Cheese Prices, Do We Have A Problem?

TOPICS

Dairy

photo credit: Getty

John Newton, Ph.D.

Former AFBF Economist

Regulated milk prices guaranteed to farmers in the U.S. are based on end-product pricing formulas and mandatory price reporting for wholesale butter, cheddar cheese and dry milk powders. This pricing methodology was crafted nearly two decades ago and has remained virtually unchanged since then (How Milk Is Priced in Federal Milk Marketing Orders: A Primer).

A Widening Block-Barrel Spread

One of the challenges of a regulated, rigid pricing system is the unintended economic impacts of the free market. This is the case in today’s cheese and whey markets. For the better part of the last 20 years, block and barrel cheese prices have followed each other closely, with an average difference of 1 cent per pound, and milk pricing formulas essentially weighted them equally. Since 2017, however, things have changed: Increased barrel cheese production and increased demand for whey proteins derived from barrel cheese have resulted in a widening price spread between block and barrel cheese. That spread is equivalent to a nearly $600-million-dollar reduction in dairy farm revenue over the past two and a half years. This divergence in block and barrel prices was likely unforeseen by the architects of the current milk pricing system two decades ago.

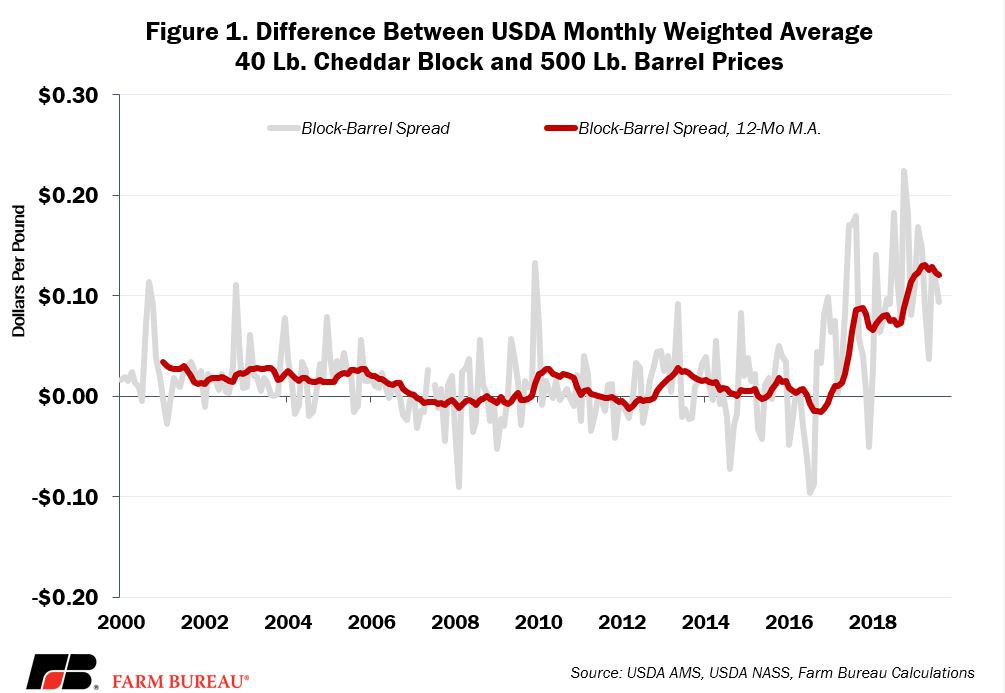

USDA announces a monthly weighted average price for cheddar cheese based on the prices of both 40-pound blocks and 500-pound barrels. The announced cheese price is equal to the weighted average of the block price and the barrel price plus 3 cents. Prior to 2017, the difference between the block price and the barrel price averaged slightly more than 1 cent per pound and ranged from a low of -9.6 cents per pound to a high of 13 cents per pound. However, beginning in 2017, the block-barrel spread began to widen, averaging nearly 10 cents per pound and reaching a record-high of 22 cents per pound in October 2018, Figure 1.

The widening block-barrel spread is due to a variety of factors. First, growing milk supplies and tight processing capacity in some regions led to distressed milk being dumped or sold at a discount. Any of this milk that flowed into barrel cheese production likely increased supplies and contributed to lower prices. Continued barrel production in the face of low prices is made more sustainable depending on the magnitude of the price discount of milk going into the plant.

Second, cheese exports – mostly blocks -- have improved in recent years. Cheddar cheese exports increased 43% in 2017 and then increased by 14% in 2018. Year-to-date cheese exports are up 13% from prior-year levels. The increased demand for block cheddar cheese has increased the price relative to barrel cheese.

Other factors also contribute to the wide price gap between blocks and barrels; these factors include a reduction in processed cheese demand (i.e., barrels) and increased demand for white whey, a byproduct of barrel cheese production. (Supply and Demand Drive the Block-Barrel Spread, Cheese Market News, and The Block-Barrel Spread is Widening, and it’s Hurting Dairy Farmers, Ted Jacoby)

Impact on Milk Prices and Dairy Farm Revenue

Since end-product pricing formulas use the weighted average of block and barrel prices, the impact of a wide block-barrel spread results in a Class III milk price that reflects both high-valued blocks and lower-valued barrels. In fact, since 2000 the weight of barrels in the Class III milk pricing formula has been 50%, thus when barrels are at a substantial discount to blocks, half of the price discount manifests in the Class III milk price.

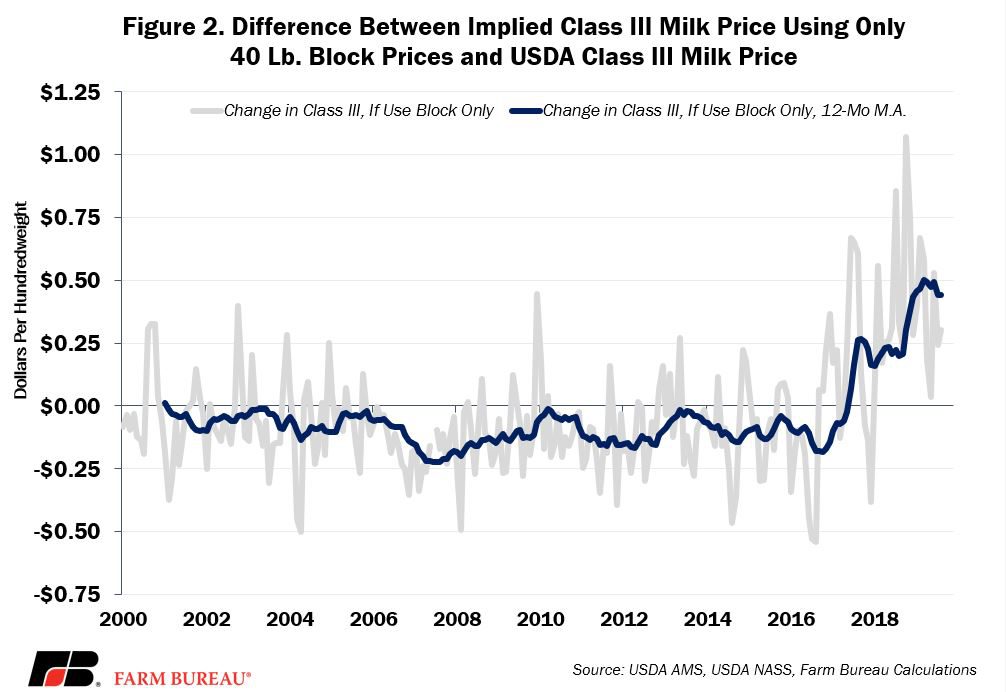

If the Class III milk price were based on blocks alone, it would have been as much as 75 cents to $1 per hundredweight higher in some months. Since 2017, the average change in the Class III milk price would have been 23 cents per hundredweight. Figure 2 compares the implied Class III milk price based on blocks to the USDA announced

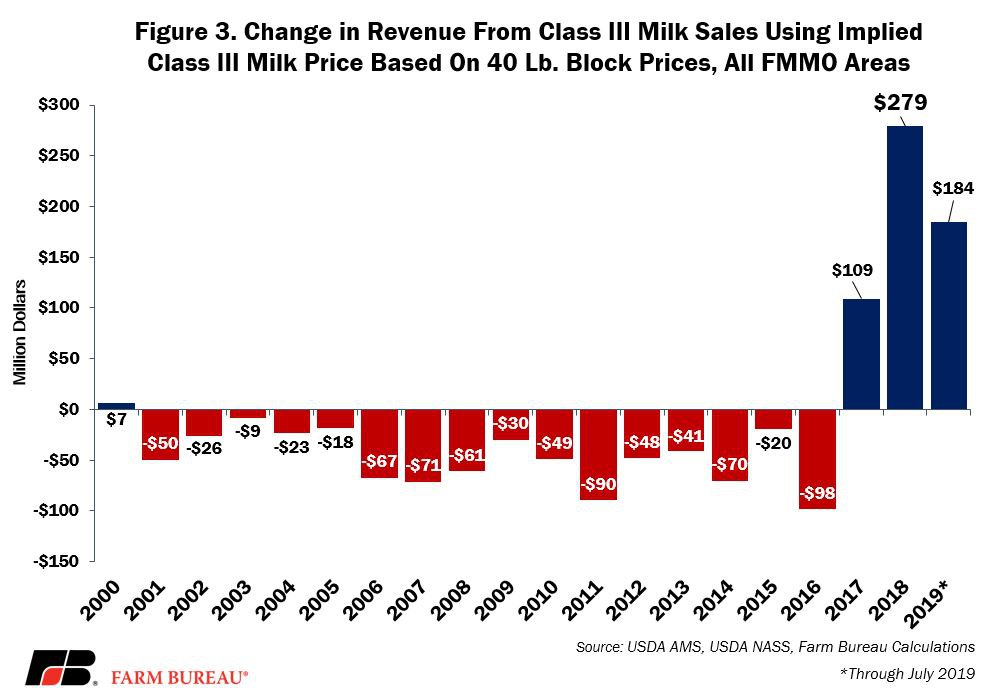

With more than 60 billion pounds of milk utilized in Class III each year, i.e., milk used for cheese production, the block-barrel spread is equivalent to a $573-million-dollar shortfall in Class III revenue. This is money many farmers would like to have seen in the FMMO revenue sharing pools, and had it been included, the national average regulated minimum milk price would have increased by approximately 16 cents per hundredweight. Figure 3 highlights the annual change in the revenue from Class III milk sales using only the block price in the end-product pricing formula.

Solutions on the Horizon

While the block-barrel spread has the current attention of the dairy industry, this is not the first time milk pricing formulas have been subject to additional scrutiny due to rapidly changing supply and demand factors for specific dairy products. In 2014 the difference between the value of whey protein concentrate and the dry whey price used in the FMMO pricing system reached as much as $1.20 per pound. Given that a 10-cent change in whey prices is equivalent to approximately 59 cents per hundredweight in the Class III price, the difference of $1.20 represented more than $7 per hundredweight – real money to dairy farmers.

Because these higher-valued whey proteins were not used to determine farm-level milk prices, some believed millions of dollars in Class III revenue were left on the table. As a result, some argued that the FMMO pricing system should be modified to reflect the whey protein concentrate value and not the dry whey value. Shortly thereafter, whey protein concentrate production reached a record-high and prices declined, reflecting the market response to price signals with prices realigning without intervention.

It is important to note that end-product pricing formulas are working exactly as designed by reflecting the value of both blocks and barrels in the milk price formula. The challenge is that when end-product pricing was envisioned, a wide block-barrel spread was unanticipated, and now the impact is perceived to be weighing down regulated milk prices.

Many dairy industry stakeholders seeking to tweak federal dairy policy have pointed to the block-barrel spread’s impact on farm milk checks as evidence that milk pricing regulations need to be updated. Milk pricing rules are nearly 20 years old, and FMMO revenue sharing and minimum pricing enforcement rules are more than 80 years old.

There are several ideas being proposed to address the wide block-barrel spread. Some have suggested the barrel manufacturers recalibrate their supply chain to produce blocks as well. This, however, is not a short-run solution and would require substantial capital investments.

With respect to milk pricing formulas, some have suggested dropping barrels from the survey and end-product pricing formula altogether. Eliminating barrel prices from the survey and formulas would put the onus of price discovery in cheese markets on blocks alone; without mandatory price reporting, market signals, such as the block-barrel spread, would be less transparent.

Another option includes expanding the survey and milk pricing formulas to include other cheese prices such as 640-pound blocks or mozzarella – effectively reducing the reliance on barrel cheese in milk pricing regulations. This would certainly lead to a higher announced Class III milk price based on current market conditions.

But…simply changing the FMMO pricing formula may not have the desired impact. First, if the block-barrel spread will self-correct, then removing barrels from the pricing formula could result in lower milk prices and revenue to farmers if a premium reflecting the historical difference is not included. This market could self-correct as we move from a market that was long milk into a short-supplied market. Note that prior to 2017, and as evidenced in Figure 3, the use of barrels in the pricing formula represented $765 million in Class III revenue.

Second, the use of only blocks in the pricing formula will increase only the regulated minimum price paid by beverage milk plants. FMMO minimum prices are not enforced on milk used to produce manufactured dairy products such as cheese or butter. Dairy cooperatives are also not required to pay minimum milk prices to their members. Thus, raising the benchmark Class III price will not change the ability or frequency of plants purchasing milk at prices other than the FMMO announced prices. These plants must account to the FMMO pool at the classified value, but the minimum pricing provisions end there. As a result, the higher announced Class III price that uses only blocks could be offset by lower premiums or other discounts -- resulting in no change to the market clearing milk price.

Expanding mandatory price reporting would increase the amount of information available to the dairy industry for price discovery. But why stop there? Why not also include prices paid for milk solids and sales prices for a variety of value-added dairy products? Farmers, processors and cooperatives could use this information for price negotiations and create a real-time spot market for milk and milk components used to produce manufactured milk products. If the desire is to improve milk price discovery, more, not less, information may be the way to go.

Trending Topics

VIEW ALL