China Bearish on U.S. Pork, but the Industry Gets by with a Little Help from our FTA Friends

photo credit: AFBF Photo, Philip Gerlach

Veronica Nigh

Former AFBF Economist

In mid-May, U.S. shipments of fresh, chilled or frozen pork products to China were down 47 percent compared to the same point in 2017. Unfortunately, for the pork sector, time hasn’t improved this situation. In fact, it has worsened. Shipments to China made between Jan. 1 and Aug. 23 are down 58 percent compared to the same point in 2017.

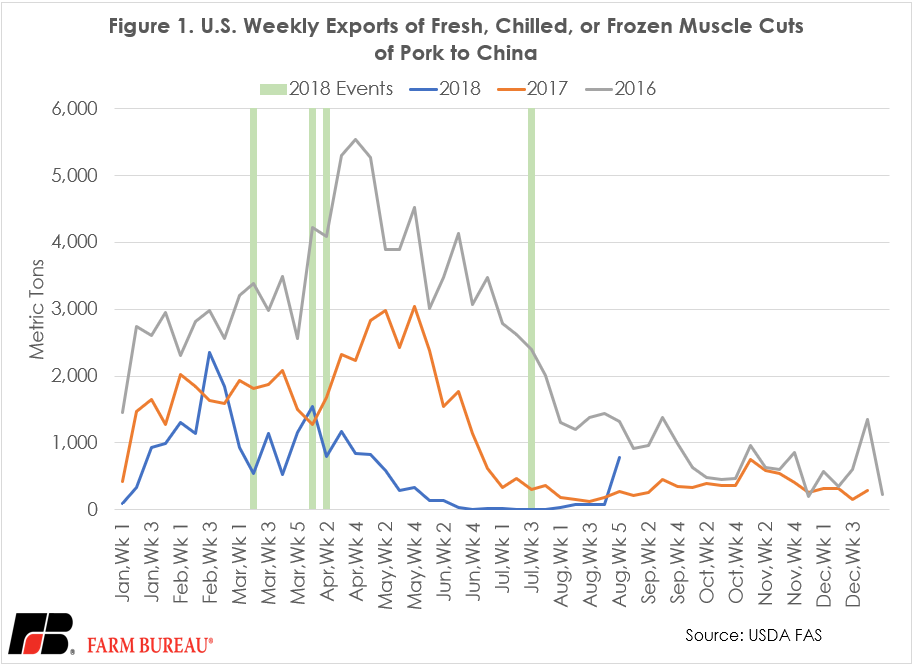

As outlined in our May article, the Squeal is Real, several trade events have impacted the competitiveness of U.S. pork in the Chinese market. Since that article, another event was added to the calendar on July 6 when additional retaliatory tariffs were placed on U.S. pork by China in response to 301 tariffs placed on Chinese goods destined for U.S. shores. As Figure 1 demonstrates, the additional July 6 tariffs were mostly for show. The damage had already been done by previous actions. By June 1, U.S. pork exports to China had effectively fallen to zero. The significant uptick in exports to China in the latest report, released Aug. 30, is likely in response to nervousness that the severity of African Swine Fever outbreak will intensify. This is a market move to keep an eye on.

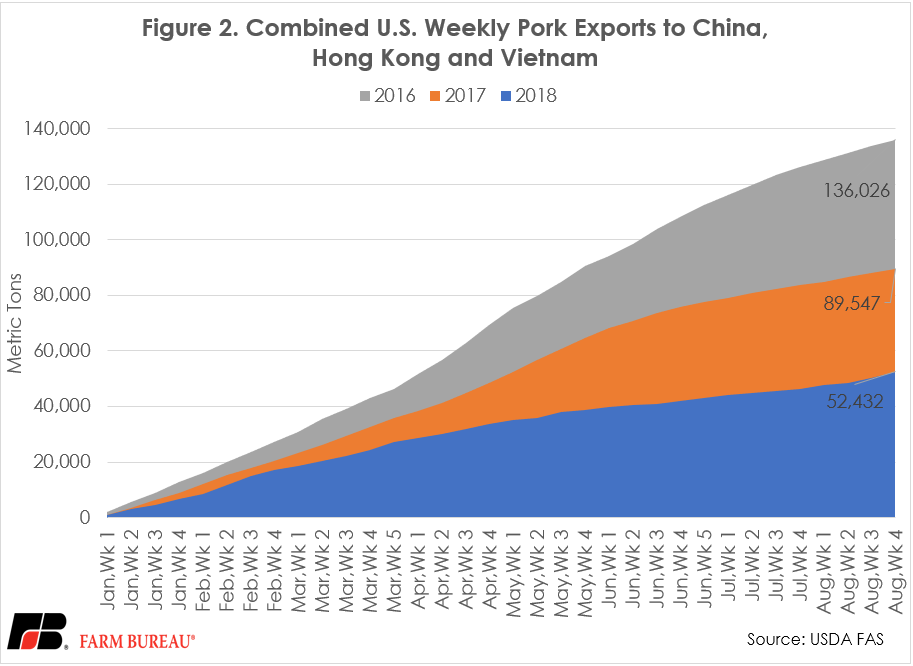

The latest export data also reveals that transshipment of U.S. pork through Hong Kong and Vietnam is still not occurring. In mid-May shipments to this three-country region were down 37 percent compared to the same point in 2016. Mirroring the drop in shipments to China, shipments of U.S. pork to the three-country region are down 41 percent through Aug. 23.

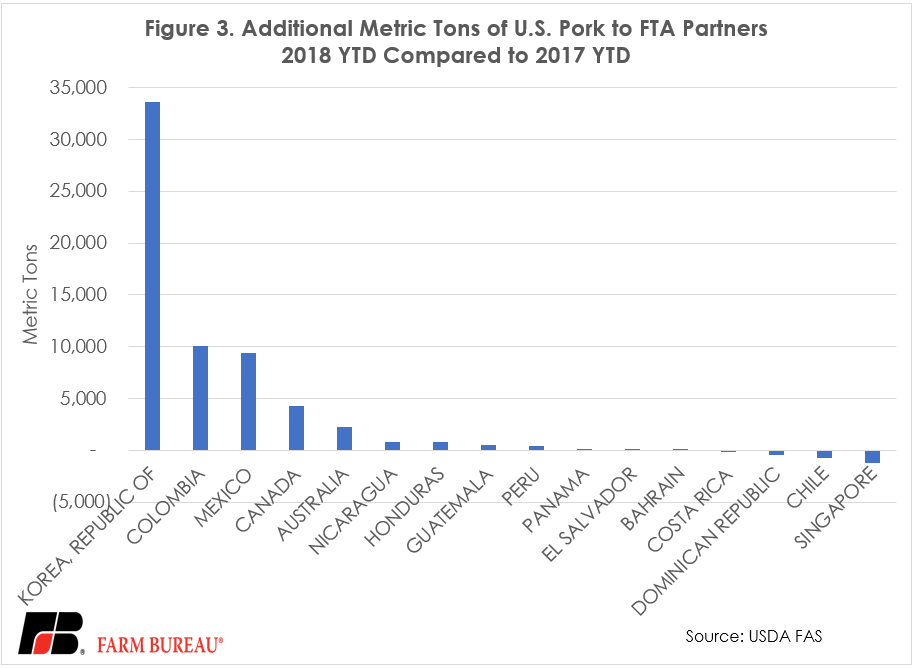

Despite these considerable headwinds to China, Hong Kong and Vietnam, which accounted for 20 percent of U.S. pork exports by volume in 2017, to date, U.S. pork export volumes are up in 2018 compared to 2017. To whom do we owe this increase? By and large, the extra purchases have come from our free trade agreement partners. U.S. pork purchases to South Korea are up 43 percent compared to the same time last year, an amazing feat considering that the country was already our sixth-largest customer in 2017. Exports to Colombia have also experienced fantastic growth, up 45 percent compared to the same point in 2017. Colombia was the eighth-largest market for U.S. pork in 2017. Mexico, already the largest purchaser of U.S. pork, has increased purchases year-on-year by 4 percent. Mexico’s growth doesn’t seem as impressive until you recognize that as such a large customer, 4 percent growth equates to an additional 9,300 metric tons. Canada and Australia, our fourth- and seventh-largest customers in 2017, respectively, have both increased purchases by 9 to 10 percent. Our FTA partners in Central America, when considered as a region, have increased purchases by 22 percent, compared to the same point last year. Net metric ton changes from fiscal year 2017 to fiscal year 2018 for each FTA partner that imports U.S. pork is individually displayed in Figure 3.

In total, by volume, exports to FTA partners in 2018 have increased by nearly 60,000 metric tons, while exports to non-FTA partners have declined nearly 38,000 tons. The net result is increased pork exports by volume of more than 22,000 metric tons. There are a few non-FTA partner bright spots, like Taiwan and the Philippines, but the non-FTA partner decline is dominated by China and Hong Kong, which are down 28,500 metric tons and 8,500 metric tons, respectively.

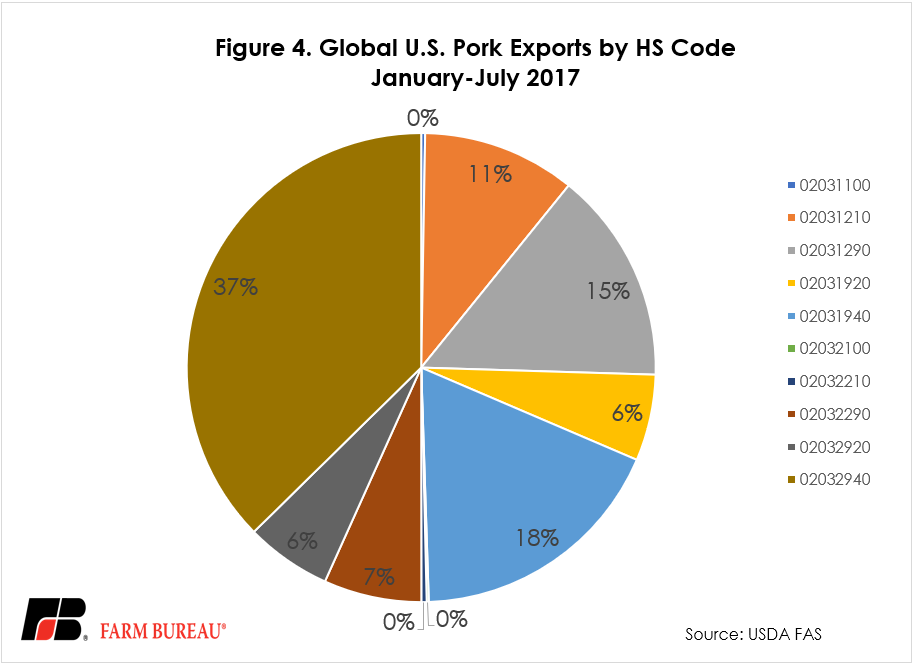

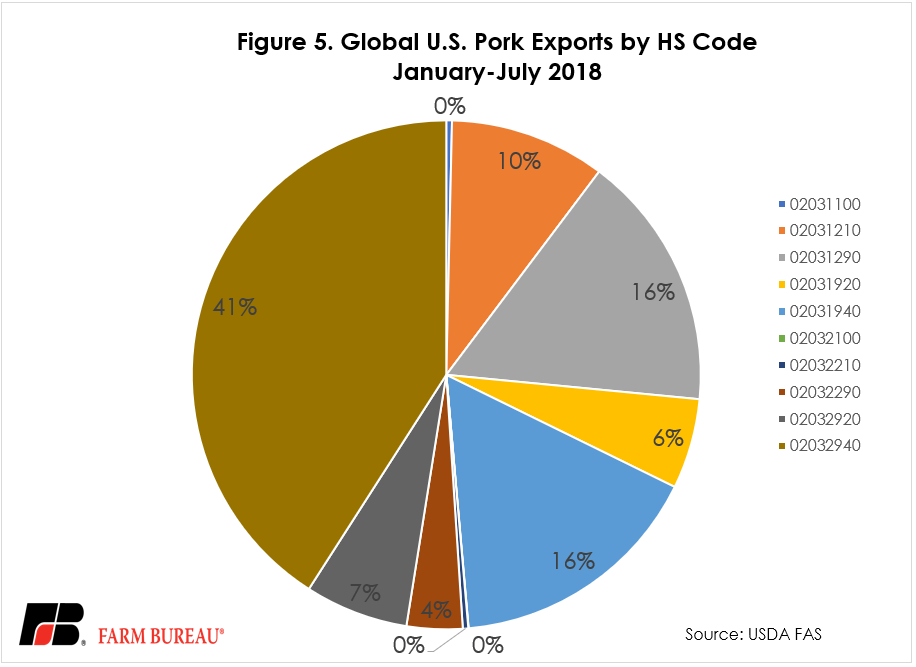

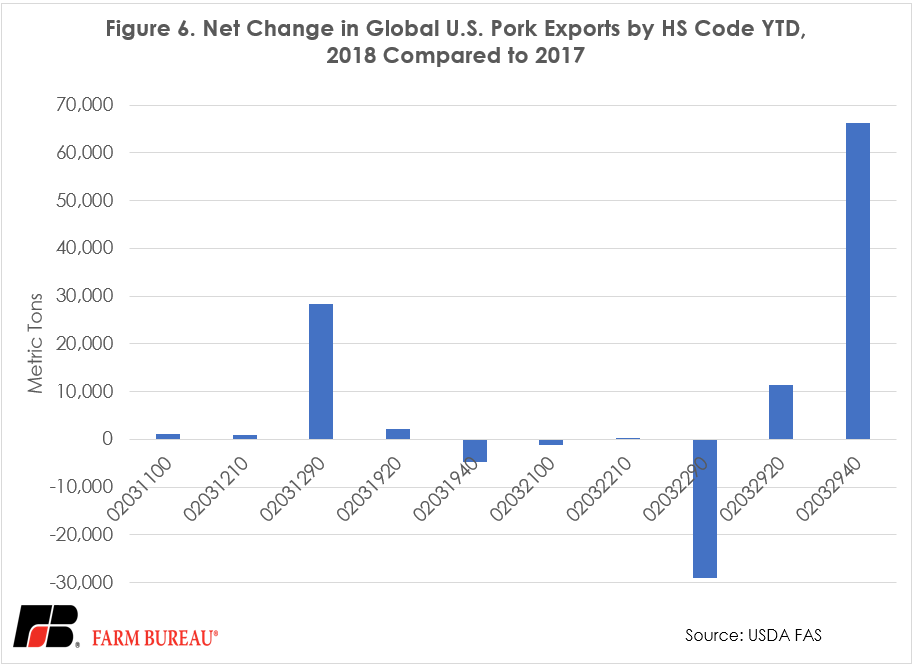

The next question should be, have we seen significant changes in the product mix exported? Product-specific data lags total volume exports by about a month, but for data available through the end of July, it does not appear as if seismic changes have been occurring. The most interesting change in the data thus far is that customers are choosing to import fresh or chilled hams, shoulders and cuts thereof, with bone in, other than processed (HS 02031290) in larger quantities in lieu of frozen hams, shoulders and cuts thereof, with bone in, other than retail cuts (HS 02032290). The largest increase in volume, has been frozen pork, other than retail cuts (HS 02032940). It certainly appears that our customers are stocking up while prices are low. The biggest takeaway from this data, however, has to be the importance of sustained trade relationships cemented by trade agreements.

Trending Topics

VIEW ALL