ICYMI: 2021 Agricultural Outlook Forum Highlights

TOPICS

Wheat

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Veronica Nigh

Former AFBF Economist

USDA’s annual Agricultural Outlook Forum provides the first glimpse at crop acreage and yield expectations, as well as supply, use and price estimates for the upcoming marketing year for major field crops such as cotton and grains and oilseeds. The forum also provides important market outlooks for livestock and dairy and highlights the forecast for U.S. agricultural exports and imports during the fiscal year. Today’s article provides a summary of key market information presented at USDA’s February 2021 Agricultural Outlook Forum.

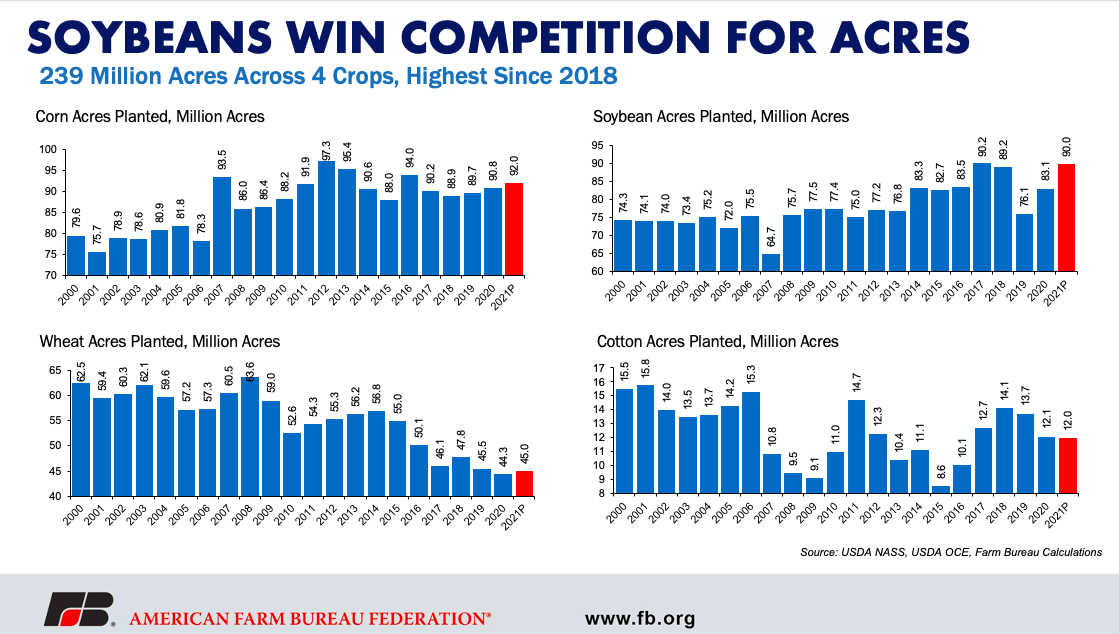

First Look at 2021 Crops

Four crops, corn, soybeans, wheat and cotton, account for a projected 239 million total planted acres in 2021, just above 2018 acreage. Corn and soybean acreage combined accounts for 182 million acres, which would be a record amount planted for the two row crops. Importantly, planted area to these four crops is expected to increase 9 million acres from 2019. Given that nearly 10 million acres qualified for prevent plant in 2020, and the recent rally in crop prices, this increase in acreage was anticipated.

Soybean planted acres stole the show at an estimated 90 million acres, an increase of 8.3% from 2020, when soybean planted acres totaled just above 83 million acres. If realized, 90 million soybean planted acres would be the second-highest acreage ever, behind only 2017. Given yield expectations of 50.8 bushels per acre, just above 50.2 bushels per acre in 2020, the soybean production level for 2021 could reach 4.5 billion bushels, making it the largest soybean crop on record.

USDA projects corn planted acres to increase to 92 million acres in 2021, just 1.3% more than the 90.8 million that were planted in 2020 and the fifth-highest acreage ever.. Given a yield estimate of 179.5 bushels per acre, it’s possible that 2021 could produce the first-ever 15-billion-bushel corn crop.

Wheat planted acres are estimated at 45 million acres in 2021, which is 1.6% more than the record low of 44.3 million acres planted in 2020. For wheat yields, the estimate of 49.1 bushels per acre is slightly lower than 2020’s 49.7 bushels per acre. However, the uptick in planted acres offsets the slight decrease in yields. For 2021 wheat production, USDA estimates a 1-million-bushel increase from 2020, at about 1.8 billion bushels of wheat.

USDA estimates that 2021 cotton planted acres will decrease slightly to 12 million acres from 12.1 million acres in 2020. The National Cotton Council published its annual Early Season Planting Intentions Survey that indicated cotton producers intend to plant 11.5 million acres in 2021, slightly less than USDA’s estimates. Early estimates peg cotton yields for 2021 to be 840 pounds per acre, up from 825 pounds per acre in 2020. At this level, cotton production for 2021 is estimated to reach 17.5 million bales, up 17.1% from 2020, when production was just under 15 million bales.

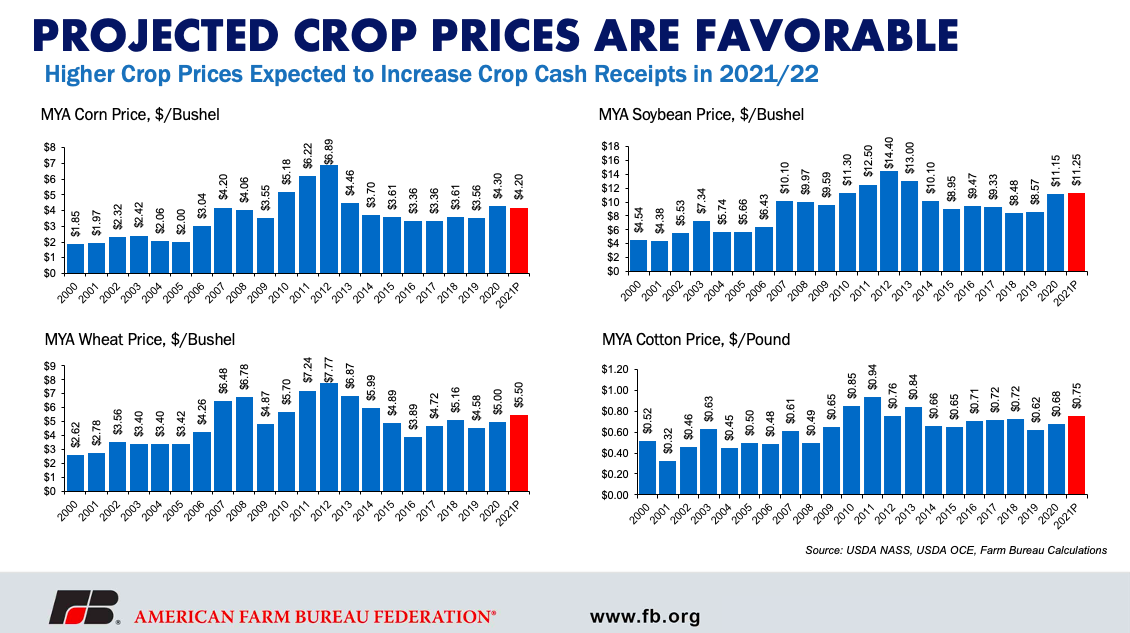

Despite the large corn and soybean crops, demand is expected to remain strong in 2021. Ending stocks for corn, cotton, soybeans and wheat are all projected lower in 2021, and in the case of soybeans, ending stocks are near historically low levels. The tighter supplies are expected to push marketing year average prices for cotton, soybeans and wheat higher, while corn prices are expected to remain at favorable levels.

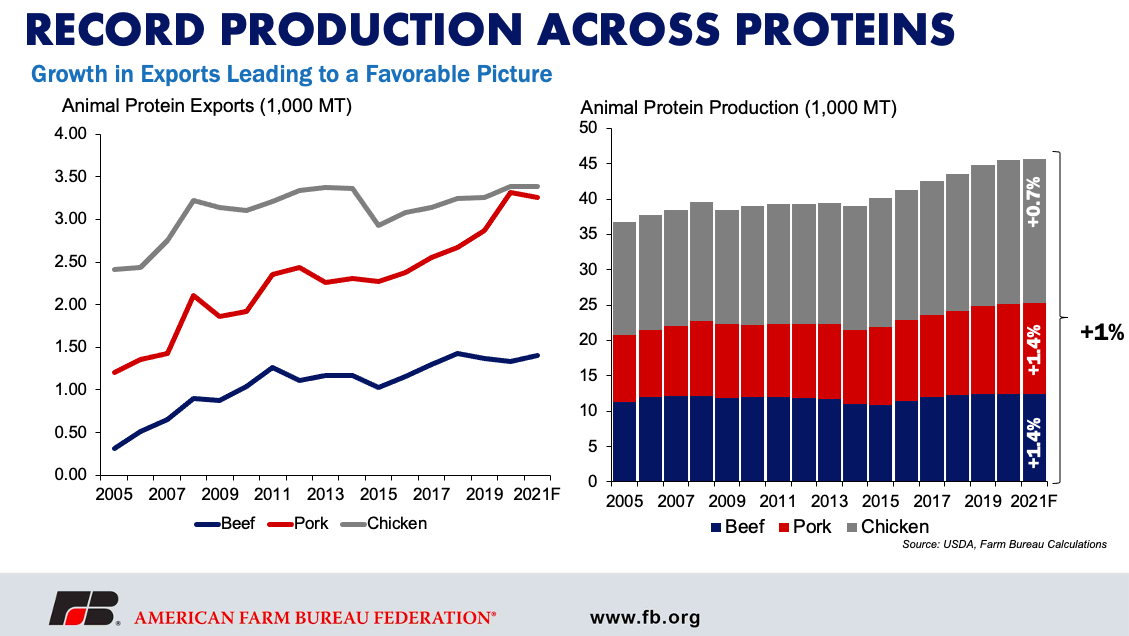

Expected Rebound in Livestock Prices, Despite Record Protein Production

Despite the unprecedented challenges in the processing sector due to COVID-19, red meat and poultry production in the U.S. hit an all-time record of 106.5 billion pounds in 2020. Beef production remained relatively unchanged, while pork and broiler production increased last year. At the height of the coronavirus pandemic, weekly production for both beef and pork was down 34% from 2019 At that time, few thought the industry would recover to produce more red meat and poultry than ever before. This result is due to a strong start to 2020, with production surging pre-pandemic, as well as increased slaughter weights due to the backup in animals that occurred because of the supply chain disruptions.

Moving forward into 2021, USDA is forecasting a 1% increase in overall red meat and poultry production. Increasing feed costs are expected to somewhat dampen production gains across the species, as producers are likely to struggle to put weight on their animals in an economic way. USDA is forecasting a 1.4% increase in beef production for 2021, with the increase coming in on higher commercial steer and heifer slaughter, while cow slaughter declines.

On the pork side of things, USDA is forecasting record production of 28.7 billion pounds, a 1.4% increase from 2020. This increase is expected to be driven more by increasing slaughter hog inventories, while lighter carcass weights will likely pull down on production gains from increased slaughter. Like pork, broiler production is forecasted to be record large, coming in at nearly 45 billion pounds, driven by heavier bird weights.

Exports are an important outlet for animal protein and are expected to account for roughly 11% of beef production, 17% of broiler production, and 25% of pork production in 2021. Beef exports saw a slight decline in 2020, likely a result of the lack of availability of supply and higher non-farm domestic prices, but USDA is forecasting an increase of over 6% in 2021. Strong international demand from late 2020 is expected to carry forward into this year. USDA is forecasting a 1.5% decline in pork exports in 2021, coming off of a strong 2020 surge. The driving factor behind both last year’s strength and the forecasted decline is African Swine Fever in China. The slow rebuilding of their hog herd led to an animal protein deficit in China and a resulting surge in animal protein imports for the country across the board. In 2021, USDA is forecasting China will recover some from ASF and require fewer pork imports. However, export growth in other key markets such as USMCA countries and Japan are expected to somewhat offset these losses. USDA forecasts U.S. broiler exports will marginally increase in 2021, rising by 0.3%. In 2020 China lifted its ban on U.S. broiler meat, and the 2021 increase is linked to continued import demand from the country and a gradual recovery of global economic conditions.

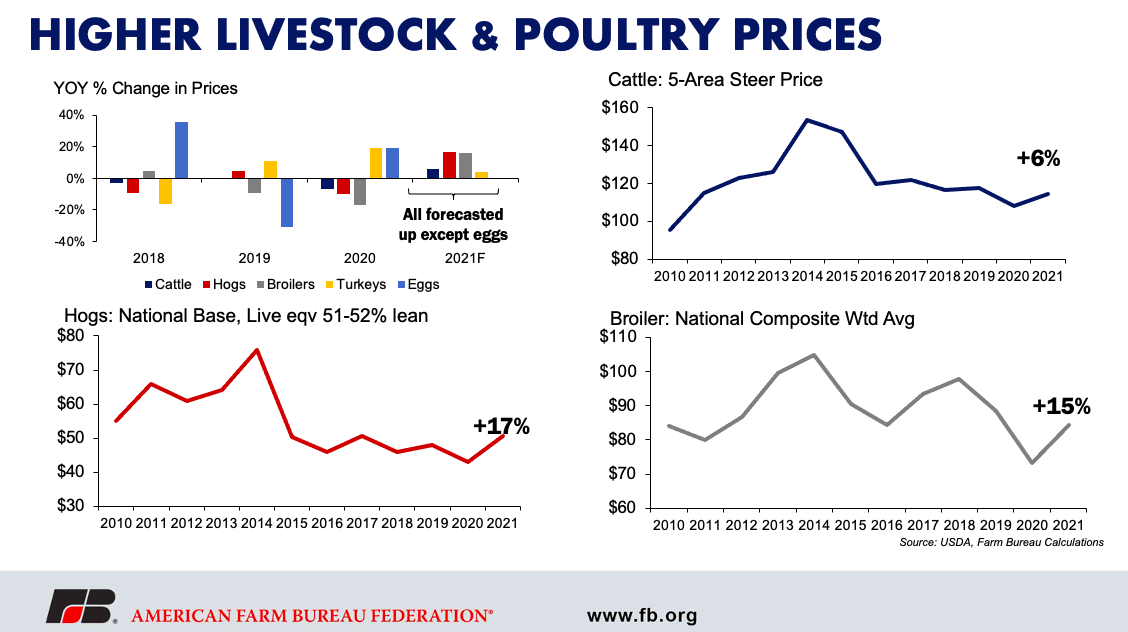

Another big takeaway from USDA’s Outlook Forum is that across the board, livestock and poultry prices are forecasted to be up. Even with higher beef production, strong domestic and export demand are expected to support more elevated prices in cattle. USDA is forecasting the 5-area steer price to average $115 per hundredweight, an increase of 6% over 2020. Similar to cattle, strong domestic and export demand for pork is expected to support hog prices, even with the forecasted increase in pork production. USDA forecasts U.S. hog prices, on a national base, 51%-52% lean, live equivalent to average $50.50 per hundredweight through 2021. USDA is also forecasting higher average 2021 broiler prices, expecting prices to be supported by lighter production in the second half of the year, in addition to improving demand.

Agricultural Trade

The ability to contain the COVID-19 pandemic, which caused a global economic contraction of 4.4% in fiscal 2020, will be the primary influencer on the global economy (and U.S. agricultural exports). As of the Outlook Conference, USDA is projecting that containment of the disease, at least to some degree, will occur, spurring global gross domestic product (GDP) growth 5.5% in fiscal 2021. Emerging markets (Brazil, Russia, India, Indonesia and China), which account for more than 40% of the global population and nearly 25% of global GDP, are expected to lead the pack with GDP growth of 6.3%.

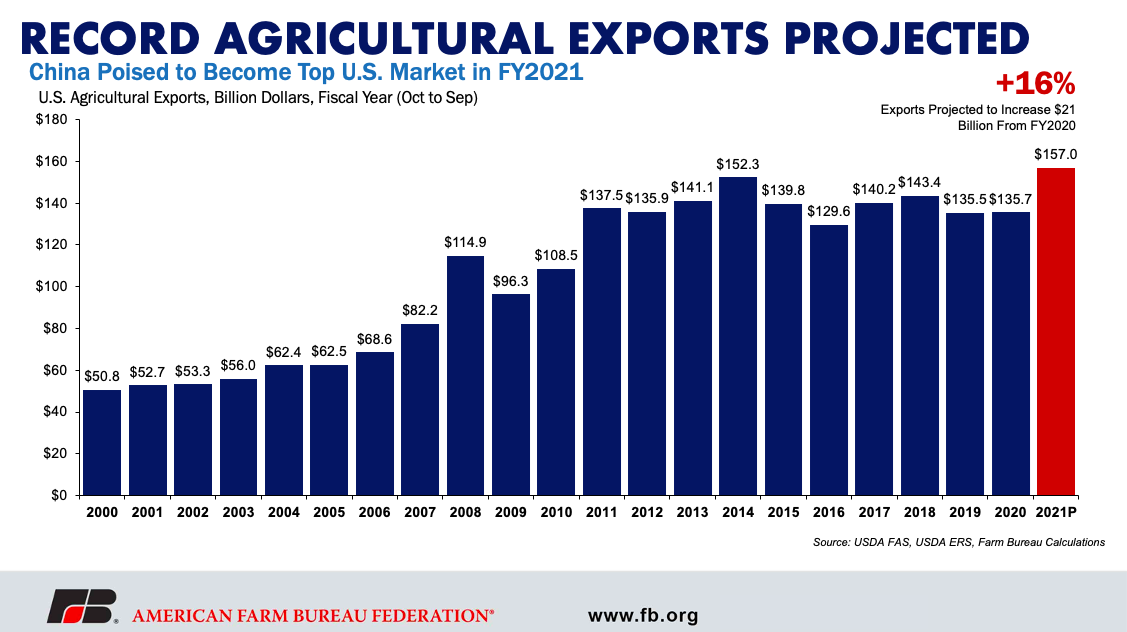

On this projection, U.S. ag exports are forecast to rise to a record $157 billion in fiscal 2021. This would be an increase of $21.3 billion over fiscal 2020’s $135.7 billion. If realized, this would be the third-largest fiscal year-over-fiscal year increase in U.S. ag export history. By product, USDA is forecasting increased exports in every major commodity group. Grains and feeds are projected up $7.8 billion, oilseeds and products up $11.1 billion, livestock, dairy and poultry up $1.2 billion, horticultural products up $800 million, cotton up $300 million, sugar and tropical products up $300 million and seeds up $100 million. USDA is projecting an increase, or at a minimum no change, in agricultural exports to every major region across the globe.

After trade spats took their toll in recent years, China is poised to once again become the largest U.S. agricultural market in fiscal 2021, with record exports of $31.5 billion forecasted This growth is projected despite significant tariffs, which remain on nearly 99% of U.S. agricultural exports to China. Much of the increase in demand for U.S. agricultural products is dependent on very strong feedstuff usage from a rebounding Chinese hog herd.

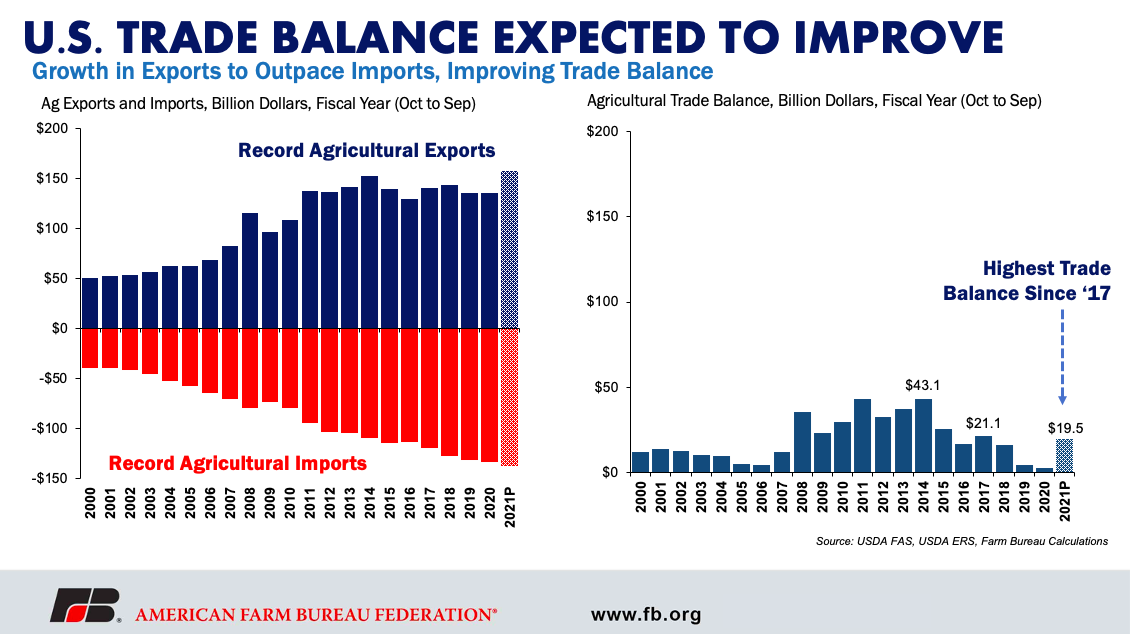

Imports are also expected to rise on an improved U.S. economy. Fiscal 2021 imports are forecast at $137.5 billion, up $4.3 billion over fiscal 2020 imports of $133.2 billion. If imports and exports reach forecasted levels, the trade balance in agriculture would improve to $19.5 billion in fiscal 2021, a $17 billion increase over the very slim $2.5 billion trade surplus in fiscal 2020.

Summary

USDA’s annual Agricultural Outlook Forum provided an optimistic first look at the 2021 agricultural economy. Crop acres are expected to increase for corn, soybeans and wheat and higher crop prices are expected for wheat, cotton and soybeans. On the livestock front, record red meat and poultry production is also expected to be accompanied by higher prices. Agricultural exports are expected to reach new highs on the back of strong fiscal year 2021 exports to China. The improvement in exports is expected to bolster the U.S. agricultural trade balance to $19.5 billion. Combined, higher crop and livestock prices are expected to boost farm cash receipts and push U.S. net farm income, a broad measure of farm profitability, to $111 billion in 2021. If realized, net farm income in 2021 would be the fourth-highest all time in nominal terms.

Uncertainty does remain. Strong exports, and thus higher crop and livestock prices, are highly dependent on how trade with China progresses in the coming months, as well as the rate of recovery in a post-COVID-19 global economy. At the same time, crop prices are highly dependent on the acreage planted this spring – and currently there is robust competition among the crops. There is also Mother Nature. On one hand, any planting delays or adverse weather during the growing season could tighten an already tight supply of grains and oilseeds in the U.S. On the other hand, favorable weather could help stockpiles recover, thereby putting the onus of supporting prices on the demand side of the balance sheet.

Importantly, this outlook will change. The next opportunity to update acreage expectations will be the survey-based March Prospective Plantings report. Following the March intentions report, the May report will detail farmers’ 2021 planting intentions and the May World Agricultural Supply and Demand Estimates will provide the first look at updated crop balance sheets.

Trending Topics

VIEW ALL