Inflation 101: A Blast from the Past

TOPICS

TransportationBob Young

President

photo credit: Pixabay // CC0

Bob Young

President

Last month’s article on inflation generated a lot of interest in the form of media interviews, a few phone calls, and even a presentation to the American Farm Bureau board of directors. There is justification for the concern, particularly within production agriculture. Some of us remember the heavy dose of inflation of the 1970s and the cost of fixing the problem - long-term interest rates over 15%, land price collapse, a surging value of the dollar due to the interest rate hike, and a collapse of agricultural exports. The agricultural debt crisis drove the entire Farm Credit System to its knees. Numerous rural agricultural banks closed up shop. It was a scary time. Nobody wants to go back there.

This is the first in a short series of articles discussing the inflationary period of the 1970s and the Federal Reserve's actions to deal with long-term embedded inflation. Words like “stagflation” will come into play.

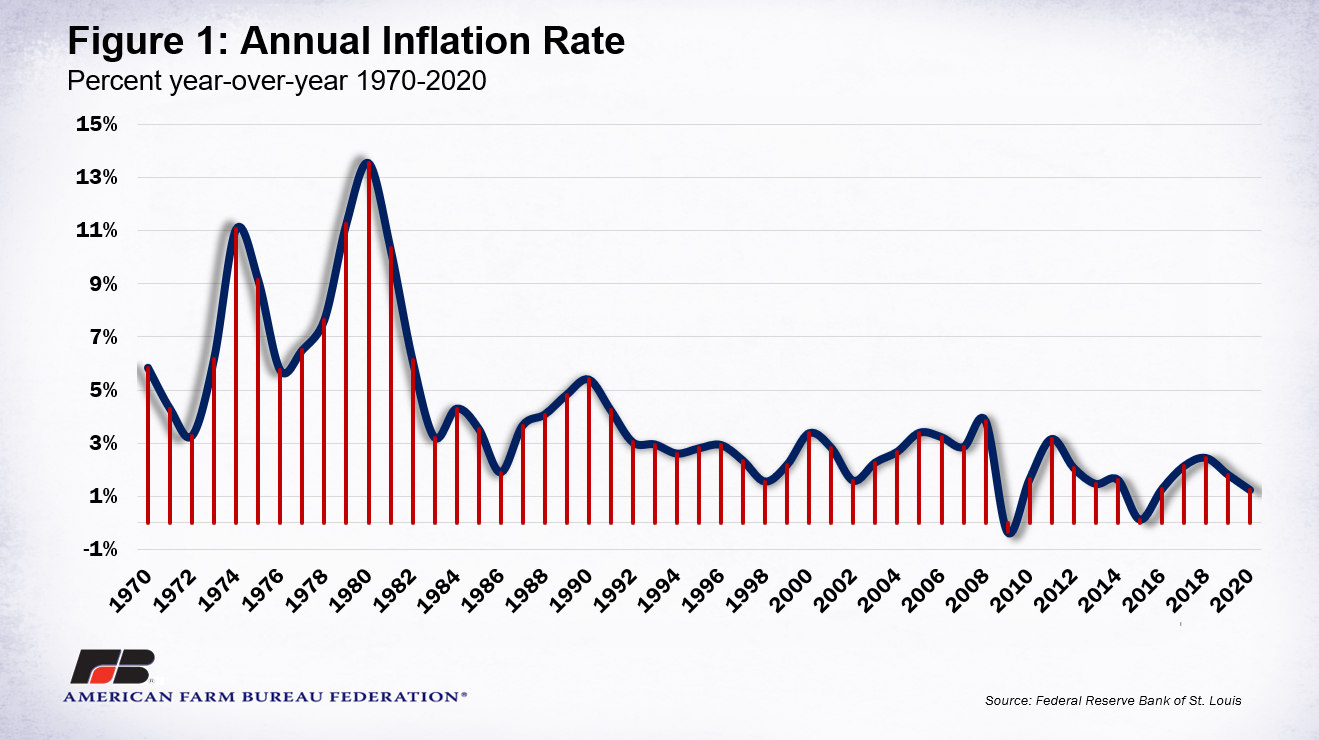

Before going much further, let’s recognize one of the drivers of the recent spike in prices comes from simple arithmetic. Overall prices – Consumer Price Index all urban –dipped by 2.4% on an annual basis in March 2020 and by an annualized 8.4% in April 2020. So just holding steady this March and April would be a marked change from the early stages of the pandemic. Add to that an overall economic recovery with stimulus thrown in as well and…

Monthly data is noisy. Think of yield monitors as you move across a field or individual cattle weights instead of a full pen. As we went through COVID-19, even though we had daily case data, information was reported as a seven-day average. So pay attention to the monthly data, but don’t be overwhelmed by one or two data points.

To talk about inflation in the 1970s, one needs to return to the late 1960s. Then-President Johnson, with his Great Society and spending on the Vietnam War, gave a significant boost to the overall economy. Nixon was elected in 1968 and brought many economic policy changes with him. He fired William Martin as chairman of the Federal Reserve and appointed Arthur Burns. Burns faced pressure to keep interest rates low and drive the economy. In 1971, Nixon also pulled the link between gold and the dollar, allowing the dollar to float freely in global markets. As a result, the dollar weakened against many major currencies. A lower-valued dollar makes imported goods more expensive in dollar terms.

And then we need to talk about oil prices. Between 1970 and 1973, a barrel of oil rose in price from $3.18 to $3.89. In 1974 it rose to a whopping $6.87 per barrel. Pretty cheap by today’s terms, but this was a 77% jump in one year. Oil prices reached $12.64 per barrel by the end of the decade.

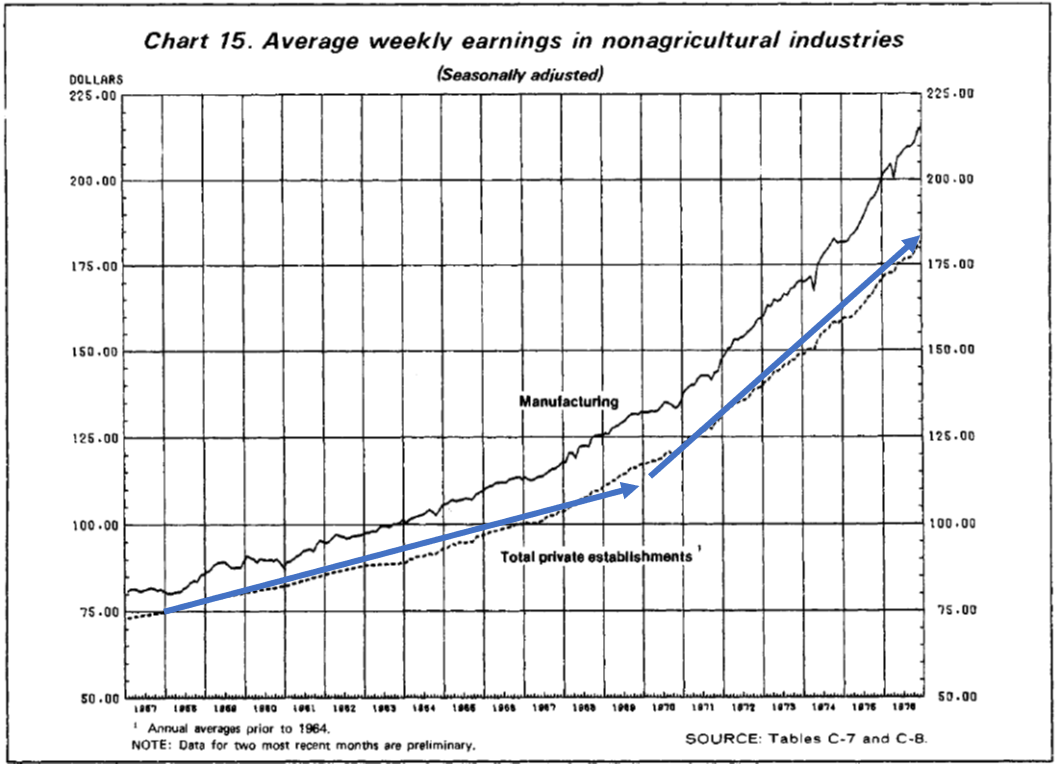

People developed expectations during this era of high inflation and built those expectations into wage and salary demands. Apologies for the quality of the graphic below, clipped from a 1976 Bureau of Labor Statistics report. Note the change in the slope of the curve beginning in about 1970. This increase in wage rate growth shows not just a one-time rise in compensation but long-term gains. When the entire economy goes five and six years with faster than previous wage growth, inflationary expectations get pretty widespread.

We are coming out of the pandemic with job growth and anecdotal evidence of rising wage rates. Yet, a week hasn’t gone by without some article reporting companies not able to find staff, even when offering over $15 per hour for entry-level positions.

We have already touched on the various oil crises that hit during the 1970s. The United States took 63.5 quadrillion BTUs of fossil fuels to produce $1.07 trillion in gross domestic product in 1970. In 2020 we took 72.9 quadrillion BTUs to make $20.9 trillion in GDP. Thus, energy in general and fossil-based energy in particular do not play as pivotal a role as they did during the previous period of high inflation.

Inflation is picking up, but we are a long way from the conditions of the 1970s. We are not facing a fundamental shift away from a gold standard, for example. We have developed substantial domestic supplies of fuel, and the overall demand for fossil fuels may be stabilizing after we get past the pandemic recovery. We are not coming off of a major change in how global financial markets function. We know now how to operate without a metals base to our finances. The Federal Reserve has additional levers to help manage the economy, beyond just the interest rate targets they used in the past.

Again, the wild card will be wage rates. If we adopt the idea that wages need to consistently rise by more than the inflation rate for the next four or five years in a row, that by itself could drive inflation into the system.

Trending Topics

VIEW ALL