Cotton Tariff Profile

TOPICS

CottonMegan Nelson

Economic Analyst

photo credit: Alabama Farmers Federation, Used with Permission

Megan Nelson

Economic Analyst

Our Market Intel series on commodity-specific tariff profiles continues with cotton.

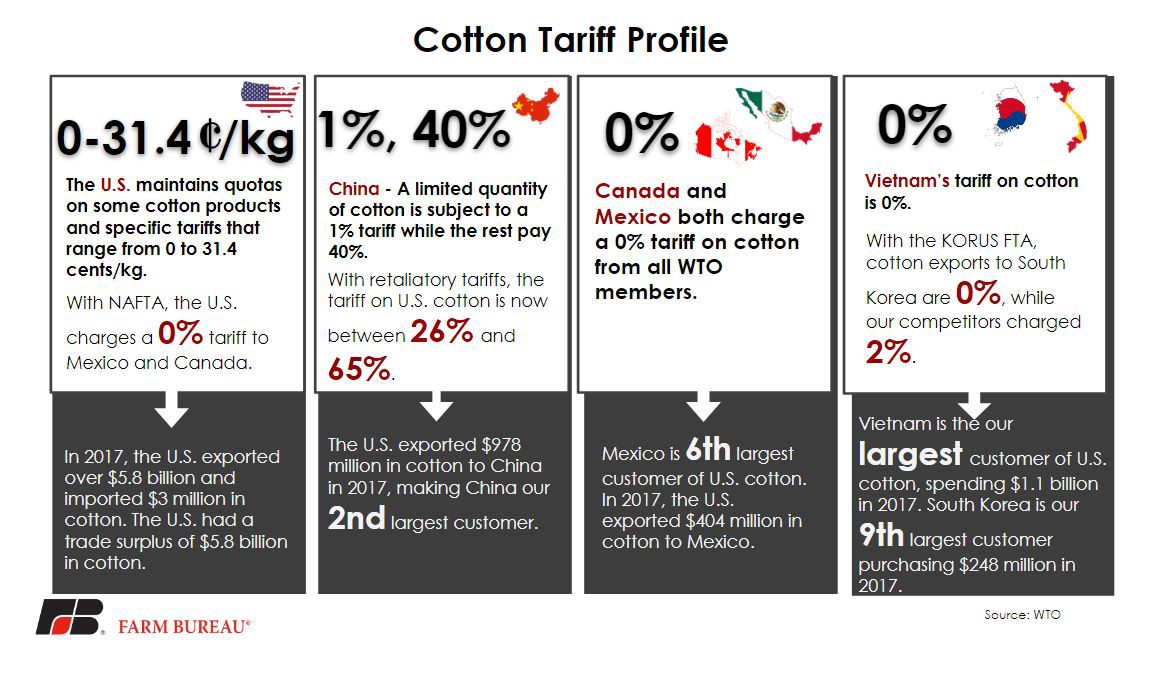

The U.S. produces 16 percent of the world’s cotton, and with over $5.8 billion in cotton exports, is the top cotton exporter in the world. In 2017, the U.S. imported a scant $3 million worth of cotton, resulting in a trade surplus of $5.8 billion in cotton. With lower cotton prices in recent years, Congress has allowed cotton producers to return to Farm Bill programs in the form of seed cotton. Other forms of U.S. support to cotton producers include maintaining quotas on some cotton products, as well as specific tariffs ranging from 0 to 31.4 cents per kilogram.

China also employs measures to protect its cotton industry by using a quota system to charge a 1 percent tariff on a limited quantity of cotton while the rest is subject to a 40 percent tariff. However, U.S. cotton faces retaliatory tariffs of 26 percent for a limited quantity, and 65 percent for the rest. In 2017, China was our second-largest customer, purchasing $978 million in U.S. cotton.

Mexico is our sixth-largest customer, purchasing $404 million in U.S. cotton in 2017. The North American Free Trade Agreement guarantees that U.S. cotton exporters are charged a 0 percent tariff on cotton into Mexico and Canada.

With Vietnam’s burgeoning textile industry, it is no surprise that it is our largest customer of U.S. cotton. Charging a 0 percent tariff, Vietnam imported $1.1 billion in U.S. cotton last year.

With the Korea-U.S. Free Trade Agreement, U.S. cotton exports to South Korea are charged a 0 percent tariff, while our competitors are charged a 2 percent tariff. South Korea is our ninth-largest customer, purchasing $248 million worth of U.S. cotton in 2017.

To read more in the series check out our deep-dive into soybean, wheat, corn, and pork tariffs.

Trending Topics

VIEW ALL