From Potatoes to Pork - Strong Demand Tightens Stored Commodity Stocks Across the Spectrum

TOPICS

Vegetables

photo credit: Alabama Farmers Federation, Used with Permission

Daniel Munch

Economist

COVID-19-induced market shifts continue to upend many aspects of the food supply chain, from widespread transportation hurdles complicating the movement of inputs and goods to the lingering pressures of underlying inflation on consumer purchasing behavior. USDA’s latest Cold Storage Report, released last Monday, reveals the impacts of these factors and others, such as the past year’s drought, on stores of some core food items. The monthly report, provided by USDA’s National Agricultural Statistics Service, shows the end-of-month volume of commodities in longer-term (30+ days) cooled storage throughout the U.S. An important market-moving report, it covers most commodities that require cold transport, ranging from eggs to fruits and vegetables to dairy and meat. The January 2022 report reflects the ending-year stocks for 2021.

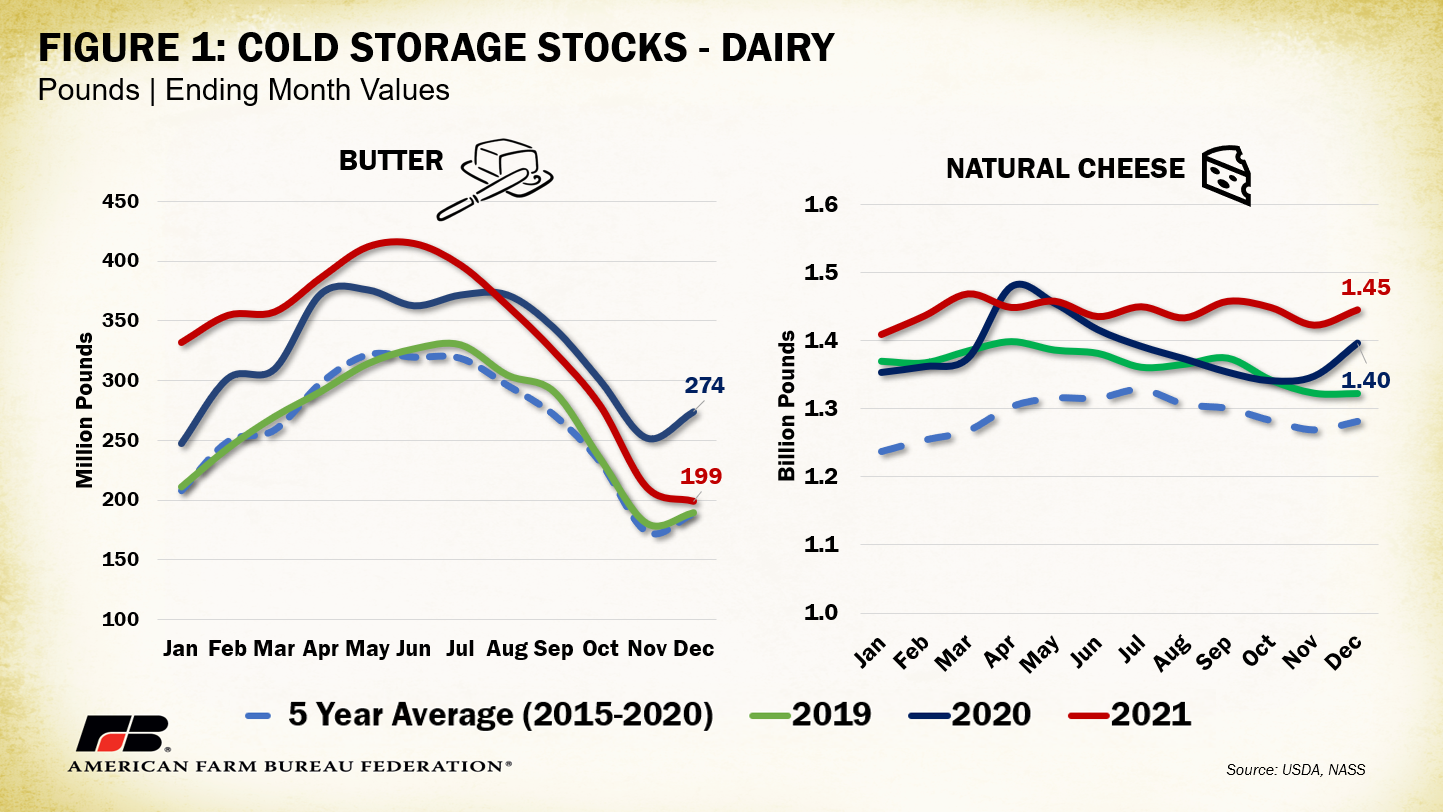

Dairy

Starting with dairy, cold stores of butter were 27% below 2020 levels but were still 5% above the 2015-2020 five-year average. The initial supply chain “turn-off” that occurred for many restaurants and institutions, like schools, meant we consumed less butter. In fact, unlike previous years, in 2020, the monthly market consumption of butter in the U.S., also referred to as domestic commercial disappearance, did not surpass ending commercial stocks. A return to business-as-usual market conditions established the expectation that cold stored butter volume would drop as restaurants re-opened and institutional usage returned. Indeed, we’ve experienced strong demand for butter lately, with near $3.00/lb CME group trading levels - the highest in six years and pushing the Class IV price upward and past its Class III counterpart. That said, butter stores are nowhere near their record lows of 10.8 million pounds back in 1975.

Chilled natural cheese stores, on the other hand, are one of the few commodities with a higher volume stored than last year by 3.5% and up 13% fromthe 2015-2020 five-year average . This may appear a surprising statistic given demand for natural cheeses cut from blocks jumped when consumer demand shifted almost wholly to retail outlets during 2020 and into much of 2021. Export demand from heavy cheese buyers like Mexico also remains elevated (+28% year over year). That said, the positive change in stored cheese is driven by the recent increase in block cheese processing capacity as new plants across the Upper Midwest came online, contributing to increased supply levels.

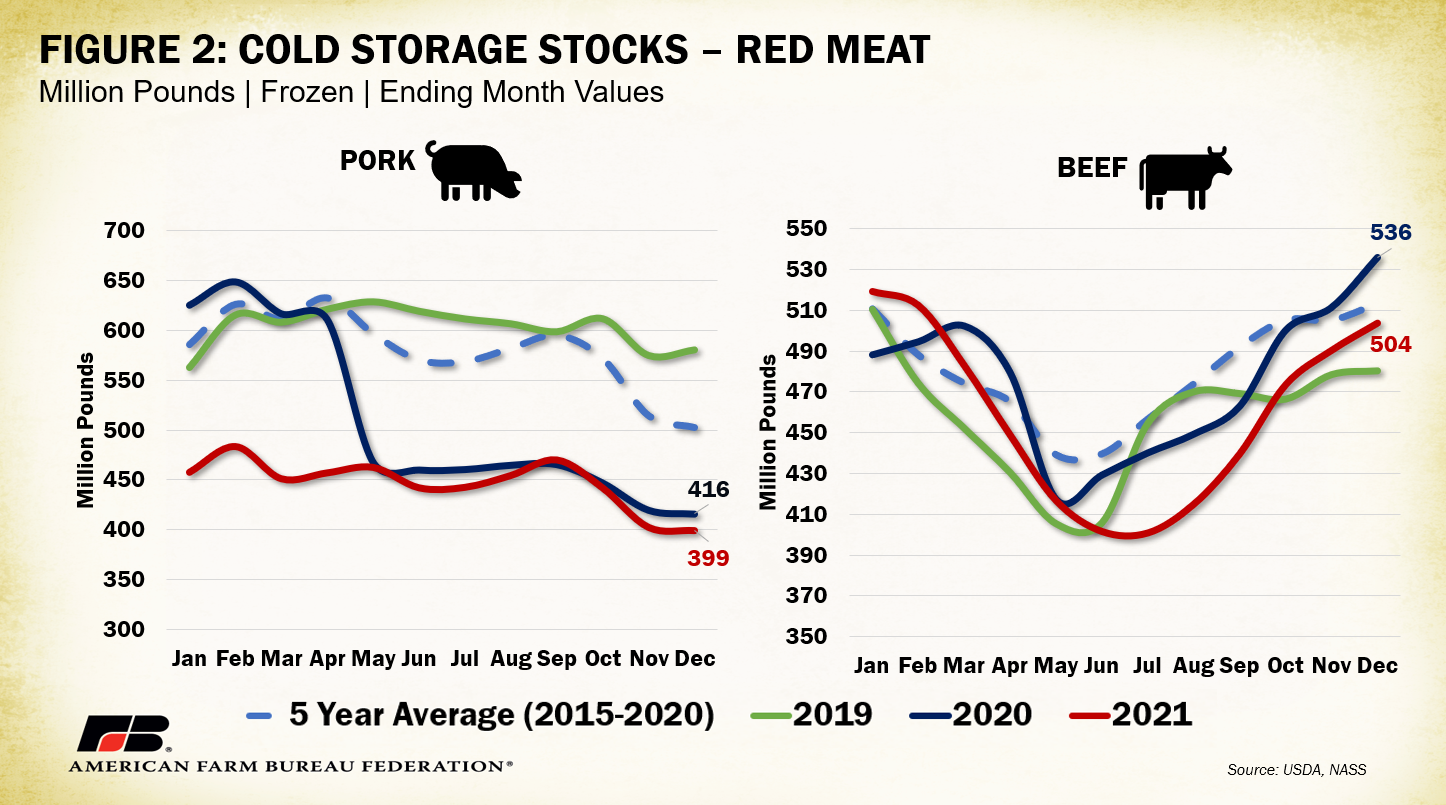

Red Meat

Moving on to frozen pork and beef, stored volumes are down 4% and 6%, respectively, from December 2020. Unlike dairy products, both also decreased compared to their 2015-2020 five-year average (-21% for pork and -2% for beef). At 399 million pounds, current frozen pork levels are 180 million pounds below 2019 and the lowest since August 2010, when frozen pork levels were 388 million pounds. As displayed in Figure 2, the drop in stored frozen pork occurred in line with the onset of COVID-19 in early 2020, when many processing plants were closed pressuring stored supplies as retail demand persisted. Since then, the market has not been able to build back to its pre-COVID storage levels, partially because of a tightening national herd and lower average hog weights. According to the December Quarterly Hogs and Pigs Report, inventory of all hogs and pigs was down 3.7% to 74.2 million head from 2020, which is the lowest since June 2018. Sows kept for breeding have increased by only 0.1% and the number of market hogs weighing in at 120 pounds or more dropped by 7.2% since quarter four of 2020. Paralleled by strong consumer and export demand, stored frozen pork volumes are likely to continue to contract until a more significant expansion in the breeding herd takes place. Otherwise, the price outlook for pork remains positive during an era of low supply.

The decline in frozen beef stores has a slightly different story. The drop in beef supplies during 2020 was not too out of the ordinary from normal seasonal declines, but beef had a much stronger recovery in the latter half of 2020 when compared to pork. When May slaughter rates of hogs and cattle dropped 35% between 2019 and 2020, due to processing plant closures and labor shortages, producers had to hold onto animals longer, driving up carcass weights as animals continued to gain. During 2020, average dressed weights of cattle increased 2.61% (about 23 pounds each) and hogs increased 1.67% (about 3.5 pounds each). When paired with stable cattle on feed increases in the second half of 2020, beef’s supply recovery is more apparent. More recently, in the latest Cattle on Feed report, cattle and calves on feed for the slaughter market were up 1% this January over January 2021- the second highest number since the series began in 1996. Placements in feedlots during December 2021 were 6% above 2020 at 1.96 million head. Though these numbers look strong for supply-side forces, some of these increases may be linked to heightened efforts to get feeders to market before facing continued abysmal winter forage conditions and high feed prices. The ability for producers to reap the benefits of heightened retail prices relies on the reduction of supply to increase farmer and rancher level negotiation potential, a likely outcome for 2022 given 2021 liquidation rates.

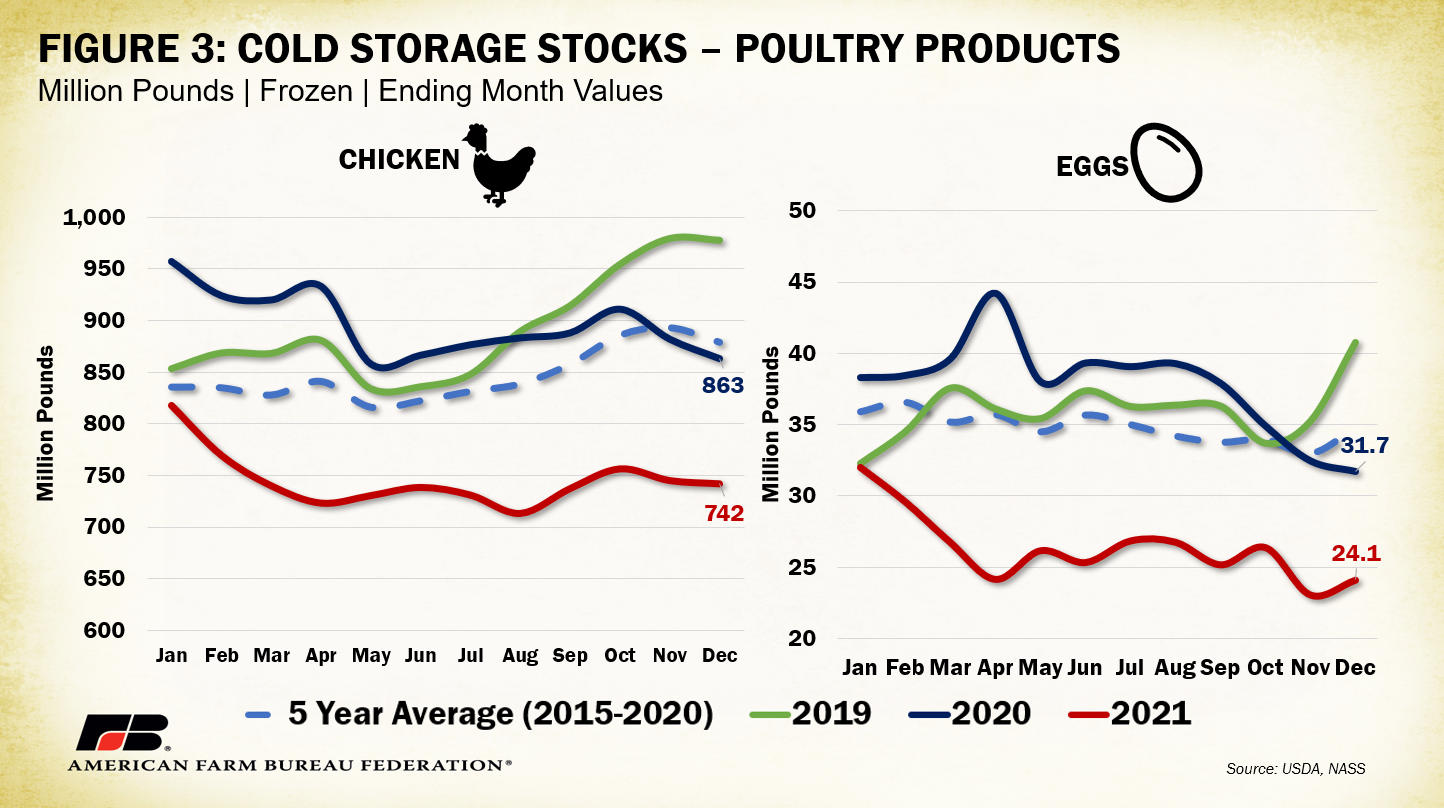

Poultry Products

Stores of frozen chicken checked in at 16% below both the 2020 and five-year 2015-2020 averages. Consumer demand for chicken has remained strong and increasingly so as inflation and other costly economic forces push consumers to substitute for cheaper protein options. Total cash receipts for broilers are expected up 50% between 2020 and 2021, a difference of $10 billion. Even with broiler production up 5% year over year and bird weights up 1%, supplies continue to dwindle, illustrating the intensity of consumption.

On the eggs side, cold storage stocks are down 24% from 2020 and 31% from the 2015-2020 average, similarly linked to strong consumer demand among all protein items but especially low-cost protein items. According to the January Chicken and Eggs report, December egg production was up 1% from 2020, with total layers up about 1.8 million to 392.7 million hens. Like broilers, future price prospects look strong for eggs under current economic conditions.

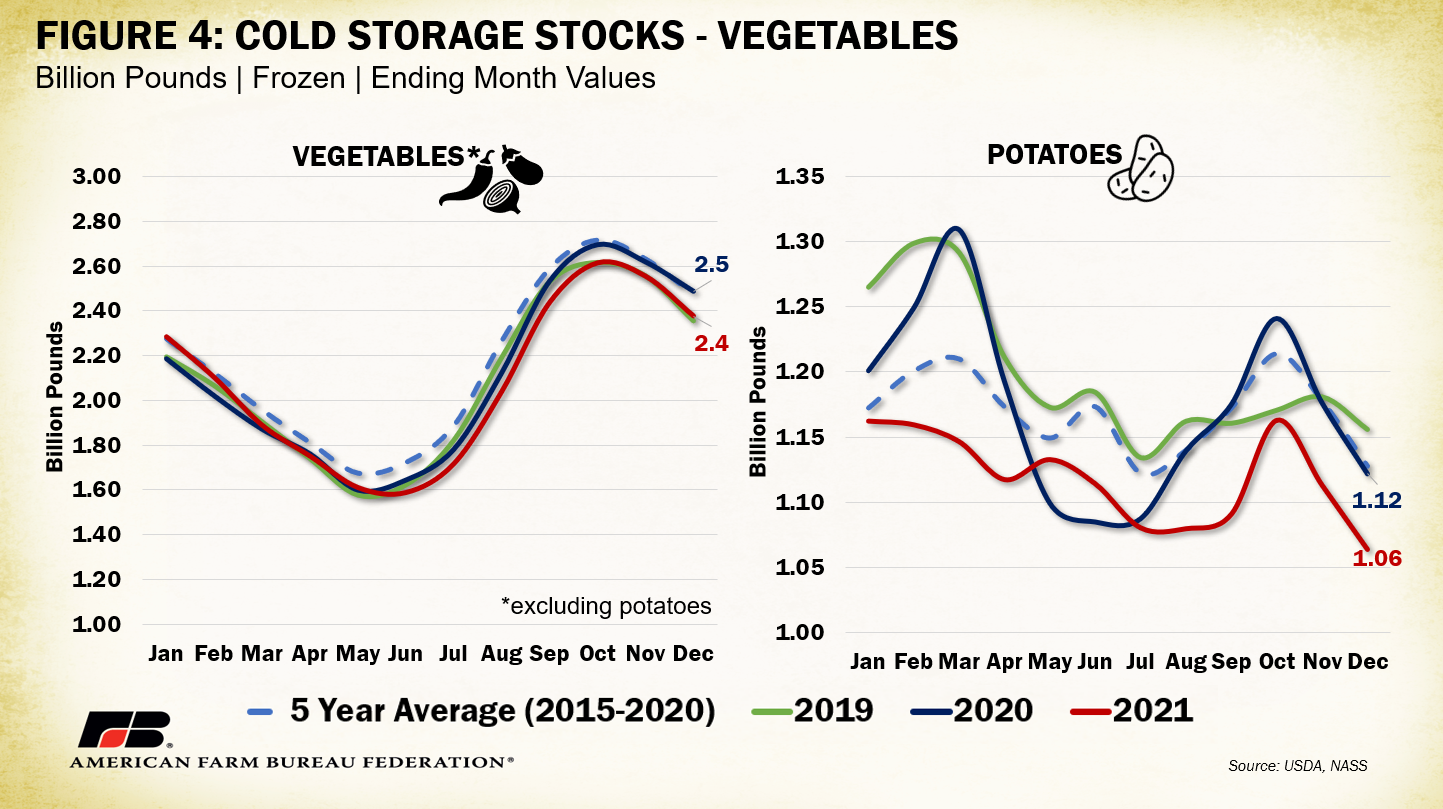

Vegetables & Fruit

Unlike the higher cash receipts received overall for livestock products and most row crops, total fruit and vegetable receipts are expected to drop about 10% each from 2020 or by just over $4 billion across both categories. For vegetables, this is linked to both an average reduction in prices received and lower volume produced from last year. The November Vegetable and Pulse Outlook found that despite dismal growing conditions in Western states courtesy of severe drought, shipping-point prices for fresh veggies averaged 18% below the 2020 average for the first nine months. On the utilized production side, processing vegetable production dropped 4.6% and dry beans, peas and lentils dropped over 35% with only fresh vegetables up by 3.5%. Lower prices have pushed a modest increase in retail shipments of vegetables, eating into some frozen stocks and leading to the 4% drop in year-over-year cold storage volumes and the five-year (2015-2020) average. As the yield impact of Western drought becomes more and more apparent across vegetable varieties, prices are expected to shift more positively.

Potatoes have been able to buck the price drop trend amongst vegetables. The 2% smaller crop from 2020 (a fourth consecutive annual decline) combined with strong North American and international processing demand lifted U.S. seasonal-average potato prices above $10/cwt for an average 14% price increase between 2020 and 2021. Drought in large potato-producing states like Washington and Idaho, which account for 55% of U.S. production, dropped their potato production rates by 9% and 7%, respectively. Paralleling production declines, potato stocks have dropped 5% from last year and 6% from the five-year (2015-2020) average. Record prices are expected into 2022 as demand continues to bite in a smaller supply.

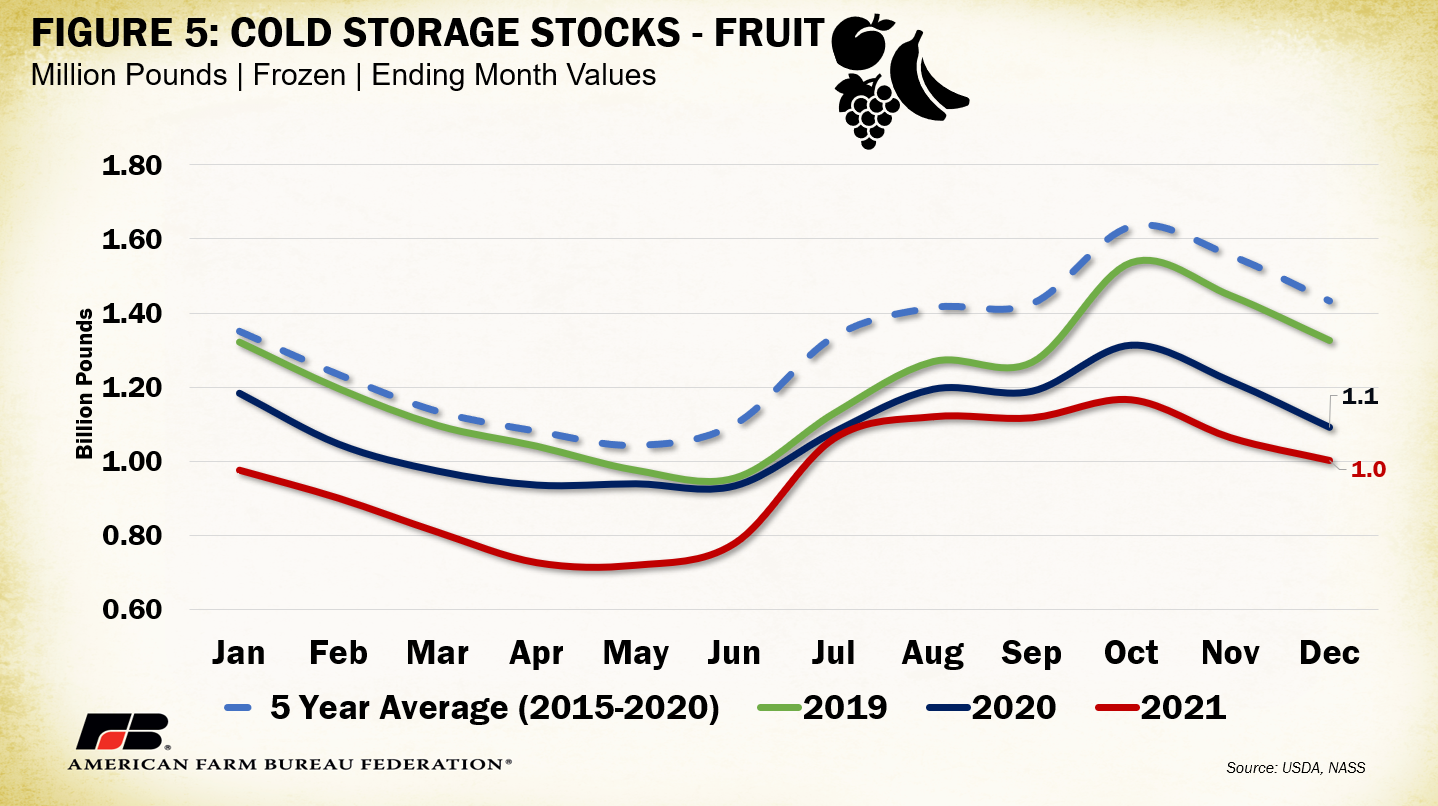

Fruit dynamics have been mixed on the price and production front. According to the most recent Fruit and Tree Nuts Outlook, citrus production across the country dropped 6% – with a 28-year low in Texas, equating to a 40% drop between 2020 and 2021. In Arizona, lemon production dropped 55%. Citrus greening disease, attrition in bearing acreage and high temperatures are to blame for these reductions. Oranges faced steep price declines (11%) year-over-year while grapefruit (+42%) and lemon (+52%) prices climbed. For non-citrus fruits, many, such as apples, peaches, cherries, cranberries, pears and grapes, were forecasted have stronger or stable production from last year, with non- drought areas offsetting regional losses. Prices for some fruits, such as strawberries (-34%) and peaches (-8%), dropped but were somewhat offset by increases in apples (+23%), grapes (+6%) and pears (+7%). Year-round demand for fresh and frozen fruit continues to increase as consumers focus on healthier lifestyles – especially amid continued viral spread concerns. Like vegetables, the average price outlook across fruits looks strong going into 2022 given supply and demand conditions. Correspondingly, frozen stocks of fruit remain 8% below 2020 levels and a whopping 30% below the five-year (2015-2020) average.

Across the specialty crops spectrum, reliance on foreign imports has increased, especially during periods of natural disasters, when unaffected competing countries have the upper hand on production conditions.

Conclusion

This past weekend, I ventured out for my once-a-month freezer load-up of meat, poultry and seafood and noticed completely empty shelves at two out of the three retail locations I shopped in Northern Virginia. Not an ounce of beef, pork, chicken or even salmon. Perhaps this was linked to vertical integration challenges within specific retail companies or connected to wider transportation shortfalls, in any case persistent supply chain failures were evident for many refrigerated items relied upon by consumers. The January Cold Storage Report reveals drops in long-term stores of many of these core food products. Beyond supply chain snags, some drops, such as pork and butter, are still linked to initial disruptions from COVID-19, while others, like fruits and vegetables, have been more connected to weather-related supply pressures. Combined with high demand and the already inflated cost of food, weakened stores of frozen and chilled goods compounds the likelihood for high prices into the foreseeable future. Though prices may look great at face value, farm-level take-home margins may be much less appealing after costly inputs and inflation are accounted for.

Trending Topics

VIEW ALL