How Milk Is Really Priced in the U.S.

TOPICS

Milk

photo credit: Getty

John Newton, Ph.D.

Former AFBF Economist

In the U.S., minimum milk price regulations enforced by Federal Milk Marketing Orders are based on a system of mandatory dairy price reporting, milk pricing formulas, price discrimination based on the end-use of raw milk and equity payments from a revenue sharing pool. A recent Market Intel, How Milk Is Priced in Federal Milk Marketing Orders: A Primer, reviewed milk pricing regulations under Federal Milk Marketing Orders.

This complex government framework of determining regulated milk prices that ultimately set the benchmark value of milk at the farm-level begins with price discovery in Chicago. The Chicago Mercantile Exchange has electronic spot markets for butter, cheddar cheese, nonfat dry milk and dry whey – the same products that are surveyed in USDA’s mandatory dairy price report (Background on National Dairy Product Sales Report).

Price Correlation with USDA Survey Prices

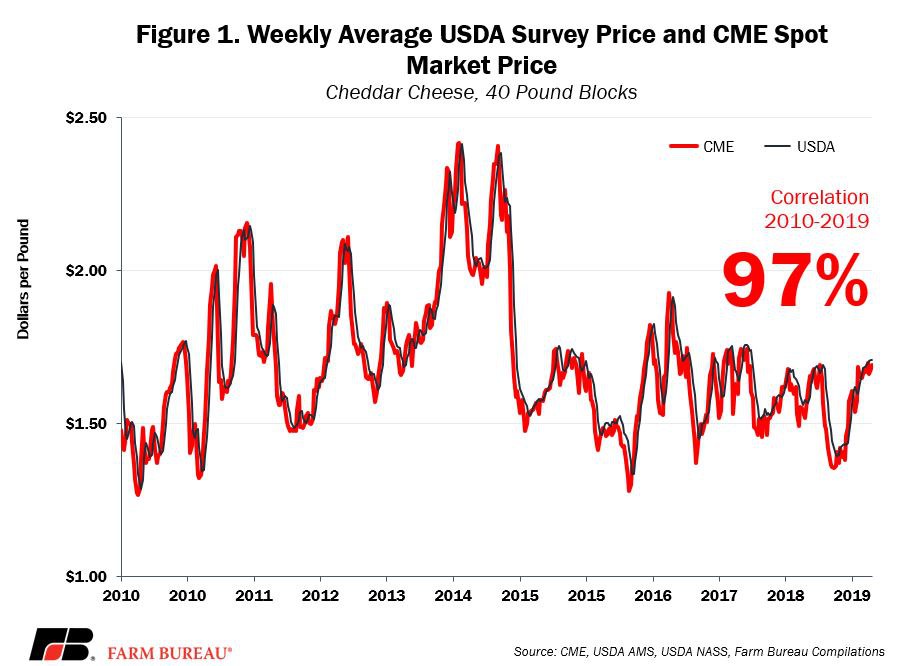

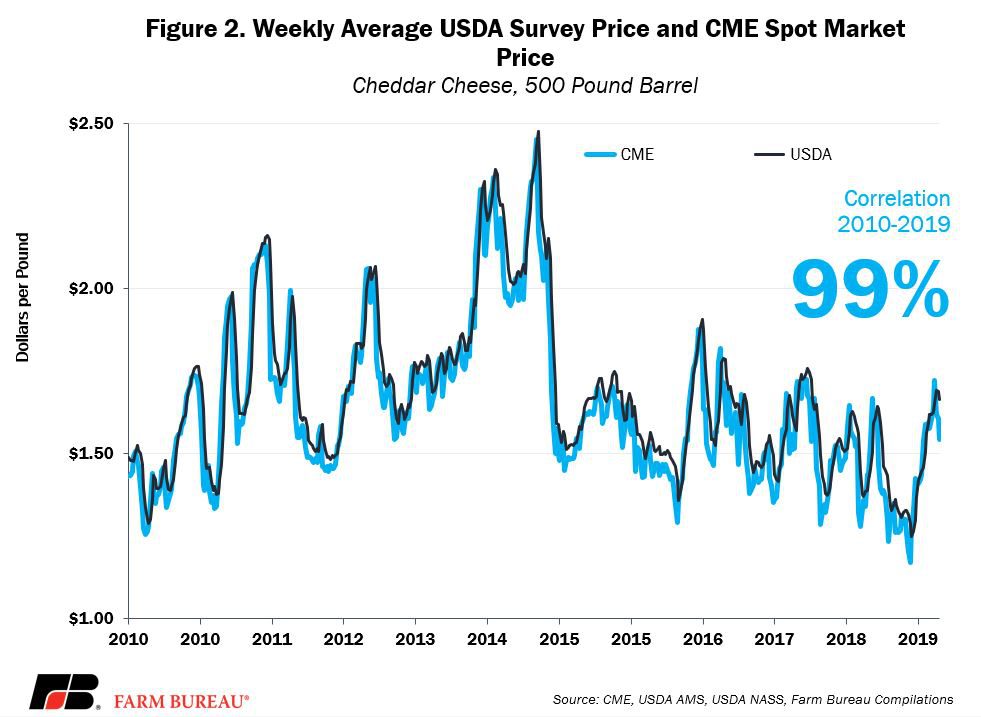

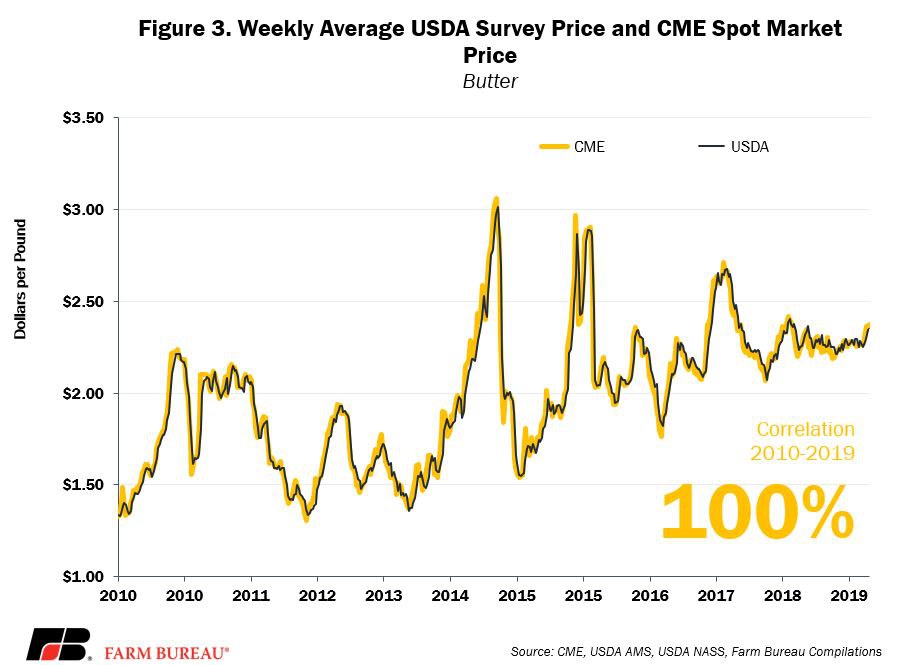

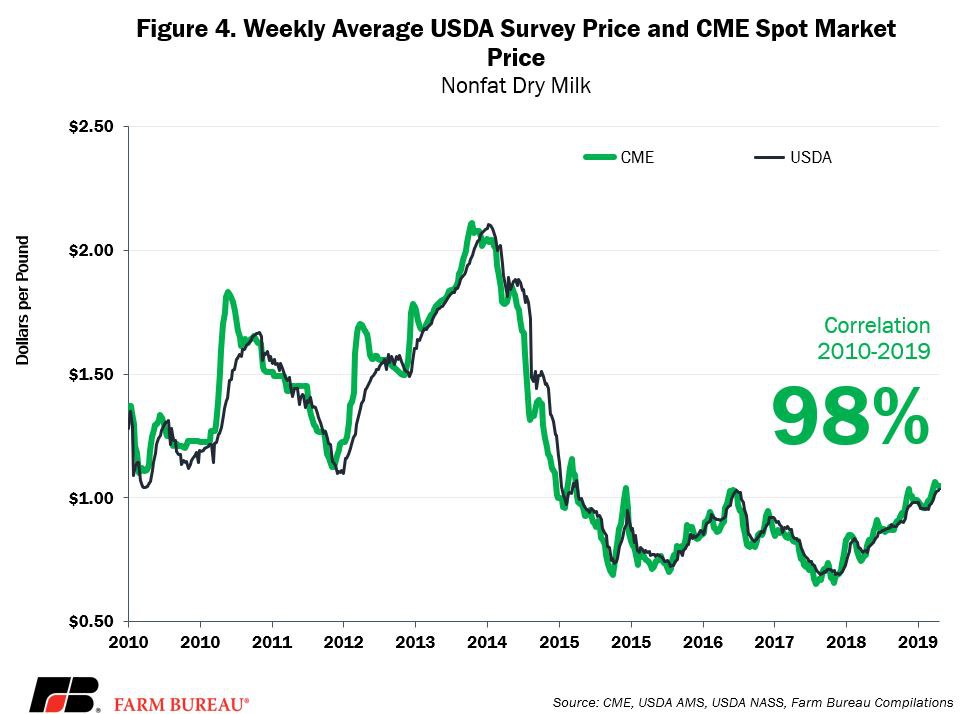

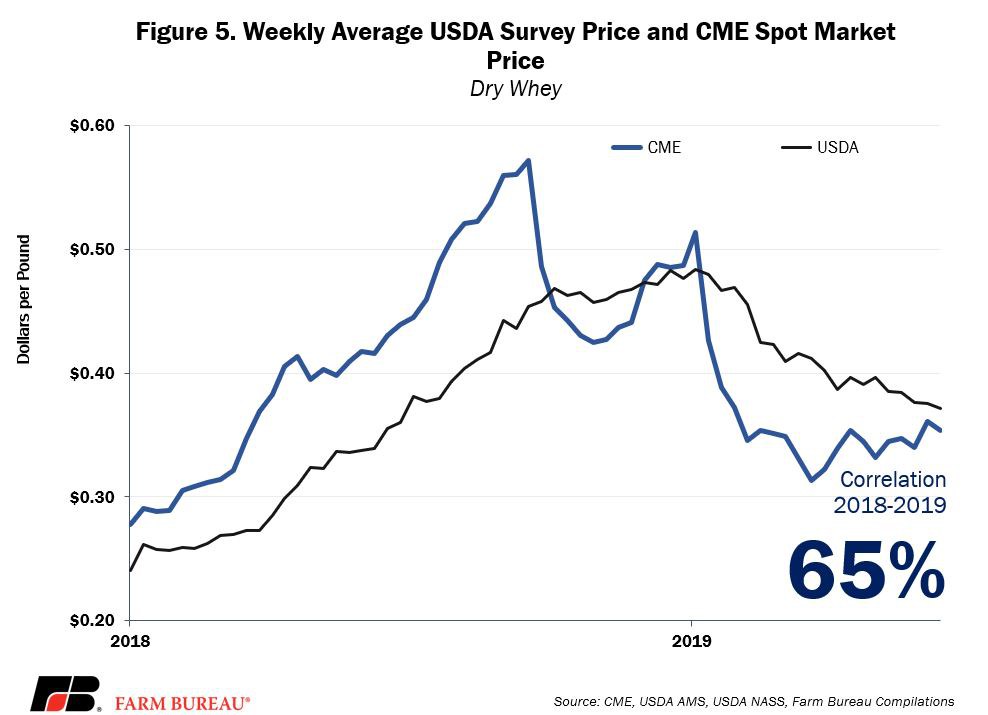

Reviewing the weekly average CME dairy spot market prices alongside USDA’s weekly National Dairy Product Sales Report survey prices for cheddar, butter and dry milk powders reveals a high degree of correlation – at or above 98% – for butter, cheddar and nonfat dry milk since 2010. For dry whey, the correlation is 65% from March 2018 to the present. In addition to the high degree of correlation, a regression analysis reveals that all USDA survey prices are statistically linked to CME prices from the prior two weeks. As a result, while not directly linked to USDA’s survey prices, CME settlement prices discovered in Chicago indirectly price all milk across the entire U.S. regulated on FMMOs.

Figures 1 through 5 highlight the strong price relationships observed between weekly average CME spot market prices and USDA’s dairy product survey prices for cheddar cheese, butter and dry milk products.

Trading Volume Relative to U.S. Dairy Product Production

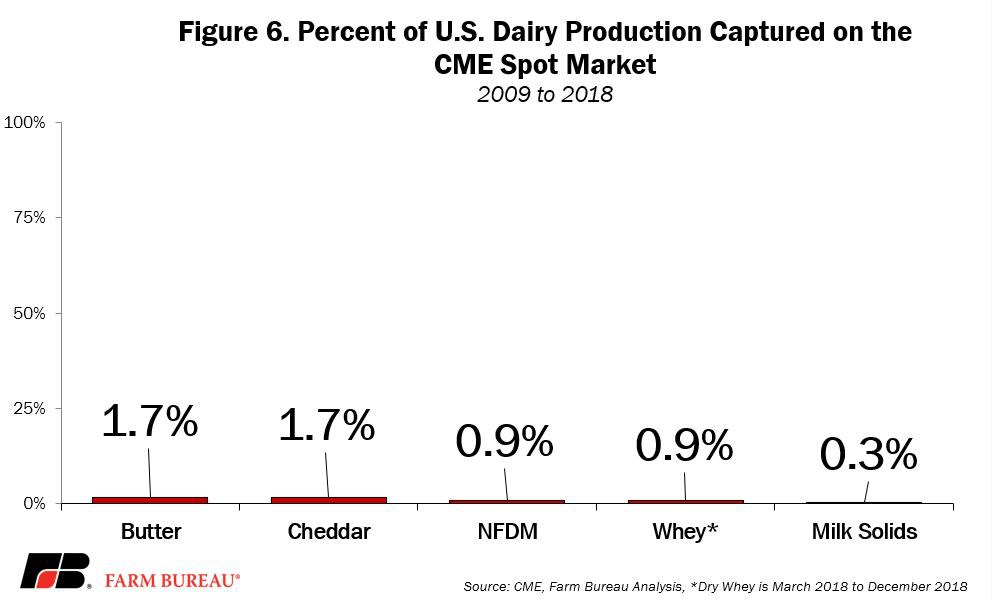

Given the strong link between CME spot market prices and USDA’s survey prices, which are then used in federal milk pricing regulations, it is appropriate to evaluate the spot market trading volume relative to U.S. production levels. To provide this perspective, we compared the CME spot market trading volume over the last decade to U.S. dairy product and milk solids production.

From 2009 to 2018 there were more than 7,200 loads of butter traded on the CME spot market. Based on the maximum contract size, these loads represent approximately 313 million pounds of butter. Over the same period, nearly 18 billion pounds of butter were produced in the U.S. Thus, less than 1.7% of butter production was traded on CME spot markets.

Across cheddar blocks and barrels, approximately 573 million pounds of cheddar cheese was traded on the CME from 2009 to 2018. Meanwhile, U.S. cheddar production totaled 33.5 billion pounds – indicating that 1.7% of U.S. cheddar production was traded on the CME. Similarly, less than 1% of nonfat dry milk was traded on the CME, and in 2018 less than 1% of dry whey was traded on the CME.

Converting these dairy products to their milk solids equivalent indicates that approximately 785 million pounds of milk solids were traded on CME spot markets over the last decade. Compared to total solids production of 257 billion pounds, CME spot market activity represented 0.3% of total U.S. milk solids production – yet it was used as a benchmark to set regulated prices for more than 3.6 trillion pounds of milk.

Price Discovery Using Spot and Futures

Reliance on futures markets for price discovery is common. For example, grain and oilseed prices are often quoted based on the futures price in Chicago, plus or minus the local basis. The local basis then changes based on regional supply and demand conditions. Cotton prices are linked to prices discovered through futures market transactions on the Intercontinental Exchange. Lean hogs and cattle also rely on futures markets for price discovery.

The difference in price discovery between dairy and the rest of the agricultural sector is two-fold. First, dairy is the only major U.S. commodity that uses (indirectly) CME spot markets in federally regulated pricing formulas. The connection between spot markets to FMMO milk prices may serve as a deterrent to adding trading volume and liquidity – hindering price discovery. Some participants may not be willing to engage in spot market transactions due to the impact it may eventually have on farm-level milk checks. For example, a dairy cooperative seeking to sell surplus cheese, butter or dry milk powders could risk driving commodity and milk prices further down based on the spot market transaction. In this scenario, the actions of the cooperative in the spot market could result in lower farm-level milk prices for all their farmer-members. This occurs only because CME spot market prices indirectly set milk prices.

Second, while the spot market provides an opportunity for buyers and sellers to transact and aids in futures market liquidity, this small sampling is then injected into the regulated milk prices used in FMMOs. The combination of end-product pricing formulas and USDA’s requirement that products sold under terms of a forward contract are excluded from mandatory price reporting results in only spot market transactions facilitating price discovery in FMMOs. Prices established under the terms of a forward contract – which is likely based off futures prices – are not surveyed under mandatory price reporting. As a result, the price discovery and liquidity from these markets have no impact on farm-level regulated milk prices.

Consider Expanding Mandatory Price Reporting

Farm Bureau analysis of USDA’s mandatory dairy product reporting revealed that less than 10 percent of the milk solids in the U.S. were captured in USDA’s survey over the last two decades. One reason is that mandatory price reporting excludes prices established under the terms of a forward contract, e.g., products sold for export typically have agreed upon prices and a later delivery date.

The rationale, some propose, is that regulated milk prices should be based off the current value of milk. But, could farmers share in the risk from a sales price agreed to 60, 90 or 180 days, or even a year, prior? If we are going to have end-product pricing formulas, why not capture more of the dairy market transactions and share in the risk through the revenue sharing pool? If dairy futures prices are truly unbiased, which we should agree they are, the risk sharing should wash out and would be unlikely to change the average long-run regulated milk price.

Expanding the risk sharing by including prices negotiated in a forward contract would increase the volume of products captured in USDA’s mandatory price survey. Moreover, by including both cash settlement and physical delivery transactions, price discovery in milk would be expanded to many more market participants. This would also reduce the impact of spot market transactions on milk prices and may reduce price volatility. Additionally, reducing the role of spot markets on milk price discovery could provide some dairy manufacturers cover to enter the spot market on a more frequent or permanent basis – thereby improving volume and price discovery in the spot market. Doing so, however, could impact convergence of CME futures contracts that settle to USDA-announced prices.

Expanding mandatory price reporting should not be considered in a vacuum, and perhaps the products survey should be reconsidered, it could be expanded to other products or used for other purposes such as surveying the value of milk solids -- creating a real-life basis map for spot milk and milk solids. Maybe mandatory price reporting should not be used for regulating prices, but instead to facilitate price discovery in a competitively priced market. In either case, in considering an expansion of price reporting we must also contemplate other tweaks to the FMMO program designed to help modernize, simplify and improve milk pricing for the entire dairy supply chain.

Note: In January 2019, voting delegates to the American Farm Bureau Federation’s 100th annual meeting recommended to the AFBF board of directors that the organization convene a Farm Bureau- and producer-led coalition to review methods to restructure and modernize the current Federal Milk Marketing Order system. This article was prepared to inform that policy development effort. A background paper on CME dairy spot markets, including price settlement procedures and trading hours prepared for AFBF’s Federal Milk Marketing Order working group is available here.

Trending Topics

VIEW ALL