Corn and Soybean Supply and Demand Projections Largely Unchanged

photo credit: USDA CC BY 2.0

John Newton, Ph.D.

Former AFBF Economist

On June 30, 2017, USDA will release the highly anticipated Acreage report. The June Acreage report provides the first survey-based estimate of crop plantings and expected harvest. Given that USDA will soon update crop size projections for the 2017/18 crop year, the focus of USDA’s June 9, 2017, World Agricultural Supply and Demand Estimates was on old- and new-crop consumption.

Corn and Soybean Consumption Mostly Unchanged

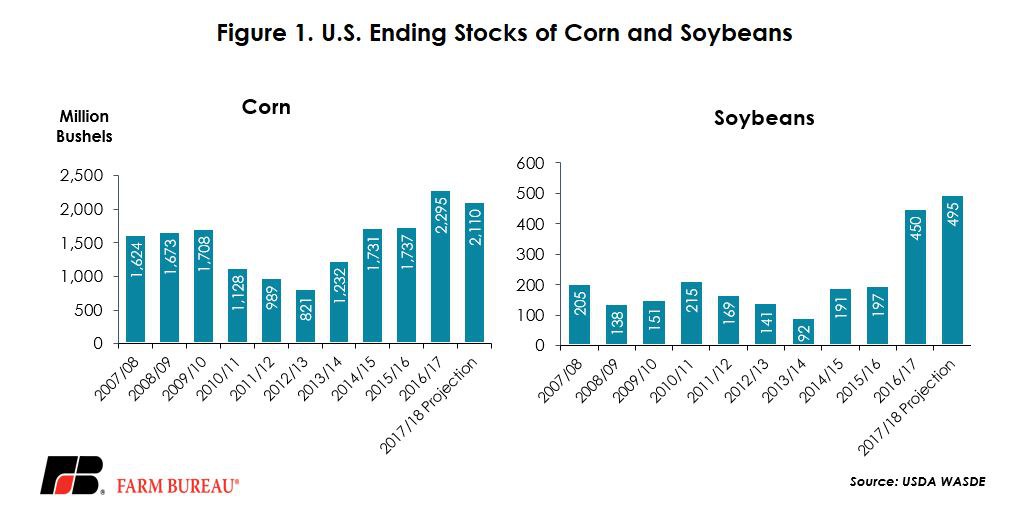

For corn, the most recent WASDE made no changes to the 2016/17 or the 2017/18 balance sheets from the prior month’s estimates. For soybeans, the 2016/17 balance sheet saw a 15-million-bushel reduction in crushings from the May estimate. The 15-million-bushel reduction in consumption pushed old- and new-crop ending stocks higher, to 450 million bushels and 495 million bushels, respectively. No other changes were made on the 2016/17 or the 2017/18 soybean balance sheets.

The trade outlook, however, went the other way. The average trade estimate was for USDA to increase corn consumption and lower ending stocks to 2,287 million bushels, 8 million bushels below the May WASDE projection. A similar reduction in ending stocks was projected for soybeans. The average trade estimate of soybean ending stocks was 433 million bushels, 2 million bushels below the May WASDE projection.

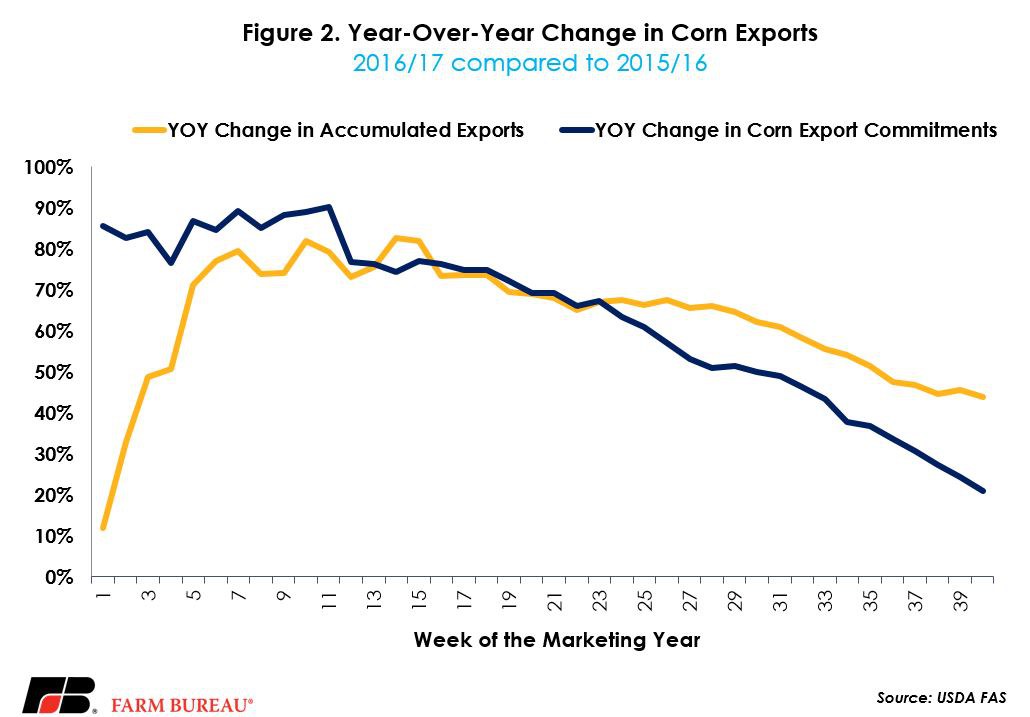

For corn, many trade analysts expected USDA to increase corn exports higher than the current projection of 2,225 million bushels, 18 percent above 2015/16, due to the strength in accumulated exports of corn. Earlier in the marketing year, weekly corn exports were as much as 90 percent above prior year levels, Figure 2. However, the pace of corn exports has slowed. USDA’s June 8, 2017, Foreign Agricultural Service corn export sales data indicated that 1,696 million bushels have been exported through the first 40 weeks of the marketing year, 44 percent above prior-year levels. Total export commitments -- accumulated exports plus outstanding sales -- are 2,127 million bushels, 21 percent above prior-year levels.

While corn exports remain well above prior-year levels, it’s likely that the recent slowdown in corn exports, combined with the competition from the record South American crop, contributed to USDA’s decision to leave corn exports, and thus the balance sheet, unchanged.

Moving Forward

With consumption of old-crop and new-crop corn and soybeans mostly unchanged, attention now turns to the Acreage report at the end of the month. It’s expected that planting delays and poor corn crop conditions may push soybean acreage above the current projection of 89.5 million acres. Additional soybean acreage could ultimately push prices lower than the current projection of $8.30 to $10.30 per bushel. The additional soybean acreage would likely come at the expense of corn. Fewer corn acres would help to draw down stock levels and could push prices above the current projection of $3.00 to $3.80 per bushel.

The July 12, 2017, WASDE will use updated acreage and weather-adjusted trend yields to estimate corn and soybean production in 2017/18. Partially resolving production uncertainty for new-crop corn and soybeans will provide an opportunity to revise price expectations and marketing decisions.

Trending Topics

VIEW ALL