De-Pooling and Record-Large Negative PPDs Continue Into July

TOPICS

Federal Milk Marketing Order

photo credit: Mark Stebnicki, North Carolina Farm Bureau

John Newton, Ph.D.

Chief Economist

On the back of COVID-19-related price shocks and a record-high cheese price, the July Class I milk price was nearly $2.60 per hundredweight, or 13%, below where it would have been prior to a 2018 farm bill change, spurring the withholding of 8-plus billion pounds of milk over two months, a 32% reduction from the prior year, from Federal Milk Marketing Order revenue sharing pools across the county.

As a result, FMMO revenue sharing pools were short $527 million in June and $667 million in July, for a combined $1.2 billion. This shortfall caused record-low FMMO minimum milk prices across the U.S. that showed up in dairy farmers’ milk checks as negative producer price differentials The PPD in California, for example, amounted to nearly -$10 per hundredweight for July. Put simply, most dairy farmers are not happy. To make matters worse, public and private risk management tools were unable to protect against these record-large milk check deductions.

De-Pooling and Negative PPDs

Milk pricing provisions, de-pooling, negative PPDs and the reasons for these milk check deductions were reviewed in recent Market Intel analyses, e.g., How Milk Is Priced in Federal Milk Marketing Orders: A Primer, Negative PPDs to Offset Milk Price Rally, Revisiting Record-Large Negative PPDs on Milk Checks and Lack of DMC Payments Does Not Reflect Dairy Farmers’ Difficulties.

To summarize, in component pricing orders, proceeds from the pool are based on the difference between the classified value of the milk and the component value of the milk. When the component value of the milk exceeds the classified value of the milk, the proceeds from the pool are negative and result in a negative producer price differential. When the pool return (PPD) is expected to be negative, handlers may seek to de-pool higher-valued manufacturing milk to avoid paying into the pool. Importantly, de-pooling manufacturing milk to avoid negative PPDs is allowed under FMMO rules.

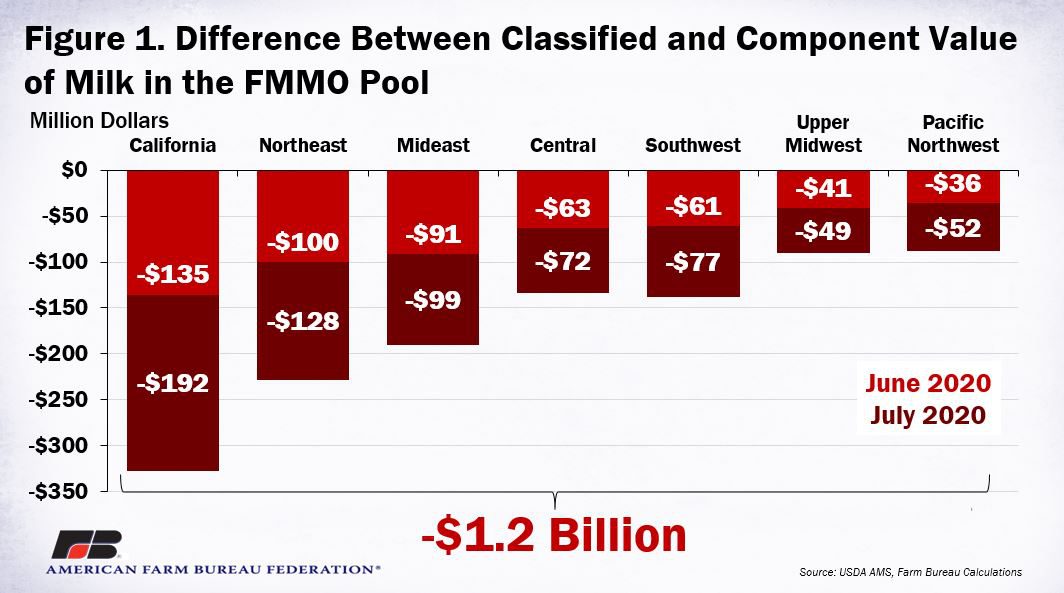

During June and July, the difference between the classified value of milk and the component value of milk across the seven component pricing orders was $1.2 billion. The difference was the largest for California at $327 million, followed by the Northeast at $228 million. Figure 1 highlights the difference between the classified and component values for June and July 2020.

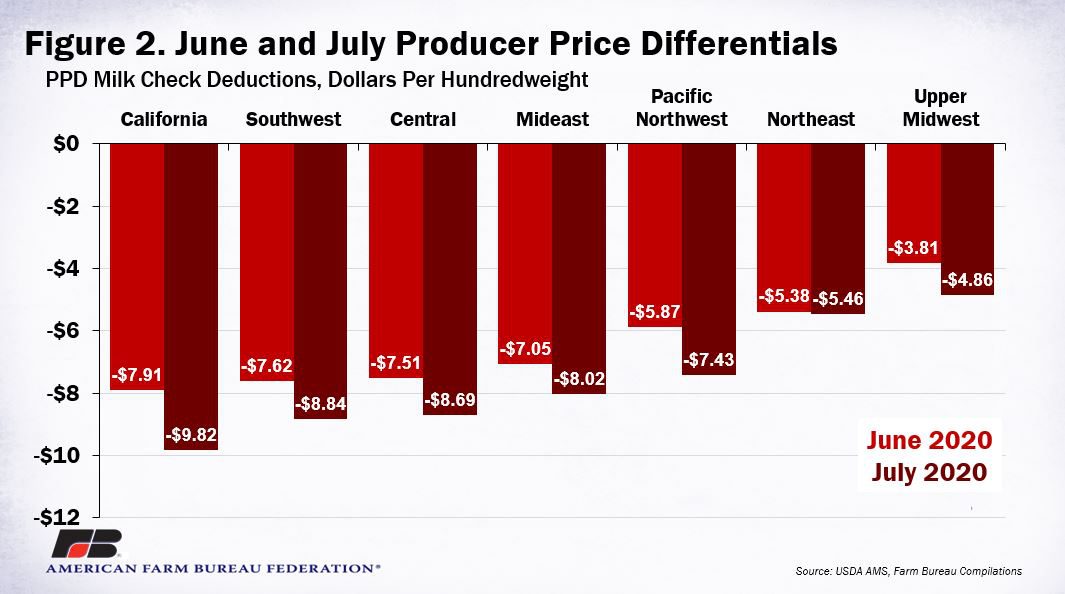

In all FMMOs the July PPD was lower than the June PPD. California had the lowest negative PPD at nearly -$10 per hundredweight, followed by the Southwest at -$8.84 per hundredweight. Due to the volume of Class III milk remaining in the Upper Midwest FMMO, their PPDs were the highest in June and July at -$3.81 and -$4.86 per hundredweight, respectively. Figure 2 highlights the June and July PPDs by FMMO.

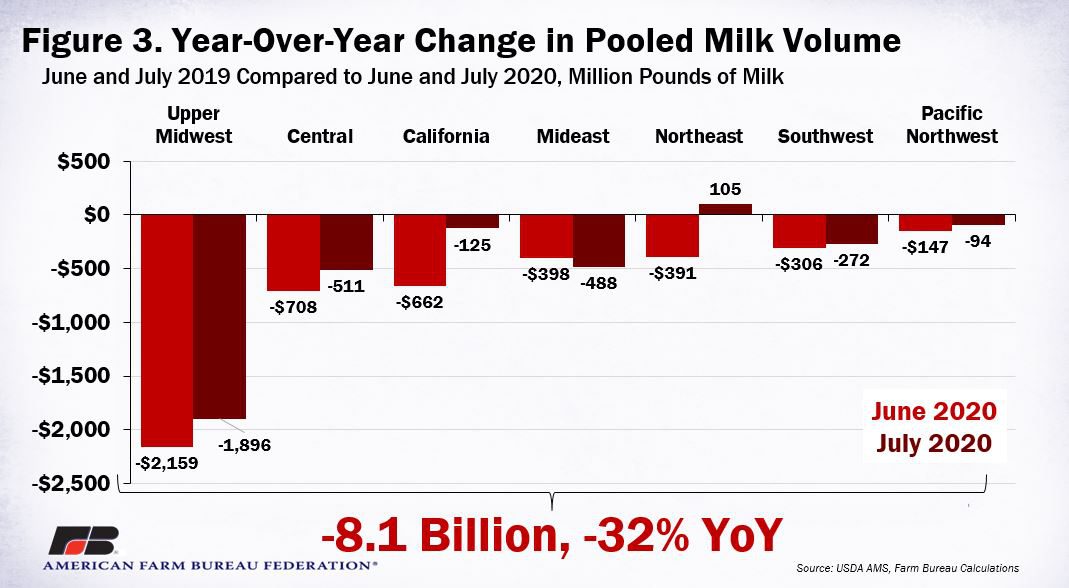

Milk processors and dairy cooperatives were very well aware of the price volatility, the high likelihood of negative PPDs and the impact on June and July FMMO pool returns. As a result, 4.7 billion pounds of milk was de-pooled in June and 3.3 billion pounds of milk was de-pooled in July – a combined 8.1 billion pounds of de-pooled milk over two months. Most, if not all, of the de-pooled milk was Class III milk used to produce cheese.

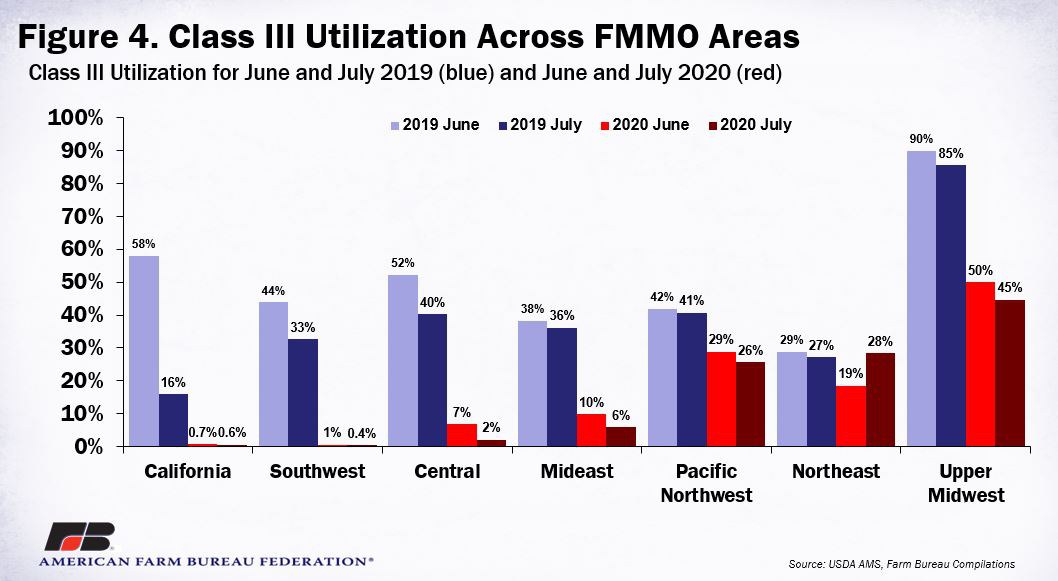

The pooled milk volume rose from 8.2 billion pounds in June to 8.8 billion pounds of milk in July. This is important because the ability to re-pool milk after de-pooling is not immediate, so milk will likely come back into the pool in upcoming months as the PPD is expected to turn positive as early as August. Figures 3 and 4 highlight the amount of milk de-pooled and the impact on Class III utilization in these component pricing orders.

What’s the Fix?

Despite milk prices in June and July recovering strongly from the early COVID-19 lows, many dairy farmers have yet to reap those higher prices and public and private risk management tools are ineffective in covering these losses as PPDs are generally considered acceptable basis risk. Dairy farmers and congressional leaders are now asking what can be done to fix the current situation.

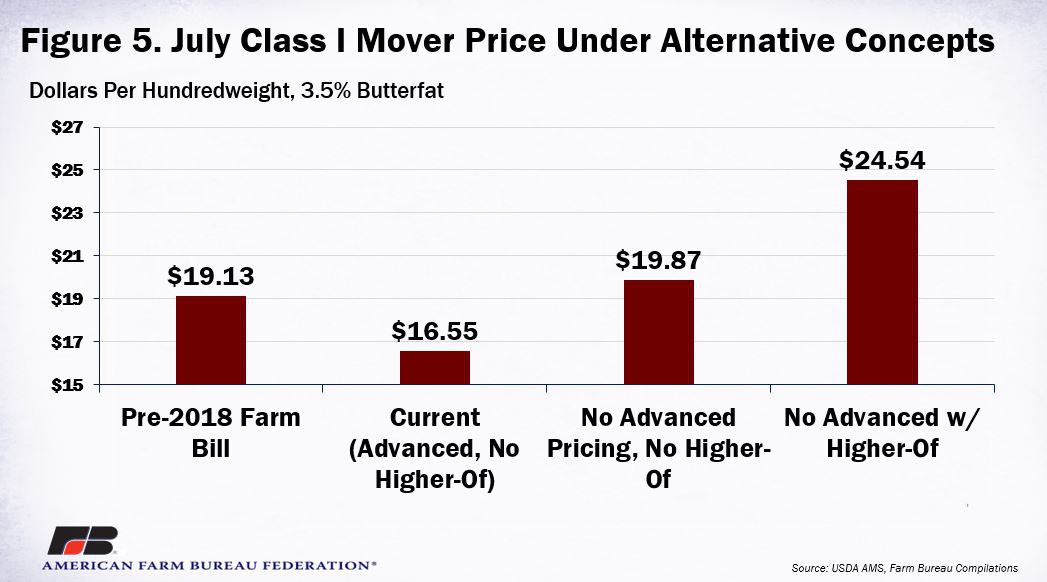

There are several concepts being considered. Some have argued that the advanced nature of fluid milk pricing is no longer needed given the hedging abilities provided by the 2018 farm bill. Without advanced pricing, and without the higher-of, the base Class I mover in July would have been announced in early August (instead of late June) at $19.87 per hundredweight, more than $3.30 per hundredweight higher than the current price, reducing the magnitude of the negative PPD and partially eliminating the incentive to de-pool. What about reverting back to the higher-of and keeping the current advanced pricing rules? Well, that gets you to a base Class I milk price of $19.13 per hundredweight, $2.58 higher than the current pricing methodology.

How about eliminating the advanced pricing component and going back to the higher-of, i.e., announcing the July Class I price in early August based on the higher-of Class III and IV prices? That results in the highest price for farmers because the pricing is timelier and based on the highest-valued manufacturing class of milk. Had these rules been in place, the July base Class I mover would have been $24.54 per hundredweight, nearly $8 per hundredweight above the current pricing methodology. In Florida, where the Class I differential is as high as $6 per hundredweight, the Class I price would be $30.54 per hundredweight. The only downside to eliminating the advanced pricing component and going back to the higher-of is that it brings back the challenge of hedging Class I milk for farmers, beverage milk processors and end-users such as schools and restaurants. Figure 5 highlights these alternative pricing proposals and the impact on the base July Class I mover.

What About De-Pooling?

FMMOs have long been a mechanism to redistribute dollars from the higher-valued Class I market to producers supplying the manufacturing plants such as cheese or butter facilities, i.e., cross-product subsidization. When the manufacturing milk value is greater than the Class I value, there is less to redistribute from the Class I market, and in some cases the pool is deficient, resulting in a negative PPD. When that is the case, manufacturing plants and cooperatives may elect to de-pool milk in the appropriate classes to reduce their pool liabilities.

There are several possible solutions to de-pooling. First, the ability to re-pool milk after de-pooling could be significantly constrained such that the financial incentive associated with de-pooling is reduced. This may not eliminate negative PPDs, however. Another proposal involves eliminating the advanced pricing component and bringing back higher-of pricing to ensure Class I prices are always above the manufacturing value. Nothing short of the latter would guarantee an elimination of negative PPDs and thus the incentive to de-pool. More forward-looking concepts could include less regulation in the form of a competitive-pay-pricing environment without minimum price enforcement or the pooling of Class I differentials only.

Summary

For the last two months dairy farmers have dealt with historical market volatility leading to record-high cheese and protein prices, followed by a quick price drop. Combined with a recent change in milk pricing rules, dairy farmers have become more attentive to FMMO pricing rules that allow massive de-pooling of milk and record-large milk check deductions. Even for farmers who did the “right thing” and managed their risk, public and private risk management tools have been unable to protect them.

So which way does the industry go? Do we revisit Class I milk pricing rules and de-pooling? There is certainly momentum in that direction. What about component pricing in the Southeast or tighter pool qualification criteria? Higher make allowances are certain to be a goal for some.

Before rushing to address the most recent conditions, dairy industry stakeholders should support giving more dairy farmers a voice and a vote during FMMO reform by amending the decades-old Agricultural Marketing Agreement Act to allow for modified bloc voting (Dairy Farmers Deserve a Voice and a Vote on Policy That Impacts Their Farms). Once achieved, the industry can gather as a whole and find a mutually agreeable path forward that rewards the entire dairy supply chain, as well as consumers.

Top Issues

VIEW ALL