Examining Cattle Transactions in the U.S.

TOPICS

Market IntelMichael Nepveux

Former AFBF Economist

photo credit: Chris Peterson, Used With Permission

Michael Nepveux

Former AFBF Economist

In recent months, there have been many conversations about how cattle are and should be marketed in the U.S. Some discussion has focused on the optimal level of cattle transactions through certain marketing channels in order to facilitate greater price discovery. In order to more fully understand these conversations and their implications, it is helpful to take a step back and look at how cattle are currently marketed in this country as well as the implications of mandating how private companies make business decisions.

The Current Picture

There are a variety of market transactions through which cattle are marketed in the U.S. Thankfully, due to Livestock Mandatory Reporting, we have the data to be able to understand how these animals change hands and how these methods have evolved over time. There are four primary transaction types reported by USDA through LMR.

Negotiated purchases, often referred to as the “spot” or “cash” market, are where the price is determined through buyer and seller interaction on the day of sale. Forward contract purchases are an agreement for the purchase of cattle executed in advance of slaughter, where the base price is established. Negotiated grid is where the base price is negotiated between buyer and seller and is known at the time the agreement is made. The final net price is determined by applying a series of premiums and discounts based on carcass performance after slaughter. Formula purchases is the advance commitment of cattle for slaughter by any means other than negotiated, negotiated grid or forward contract. Formula pricing uses a pricing mechanism in which the price is often not known until a future date.

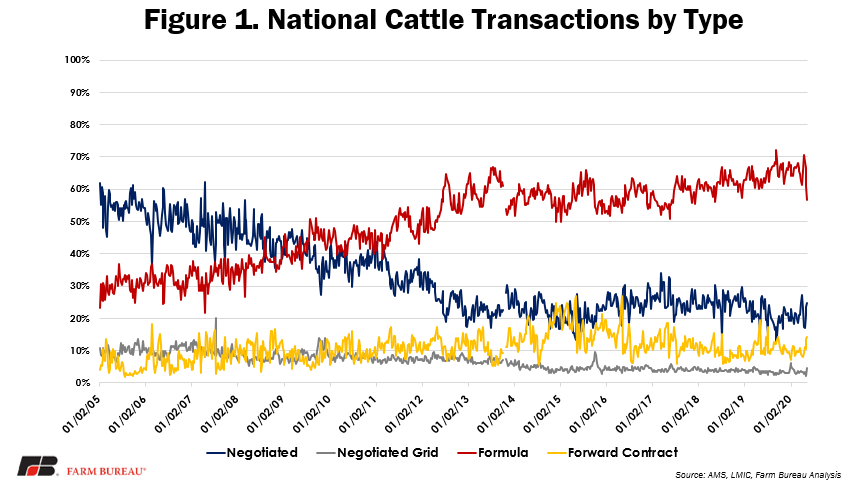

Over the past 15 years, we have seen a dramatic shift in the way cattle are marketed. In the mid-2000s, roughly 50%-60% of cattle sold were through the negotiated market. Over time, this method of marketing fed cattle has declined and been replaced by formula transactions. We have seen the negotiated market fall from 50%-60% of transactions to roughly 20%, and at the same time we have seen formula transactions increase from roughly 30% to 60%-70% of transactions. Over that same period, we have seen a slight decline in negotiated grid transactions and a fluctuating volume of forward contract transactions.

Live vs. Dressed Marketing

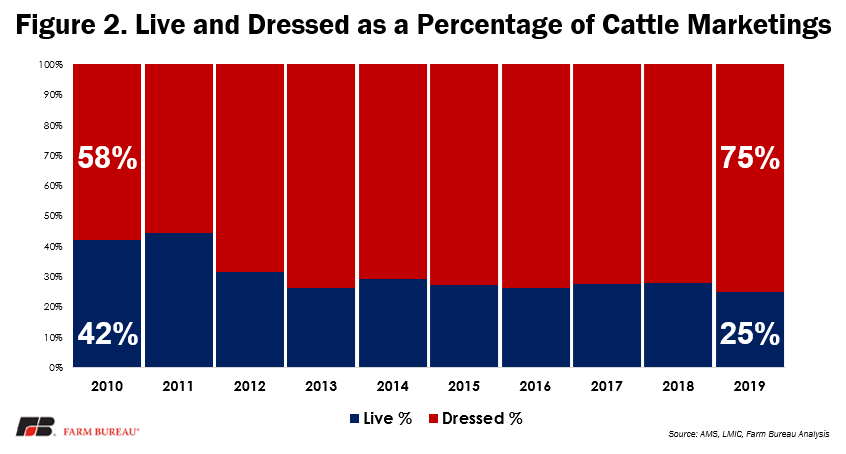

Cattle can also be marketed on a live or dressed (carcass) basis. Over the previous 10 years, we have seen a moderate shift even further away from live marketing to dressed marketing. In 2010, just under 60% of fed cattle transactions were on a dressed basis while just over 40% of transactions were on a live basis. Last year the percentage of dressed transactions had increased to 75% and the percentage of transactions on a live basis had declined to 25%.

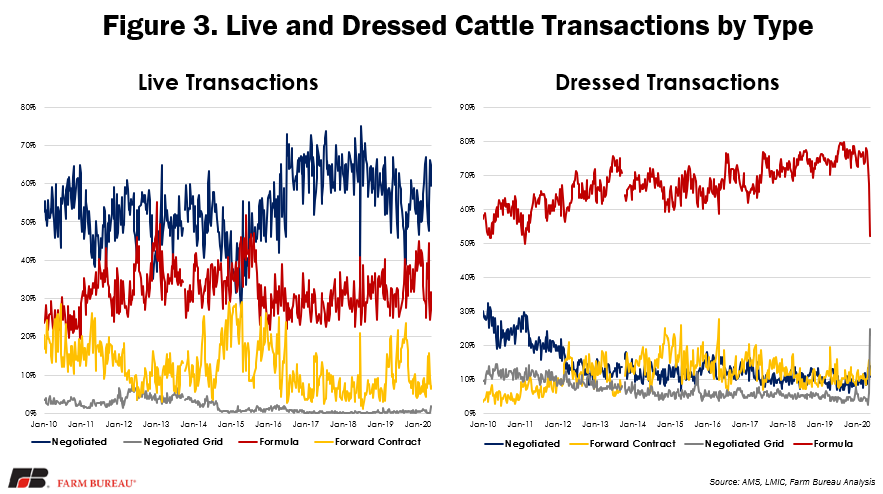

There is also significant variation in the types of transactions within each of these marketing channels. Live cattle transactions have traditionally been dominated by negotiated trade – accounting for over 60% of transactions – and to some extent formula transactions. These two are followed by forward contract transactions, while negotiated grid has maintained a miniscule share of the trade. Dressed marketing is very much dominated by formula transactions. Given the large share of cattle that are sold on a dressed basis, and the fact that dressed cattle are mostly sold through formula pricing, the end result is reflected in Figure 1 with formula making up the majority of transactions for all cattle. One interesting development is the sharp increase in negotiated grid transactions at the expense of formula contracts. From January through April 2020, the share of negotiated grid transactions for dressed cattle marketings averaged around 4% of the total. During the most recent two weeks for which we have data, that share jumped to 24% and 23% of the total.

Regional Differences in Transactions

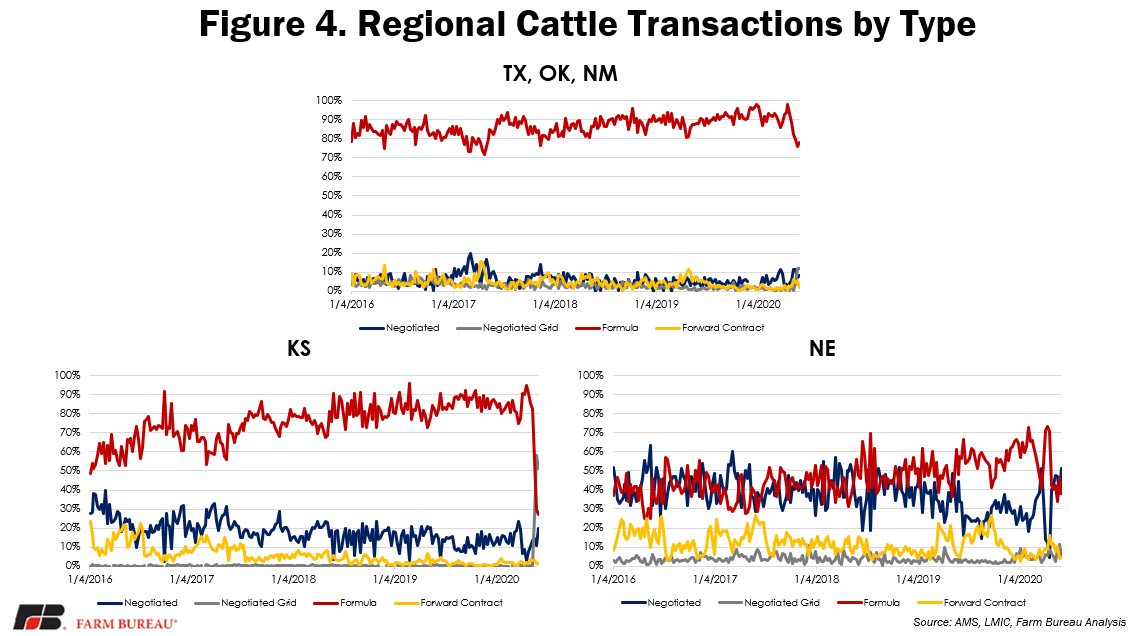

It is also important to understand that types of transactions vary by market regionally. Negotiated trade is more common in certain states, such as Nebraska, which have seen its negotiated percentage range from 30-60% in recent years. Other states typically have very little negotiated trade. In Texas and Oklahoma, for example, negotiated trade accounts for only 5-8% of cattle transactions. These discrepancies between regions contrast with the national picture, where we see negotiated trade around 20-23%.

AFBF Supports Producers’ Freedom to Enter into AMAs

To maintain producers’ freedom to enter into progressive, value-added cattle pricing arrangements and contracts, AFBF delegates oppose a mandatory minimum for negotiated cattle slaughter. There can be no doubt that mandates on negotiated cash trade ultimately limit the use of AMAs. While more negotiated trade would further bolster price discovery, a minimum negotiated trade threshold means that the federal government must monitor and maintain the minimum, inviting further government intrusion into the industry. Furthermore, this additional regulation likely won’t solve the problems it is purported to solve and could potentially result in negative consequences for the industry.

We support rights of producers and packers to enter into formula pricing, grid pricing and other marketing arrangements and contract relationships.

AFBF Policy

A key point to remember when discussing the optimal level of negotiated transactions is that PRICE DISCOVERY is not the same as PRICE DETERMINATION. While enhanced price discovery is a good thing, it does not necessarily mean it will result in higher prices (as many proponents of minimum thresholds contend). It is critical to note that the black swan event that is the COVID-19 pandemic and its impact on our country’s economy is an unprecedented exogenous shock to the overall food system and supply chain. No amount of negotiated trade would provide relief from supply chain challenges of this magnitude.

The abundant research by academic faculty at various land-grant institutions on the costs and benefits of AMAs and the impacts of mandatory minimum negotiated trading volumes show that limiting the use of AMAs by the beef industry will decrease efficiency, increase processing and marketing costs, and could potentially reduce beef product quality. One of the most comprehensive research undertakings was the USDA GIPSA RTI Livestock and Meat Marketing Study (LMMS). The six-volume, peer-reviewed report, which represents the work of 30 researchers and nearly three years of effort, indicates that there are almost no benefits to a mandatory minimum level of negotiated transactions. Instead, according to the study, a mandatory minimum level of negotiated transactions could create considerable costs due to lost efficiency and product quality, costs largely borne by cow/calf producers and consumers. In addition, a recent white paper by Colorado State University’s Dr. Koontz indicates a mandatory policy of 50% minimum negotiated cash transactions would result in a $2.5 billion loss to the industry in the first year, and an overall loss of $16 billion over 10 years.

Summary

There are many conversations happening in the countryside about how cattle are marketed in the U.S. Many of these conversations have focused on establishing a minimum threshold for certain types of cattle transactions. We can and should promote a more robust price discovery system, but not at the expense of producers’ ability to utilize value-based, consumer-driven marketing arrangements. AFBF’s producer members realize that producers, not the federal government, know the best course of action for their individual operations and that there is no easy one-size-fits-all solution.