Crop Insurance Guarantees Soar

TOPICS

Soybeans

photo credit: AFBF Photo, Morgan Walker

John Newton, Ph.D.

Chief Economist

What a difference a year makes. In 2020, the spring crop insurance prices for corn, soybeans and cotton were near the lowest levels of the last decade (Crop Insurance Guarantees Fall in 2020). Now, on the back of strong export demand from China and smaller-than-anticipated old-crop inventories, crop insurance prices have experienced the largest year-over-year increase in more than a decade, helping to boost insurance protection for farmers as they prepare for the planting season. Today’s article reviews the spring crop insurance prices for conventionally produced corn, soybeans and cotton.

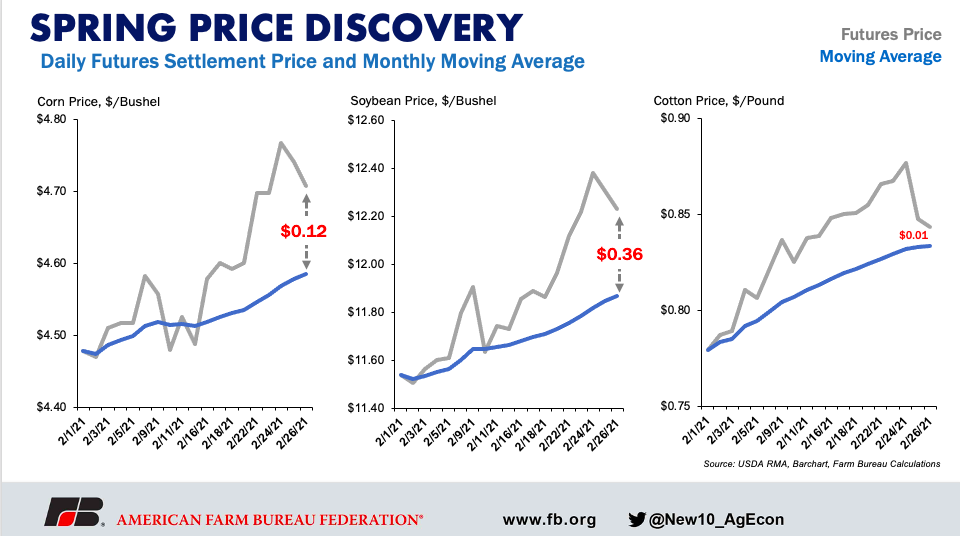

Spring Price Discovery Period

Each year, in advance of the planting season, USDA’s Risk Management Agency recalibrates crop insurance protection based on expected commodity prices and risk in the market. During a month-long February survey period, market expectations for prices are averaged to determine the spring crop insurance price. When combined with a farmer’s yield history, the spring prices and yield determine the level of revenue protection available during the crop year.

Crop insurance prices, and thus the revenue guarantees, are determined by averaging the Chicago Board of Trade (corn and soybeans) and Intercontinental Exchange (cotton) futures contract settlement prices during a month-long price discovery period. Spring prices for corn, cotton and soybeans are determined by averaging the new-crop futures contract settlement prices (December for corn and cotton, November for soybeans) during the month-long February price discovery period.

During February, the December corn futures price ranged from a low of $4.47 per bushel on Feb. 2, to a high of $4.77 per bushel on Feb. 24. The December futures contract ended the month at $4.71 per bushel, 12 cents per bushel higher than the month-long moving average of $4.48 per bushel. The November soybean futures contract ranged from a low of $11.51 per bushel on Feb. 2 to a high of $12.38 on Feb. 24. The contract ended the month at $12.23 per bushel, 36 cents per bushel above the moving average of $11.87 per bushel. Finally, for cotton, the December futures price ranged from a low of 78 cents per pound on Feb. 1, to a high of nearly 88 cents per pound on Feb. 24. The December futures prices ended the month at 84 cents per pound, 1 cent higher than the month-long moving average. Importantly, should the higher futures prices remain through the October harvest price discovery period, the higher harvest price will replace the spring price in the crop insurance guarantee.

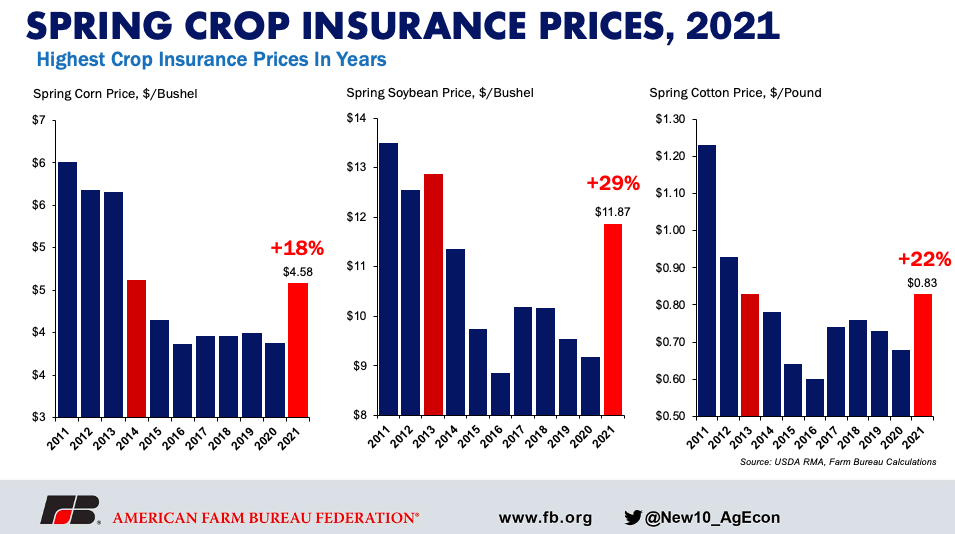

2021 Spring Crop Insurance Prices

On the back of strong export demand, and following two tough growing seasons, U.S. inventories of corn, soybeans and cotton are projected to be much tighter than previously estimated. In fact, at USDA’s annual Agricultural Outlook Forum, the Department projected higher soybean and cotton prices, and favorable corn prices during the 2021/22 marketing year (ICYMI: 2021 Agricultural Outlook Forum Highlights). Given the current market outlook, it is no surprise that spring crop insurance prices for corn, soybeans and cotton rose to their highest levels in years (Crop Insurance Price Discovery tool).

The 2021 corn crop insurance price was announced at $4.58 per bushel, up 18%, or 70 cents per bushel. The 2021 spring price is the highest since 2014’s $4.62 per bushel. For soybeans, the spring price was announced at $11.87 per bushel, up nearly 30%, or $2.70 per bushel. Like corn, the spring soybean price is the highest since 2013’s $12.87 per bushel. The spring crop insurance soybean-to-corn price ratio was 2.59 – the highest in more than 30 years. The spring cotton price was announced at 83 cents, up 15 cents per pound and 22% higher than 2019’s price. The cotton spring crop insurance price was the highest since 2013. For corn, soybeans and cotton , the year-over-year increase in the spring crop insurance prices (70 cents per bushel, $2.70 per bushel and 15 cents per pound, respectively) is the largest year-over-year increase in at least the last decade.

Summary

USDA’s Risk Management Agency recently released spring crop insurance prices for corn, soybeans and cotton. In the case of corn, the spring price of $4.58 per bushel was the highest since 2014 and was up 18% from the prior year. For soybeans and cotton, the spring prices of $11.87 per bushel and 83 cents per pound, respectively, were the highest since 2013. These higher spring prices are going to lead to higher revenue guarantees and may help expand farmers’ borrowing capacity going into the planting season.

Importantly, these spring prices are not fixed. Many producers elect to purchase the harvest price option, which utilizes the maximum of the spring or harvest price to determine if a farm has suffered a loss and may assist farmers by indemnifying at the replacement value of the crop (if the harvest price is greater than the spring price). Given the projection for tight stockpiles moving into 2021/22 and continued strength in U.S. exports, the potential exists for harvest prices to increase during the growing season. Harvest prices could also decrease if supplies are larger than anticipated, or demand is lower than currently projected, e.g., additional acreage, higher yields or lower ethanol or export demand.

For those of us armchair economists using the crop insurance price as a clue for acreage, the spring crop insurance soybean-to-corn price ratio of 2.59 – the highest in more than 30 years – signals the potential for more soybean acres. Let the competition for acres begin.

Top Issues

VIEW ALL