CBO Evaluates Impact of Trump 's Budget on Agriculture

photo credit: North Carolina Farm Bureau, Used with Permission

John Newton, Ph.D.

Former AFBF Economist

The Congressional Budget Office recently released An Analysis of the President’s 2018 Budget, i.e. an analysis of President Trump’s proposed budget blueprint for fiscal year 2018. The CBO analysis found that by 2027 the U.S. would operate at a $720 billion budget deficit and not a $16 billion surplus as projected in the blueprint.

Specific to agriculture, recall that in late May the Office of Management and Budget proposed to reduce the U.S. Department of Agriculture budget by more than $230 billion over 10 years. The proposed cuts came in the form of policy changes designed to reduce outlays by $191 billion for the Supplemental Nutrition Assistance Program and $38 billion from various farm programs – including crop insurance.

Let’s be very clear, the President’s blueprint was just that, a set of proposals. It is up to Congress to actually enact any changes to law and so far, at least, there is little indication Congress will act on these proposals. That being said, CBO found that agriculture can’t balance the budget and that reducing the risk management benefits provided by farm bill programs such as crop insurance and Title I commodity support programs would save billions less than estimated by the OMB.

Congressional Budget Office Projections

President Trump’s proposals that impact farmers and ranchers include key reductions in export assistance and market access programs, conservation program streamlining, and mandatory user fees, i.e. taxes, for food safety and inspection services.

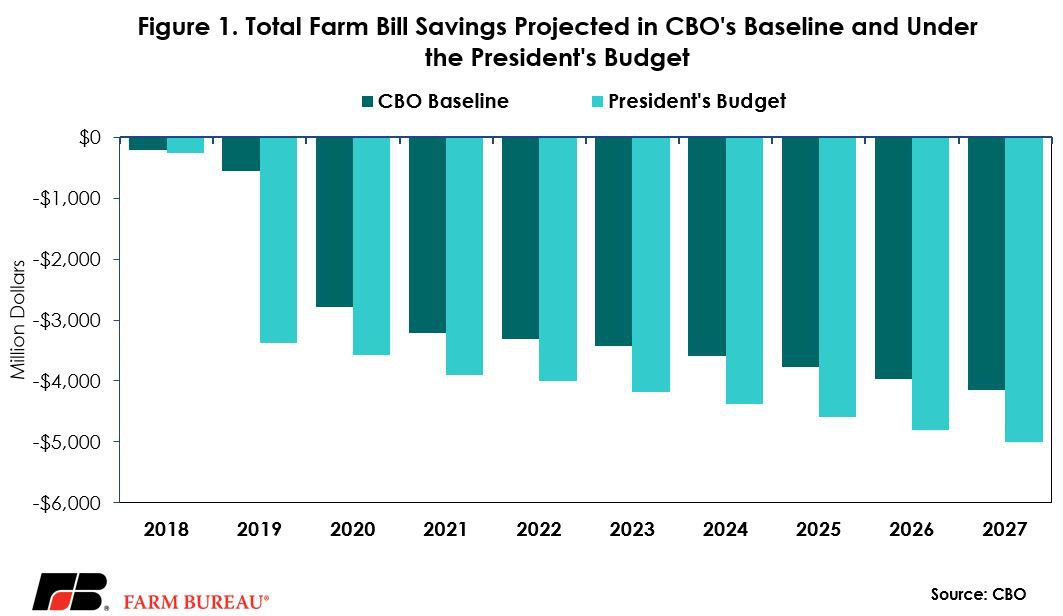

However, the most significant changes in farm program spending proposed by the administration include limiting crop insurance premium subsidies to $40,000 per policy, implementing adjusted gross income limitations for crop insurance and farm program eligibility, and eliminating the harvest price option on revenue protection crop insurance policies. OMB estimated that these changes would result in farm bill savings of $38 billion over the next decade. CBO estimated the total change in outlays to be substantially lower at $29 billion over 10 years, $9.1 billion less than the OMB estimates, Figure 1.

Impact on Crop Insurance

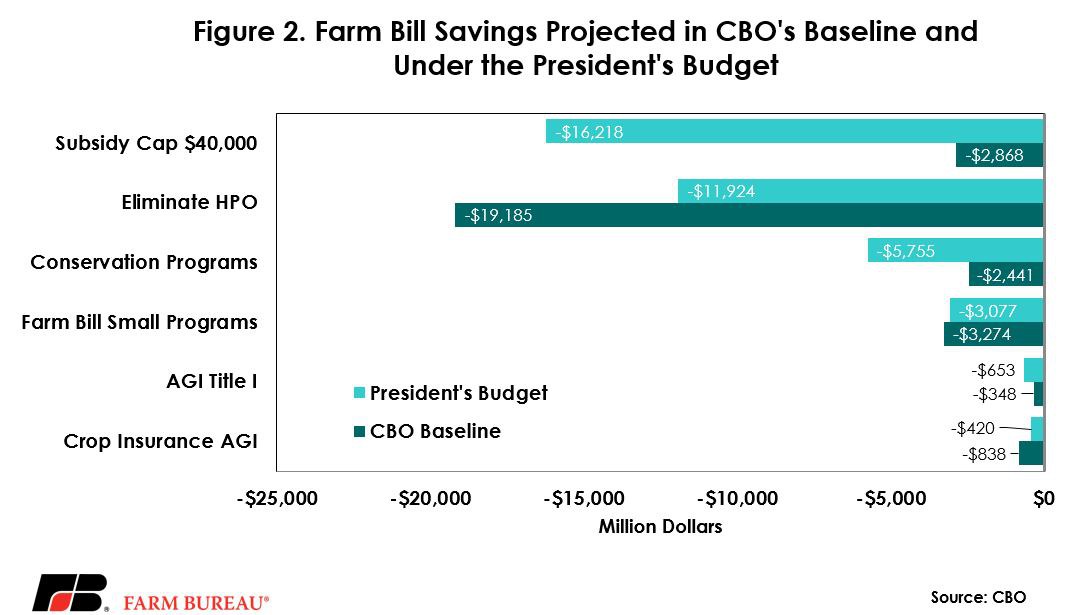

The primary differences in outlays between the CBO baseline and the president’s budget stem from the proposed modifications to crop insurance. CBO projected crop insurance savings at $22.8 billion compared to the president’s budget savings of $28.6 billion. Specifically, CBO estimated the elimination of the harvest price option would save $19.2 billion while OMB estimated the savings at $11.9 billion. For the $40,000 cap on crop insurance subsidies CBO estimated the savings at $2.9 billion, while OMB projected savings of $16.2 billion over 10 years, Figure 2.

OMB and CBO differ on the source and magnitude of the savings. The difference depends on how the package of savings is viewed and knowing that these estimates cannot be viewed independently. For example, eliminating the harvest price option would subsequently change the demand for crop insurance and may result in lesser savings from a $40,000 cap on premium subsidies – as confirmed by CBO.

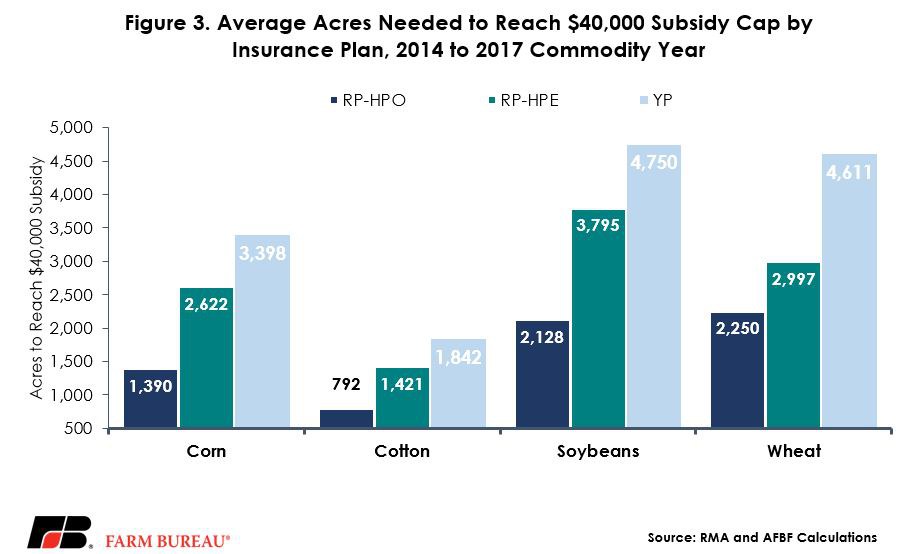

The harvest price option allows the producer to have protection on lost production at the higher of either the spring projected price or the actual price at harvest time. Farmers opt to pay a higher premium rate for this coverage. For many crops, harvest price option policies represent 80 percent to 90 percent of all crop insurance coverage. Elimination of the harvest price option may result in many farmers opting for alternative policies – with less risk management protection -- such as the revenue protection with harvest price exclusion or yield protection policies. The possibility also exists for farmers to forego crop insurance altogether.

Farmers pay billions of dollars in crop insurance premiums every year with USDA providing a cost-share benefit to make the cost of insuring the crop less expensive. Limiting this cost share to $40,000 per policy would effectively cap acreage eligible for subsidized insurance. Without the harvest price option, however, premiums would be lower and the $40,000 subsidy cap could potentially be used to cover more acreage – albeit at a lower level of protection.

Consider that from 2014 to 2017 the average subsidy for the harvest price option for corn revenue protection policies was $28 per acre. The average premium subsidy for a harvest price exclusion policy or yield protection policy was $15 and $12 per acre, respectively. The amount of acreage needed to meet the subsidy cap of $40,000 for a corn harvest price option policy is approximately 1,400 acres. For a corn harvest price exclusion or yield protection policy, these acres increase to 2,600 and 3,400 acres, respectively, due to the lower per-acre subsidy. Similar patterns are observed for cotton, soybeans and wheat, Figure 3.

It is due to this joint effect that CBO likely scored the $40,000 subsidy cap as providing substantially fewer savings than OMB projections. While the subsidy can cover more acres due to lower policy premiums, these acres would also have less risk management protection than what is currently available. Farmers could partially offset the elimination of the harvest price option by purchasing higher levels of protection on alternative policies, i.e. 85 percent coverage on a revenue protection policy.

According to the 2012 Census of Agriculture, nearly 70 percent of all farmland was on farms with 1,000 or more acres. Thus, the proposed cuts to crop insurance would impact most of the farmland utilizing crop insurance acres and would weaken the risk management protection provided by crop insurance. Additionally, the effects of this change on the overall risk pool could have a significant effect on the growers still participating, as well as the underwriters and USDA holding the risk of indemnification.

Other Farm Bill and Agricultural Programs

Other areas of agriculture support would also experience cuts to funding. However, the savings is less than anticipated. Streamlining conservation programs is estimated to save $2.4 billion, while OMB projected savings at nearly $6 billion. CBO found savings by eliminating new enrollments in the Conservation Stewardship Program, eliminating funding for the Regional Conservation Partnership Program and eliminating signing bonuses and incentive payments under the Conservation Reserve Program. These savings totaled $7.6 billion. However, CBO estimated that enhancements to the Environmental Quality Incentives Program and Agricultural Conservation Easement Program would result in additional outlays of $5.2 billion. The net impact of savings and new spending resulted in a $3.3 billion difference between the CBO baseline and OMB projections.

Other less prominent changes in agricultural outlays also contribute to the CBO’s overall $36.5 billion savings estimate. Among these are the establishment of various taxes within the food and agriculture sector, including the areas of food safety and inspection, grain inspection and stockyard administration. The CBO scored each of these taxes as less burdensome than reported by the OMB. Collectively, CBO estimated the savings for establishing these taxes at $6.4 billion, $265 million less than the OMB estimate. Additionally, the elimination of programs geared toward improving and developing the rural economy will also present a savings of $96 million, less than a quarter of the $477 million estimated by OMB.

Summary

In aggregate, CBO’s estimate of the president’s budget indicates that by 2027 the U.S. will operate at a $720 billion deficit, 2.6 percent of U.S. GDP, rather than a $16 billion surplus as projected in the blueprint. For agriculture, specifically, CBO indicated that many of the proposed cuts to farm programs and agricultural spending in Trump’s budget proposal would reduce spending by nearly $4 billion per year. However, the proposed cuts are not as high as originally estimated by OMB.

Importantly, presidents throughout the years have submitted budgets only to have them declared dead on arrival on Capitol Hill. This budget is no different, however, this perspective from the CBO on the budgetary impact of farm program changes is worth noting given the complexity in estimating the effects of policy changes on the utilization of farm programs. Importantly, the fiscal year 2018 Budget Resolution released by the House Budget Committee did not include any of the proposed modifications to farm programs.

In 2014, the CBO projected farm bill programs, including nutrition, to cost nearly $100 billion per year. However, led by improvements in the U.S. economy and lower food prices, the farm bill is now projected to cost $81 billion less than originally forecasted. With farm income and commodity prices now at the lowest levels in a decade, it is not the time to reduce the effectiveness of farm safety net programs, export incentive programs and other programs that help strengthen rural America.

Trending Topics

VIEW ALL