Farm Bureau Survey: Farmers Cautiously Optimistic About Future Farm Economy

TOPICS

Farm Economy

photo credit: AFBF Photo, Mike Tomko

John Newton, Ph.D.

Former AFBF Economist

USDA recently projected net farm income, a broad measure of farm profitability, to rise 3% in 2020 to the highest level since 2014. In fact, USDA data suggests that farm profitability has been on the rise since 2016, e.g., A Tale of Two Farm Incomes. Moreover, at USDA’s 96th annual Agricultural Outlook Forum USDA projected higher crop prices for soybeans, wheat and cotton (not for corn) and higher livestock prices for cattle, pork, dairy and some poultry products (not broilers).

In order to provide additional perspective on the farm economy, the American Farm Bureau Federation conducted an informal online survey between Jan. 8 and Feb. 14. Nearly 300 respondents completed the survey with high participation across the Midwest. Nearly 80% of the respondents identified as a farmer or rancher and the primary farming activities represented included crops, cattle and calves, followed by dairy, other livestock and specialty crops.

Farm Economy Survey Results

Survey participants were asked to provide their short-run and long-run perspectives on commodity prices and costs, farm profitability, land values and cash rents, farm debt and farm investment decisions.

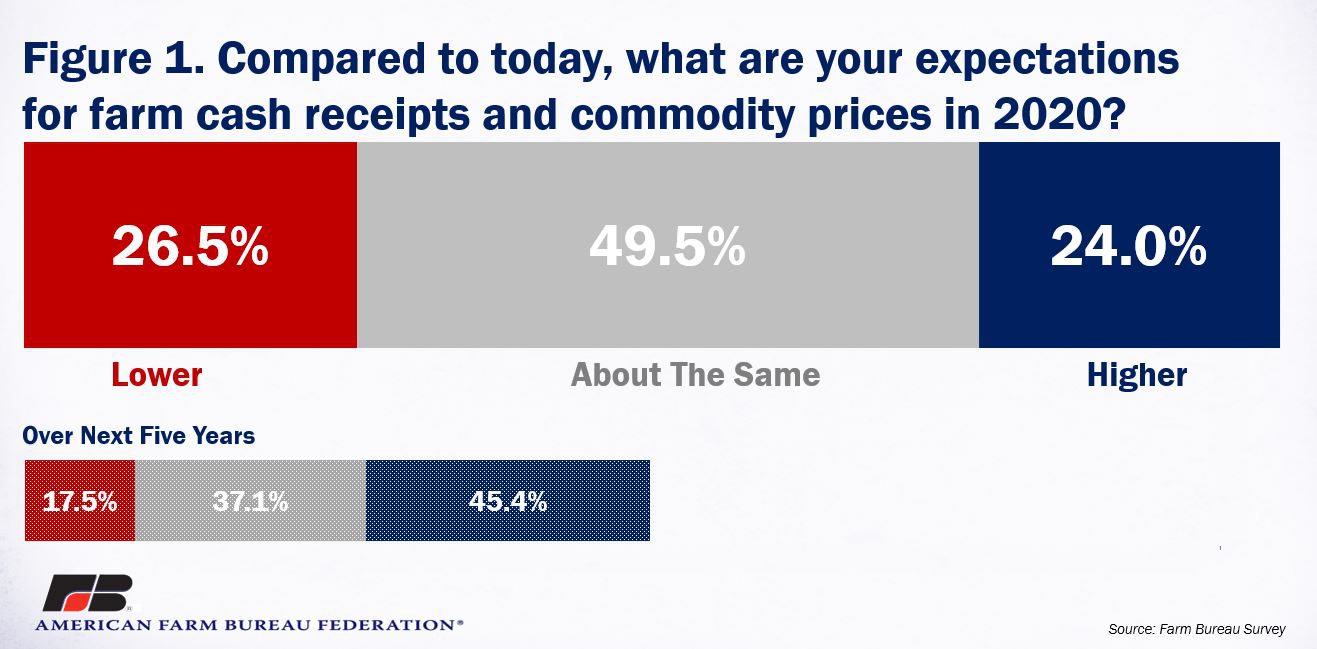

Commodity Prices

Less than 25% of the survey respondents expect commodity prices to be higher in 2020 than in 2019. Nearly 50% expect prices to be about the same and more than 26% expect commodity prices to be lower in 2020. These results align with USDA’s recent price projections for slight improvements in most crop and livestock prices in 2020. Over the next five years, however, survey participants had a more favorable outlook on commodity prices, with more than 45% expecting higher prices.

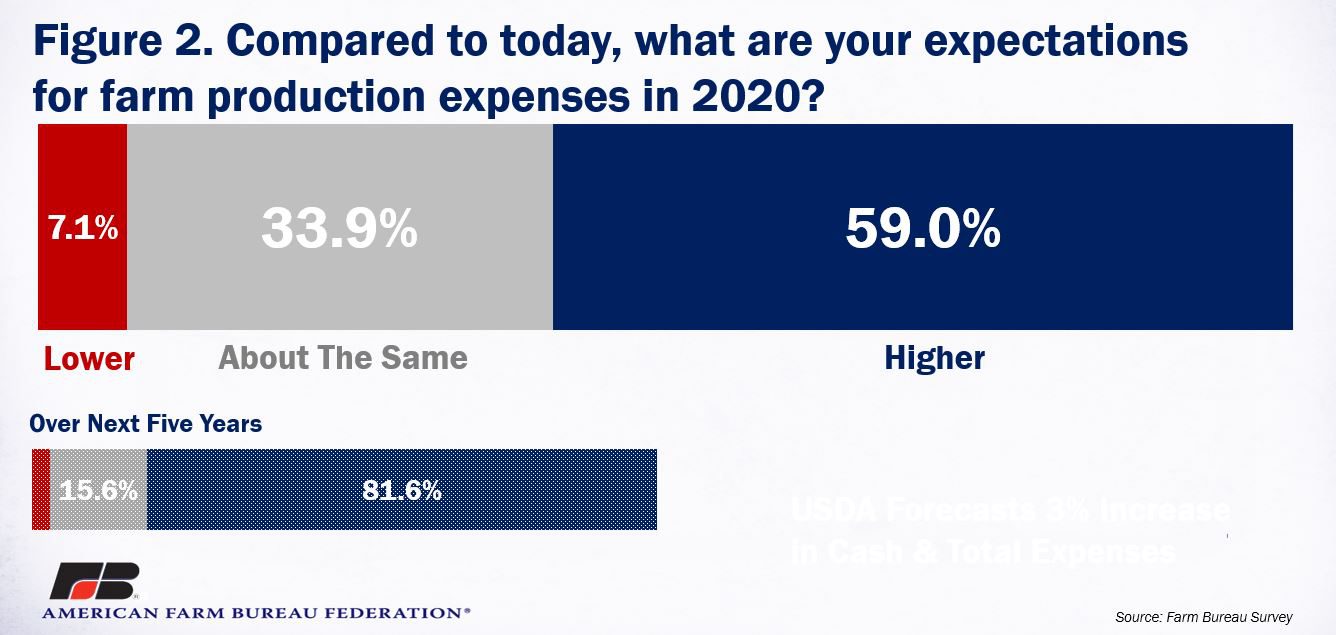

Production Expenses

USDA currently projects total production expenses to increase by more than $10 billion, or 3%, in 2020 to $354.7 billion. Nearly 60% of our survey respondents agreed that farm production expenses will rise in 2020, while only 7% expect farm production expenses to fall this year. Over the next five years, nearly 82% of the survey respondents expect farm production expenses to fall. Less than 3% of respondents expect production expenses to fall over the next five years. For context, farm production expenses have increased by 16% over the last decade and have increased in seven out of the last 10 years. Higher production costs are a near certainty in agriculture.

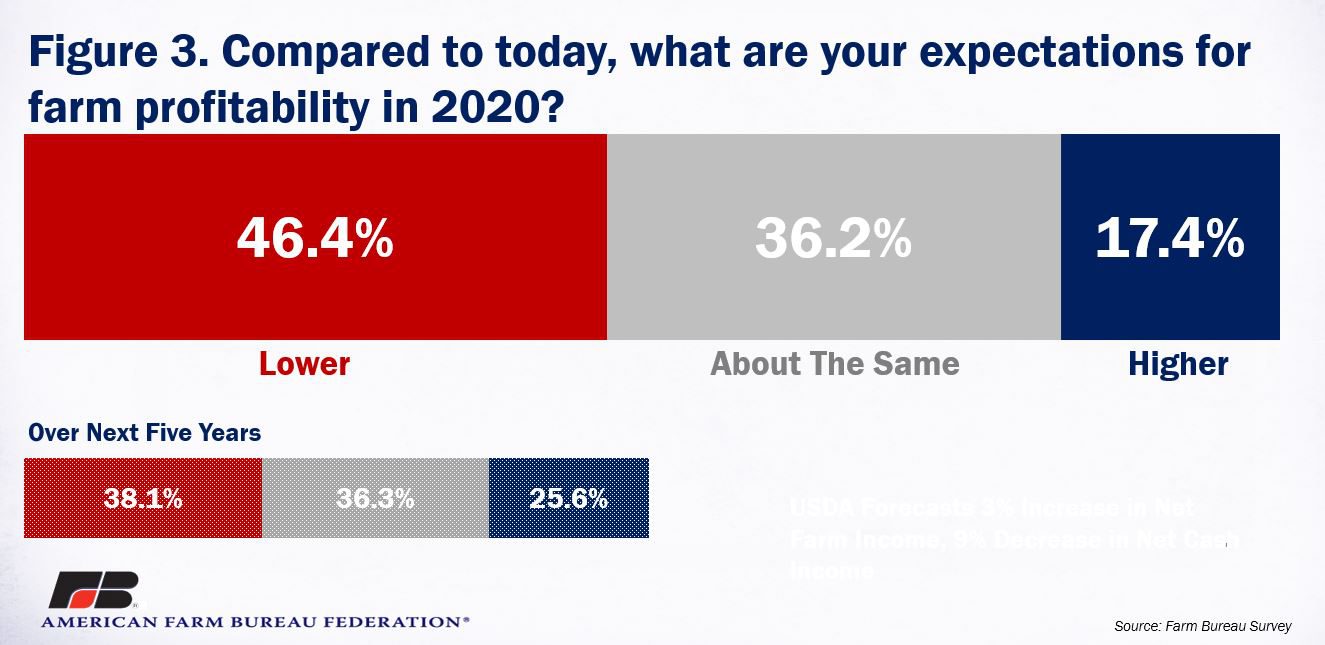

Farm Profitability

While USDA is forecasting a slight improvement in prices and farm profitability in 2020, nearly 50% of the survey respondents expect farm profitability to be lower in 2020. Approximately 36% expect profitability to be about the same and only 17% expect higher profits. A third round of trade assistance is not expected in 2020, and as a result, USDA is projecting net cash income – which does not include inventory adjustments -- to fall by 9%, or $10.9 billion, in 2020. This forecast more closely aligns with the survey responses. Over the next five years survey respondents were slightly more optimistic, with only 38% expecting lower profitability and more than a quarter expecting higher profitability.

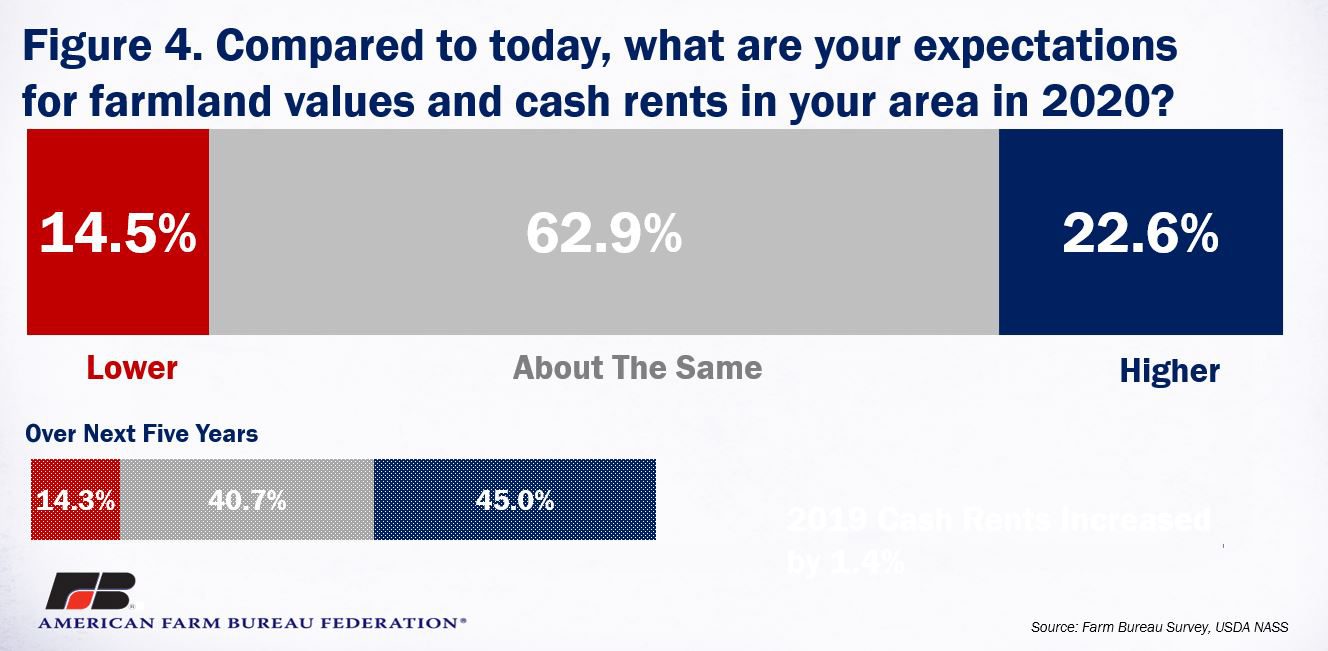

Farmland Values and Cash Rents

Aside from production costs increasing, one other certainty in agriculture is that land prices and cash rents are going up. The value of farm assets in 2020 is currently forecast at $3.1 trillion, and since 2006, farm asset values have increased by 64%. Over the last 30 years, farm asset values have only declined three times – in 2002, in 2009 and in 2015, which each coinciding with a downward shock in net farm income. Moreover, cash rental rates have mostly kept pace with inflation and increased by 1.4% in 2019, e.g., Reviewing 2019 County-Level Cash Rents.

A majority of survey respondents expect cash rents and farmland values to remain the same in 2020, while 45% expect farmland values and cash rents to increase over the next five years. Only 14% of respondents expect farmland values and cash rents to decline in 2020 and over the next five years.

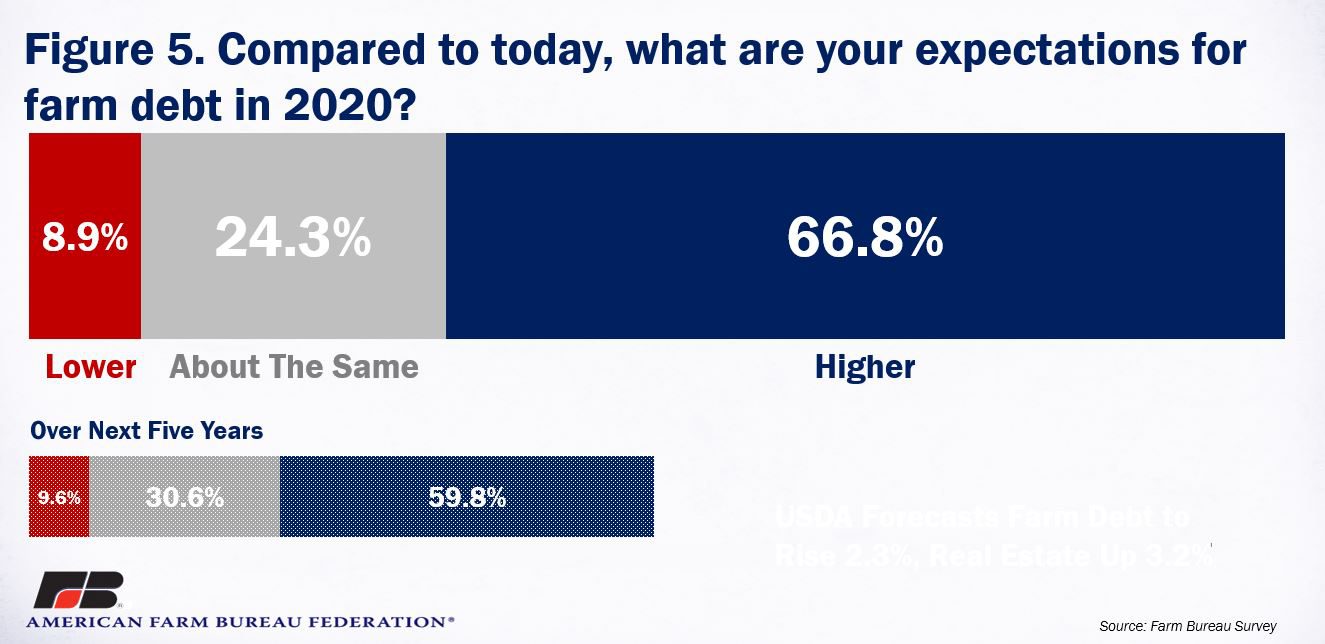

Farm Debt

U.S. farm debt is projected to be a record-high $425 billion in 2020, and real estate debt is projected to be a record-high $265 billion in both nominal and real dollars. Moreover, farm debt has increased for 17 consecutive years, declining only once over the last 20 years. A large majority of survey respondents, nearly 67%, expect farm debt to rise in 2020 and nearly 60% expect farm debt to increase over the next five years. Importantly, in the short-run less than 9% of respondents expect farm debt to decline and in the longer-run less than 10% of respondents expect debt to decline.

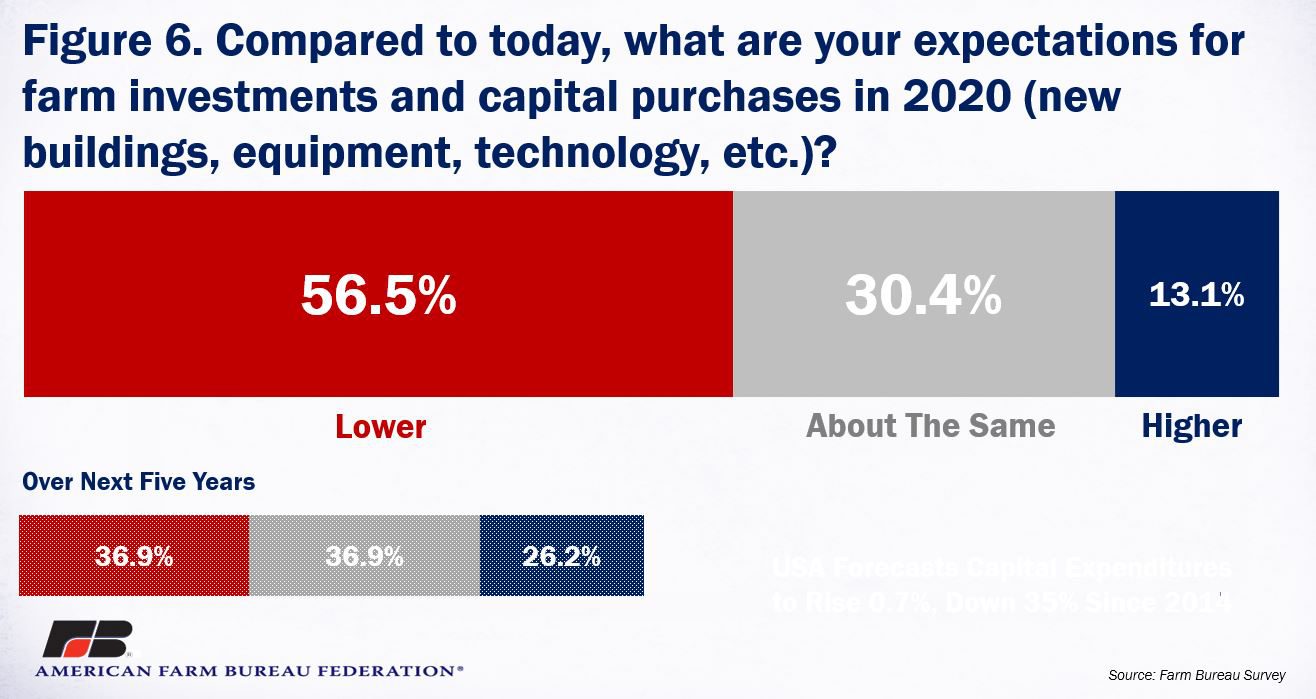

Farm Investments

A key component of a strong farm economy is re-investment in rural communities. When farm income is strong, farmers are more likely to make capital purchases and investments such as buying new farm machinery or expanding on-farm storage capacity. This drives employment in their communities and has a multiplier effect on the farm and rural economies.

According to USDA’s Economic Research Service, capital expenditures on vehicles and machinery were a record-high $33 billion in 2014, and since that point have fallen by 36%, or nearly $12 billion. During 2020, farm expenditures on vehicles and machinery are expected to fall slightly to $21 billion. This aligns with survey responses in which more than 56% of respondents indicated farm investments and capital purchases would decline in 2020. Only 13% of respondents expect to make additional capital investments in 2020. Over the next five years, however, more than a quarter of respondents expect to make additional capital investments.

Summary

American Farm Bureau Federation conducted an informal online survey to evaluate producers’ expectations on several farm economy indicators for 2020 and over the next five years. Approximately 83% of farmers and ranchers surveyed expect farm profitability to be lower or about the same in 2020 – despite a Phase 1 agreement with China, announced during the survey period, and enhanced trade opportunities with Canada, Mexico and Japan. Despite their outlook on the farm economy, a majority of surveyed farmers expect land values and cash rents to hold their value in 2020 and over the next five years.

Many farmers are cautiously optimistic that recent news on the trade front will manifest itself through higher export volumes and ultimately improved farm profitability. Until then, farmers are reluctant to make significant investments in buildings, machinery or equipment. Accordingly, more than 86% of respondents expect to keep their capital investments to a minimum in 2020, and nearly 75% were unlikely to expand investments in building, equipment or machinery over the next five years.

Nearly 300 farmers, ranchers and agricultural industry stakeholders completed the survey from Jan. 8 to Feb. 14.

Trending Topics

VIEW ALL