end to inflation is at hand. It does mean that the battle to beat it has finally begun; but inflation is almost certain to stay above 5% or 6% for the next couple of years.

So what’s going on? Why is this happening? It’s not being caused by giant corporations; and massive government spending had some impact, but that can be easily overstated.

International turmoil has driven up the price of certain things, including fertilizer and fuel; and this is having a terrible impact on farmers, particularly. However, that isn’t driving overall price inflation in the U.S., either.

Quite simply, too much money was created by the Federal Reserve Bank (often called “the Fed”), mostly in 2020, and it is turning, inevitably, into inflation. Thankfully, the Fed has begun taking steps to address this. The market may once again be reassured that it will be controlled, but it will likely take a few years to approach their long-term target of 2% per year.

It's the Supply Chain (a Little)

In October, we explained that the COVID-19 pandemic had tilted consumer demand from in-person experiences (like meals, shows, and ballgames) – to physical “stuff” to be enjoyed at home, and we said that our current price inflation was driven substantially by supply chain issues, particularly a shortage of shipping, rail, and trucking capacity to meet this growing demand for ‘stuff’. These transportation bottlenecks continue, but by now it is clear that they are part of the general limits on how fast the economy can grow, held back by limited labor availability and the slow and cautious recovery of food service and live entertainment.

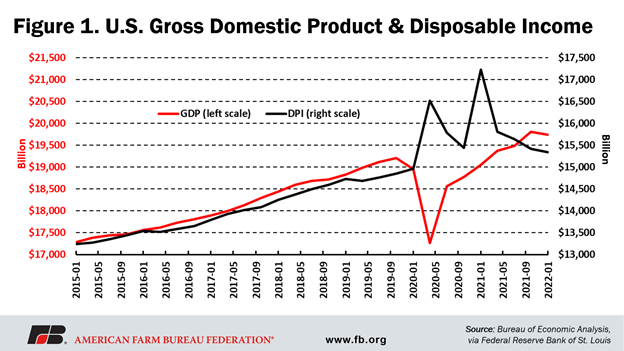

And yet, the economy has recovered to the point that it is nearly back on the pre-pandemic trend.

This economic recovery has been strong enough that we can only conclude that short supply of overall production can’t explain high prices anymore, and that we were overestimating its contribution to inflation in October. Market disruptions to fuel and food have goosed inflation in recent months. However, the much larger reasons for current overall inflation, and those that will persist in the coming years, are the unprecedented actions of the Fed since March 2020 and the resulting growth in the money supply, something to which very few people were really paying attention last October.

It's the Money Supply (Mostly)

In the words of Federal Reserve Bank Chairman Jerome Powell, the Fed controls the rate of inflation through three “blunt tools”: 1) raising and lowering the interest rates it charges other banks for money, 2) buying and selling assets on the open market, and 3) signaling its future intentions to the market. Let’s look at how and what they’ve been doing.

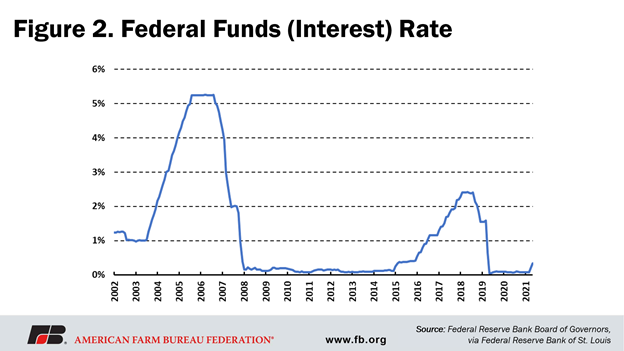

First, the Fed lowered interest rates by 1½% in March 2020, from about 1½% to just above 0%, effectively lowering other banks’ cost of borrowing to nothing. This increased banks' borrowing of money the Fed created. (See Figure 2.)

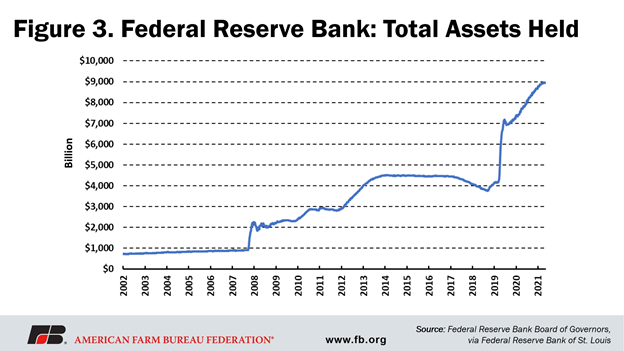

Second, since the beginning of March 2020 the Fed bought nearly $6 trillion in assets (mostly bonds and other long-term securities) with money they created (and which added to the money supply). This includes $3 trillion in just the four months beginning March 2020. These purchases by the Fed were intended to put more money into the economy.

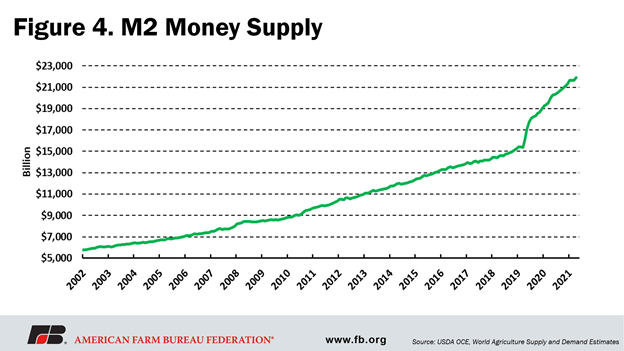

The “M2” version of the money supply, shown below, is the most common measure of the amount of money in the U.S. economy and includes cash in circulation, checking and savings accounts, and other readily available personal accounts.

The Fed’s actions drove a $6.4 trillion increase in the M2 money supply between March 2020 and the end of 2021. This was a massive and unprecedented 42% increase in only 22 months, far more than could be absorbed by economic growth, even with the strong recovery we have had.

Finally, the last of those three blunt tools is the Fed’s forward guidance, including their explanation of how they see the current situation. After initially insisting that inflation was ‘transitory’ and due to supply chain issues, the Fed’s leadership has finally acknowledged that it is persistent. They have also acknowledged their responsibility to control this inflation and that they will use the tools that drive the money supply to return inflation to the target rate of 2% (though they do so without mentioning the money supply directly).

The job of the Fed is to manage the money supply to promote 1) price stability and 2) maximum employment. For four decades, the Fed has focused on price stability, which has provided a stable environment to support the growth and employment. During the pandemic, they focused on short-term support for the second goal with little focus on the first, through that massive money supply expansion.

This was supposed to stimulate demand. But was that stimulus needed? Or even helpful?

The Fed’s monetary stimulus was done on top of enormous new federal spending commitments – Congress increased its spending commitment for pandemic relief and economic stimulus by about the same $6 trillion amount between March 2020 and late 2021. This spending (most of it bipartisan) included much needed relief for those affected and overdue infrastructure investments, as well as pure stimulus spending, such as the roughly $11,400 sent to an average family of four, regardless of job status. Note that the infrastructure investments are critical to continued growth in the general and farm economies, regardless of the pandemic.

This combination of stimulus-related spending and the Fed’s money creation was almost certainly an overstimulation of the economy. Consider that the stimulus spending in response to the 2008-2009 recession was less than $900 billion, including both relief and infrastructure investments. In addition, the 2008-2009 recession was a demand-based recession, while the COVID recession was about the temporary cutting off of the supply for many in-person services. There was a lot of disposable income, including enhanced unemployment benefits to most of those put out of work, substantial government support for businesses who kept people on payroll, and the regular paychecks of the vast majority of the workforce. (See Figure 1.) This ensured that personal incomes and overall demand didn’t flag; so there was little reason for the Fed to pursue demand stimulus through such a loose money policy.

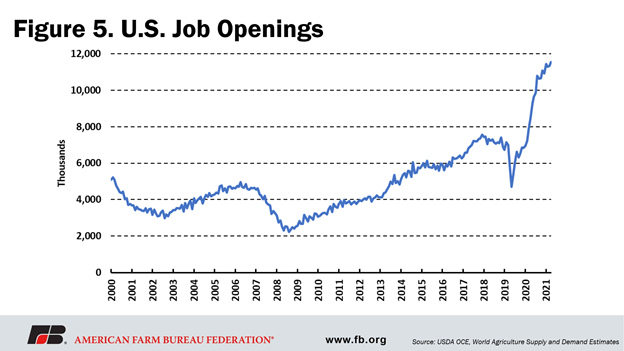

Another indication of the overstimulation of the economy is the record job openings data, a rough indication of the excess demand in the economy that can’t be met by the available workforce. (See Figure 5.)

So, arguably, the Fed’s monetary stimulus was an overdose of the wrong prescription.

Since the Federal Reserve Bank is an independent central bank, operating independently of the executive and legislative branches, it has no obligation to finance government spending. That is, it was in no way obliged to match government spending with money creation.

What happens when the money supply is pumped up too much? Such a massive injection of money into the economy has to work itself out, mainly through 1) an increase in the economy (which needs more money roughly in proportion to its growth), 2) an increase in the demand for money as a held asset and 3) an increase in prices, i.e., price inflation, over two to three years. (For more detail on this analysis see Greenwood and Hanke.)

This leaves excess money equal to about 30% of the money supply. This will have to work its way through the economy in the next few years in some combination of inflation, which will happen, and contraction of the money supply, which the Fed is unlikely to do. That means, unfortunately, that it would not be unreasonable to expect two to three more years of inflation in the 6% to 8% range, far above the Fed’s long-run inflation target of 2% per year.

Those Who Ignore History…

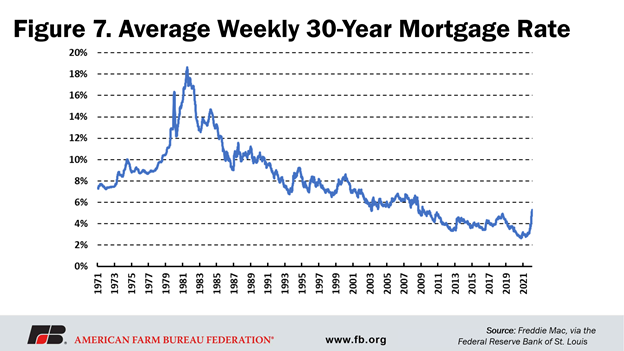

It may not be too early to call this ‘runaway inflation’, because there is a lot of inflation still to come, and because it is so critical that we recognize what a dangerous phenomenon inflation is, and how important it is to long-term economic growth that we stop it. The last time inflation was this high, the U.S. economy was suffering its second economic recession in three years as the Federal Reserve Bank finally reined in the inflation that had galloped through the 1970s. (See Figure 6.) Those of us who remember those days recall inflation was massively disruptive to the economy, making prices uncertain, eroding incomes, devaluing savings, and building destructive expectations of continued inflation into interest rates, leading to 30-year mortgage rates near 20%. (See Figure 7.) It helped to define a generation and was particularly painful for farmers, who were put on a treadmill of rising crop and land prices in the 1970s, only to be stuck with high-interest debt when the treadmill ground to a halt.

Perhaps the best thing that came out of that era (other than roller disco and Star Wars) were the lessons about managing monetary policy. The 1960s belief that inflation would always support economic growth was wiped away as “stagflation” – a combination of high inflation, high unemployment, and stagnant demand – made 1970s headlines. By the 1980s, it had become an accepted economic principle that putting money into the economy faster than the economy can absorb it will cause inflation, and that continuing to do so was dangerous to the economy. The cure – slowing the growth in the money supply – was applied by then-Federal Reserve Chair Paul Volcker, based on the monetarist principles laid out by Milton Friedman. This was painful to the whole economy and particularly to farmers; but it was necessary to establish the stable monetary environment that has supported continued economic growth over the last four decades. In fact, it took years for financial markets to be assured that inflation was not around the corner and to reduce long-term interest rates to the levels we have enjoyed until recently.

By ignoring these lessons of our monetary history, the Fed has led us to repeat it. A reasonable stated intent of making Fed policy more amenable to high employment and wage growth seemed, during the response to the COVID recession, to turn into a belief that a free lunch could be had from monetary expansion.

So perhaps once again, we can find this inflationary episode’s silver lining in the rediscovery of how monetary tools work and, more importantly, how they don’t work. And we look for the Fed to renew its focus on price stability and to exercise due restraint in the future. The Fed’s actions and statements last week – including a half percentage increase in their lending rate, their pledge to sell off up to a trillion dollars in bonds and securities over the next year, and their statements supporting further action in the coming months – are all encouraging, in this respect.

In the meantime, farmers, ranchers and consumers will face the pitfalls of inflation until time and more sober policy can return us to price stability.

Trending Topics

VIEW ALL