Canadian Dairy Is Having Its Cake and Eating it Too

TOPICS

Trade

photo credit: Christopher Policarpio / CC BY SA-2.0

John Newton, Ph.D.

Former AFBF Economist

Canadian dairy farmers are expected to increase milk production this year by 4 percent, to 21.6 billion pounds. This follows three consecutive years of growth in Canadian milk production. In fact, since 2014, Canada’s milk production has grown by more than 16 percent, more than any other major dairy-exporting region. For comparison, from 2014 to 2018, U.S. milk production will grow 6 percent, the European Union is expected to grow 4 percent and New Zealand milk production is expected to remain flat.

Spurred by increasing demand for butter and higher milkfat-containing products, the growth in Canadian milk production does have a downside: increased supplies of less desirable skim milk solids, i.e. nonfat dry milk powder. During 2015, nonfat dry milk powder inventories in Canada reached a 38-year high of 60,000 metric tons. Partially in response to these growing inventory levels, as well as imports of competitively priced U.S.-produced ultra-filtered milk proteins, Canada introduced a national ingredients pricing scheme designed to lower the price of skim milk solids and reduce dairy product imports from the U.S. (Canada Closes Door on U.S. Dairy Farmers). The scheme was fully implemented in 2017. Equally trade distorting, the lower prices for Canadian-produced skim milk solids allowed Canada to engage in the export market in a significant way.

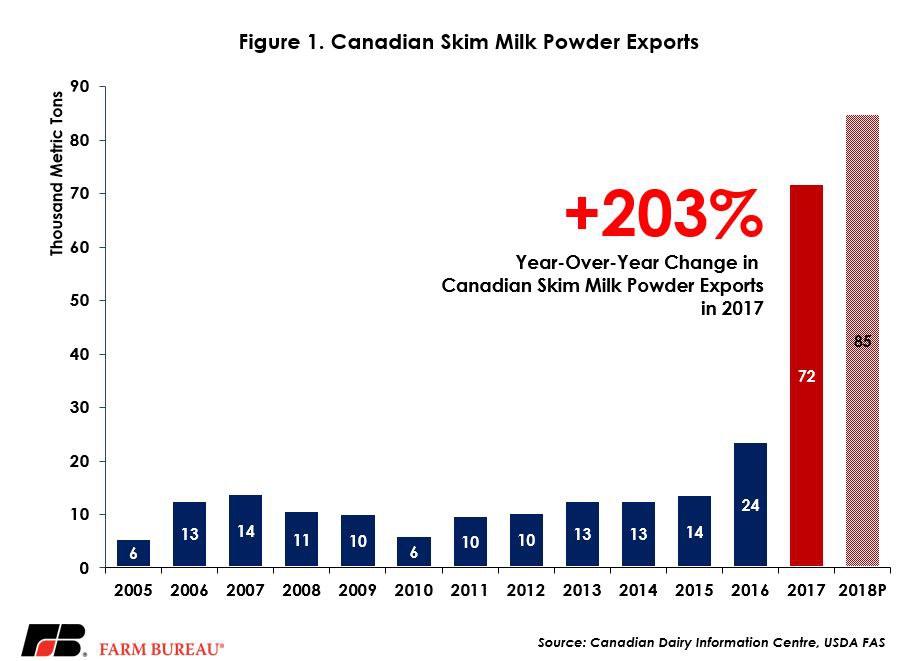

In the decade prior to 2016, Canada exported an average of 11.3 thousand metric tons of skim milk powder per year using export subsidies. In 2016, Canadian skim milk powder exports to the world climbed 74 percent year-over-year, to 24 thousand metric tons. The 2016 export volume represented approximately 23 percent of Canada’s nonfat dry milk production. By 2017, and as a direct result of the national ingredients strategy, total skim milk powder exports from Canada increased 203 percent, to 72 thousand metric tons, Figure 1. This trend is expected to continue in 2018, as USDA projects total Canadian skim milk powder exports to increase by 13 percent, to 85,000 metric tons – representing 61 percent of their nonfat dry milk production.

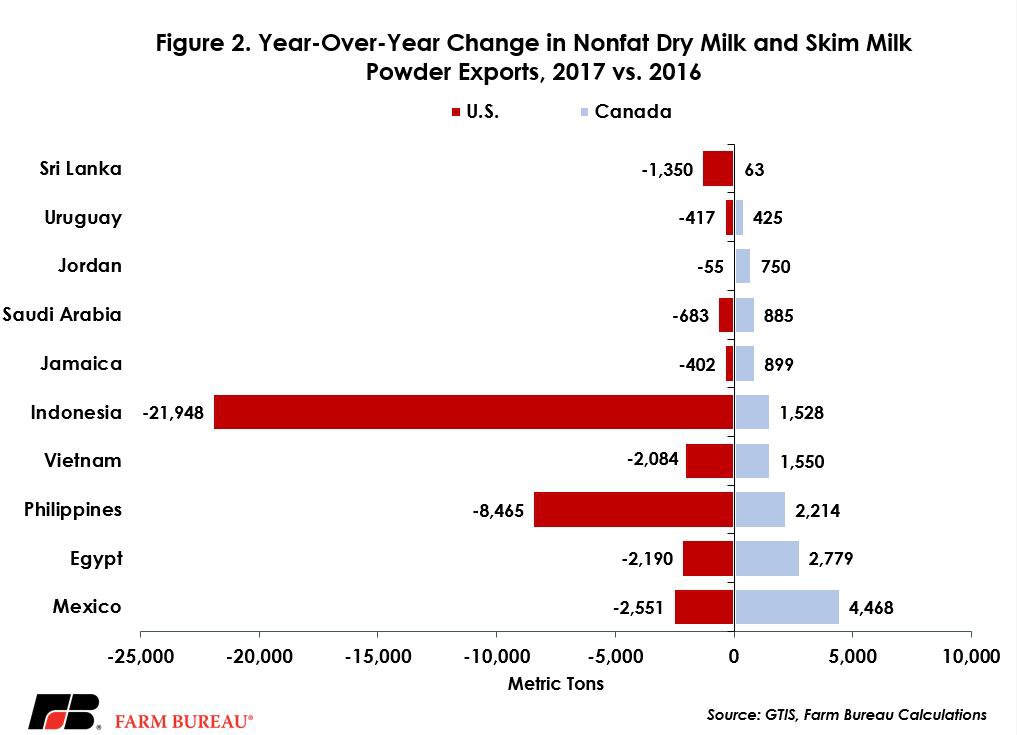

The recent surge in Canadian skim milk powder exports has cannibalized sales of U.S.-produced skim milk powders in foreign markets. For example, during 2017, Canada exported 4.5 thousand metric tons more skim milk powder to Mexico than the prior year – an increase of 122 percent. Meanwhile, U.S. skim milk powder exports to Mexico dropped by 2.5 thousand metric tons. Similar shifts in market share were observed in the Philippines, Indonesia, Vietnam, Jamaica, Saudi Arabia, Jordan, Uruguay and Sri Lanka, Figure 2.

The largest beneficiaries of Canada’s newfound exporting prowess include Algeria, Jordan, South Africa, Uruguay and Sri Lanka. The import volume of skim milk powder from Canada to these countries combined increased 1,000 percent to over 2,000 percent.

In a perfectly competitive market, there would be nothing wrong with Canada’s milk pricing and exporting actions with respect to skim milk solids. However, Canada’s dairy farmers do not operate in a competitive market like U.S. dairy farmers do. To insulate its domestic dairy market, Canada maintains strict tariffs and import quotas and administers a milk supply management system – effectively making farm-level milk prices, and thus consumer (retail) dairy product prices, much higher than in many other countries.

For dairy products that Canada’s domestic market desires, consumer prices are artificially higher due to its supply management system. The higher returns from their provincial government-imposed supply management system allow for both the exporting of skim milk solids into international markets and for Canada’s milk processors to buy Canadian-produced skim milk solids at artificially low prices. The lowering of prices for Canadian-produced skim milk solids made Canada more competitive in export markets and simultaneously made U.S. imports into Canada less competitive.

The bottom line is that for products in surplus in the market, i.e. skim milk solids, the national ingredients pricing scheme functions similarly to an export subsidy and allows Canada to dispose of the surplus product in global markets at or below international market-clearing prices. That type of trade-distorting policy is one factor that has contributed to lower U.S. milk prices.

There is no doubt that U.S. trade negotiators have this issue, as well as the supply management system, as one of the top agricultural issues to negotiate with Canada in a North American Free Trade Agreement modernization. Repealing the national ingredients strategy will go a long way toward making trade fairer and improving the income of U.S. dairy farm families.

Trending Topics

VIEW ALL