How Consumers Purchase Food Is Changing

TOPICS

Market IntelMegan Nelson

Economic Analyst

photo credit: Donnie Ray Jones, Used with Permission

Megan Nelson

Economic Analyst

USDA-Economic Research Service’s most recent update to the Food Expenditure Series revealed that U.S. consumers spent more than ever on food, with food purchases at restaurants and other similar establishments more prevalent than purchases for at-home consumption. Consumption patterns continue to change in the short term as the nation responds to social distancing guidelines, this article highlights the food expenditure for some of the impacted sectors.

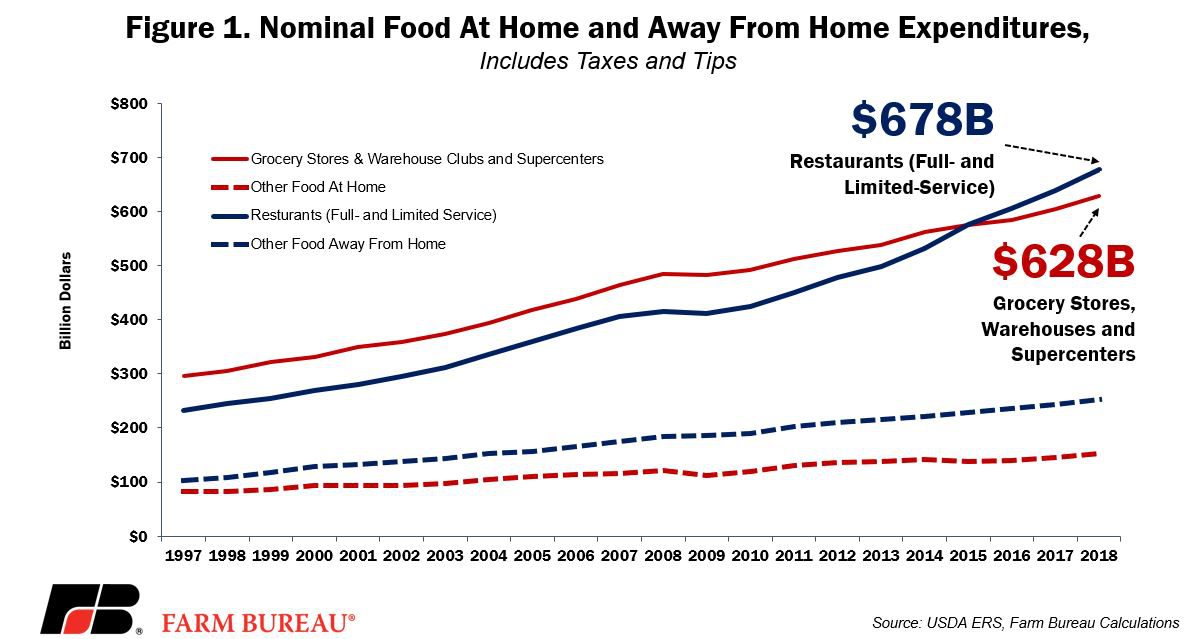

ERS’s statistics show consumers spent a record $1.7 trillion on food and beverages in 2018, up $78 billion, or nearly 5%, from the previous year. Of that total, food purchases in grocery stores, warehouse stores or supercenters totaled $628 billion, up $23 billion, or nearly 3%, from 2017. Food purchases in full-service and limited-service restaurants totaled $678 billion -- $50 billion more than sales in grocery-type outlets and up $39 billion, or nearly 6%, from the previous year. Food purchases in restaurants have exceeded those of grocery-type outlets every year since 2015.

The $931 billion consumers spent on overall food away from home expenditures in 2018 exceeded food at home expenditures by nearly $150 billion. As American consumers increasingly turn to the convenience of foods prepared outside the home, food-away-from-home spending has surged past food-at-home spending every year since 2010, e.g., U.S. Food Expenditures at Home and Abroad and Check, Please! More U.S. Consumers are Dining Out. Figure 1 highlights nominal food-at-home and food-away-from-home expenditures.

However, in the face of COVID-19’s self-distancing requirements as well as the pulling forward of demand, Americans are changing their food purchasing patterns and shifting back to food at home expenditures – at least temporarily.

Food-at-Home Expenditures

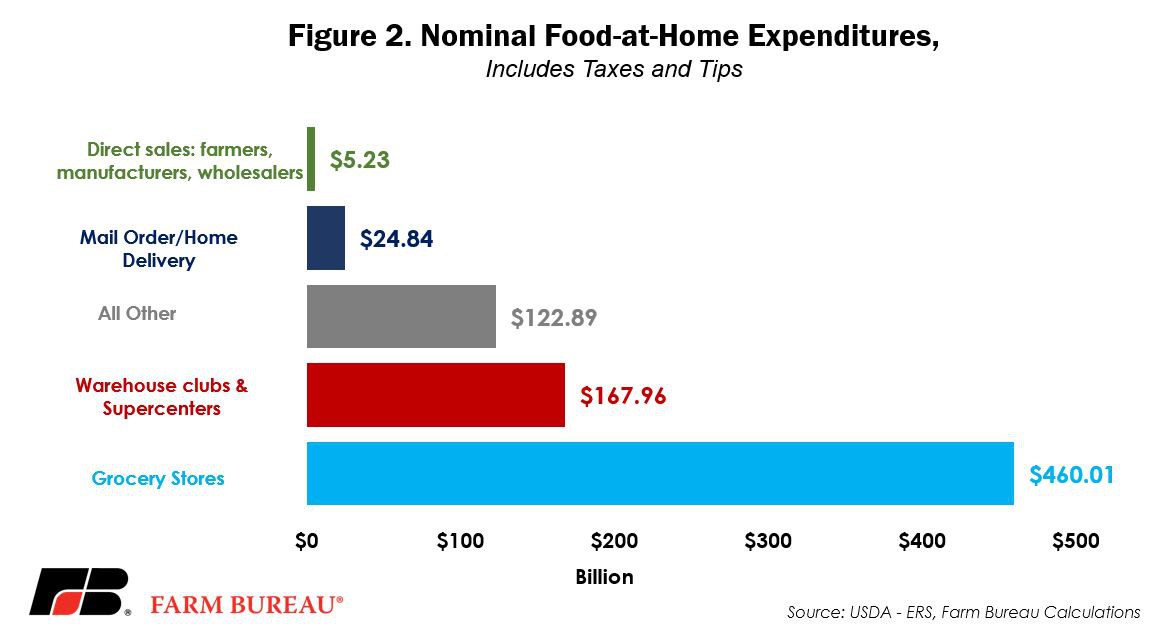

Total U.S. food-at-home expenditures reached $781 billion in 2018. USDA defines food at home expenditures as purchases of food where the final purchaser is the consumer, this includes food purchases from grocery stores, warehouses, convenience stores and farmers markets. Grocery store and warehouse clubs and supercenters purchases made up over 80%, or $628 billion, of all food-at-home purchases in 2018.

While U.S. food-at-home purchases have been steadily decreasing as a percentage of total food expenditures, total food-at-home purchases increased $30.3 billion, or 4%, from 2017 to 2018. The largest category increase in food-at-home purchases is seen in mail order and home delivery purchases, reaching $24.84 billion in 2018, increasing 9%, or nearly $2 billion, from 2017 levels. In contrast, direct-to-consumer food sales by farmers, manufacturers and wholesalers decreased 12%, or $713 million, from 2017 levels to $5.23 billion in 2018. Figure 2 details foo- at-home expenditures by location category in 2018.

Food Away from Home Spending

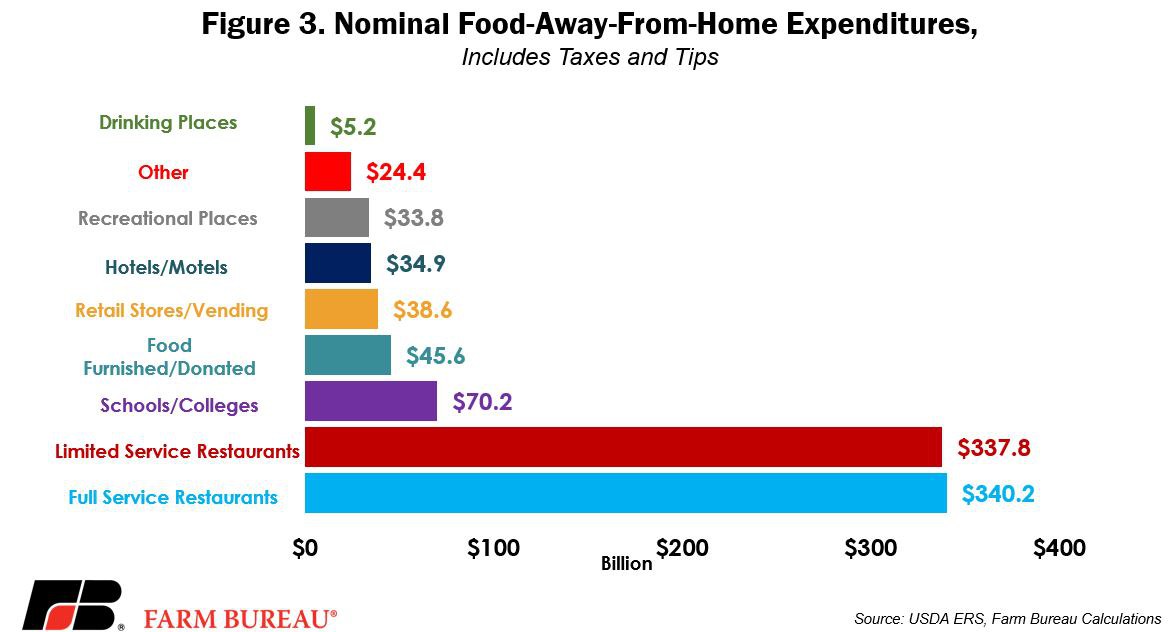

In 2018, U.S. consumers spent $931 billion on food away from home, such as meals or snacks supplied by commercial food service establishments. Food sales at restaurants, including full- and limited-service restaurants, accounted for 73% of all food-away-from-home spending, up nearly 30% from a decade prior. From 2000 to 2015, limited-service restaurants, or fast-casual restaurants, led most of the industry’s growth in sales and number of outlets. In 2016, limited-service restaurants surpassed full-service restaurants in dollars spent, further signaling dietary and food choice changes for Americans.

Aside from restaurant spending, other outlets where many Americans typically find reliable sources of readily available food include schools and colleges, hotels and motels, and recreational establishments. These establishments accounted for a collective 15%, or $139 billion, of food-away-from home purchases in 2018. Americans also make a substantial amount of food-away-from-home purchases through airlines. Included in the food furnished or donated spending category, airline services and other travel-related food purchases totaled $45 billion in 2018, up more than $1 billion, or 2%, from the prior year. Figure 3 details food-away-from home expenditures by location category in 2018.

Impact on Food Consumption

As the normal course of business in the U.S. continues to be disrupted by COVID-19, the way Americans access food will change. Current expectations are for the social distancing guidelines to extend into the second quarter, resulting in increased sales in grocery-type outlets and delivery from limited-service restaurants instead of full-service dining, schools and colleges, hotels and motels, airlines and recreational establishments. This likely will not be a one-to-one substitution of expenses as a portion of the food-away-from-home expenditures include tips and additional service charges associated with full-service restaurants.

To accommodate these changing consumption patterns many food processors are shifting their production lines to focus on cuts of chicken, beef and pork that are more marketable for home consumption, shelf-stable products and frozen food products, rather than food items more suitable for food away from home use. This is possible because of the flexibility of the U.S. food supply chain.

While the way consumers are purchasing food is changing, the availability of food is not in question. Consumers continue to have access to abundant supplies of food, as USDA in February projected record production of pork, poultry, dairy products and near-record beef production. Production of fruits, vegetables, feed grains and oilseeds are also expected to be robust.

Trending Topics

VIEW ALL