Cotton and Peanut Plantings Jump Above Expectations

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Former AFBF Economist

Implications

While growers intend to substantially increase acreage of cotton and peanuts this year, uncertainty remains. For cotton, the pace of plantings, crop conditions, the pace of exports, and global (i.e. China) inventory levels are key fundamentals to monitor. For peanuts, higher acreage does not mean substantially higher production as crop yields and acreage abandonment may reduce the crop size. Managing risk is key. For peanuts, price risk is managed through the 2014 Farm Bill’s Price Loss Coverage and marketing loan programs. Without a Farm Bill Title I program, cotton growers have risk management tools including Title XI crop insurance products such as revenue protection and STAX, as well as Intercontinental Exchange futures.

Review of Cotton and Peanut Acreage Intentions

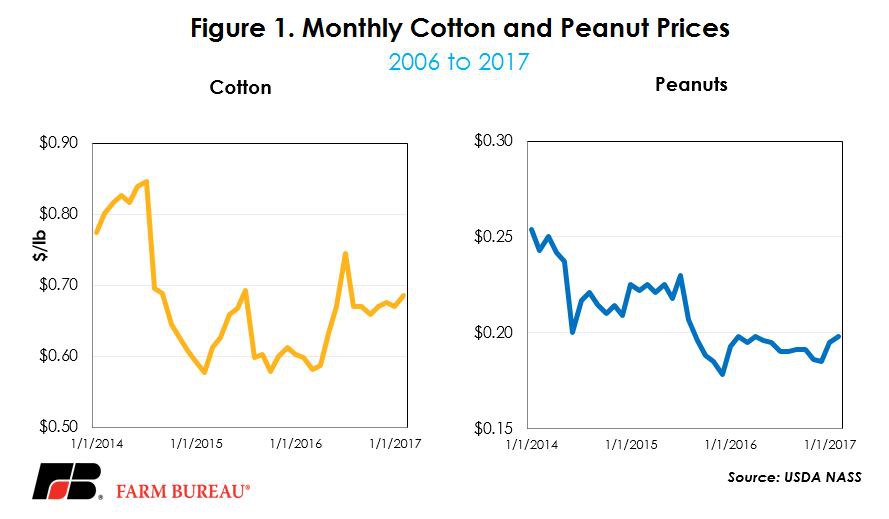

Global cotton inventories are currently projected to be down nearly 20 percent from the high set in 2014 at 90.482 million running bales (RB). To say the pace of U.S. cotton exports for the 2016/17 marketing year has been strong is an understatement. USDA’s March 30, 2017, export sales data reveals total export commitments of 12.3 million RB, 93 percent of the World Agricultural Supply and Demand Estimate (WASDE) projection for the year and 71 percent above last year’s levels. Based largely on these fundamentals, new-crop cotton futures prices have been trading 15-20 cents above the 2015/16 marketing year average price of 61.2 cents per pound, Figure 1.

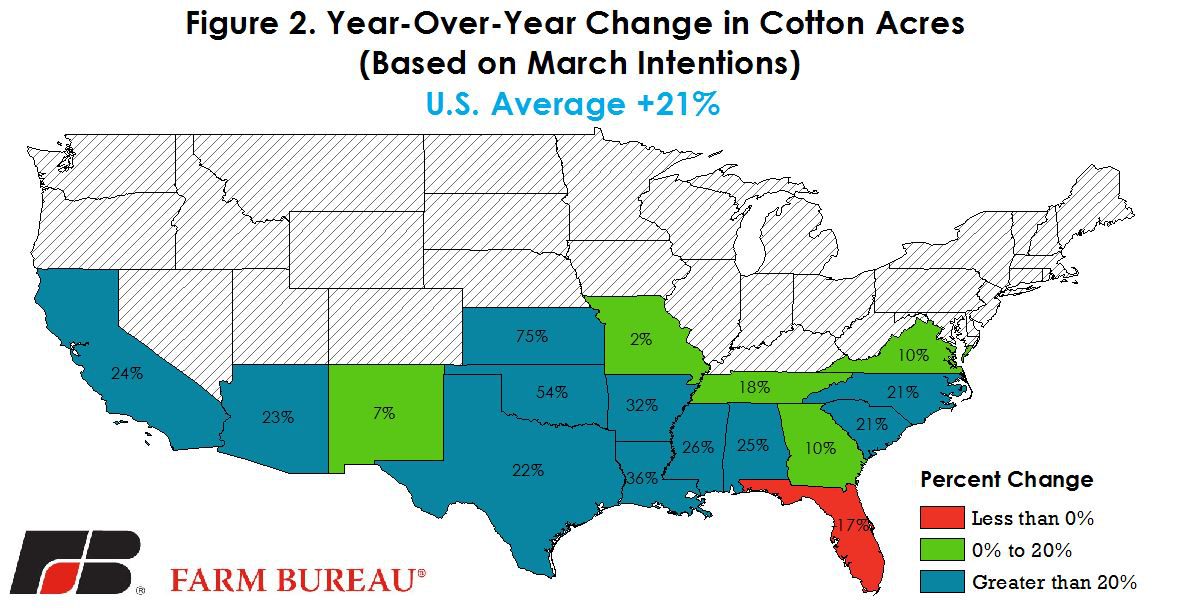

It’s no surprise then that U.S. producers are responding to these market signals by devoting more acreage to cotton for the 2017/18 marketing year. USDA’s March 31, 2017, Prospective Plantings report indicated that growers intend to plant 12.233 million acres this year, an increase of 21 percent from last year. This total was well above the National Cotton Council’s February survey estimate of 11 million acres and USDA’s projection of 11.5 million acres.

Only one state is projected to see fewer cotton acres in 2017, as Florida is expected to lose 17 thousand acres. Acreage increases ranged from a low of 4 thousand additional acres in New Mexico to 1.25 million additional acres in Texas. Based on March intentions, Figure 2 highlights the percentage change in cotton acreage by state for the 2017/18 marketing year. AFBF’s April 3 Market Intel report, “Soybeans Trumping Corn in 18 States”, indicated that many of these states adding cotton acreage are projected to experience large declines in corn acreage.

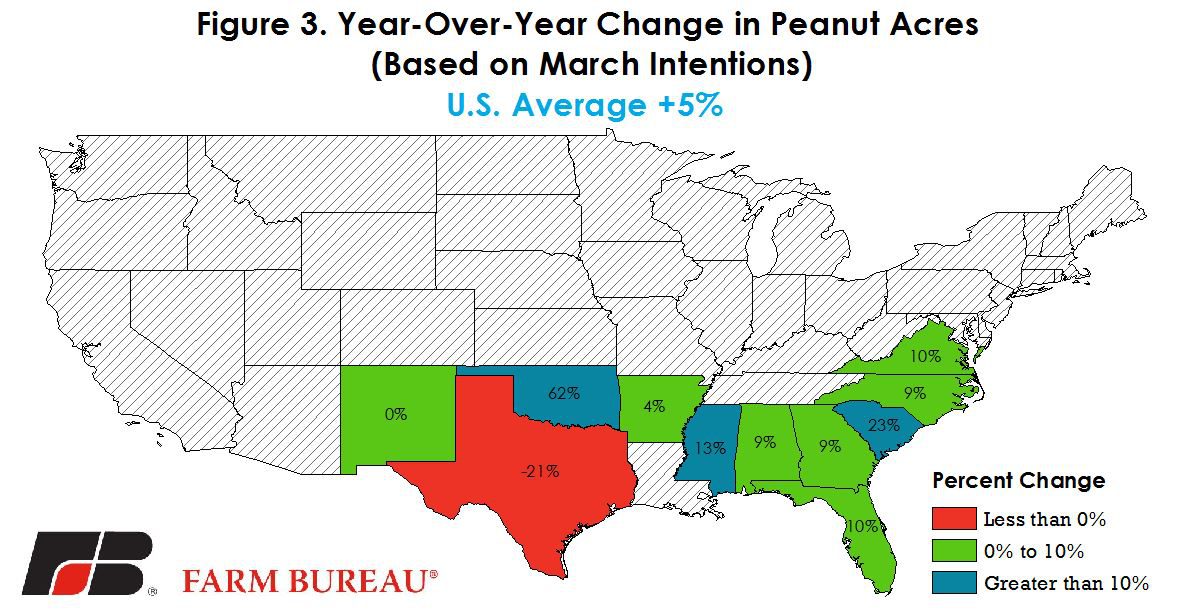

In addition to adding more cotton acreage, many southern states are expected to add more peanut acreage in 2017/18. March intentions revealed that growers will plant 1.75 million acres of peanuts, 80 thousand acres more than last year. This total, if realized, is 28 percent higher than the 10-year Olympic average, and would be the largest acreage devoted to peanuts in more than a quarter-century when 1.733 million acres were planted in 1993. Only Texas is expected to plant fewer peanut acres in 2017/18. Acreage increases ranged from no change in New Mexico to a 62 percent increase in Oklahoma. Based on March intentions, Figure 3 highlights the percentage change in peanut acreage by state for the 2017/18 marketing year.

With cotton prices expected to be stronger in the upcoming year (and more competitive on returns per acre), why was there such a large increase in peanut acreage? The answer is two-fold. First, fundamentals in peanuts support higher prices and thus additional acreage. End of February peanut stocks in 2017 were 3.5 million pounds in shell basis, down 18 percent from prior years' levels. Final ending stocks for 2016/17 are projected at 1.695 million pounds, down 5 percent from 2015/16. Based on USDA’s Agricultural Prices, the price received for peanuts has increased approximately 11 percent from year-ago levels, Figure 1.

Second, with a Price Loss Coverage reference price of 26.75 cents per pound ($535 per ton) growers with peanut or generic base may receive program payments as high as 7 cents per pound or $140 per ton. Generic base are former cotton base acres. These acres can be planted to any program crop and can receive payments by the program elected for that crop. USDA data reveals that in 2015 nearly 1 million generic acres were planted to peanuts. The Congressional Budget Office January 2017 baseline for farm program outlays projects peanut outlays to exceed $500 million for the 2018 fiscal year on slightly more than 2 million base acres, i.e. an average of $280 per base acre.

Trending Topics

VIEW ALL