EPA Lowers Proposed Volume Standards for RFS

photo credit: Mark Stebnicki, North Carolina Farm Bureau

John Newton, Ph.D.

Former AFBF Economist

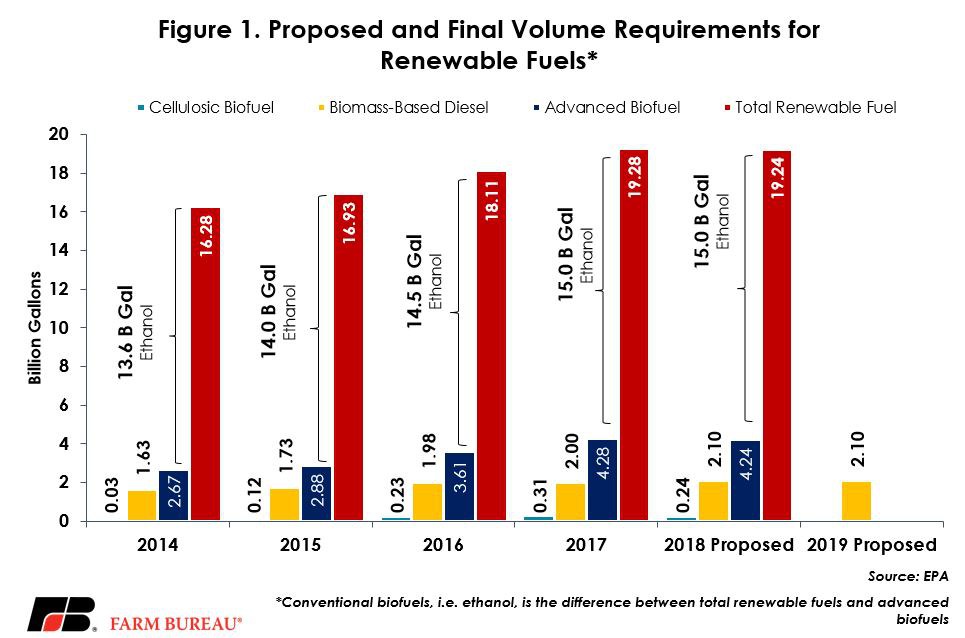

On July 5, 2017, the Environmental Protection Agency released Proposed Volume Standards for 2018, and the Biomass-Based Diesel Volume for 2019. This proposal includes volume requirements for cellulosic biofuel, advanced biofuel, biomass-based diesel, and total renewable fuel for 2018. The 2018 proposed volume requirement for total renewable fuel is 19.24 billion gallons, down 40 million gallons from the 2017 volume standards and well below the lofty goal of 26 billion gallons set in the Renewable Fuel Standard statute.

Included in the 2018 proposed volumes are reductions in the volume requirements for advanced biofuels by 40 million gallons and cellulosic biofuel by 73 million gallons. Biomass-based biodiesel volumes were proposed at 2.1 billion gallons for both 2018 and 2019. Importantly, the 2018 biofuel mandate leaves untouched 15 billion gallons of conventional biofuels, i.e. corn-based ethanol, required under statutory levels. Figure 1 highlights the proposed and final volume requirements from 2014 to 2019.

Advanced Biofuel Volumes Lower

EPA estimated reasonably attainable volumes of advanced biofuels at 4.27 billion gallons, 30 million gallons higher than the 2017 final level. The sources of these advanced biofuels included cellulosic biofuel, advanced biofuel, renewable diesel, imported sugarcane ethanol and other advanced biofuels. The benefits of increasing the advanced biofuel volumes would have included reduced greenhouse gas emissions and increased energy security.

In prior years, these benefits were included as justification for backfilling non-cellulosic volumes with biomass-based diesel and advanced biofuel. This year, the environmental and energy security benefits associated with backfilling non-cellulosic volumes were weighted against the costs of procuring sugarcane ethanol and soybean-based biodiesel – placing a greater emphasis on cost considerations and used as justification to reduce volumes.

EPA has statutory waiver authority to reduce the regulatory biofuel volumes that apply to gasoline and diesel transportation fuel produced or imported into the U.S. EPA cited the costs and marginal benefits associated with displacing petroleum-based fuels as rational in foregoing the benefit achieved by increasing the advanced biofuel requirement. For example, the costs of soybean biodiesel were estimated to range from $0.83 to $1.13 per ethanol-equivalent gallon of diesel displaced and were estimated to be higher than the costs of the petroleum fuels. Based on this cost-benefit analysis, the EPA recommended reducing the advanced biofuel volume to 4.24 billion gallons, a reduction of 40 million gallons from 2017.

Implications for Soybean Oil and Soybeans

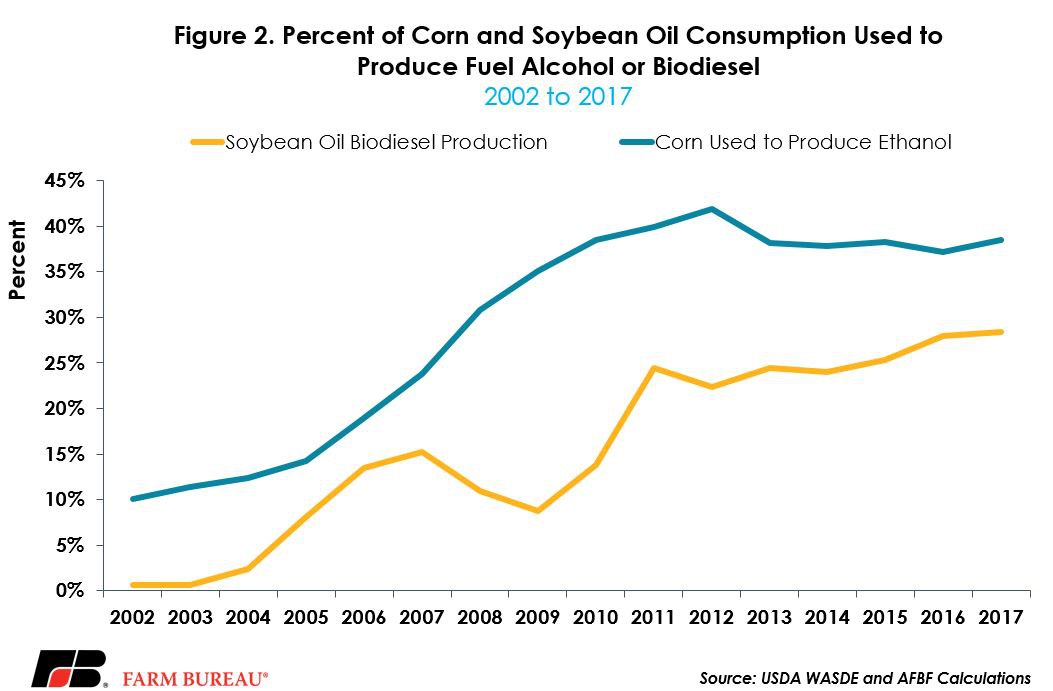

Following the proposed rule, Chicago Mercantile Exchange soybean oil futures opened 1 percent lower, and average 33 to 34 cents for 2017 and 2018 contracts. Biodiesel production made from methyl ester is now the second-largest consumption category of soybean oil behind food, feed and other industrial uses. During the 2017/18 marketing year, USDA projects 6.45 billion pounds of soybean oil will be used to produce biodiesel, up 219 percent over the last decade. The use of soybean oil for biodiesel production, as a percent of total consumption, has followed a similar path as the use of corn for ethanol production, Figure 2.

The proposed change in the advanced biofuels requirements was slightly bearish given that this 40-million-gallon reduction comes after an increase of 730 million gallons in 2016 and an increase of 670 million gallons in 2017. The prior two adjustments sent a market signal that additional production was needed, and the most recent RFS proposal puts the brakes on those historical signals.

While 40 million gallons is a minor change from prior-year levels it will impact the soybean oil balance sheet and prices. The next opportunity to incorporate these new regulatory parameters into crop balance sheets is the July 12, 2017, World Agricultural Supply and Demand Estimates. Following last year’s final rule, USDA recognized the impact of the RFS on soybean oil consumption and raised biodiesel production from methyl ester by 250 million pounds to 6.2 billion pounds in 2016/17, an increase of 9.3 percent year-over-year. USDA is currently projecting a 4 percent increase in biodiesel production for the 2017/18 marketing year. This total could be revised lower in upcoming WASDE reports, ultimately increasing soybean oil ending stocks and lowering prices from the projected level of 30 cents to 34 cents per pound.

Advanced biodiesel requirements have had the desired effect of boosting biodiesel production from methyl ester. This consumption category represents nearly 30 percent of the domestic use of soybean oil and will continue to play a factor in crushing demand going forward. While the U.S. continues to crush soybeans for meal, the regulatory demand for oil provided an economic incentive for crushing to compete with exports – the largest consumption category for soybeans. With ample supplies of soybeans expected in 2017/18, lower demand for soybean oil as a non-cellulosic backfill could ultimately result in lower soybean crushing and higher ending stocks – potentially pushing farm-gate prices for soybeans lower than the current projection of $9.30 per bushel.

Trending Topics

VIEW ALL