Corn Acres Should Be Reconsidered in 2020

TOPICS

EthanolShelby Myers

Economist

photo credit: Tennessee Farm Bureau, Used with Permission

Shelby Myers

Economist

USDA’s recent Prospective Plantings report, conducted during the first two weeks of March and prior to the impact of COVID-19 on the farm economy, revealed that farmers intended to plant 97 million acres of corn this spring – up 7.3 million acres, or 8%, from 2019 and the highest since 2012. Since corn farmers were surveyed, COVID-19 has changed the outlook for the global and farm economies and led to sharply lower ethanol and corn prices across the U.S., i.e., Coronavirus Sends Crop and Livestock Prices into a Tailspin.

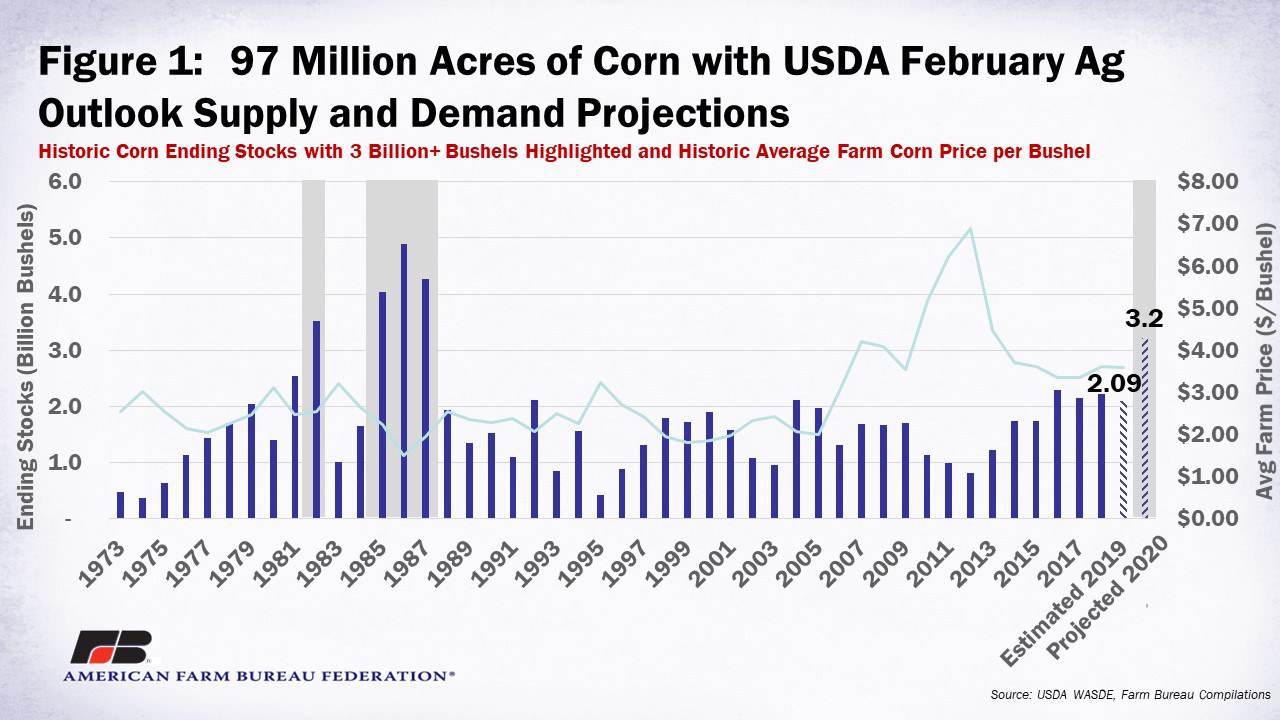

The outlook for corn specifically was updated in the latest World Agricultural Supply and Demand Estimates report, released April 9, and USDA reduced corn use for ethanol during the current marketing year by 375 million bushels and pushed ending stocks higher by 200 million bushels to 2.1 billion bushels. Given that USDA projects record corn yield in 2020, the increase in planted area combined with reduced ethanol demand will push corn stocks to their highest levels since the 1980s. To offset COVID-19-related demand destruction, fewer corn areas are needed in 2020. This article explores the supply and price implications of 97 million acres of corn planted.

Monster 2020 Corn Supplies

Assuming the average 91.5% harvest-to-plant ratio from the past 10 years holds for 2020, 97 million acres planted equates to 88.8 million acres of harvested corn. Using the current yield estimate of 178.5 bushels per acre, corn production is on pace for a record 15.8 billion bushels. Combining the latest WASDE corn ending stocks of 2.1 billion bushels with projected new crop imports of 25 million bushels, new crop corn supplies are likely to approach 18 billion bushels – the highest on record and 2 billion bushels above 2019 corn supplies.

Demand Uncertainty Heading Into 2020/21 Marketing Year

On the demand side, USDA’s 2020 Agricultural Outlook Forum projections indicate 6.84 billion bushels of corn will go to feed, seed and industrial use (5.45 billion of which are used in corn ethanol production), 5.8 billion bushels will be used in feed and residual and 2.1 billion bushels will be exported -- amounting to 14.7 billion bushels used in total, the second-highest of all time. Despite this strong demand, ample supplies approaching 18 billion bushels would push ending stocks into the neighborhood of 3.2 billion bushels with a stock-to-use ratio of 21.8% -- a carryout not seen since the 1980s.

The U.S. has not had corn ending stocks above 3 billion bushels since the 1985-1987 period when corn stocks rose above 4 billion bushels for three consecutive years. The price of corn went from $2.23 to $1.50 to $1.94 in that period. In 1982, corn ending stocks were 3.5 billion bushels, the stocks-to-use ratio at the time was 49% and the price of corn was $2.55 per bushel. Figure 1 shows the ending stocks and corn price with 1982, 1985, 1986 and 1987 highlighted and the projected 2020 estimate indicated.

Considering all of this, the 2019/2020 marketing year corn demand situation continues to evolve given idle ethanol production capacity. With federal guidance to practice social distancing and minimize travel, consumption of gasoline has decreased, followed by a decrease in the consumption of corn ethanol. USDA captured the reduced corn demand in the latest WASDE, reducing ethanol use by 375 million bushels, or 7%, from their March estimates. While this reduction likely reflects USDA’s current assessment of lost ethanol demand, should ethanol production remain constrained, future WASDE estimates could further reduce corn used for ethanol.

A Pull Back in Corn Acres Is Needed

Given updated demand expectations, fewer corn acres are needed to prevent stockpiles from being burdensome. Based on current WASDE projections, and USDA’s 2020/2021 expectations on yield and demand, corn planted acres would need to decrease 6.6 million acres to 90.4 million acres to keep ending stocks at or below 2.5 billion bushels. At 90.4 million acres planted, harvested area would be 82.8 million acres. Then, assuming yield projections of 178.5 bushels per acre hold, total corn supply would be closer to 17 billion bushels – down 1 billion bushels from current expectations. The reduced supplies would result in a stocks-to-use ratio of 17.4% and would provide support to corn prices.

Summary

With planting intentions of 97 million corn acres for 2020/2021, the U.S. is currently on track for record corn production and, given recent slowdowns in ethanol demand, potential ending stocks above 3 billion bushels, levels not seen since 1987. If ethanol demand fails to improve and ethanol capacity remains idled, corn supplies could be even more burdensome – lowering price expectations. We’re currently only 30 to 40 cents per bushel away from sub $3 old crop corn futures prices. However, in all things related to both the old and new crop, uncertainty remains.

Trending Topics

VIEW ALL