Could Harvey Lead to a Smaller Cotton Crop?

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Former AFBF Economist

Texas is the largest cotton-producing state in the U.S. by a wide margin. During 2017, Texas is expected to produce 8.8 million bales of cotton, representing 43 percent of total U.S. production and 5.9 million bales more than the second leading cotton-producing state of Georgia.

USDA’s Aug. 28, 2017, Crop Progress Report revealed the cotton harvest was 12 percent complete, up 6 percent from last year and up 7 percent from the 5-year average. However, with nearly 7.8 million bales of cotton yet to be harvested in Texas, and more than 40 inches of rain from Hurricane Harvey drowning parts of the state, the size of the Texas--and ultimately the U.S.--cotton crop could be in jeopardy.

Currently, USDA is projecting cotton production to increase and for the marketing year average cotton price to be lower for 2017/18. While the impact of the hurricane on the cotton crop is unknown at this point, this article reviews USDA cotton supply and demand projections and assesses the economic implication of crop loss due to the excessive rainfall during the key point of the growing season.

USDA Projections

USDA’s Aug. 10, 2017, Crop Production report provided the first survey-based estimate of cotton yield, harvested area and production for the U.S. For the 2017/18 crop year, cotton production is projected at 20.55 million bales, an increase of 20 percent over prior-year levels and the highest production volume since the 2006/07 crop year.

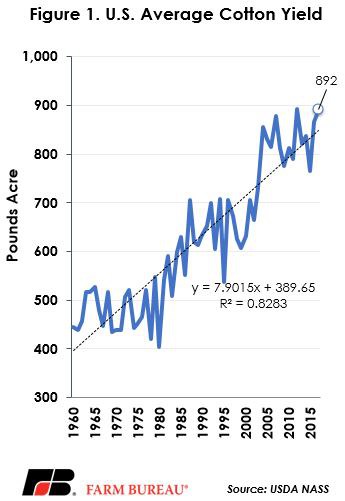

The increase is cotton production is driven by two factors. First, planted area is estimated at 12.06 million acres, 1.9 million acres above 2016/17 and the highest cotton acreage since 2012/13. Harvested area is estimated at 11.05 million acres, 1.5 million acres above last year and the highest harvested area since 2006. The abandonment rate is estimated at 8 percent, well below the 5-year and 10-year averages of 16 percent, but above recent abandonment rates of 6 percent in 2015 and 2016. Second, cotton yields tie the previous record-high of 892 pounds per acre set in 2012. If realized, the 2017/18 cotton yield would be 3 percent above 2016/17 yields, Figure 1.

The increase in cotton production was not unanticipated. USDA’s March 31, 2017, Prospective Plantings report indicated that growers intended to plant 12.233 million acres of cotton in 2017, an increase of 21 percent from 2016. The April 5, 2017, Market Intel article, Cotton and Peanut Plantings Jump Above Expectations, highlighted these planting intentions and the economic factors driving increased cotton acreage and fewer corn acres.

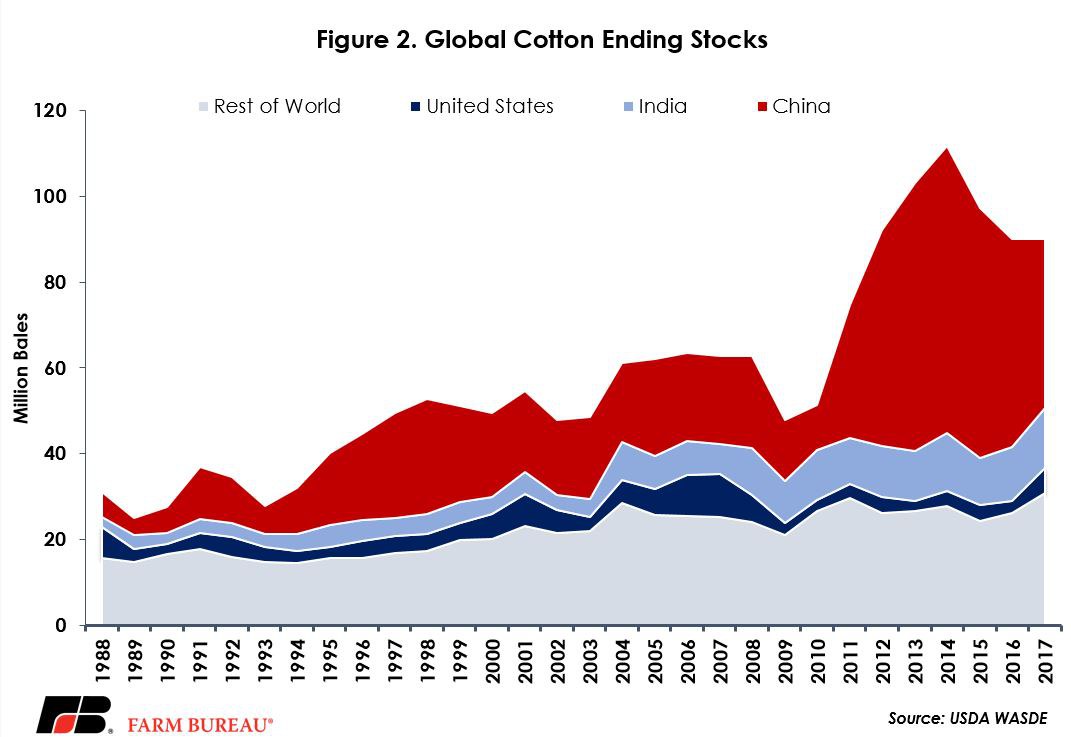

At the time growers were making acreage decisions, U.S. cotton exports were surging above prior-year levels. While exports slowed since planting, old-crop cotton exports are currently projected at 14.9 million bales, 62 percent above 2015/16 levels and the second-highest export volume since 2005. The strength of U.S. exports has pulled down ending stocks for 2016/17 to a projected 2.8 million bales, a reduction of 26 percent from 2015 stock levels. Global ending stocks in 2016 are now projected to be 7 percent lower at nearly 90 million bales, Figure 2. Due to the export strength, cotton prices were in a steady uptrend during a large portion of the growing season. New-crop cotton futures rallied to contract highs above 80 cents per pound.

However, in the months since planting a series of events have combined to roil cotton markets and increase the price uncertainty. First, during the growing season, weather conditions revealed themselves to be more favorable than earlier anticipated. Second, the June acreage report revealed cotton area planted at 12.06 million acres – slightly above March intentions. Then, the Crop Progress report revealed yields in line with the previous record, and the highest cotton production volume in 11 years. Selling accelerated after the release of the August production report and the market trended lower. In the Aug. 10 World Agricultural Supply and Demand Estimates report, USDA projected for the marketing year average cotton price to be 61 cents per pound, down 7 cents or 9 percent from 2016/17 marketing year average price of 68 cents.

Prices are lower due to increased global production, a modest increase in consumption and higher ending inventory levels. Global cotton production is projected at 117.31 million bales, an increase of 10 percent, or 10.8 million bales, over prior-year levels. Higher production volumes and a modest increase in global consumption are contributing to marginally higher projections for global stock levels in 2017/18. New-crop ending stocks are projected at 90.1 million bales, up slightly from 90 million bales of carry-in supplies.

Globally, the large increase in production is not completely offset by increases in consumption. Global consumption is projected at 154.57 million bales in 2017/18, 3.6 million bales above the prior year’s level. Global stocks-to-use is projected to be marginally lower, down to 58 percent from last year’s 60 percent. The decrease in global stock-to-use is due to continued reductions in Chinese stocks. Chinese stocks are projected to be down 20 percent year-over-year, and down 41 percent from the record high of 67 million bales in 2014. The reduction in Chinese stocks is due to reserve sales.

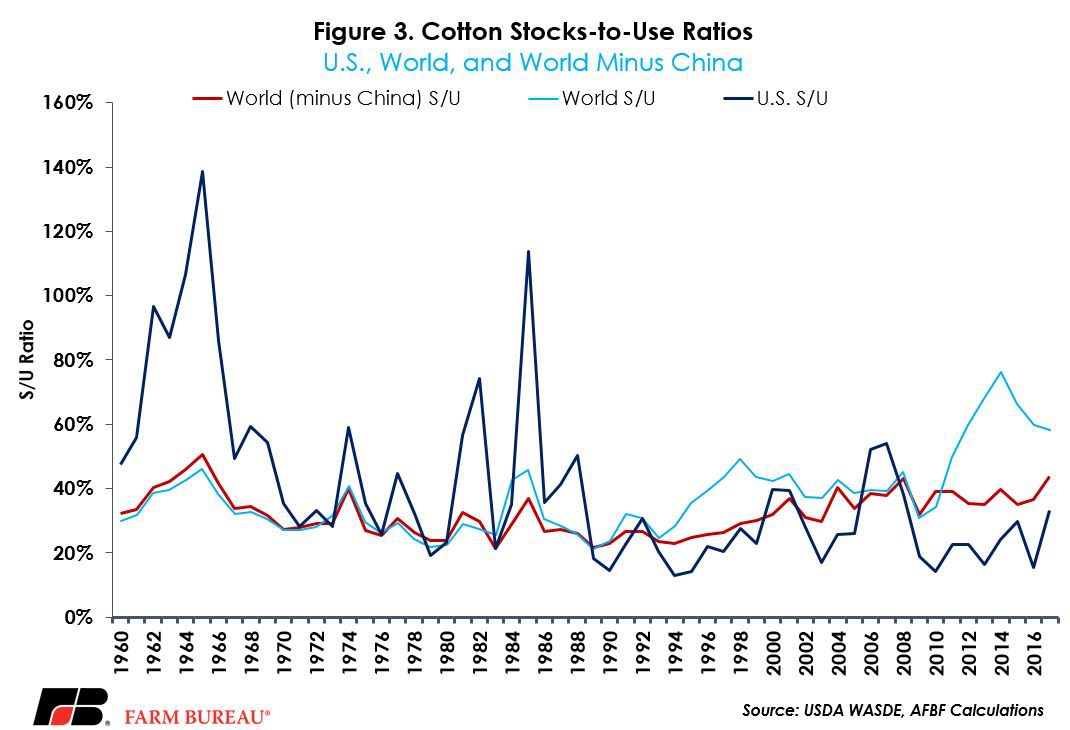

For the U.S., USDA projects total use in 2017/18 to fall to 17.6 million bales, down from the 18.17 million bales consumed in 2016/17, and below the 20.55 million bales produced in 2017. As a result, the stocks-to-use ratio is expected to jump substantially, to 33 percent, from last year’s 15 percent. If realized, 2017/18 U.S. stocks-to-use carryout would be the highest since 2008.

Many in the trade often discount the accuracy of Chinese production and inventory numbers. Removing Chinese stocks from global inventory levels, stocks-to-use levels for 2017/18 are projected at 44 percent. If realized, this would be the highest since 1965, Figure 3, and would likely dampen potential for a substantial price rally – absent a supply shock somewhere in the world.

Upcoming Uncertainty

At this point uncertainty remains in the U.S. cotton complex. First, USDA is currently assuming a very low abandonment rate of 8 percent. Crop conditions remain favorable, with 65 percent of the crop in good-to-excellent condition, and another 24 percent in fair condition. Ninety-three percent of the crop is currently setting bolls, with 18 percent opening. Conditions are expected to change in the coming weeks.

Severe flooding related to Hurricane Harvey is likely to have impacted major cotton producing regions. The storm surge and rainfall from Hurricane Harvey resulted in more than 40 inches of rain in some areas of Texas. Following the excessive rainfall and high winds, crop conditions are likely to deteriorate. With expectations for poorer crop conditions in the nation’s leading cotton producing state, projections for a 20-plus million-bale crop is far from a certainty. Should abandonment approach the 5- and 10-year average levels of 16 percent, the size of the cotton crop would be reduced, and may provide positive pressure for U.S. cotton prices.

The extent of a sustained price rally, however, is likely limited given that the U.S. represents approximately 18 percent of global cotton production, and Texas represents less than 8 percent of global production. Nearly 70 percent of U.S. cotton production is exported, and given that U.S. farmers represent less than 20 percent of the world supply, U.S. producers remain price-takers in the global marketplace, even in the face of regional supply shocks like Harvey.

In addition to the weather and crop size concerns, another stress on cotton producers is the current price of cottonseed. As a benchmark, the Memphis North region is currently featuring a price around $200 per ton. This is compared with approximately $250 per ton a year ago, and a high of around $400 per ton set in 2013/14. Cottonseed, at these prices, will not pay a farmer's ginning fees. That means instead of the gin rebates seen in recent years, producers will get a bill for ginning costs at the end of the year. Ginning costs combined with potential crop losses could result in lower revenue for cotton producers.

Crop insurance can help with revenue declines due to lower prices or yields, but for U.S. cotton producers the revenue protection is lower due to the prolonged period of low prices experienced in recent years. Those with a harvest price option could see additional protection if prices increase due to a smaller crop. However, without the additional safety net provided by Title I commodity programs or a cost-sharing program on ginning, cotton producers have one less tool in the toolbox to manage farm income risk.

A recent Market Intel article reviewed the opportunity to enhance the cotton safety net provisions: Cotton Coming Back in Title I? The first steps put forward by the Senate would improve the safety net for cotton producers by making cottonseed eligible for Title I support beginning with the 2018 crop year – a distant but much-needed boost given the uncertainty faced by U.S. cotton producers.

Trending Topics

VIEW ALL